Energy Stock Outlook: Stocks Losing Steam as Commodity Doldrums Weigh on Sector

Global oil prices are down even as natural gas prices also weather a tough spell.

This article is part of Morningstar’s Q2 market review and outlook.

Our analysts and specialists put the performance trends of stock, sectors, bonds, and funds in the second quarter of 2023 into perspective, and look ahead with a fresh market outlook.

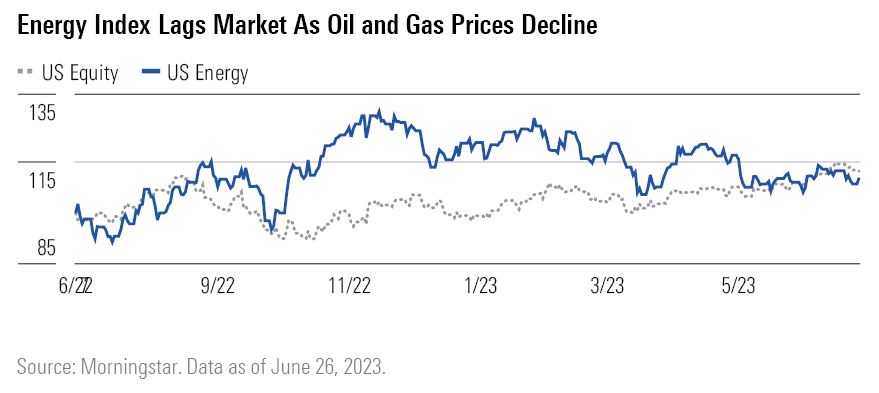

Energy stocks continued to be underperformers in the second quarter, which isn’t surprising in a weak environment for oil and gas prices. Global oil prices declined 10% (WTI) and 10% (Brent) since the prior quarter, despite cuts from OPEC and its partners. And natural gas prices have also had a tough spell, with further declines for U.S. and international benchmarks (Henry Hub, Dutch LNG, and Japan Korea LNG slipped 21%, 34%, and 31%, respectively).

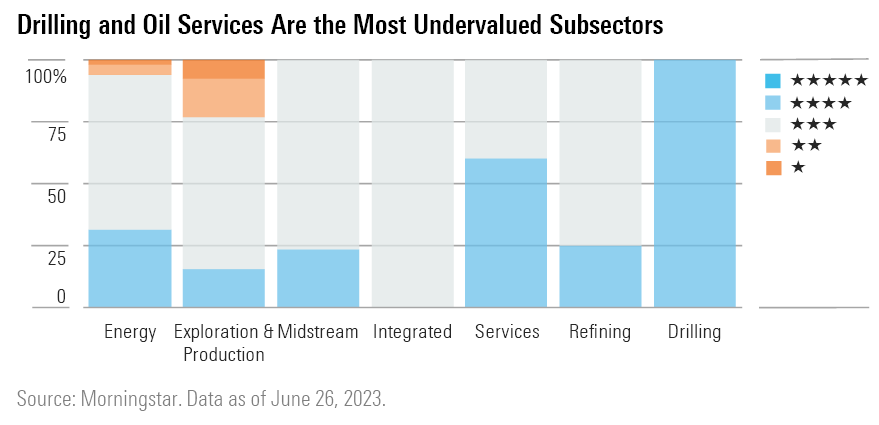

However, even after these declines, just 36% of our energy coverage looks undervalued, which suggests investors are underwriting higher midcycle prices than we are ($60 Brent, $55 WTI, and $3.30/mcf Henry Hub). Opportunities are mostly concentrated in the oilfield service segment.

