Industrials: Like the U.S. Economy, the Sector Remains Resilient

The sector has benefited from healing supply chains and favorable pricing, though the tight labor market is still challenging.

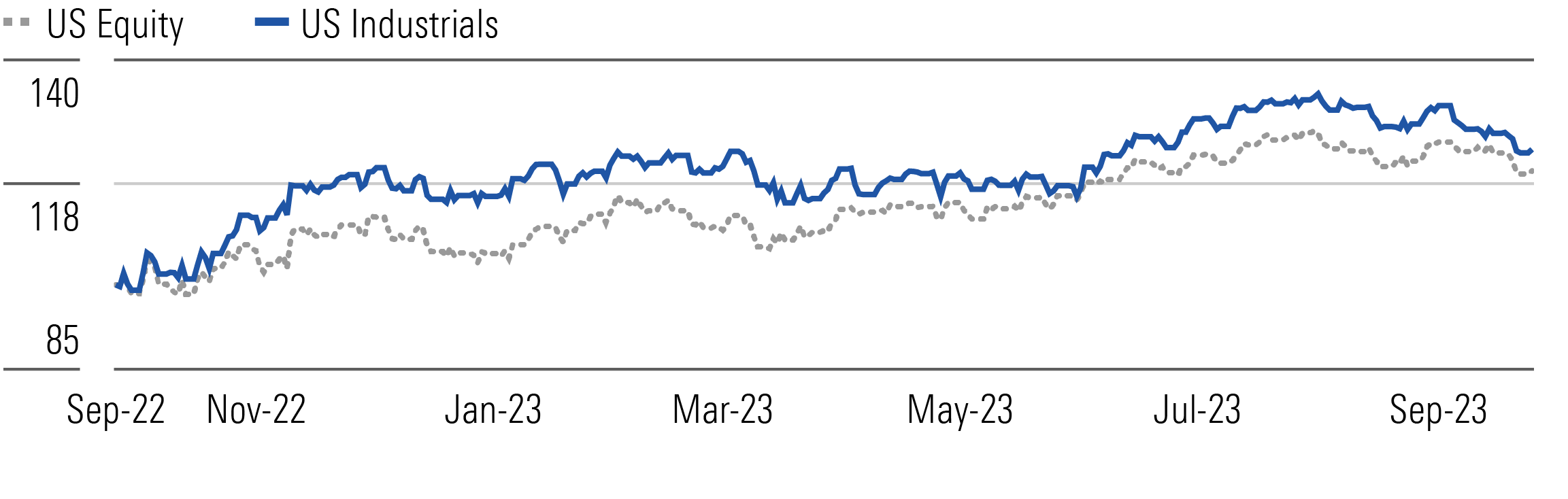

The Morningstar US Industrials Index lagged the Morningstar US Market Index during the third quarter of 2023 but outperformed on a trailing 12-month basis. The sector’s performance was led by industrial distribution and products, construction, and transportation & logistics. In contrast, the aerospace & defense and waste management industries lagged.

Industrials Underperform In Q3, but Trailing 12-Month Outperformance Continues

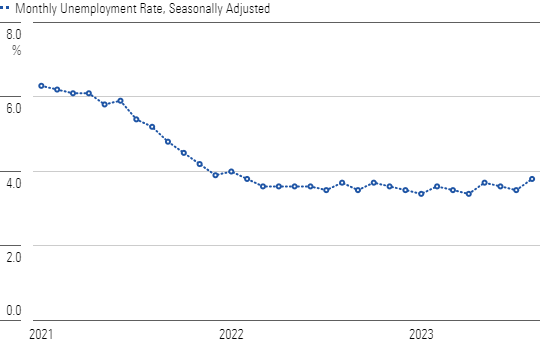

The U.S. economy remains resilient even as inflation persists above the Fed’s 2% target and economic growth slows across Europe and China. Second-quarter earnings were generally positive for industrials, with over two-thirds of our coverage beating FactSet consensus expectations of earnings per share. The sector benefitted from healing supply chains and favorable pricing, but the tight labor market is still challenging. Even so, staffing company stocks have underperformed, suggesting the market is still weary of a recession and a loosening labor market. Nevertheless, we maintain our positive long-term outlook for U.S. staffing firms.

