Industrials: An Uneven Start to 2016, but Compelling Values Remain

The industrials sector had a bumpy start to 2016, but the near- to midterm outlook remains positive, and we see value in some names.

- At the time of writing, the industrial names in our global coverage universe are trading at an aggregate 3% discount to their fair value. Earlier this year, the sector at one point traded at a 24% discount to fair value, but the recent market rebound has eliminated much of this gap, and industrials now appear close to fairly valued. Nonetheless, a handful of stocks present opportunities for investors.

- Industrials continue to be affected by volatile energy prices and a strong U.S. dollar, but the recent increase in oil prices and a stabilizing dollar has alleviated some pressure. While the recent appreciation in the greenback has slowed, a strong dollar still presents a headwind to U.S. exporters and a tailwind for European and Asian manufacturers.

- Indicators of manufacturing activity indicate some softness in the global economy, but we do not see anything to panic about quite yet. In February, the U.S. Institute for Supply Management (ISM) manufacturing index registered 49.5. This was the fifth consecutive reading below 50--less than 50 indicates a contraction in manufacturing--but it was still the highest reading since October 2015. Beyond the U.S., the euro area's Markit manufacturing PMI came in above 50 in February, signaling expansion. Chinese exports fell 25.4% in February, indicating a slowdown in activity, and the Chinese manufacturing purchasing managers index also dropped to 49 in February, but only slightly missed consensus forecasts.

- Subsectors had an uneven start to the year, but the 2016 outlook for each area is generally positive. The aerospace and defense sector will experience top-line growth this year thanks to growing commercial aircraft deliveries coupled with increasing defense budgets, and airlines will achieve record profitability in 2016. Automakers should see modest growth, with Europe leading the way in light-vehicle demand. Although it had a weak start to the year partly as a result of bad weather, construction fundamentals remain sound, and we expect this sector to expand this year. Juxtaposed with all this good news sits the rail business, which remains mired in a downturn that will likely continue through 2016.

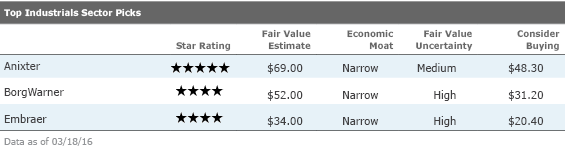

Digging a bit deeper into our global coverage of industrial stocks, only 12 companies currently garner 5-star ratings from our analysts. Eighty-four companies we cover (out of 186) are fairly valued and as such are in 3-star territory, reflecting the broader Morningstar analyst view that stocks in our coverage are more or less fairly valued. Nonetheless, we believe a few stocks offer compelling value to investors. We highlight

Prices in energy and commodity markets rebounded during this quarter after oil hit 12-year lows in early January. While lower energy and commodity prices have inexorably led to reductions in order books for machinery and equipment producers, the prospect of higher future prices fueling more customer demand has recently lifted industrial stock prices. At the same time, a continued slowdown in Chinese demand for raw materials and container and bulk shipping continues to adversely affect many industrial firms either directly or indirectly. A more stable U.S. dollar relative to other currencies has taken some volatility off the table for exporters, but the greenback remains at 10-year highs in trade-weighted terms versus other major currencies.

In the automotive sector, we expect 1%-3% global demand growth in light-vehicle sales for 2016. The year started off on a positive note for U.S. automakers, with a seasonally adjusted annualized selling rate of 17.53 million, up from 16.39 million in February 2015. While U.S. growth should continue in 2016, we do not expect significant volume increases like the past few years. In the first two months of the year, sales to U.S. consumers and fleet businesses have risen by a combined 3.4% year over year. The ongoing shift toward a more consumer-led economy in China should benefit automakers over the long term, but near-term demand is slowing, and we expect light-vehicle demand growth of only 1%-3% in 2016. Europe remains a bright spot, and we anticipate European passenger-car registrations to increase 5%-7% in 2016 as the region continues to recover.

