Energy Sector Losing Steam as Prices Retreat

Schlumberger, ExxonMobil and Equitrans are top picks as the sector looks less attractively valued than others.

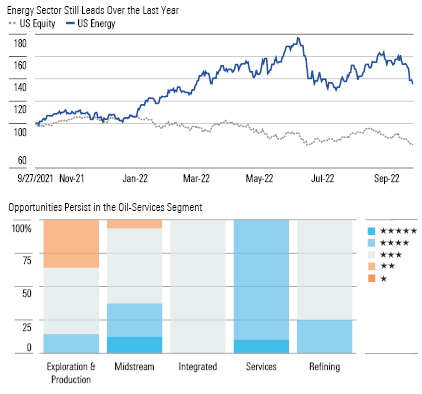

The Morningstar US Energy Index dropped 1.9% in the second quarter compared with the market’s 3.1% decline. Given the sector’s outperformance over the last 12 months, we now view the sector as much closer to fairly valued on average than our other sector coverages, with the median stock trading at a 9% discount. However, we continue to see opportunities in the oil-services segment, which trades at an average discount of 33%.

A slowing demand outlook, primarily due to recession fears in the U.S. and Europe along with a continued zero-COVID policy in China, has helped alleviate some tightness in global oil markets. WTI prices have retracted from recent highs, dipping below $90 per barrel in August, the lowest level since the start of the Russia-Ukraine conflict in February. Thus far, the impact of sanctions on oil supply has been milder than many anticipated and, although the EU ban on Russian imports has yet to take effect, the disruption now looks likely to stay in the low end of the range of early estimates of 1 million-4 million barrels per day. Rystad Energy expects Russian oil supply to fall to 9.5 mmb/d in 2022 and 8.9 mmb/d in 2023 (from 9.6 mmb/d in 2021).

S

ource: Morningstar Equity Research. Data as of Sept. 27, 2022.

Sectors Decline as Prices Retreat From June's Highs

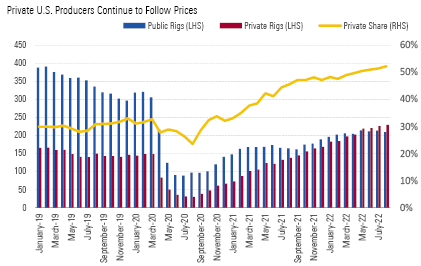

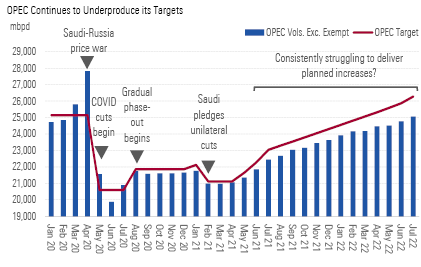

Traditional swing players such as the United States and OPEC will help replace forgone Russian supply. In the U.S., public producers have maintained their commitments of capital discipline but are still expected to deliver 3% and 4% annual growth in 2022 and 2023 respectively. And private producers have been ramping more quickly given favorable economics. The U.S. rig count increased to 695 in August from 569 at the start of the year. Likewise, while OPEC has been systematically failing to deliver its targeted volumes, output has been growing nonetheless and is closing in on prepandemic levels. In July, the cartel’s core producers missed their cumulative target by 1.2 mmb/d but still delivered 29 mmb/d (6.8 mmb/d higher than the June 2020 low and within 0.5 mmb/d of the December 2019 level). As a result, global crude inventories have been edging closer to historical norms throughout 2022, despite the crisis in Ukraine. But prices will remain above midcycle levels in the back half of 2022 unless the Ukraine crisis completely subsides immediately, or a full-blown recession takes hold.

Sources: OPEC. Rystad. Morningstar. Data as of Sept. 19, 2022.

Top Picks

Schlumberger SLB Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $49 Fair Value Uncertainty: High

Rallying share prices have removed much of our oilfield services coverage from deeply undervalued territory, but investors can still get industry leader Schlumberger for a bargain. High demand for oilfield services lends service firms a good deal of pricing power, which we expect will support margin expansion over the next few quarters. Schlumberger’s leading-edge technological advancements continue to distinguish the firm from peers: its myriad innovations consistently add value for customers, preserving Schlumberger’s ability to command premium pricing over and above the currently favorable operating environment.

ExxonMobil XOM Star Rating: ★★★ Economic Moat Rating: Narrow Fair Value Estimate: $102 Fair Value Uncertainty: High

Exxon plans to double earnings from 2019 levels by 2025 and double cash flow by 2027 on a combination of structural operating cost reductions, portfolio improvement, and growth across its upstream, downstream, and chemical segments. Exxon estimates that under the current plan, it will generate about $100 billion in surplus cash, after funding investment and paying the dividend, during the next five years. Combined with currently higher than expected commodity prices, its current repurchase program of $30 billion through 2023, is likely just the beginning.

Equitrans ETRN Star Rating: ★★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $14 Fair Value Uncertainty: High

Equitrans now expects the Mountain Valley Pipeline , or MVP, to be in service in the second half of 2023 with a revised cost estimate of $6.6 billion. The recently announced proposed energy permitting provisions (separate legislation from the Inflation Reduction Act of 2022) contains direct benefits for MVP, thanks to West Virginia’s Sen. Joe Manchin’s support, given the pipeline’s presence in West Virginia. We expect the permits to be completed by the end of 2022, allowing construction to proceed in 2023. Equitrans reaffirmed the current dividend payout as safe and does not see any debt compliance issues.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)