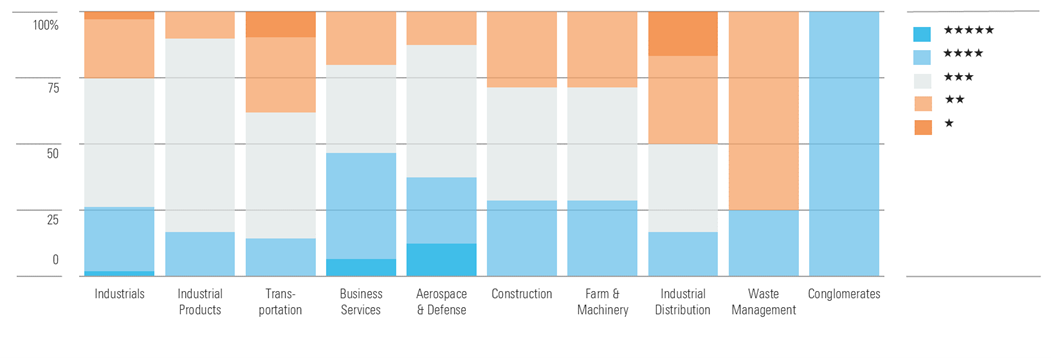

Industrials Sector Fairly Valued, but Some Opportunities Available

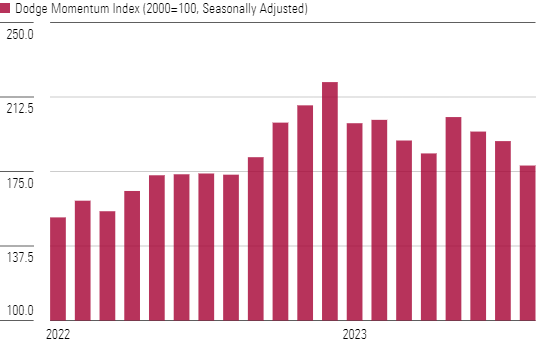

Construction companies have been among the sector leaders in terms of stock performance this year, but those with more commercial exposure have lagged due to concerns about the commercial real estate market. However, we maintain our favorable long-term outlook for the construction industry, and we continue to see tailwinds from the Inflation Reduction Act, which incentivizes environmentally conscious building practices and materials. HVAC is one industry that should benefit from the IRA, but we think this opportunity is already priced in for most of those stocks.

Tight Labor Market Is Still a Challenge for the Sector

Transportation and logistics stocks saw mixed returns during the quarter. Many airlines have cut guidance for the rest of the year on higher fuel and labor costs. We maintain our view that U.S. airlines operate in a no-moat industry and capacity additions will beget increased competition. Railroads have seen volume headwinds from sluggish industrial production and heavy truck competition for intermodal transportation. Overall, railroad valuations look reasonable, and the market appears to be agreeing with our outlook. However, concerns over the near-term disruption of volume and margin related to the East Palestine derailment create a longer-term upside opportunity for Norfolk Southern’s NSC stock price, in our view.

Commercial Construction Activity Has Moderated

Top Industrials Sector Picks

ManpowerGroup

- Fair Value Estimate: $109.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

Manpower MAN is one of the three largest multinational firms in the fragmented $600 billion global staffing industry. It offers each main staffing service (temporary, permanent, and project-based) across a variety of professions under its four subsidiary brands. Despite operating in a highly competitive and cyclical industry, we believe Manpower will benefit from an increase in recruitment outsourcing as companies look to improve labor efficiency. It will also continue to strategically grow its higher-margin businesses to improve profitability amid an uncertain job landscape.

Johnson Controls International

- Fair Value Estimate: $72.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Johnson Controls JCI manufactures, installs, and services HVAC systems, building management systems and controls, industrial refrigeration systems, and fire and security solutions. Commercial HVAC accounts for about 40% of sales, fire and security represents 40%, and residential HVAC, industrial refrigeration, and other solutions account for the remaining 20%. Johnson Controls is in a strong position to benefit from increased demand for energy-efficient building products and solutions, as well as greater adoption of higher-margin services.

Norfolk Southern

- Fair Value Estimate: $239.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

Norfolk Southern operates in the Eastern United States. On more than 20,000 miles of track, the firm hauls shipments of coal, intermodal traffic, and a diverse mix of automobile, agricultural, metal, chemical, and forest products. Although the company is dealing with the aftermath of the East Palestine derailment and wage inflation, the case for long-term intermodal segment growth remains solid. We see this stock’s current discount to our fair value as a buying opportunity.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6A6R4SGLDNGMXHAH3K2CIQTF3Q.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)