Although fundamentals are sound in construction, the uncertain economic environment still took its toll on the outlook, resulting in the Architecture Billings Index, a leading indicator of construction activity, slipping to 49.6 in January (a score below 50 indicates contraction). Total U.S. housing starts also fell a surprising 3.8% in January to a 1.099 million-unit annualized pace--its weakest rate in three months--despite expectations for a modest increase. However, we attribute some of this decline in starts to poor weather in the Northeast, and we continue to believe that the fundamentals for residential construction remain solid. The American Institute of Architects' semiannual construction forecast came out at the end of January, and it projects nonresidential construction to grow a robust 8.3% in 2016.

While commercial aerospace companies have been growing nicely on the back of a decadelong upcycle in aircraft deliveries, U.S. and European defense players have suffered because of a spending downturn in their domestic markets over the past several years. However, the resurgence of global threats combined with an improved government fiscal environment will conspire to push U.S. and Europe defense budgets higher in 2016. Indeed, several defense companies recently released 2016 guidance that calls for top-line growth. Recent defense budget plans in Europe and the February issuance of the proposed U.S. defense budget for 2017 confirm our view that defense spending will grow, benefiting industry players. Commercial aircraft deliveries will increase in 2016 thanks to the introduction of new models coupled with continued demand, but we expect demand for business jets to remain muted.

Despite the recent increase in energy prices, we remain below the prevailing oil prices during the first half of 2015, and lower fuel costs should act as a tailwind for airlines throughout the first part of 2016 as carriers either exit fuel hedges early or let them expire. The International Air Transport Association is forecasting a record $36.3 billion in airline profits for 2016 thanks to low fuel prices--which only a few years ago accounted for over 30% of airline operating costs--combined with strong air traffic demand.

Recent data on trade has been weak, suggesting that global trade headwinds remain firmly in place. The CPB World Trade Monitor reports that world trade volumes were essentially flat in December 2015 after decreasing 0.3% in November. The CPB World Trade Monitor world exports index was 144 in December 2015 (it was 100 in 2005), down slightly from the September peak of 144.7, while imports reached 137.6 at the end of last year, down from a peak reading of 138.1 in October. Recent data shows that Chinese exports shrank 25.4% in February from a year earlier, and U.S. exports fell 2.1% in January.

The American Trucking Associations' truck tonnage index increased 2.6% in 2015, but this year started off flat year over year in January. Commentary from across the trucking space suggests freight demand remained sluggish heading into 2016. Some of this probably relates to tough comparisons relative to last year, when capacity was tighter and spot activity was still relatively high. That said, softer economic growth and related pressure on shipment trends loosened truckload supply during the second half of 2015--a dynamic that is still tempering opportunities for truck brokers. In comparison to ground, the IATA reported that air freight in the Asia-Pacific region, which drives the global market, rose 2.3% in January. Nonetheless, pricing and freight load factor, which fell 1.8 percentage points, remain under pressure.

Rail continues to face serious volume challenges because of low commodity prices (in particular, natural gas that is sufficiently cheap to make coal relatively unattractive), lower commodity demand from China, and reduced oil and gas investment. As a result, we decreased our fair value estimates for Class I railroads at the beginning of this year. North American coal carloads declined 12% in 2015 and other freight also proved dour as 2015 came to an end, with total carloads down 13% in the final four weeks of the year, concluding a 6% decline for full-year 2015; intermodal units improved 2% in 2015, despite declining 2% in the final four weeks. To us, this looks like a significant freight slowdown, if not a recession. We do not expect the trends creating these headwinds to change significantly in 2016, and a 13.5% drop in rail carloads during the first two months of 2016 aligns with this view.

Anixter International

AXE

Narrow-moat-rated Anixter International is an industrial distributor of power utility, communications infrastructure, specialty wire, and security products to a diverse base of public and private-sector customers. It is the nation's third-largest electrical distributor. As a large distributor, Anixter generates superior returns from its network effects and cost advantage. Unlike the general industrial distributors, Anixter sells some components that are competitively sourced by customers (in particular, wire cable and telecom wire appear to be the most susceptible to competitive sourcing). Although the market is more price-competitive, we believe Anixter has generated an 11% average ROIC over the past 10 years (16% excluding goodwill) because of its value-added services that make it stand out from competitors.

