Big Value in Big Tobacco

Potential vaping regulations have limited impact on our valuations.

The only surprise about President Donald Trump’s proposal to ban non-tobacco-flavored vaping liquids is that it took so long. We believe vaping regulation is still in its early stages, and future developments could include higher taxes and control over ingredients. Nevertheless, Trump’s proposal significantly accelerates U.S. regulation and could decimate the category in a few years.

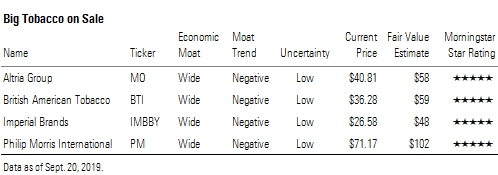

We are retaining our fair value estimates for all the tobacco companies we cover until we know more about the extent and timing of any regulation, but our worst-case scenario analysis shows that Altria MO is the most affected, having recently acquired 35% of Juul, while this latest development is probably a net positive for Philip Morris International PM. We believe there is significant value in the group at present. We see particular upside to Imperial Brands IMBBY and British American Tobacco BTI, while Philip Morris is our quality pick for its leadership position in heated tobacco and strong combustible portfolio.

After recent reports of breathing problems among several hundred vaping consumers in the United States, the Trump administration will seek to ban the sale of non-tobacco-flavored liquids, bringing forward a Food and Drug Administration proposal to review the category in 2022. Manufacturers may be able to reintroduce their products later, subject to FDA approval. While this would not solve the issue of youth access to the products, it may allow the FDA to take greater control of product quality and ingredients.

We estimate that around two thirds of the roughly $9 billion U.S. vaping market is composed of nontobacco liquids and that this could be as high as 80% for market leader Juul. The worst-case scenario is that volume of this magnitude is lost to the regulated category, with users either quitting or finding black-market alternatives rather than switching consumption to other tobacco products.

The following analysis assumes:

- 66% of the U.S. vaping market by value is nontobacco liquids.

- None of this volume elimination migrates to other categories in the portfolio.

- A ban occurs on June 30, 2020.

- International markets are unaffected by the events in the U.S.

The greatest impact of a ban would be felt by Juul, which holds a U.S. market share of around 75%, and by association Altria, which acquired 35% of Juul in December 2018. We estimate that a vaping ban would lower Altria’s earnings per share by $0.03 in 2020, or less than 1%, but the impact would magnify to around $0.17, or 4%, by 2023. Altria would almost certainly be forced to take an impairment charge on its $12 billion investment in Juul, probably about $5 billion, but excluding that destruction of shareholder capital, we estimate the impact of lower equity income to the intrinsic valuation of the company would be almost $3 per share, or around 5%, if a ban comes to fruition.

Perhaps a more pressing issue for Altria is the implied valuation of Juul in its proposed nil-premium merger with Philip Morris. We do not think the potential for a ban on vaping eliminates Philip Morris’ motivation for the deal, which we believe is iQOS distribution, but it throws a spanner in the works on valuation. The nearly 8% decline in Altria’s stock since Trump’s announcement probably prices in a reasonable allowance for a valuation impairment of Juul, but the issue could make negotiations more complex.

Imperial Brands would also be affected. It acquired then market leader Blu from Lorillard in 2014, and although it since lost its leadership position to Juul, Blu has expanded internationally. Blu in the U.S. accounts for a maximum of 1.5% of total revenue, and margins are currently much smaller than those in the combustible business (which we believe are around 40% in the U.S.) so the impact on earnings and valuation is negligible, although some write-down would be taken on Blu. Imperial paid $7.1 billion for Blu along with the Maverick cigarette brand from Lorillard, plus Kool, Salem, and Winston from Reynolds American. We estimate any write-down to be $1 billion-$2 billion range (4%-8% of market capitalization) because the value of the Blu brand has grown substantially overseas since that time.

Like Imperial, British American Tobacco has invested heavily in vaping, and through the 2017 acquisition of Reynolds American, it assumed ownership of the Vuse brand. Also like Imperial, vaping accounts for 1.5% of British American’s total revenue. At least half of this is likely to be in the U.S., although we think margins are negligible.

For most manufacturers, including Japan Tobacco, the impact of the potential U.S. vaping ban is fairly limited. The category is immature, has higher customer acquisition costs than cigarettes, and requires heavy investment in a pipeline of new products, akin to nontobacco consumer staples categories. A ban in the near term would remove little from the operating income line and revert companies’ focus, at least in the U.S., to the high-margin combustible business model. However, it would also shut the tobacco manufacturers out of a new and younger consumer segment, although our base-case valuations do not assume incremental growth from vaping.

Perhaps the most contentious assumption in our analysis is that a ban will occur only in the U.S. Regulators outside the U.S. have so far been more permissive than the FDA regarding the vaping category, so we think this is a reasonable assumption in the short term. In the longer term, however, it seems likely that vaping regulation will tighten across the world as more data comes to light about the public health impacts.

/s3.amazonaws.com/arc-authors/morningstar/2ec7ca36-5bf1-45bb-8d9c-af7c8050dc31.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2ec7ca36-5bf1-45bb-8d9c-af7c8050dc31.jpg)