Deficit Forecast for the Next Few Quarters

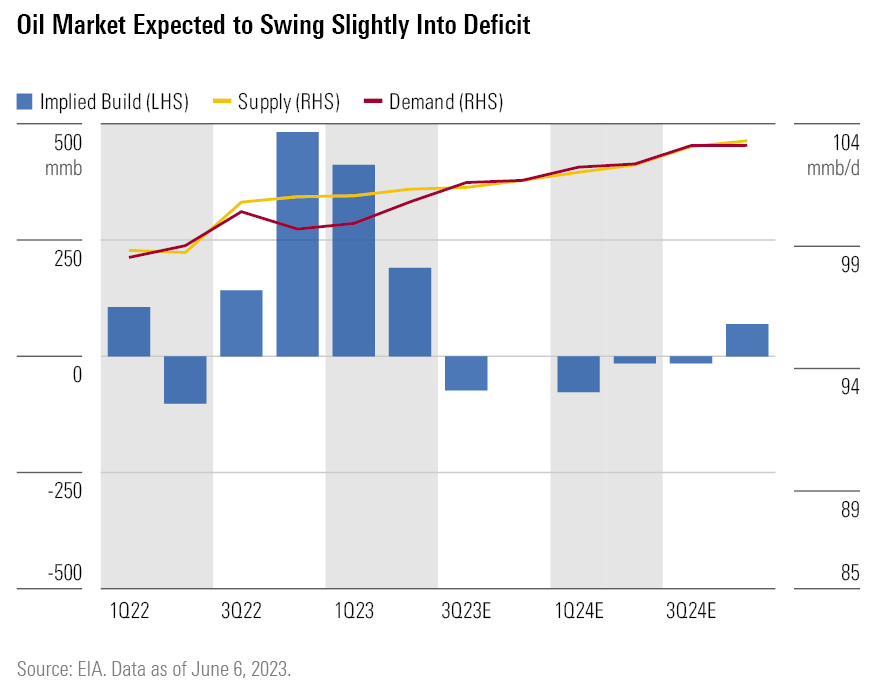

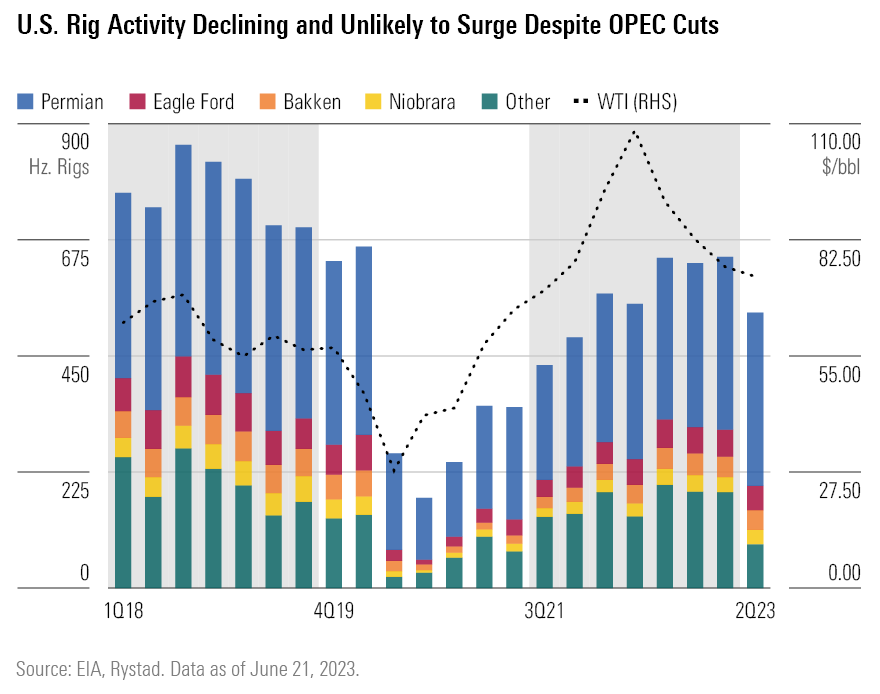

The global oil market is expected to be slightly in deficit over the next few quarters. In April, OPEC surprised traders with voluntary cuts from several member countries, which means quotas were not adjusted but volumes will decrease by 1.7 million barrels of oil equivalent per day. These cuts were initially scheduled to unwind at the end of the year. However, there were media reports they were extended through 2024 at the June 4 ministerial meeting. Official quotas were also reduced on June 4 by 1.4 mmboe/d, ostensibly pushing the combined curtailment next year to 3.1 million mmboe/d. Because several members have been persistently struggling to deliver their quotas, the 2024 adjustment merely aligns these countries’ targets with their capacities. Adjusting for this underperformance, we peg the realistic impact of the combined cuts on 2024 volumes at around 1.1 mmboe/d. The United States is unlikely to offset the cuts, as it might have a few years ago, due to ongoing producer discipline.

Meanwhile, the European Union is on track to hit its November 2023 natural gas storage target early, and gas consumption and LNG demand in China are recovering more slowly than expected. As a result, Dutch and Asian LNG spreads are likely to be low in the near term. The U.S. gas inventory outlook continues to look challenged, and we don’t see much of a respite in the near term. U.S. inventory levels remain well above the five-year average, and we wouldn’t be surprised if inventory levels continue to increase and exceed the top end of the range during 2023. We still see enough demand growth to ensure U.S. export capacity expansions in the next few years are utilized well, flipping the script and paving the way for a rebound in domestic prices.

Top Energy Sector Picks

HF Sinclair DINO

- Fair Value Estimate: $56.00

- Star Rating: 4 Stars

- Uncertainty Rating: Very High

- Economic Moat Rating: Narrow

HF Sinclair’s shares have fallen behind peers as the company struggled with refining operational issues and new renewable diesel plant startups. It also took time to digest a series of acquisitions for which it suspended the dividend for a time. We think these troubles are largely priced in, however, and expect improvement from here. HF Sinclair has already returned to paying dividends and repurchasing shares. Meanwhile, we expect a new CEO to focus on operational issues and right the ship. Economic weakness later in the year or early next would weigh on earnings, but we see valuations as compelling at current levels.

TC Energy TRP

- Fair Value Estimate: $47.00

- Star Rating: 4 Stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Narrow

After several setbacks at the high-profile Coastal GasLink project, we think the focus will shift back to the attractive core business for TC Energy. We expect 2023 EBITDA to increase to CAD 10.6 billion from CAD 9.9 billion in 2022 and the dividend to increase by 4%. TC Energy remains exposed to U.S. LNG, with its market share of U.S. feedgas on track to reach 35% by 2025. Next, we’re optimistic regarding Mexican gas, where earnings are projected to double over the next few years. Finally, Bruce Power offers ample renewables, hydrogen, and carbon capture opportunities.

SLB SLB

- Fair Value Estimate: $56.00

- Star Rating: 4 Stars

- Uncertainty Rating: High

- Economic Moat Rating: Narrow

Rallying share prices have removed much of our oilfield services coverage from deeply undervalued territory, but investors can still get industry leader SLB—formerly Schlumberger—for a bargain. High demand for oilfield services lends service firms a good deal of pricing power, which we expect will support margin expansion over the next few quarters. SLB’s leading-edge technological advancements continue to distinguish the firm from peers: its myriad innovations consistently add value for customers, preserving SLB’s ability to command premium pricing over and above the currently favorable operating environment.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)