For 2016, the company expects organic revenue growth between negative 2% and positive 2%. Management did not offer an explicit 2016 margin forecast but highlighted several risks to margins. While we anticipate that 2016 will be a challenging year, recent moves to consolidate the high-voltage sector, as well as continuing to leverage its distribution cost advantage, support our continued conviction in Anixter's narrow moat rating. Recent negative sentiment toward the electrical distributor space has pressured Anixter's share price and presents an attractive entry point for long-term-oriented investors.

BorgWarner

BWA

Narrow-moat-rated BorgWarner provides engine and drive-train components and systems to the automotive industry. BorgWarner is well-positioned to capitalize on industry trends arising from globally ubiquitous clean air legislation and consumers' demand for fuel economy. The company benefits from its ability to continuously innovate, a global manufacturing footprint, highly integrated long-term customer ties, high customer switching costs, and moderate pricing power. The intensely competitive nature of the auto sector, the vagaries of cyclical demand, and customers' pricing leverage create concern about cash flow and the sustainability of economic profits throughout business cycles. Even so, auto sector and BorgWarner fundamentals lead us to believe that, excluding recessionary years, consistent economic profitability is achievable.

Over the past two and a half years, BorgWarner has traded mostly in the 2-star range, with occasional periods in 3-star territory. After sell-side analysts adjusted estimates and price targets downward on two separate occasions last year, and amid current stock market volatility, share-price weakness has brought the stock into 4- and even 5-star territory at times. At the time of our writing, the stock was trading at around a 30% discount to our $52 fair value estimate. We think long-term investors should consider the opportunity to own BorgWarner at these discounted levels.

Embraer

ERJ

While Brazil is decidedly out of fashion, we do think Brazilian narrow-moat-rated Embraer remains attractive for long-term investors. Embraer manufactures regional jet aircraft and boasts a leading market share for aircraft between 70 seats and 130 seats. The firm's next-generation regional jet offering, the E2, with new wings, cockpit, and engines, is looking increasingly strong given Bombardier's C Series problems plus the delays plaguing the development of other competing offerings. In addition, Embraer's executive aviation unit continues to take market share from more established business jet players. Finally, we believe its defense business, while facing near-term headwinds, will grow over the long term thanks to development of the KC-390 transport aircraft.

Brazil's economic woes and its depreciating currency are affecting Embraer's ADRs. However, the company has little exposure to the flagging Brazilian economy, with over 80% of revenue generated outside Brazil. In addition, a large portion of its costs are denominated in U.S. dollars. Our valuation currently carries a high uncertainty rating because of the Brazilian real's recent depreciation against the U.S. dollar and risks in Embraer's defense and security business, whose fortunes are somewhat linked to the Brazilian government's finances. The stock looks undervalued and has been trading at around a 30% discount to our fair value estimate of $34 per ADR. Still, investors will have to be willing to stomach some near-term volatility and country-specific risk.

More Quarter-End Insights

Stock Market Outlook: Stocks Start to Look More Attractive

Credit: Corporate Bond Markets Recuperate

Basic Materials: The Recent Commodity Rally Shouldn't Give Investors Hope

Consumer Cyclical: China Growth Concerns Present Buying Opportunities

Consumer Defensive: Lofty Valuations Persist, but a Handful of Bargains Remain

Energy: Don't Expect a Quick Recovery for Crude Prices

Financial Services: Global Bank Rout Is Overdone

Healthcare: Drug Reform Worries Are Overblown

Real Estate: Companies With Enduring Demand Will Persevere

Tech, Telecom & Media: Long-Term Opportunities Amid Software's Storm

Utilities: Dividends Still Attractive, but Headwinds Remain

/s3.amazonaws.com/arc-authors/morningstar/663693f6-982a-4714-b367-25cbf17458eb.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EAAEIIRVVNE7HNVXBSGTD3WPSI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/663693f6-982a-4714-b367-25cbf17458eb.jpg)