Basic Materials Stock Outlook: Sector Underperforms, Creating Opportunities Amid Decline

Our top picks include Albemarle and Dow.

This article is part of Morningstar’s Q2 market review and outlook.

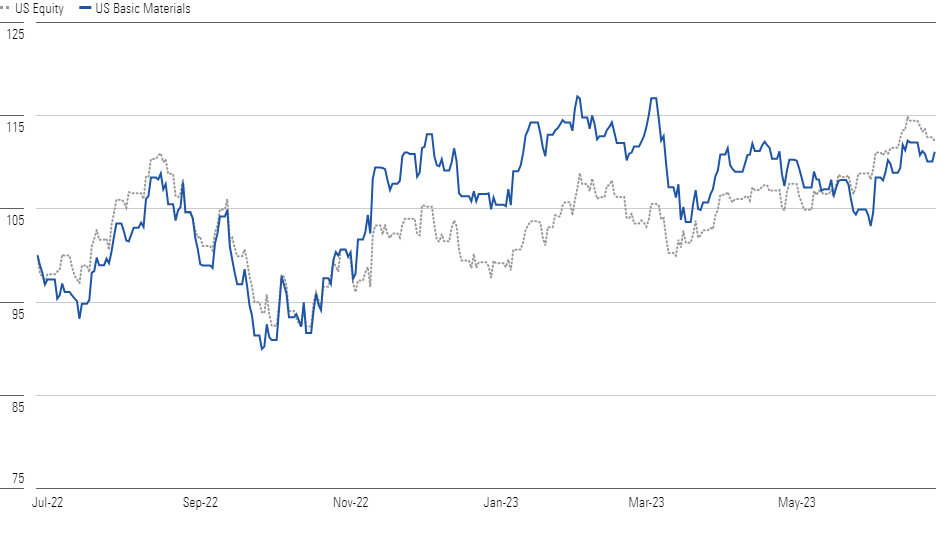

The Morningstar US Basic Materials Index underperformed the broader market during the second quarter of 2023, increasing only 0.3%, while the U.S. market index rallied 5.4%. On a trailing 12-month basis, the sector underperformed the market by 120 basis points. However, we see opportunities, with the majority of the stocks (70%) trading in 4- or 5-star territory.

Basic Materials Sector Slightly Underperforms Relative to Broader Market

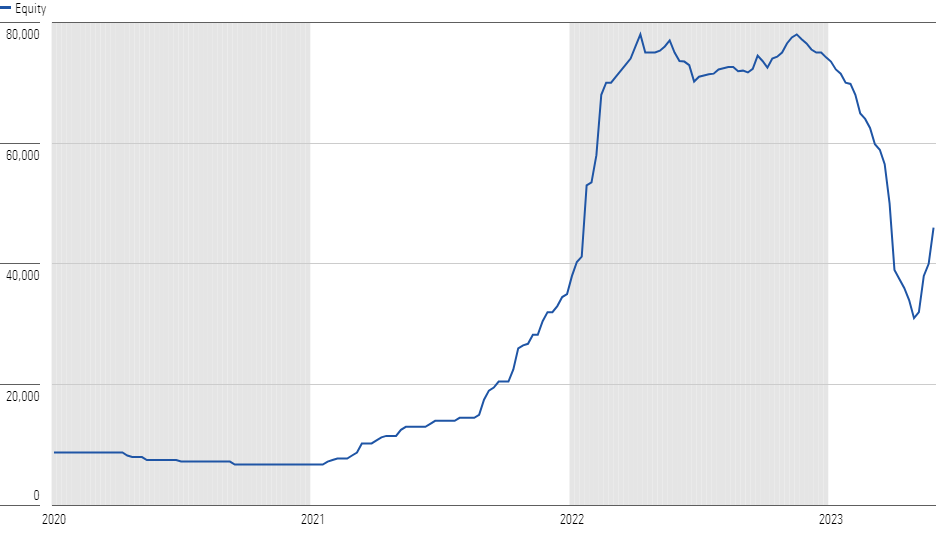

Lithium demand will more than triple by 2030 from 2022, largely due to increased electric vehicle adoption. Lithium spot prices fell 60% during several months of the year, driven by a slowdown in demand growth and new supply. However, as EV sales growth accelerated through the first half of the year, spot prices started to rise again, up nearly 50% from the cyclical low hit in early May. Based on our cross-price elasticity model, we forecast lithium prices will average in the mid-$50,000-per-metric-ton range over the next couple of years, which should allow low-cost producers to generate excess returns.

Lithium Spot Prices Have Rallied Since Bottoming Out In May

In commodity chemicals, we expect widespread macroeconomic headwinds will weigh on 2023 profits, due to lower volumes leading to reduced plant capacity utilization. However, we expect the decline to be short-lived and anticipate improving petrochemicals demand in 2024. North American manufacturers nevertheless maintain a significant cost advantage versus their international competitors, which is informed by the oil-gas ratio (the cost of Brent crude oil per barrel divided by the cost of Henry Hub natural gas per million British thermal units). A ratio above 7 times indicates a comparative cost advantage favoring North America, and our midcycle price forecasts for oil and gas imply the ratio will settle around 18 times over the next five years.

In agriculture, falling crop prices have fueled questions about farmers’ willingness to purchase premium agricultural inputs, such as seeds and crop protection products. However, we think demand will remain strong. Premium seeds and crop protection products justify their cost by helping farmers increase their crop yields, which is essential to maximizing their income in all crop-price environments.

Top Basic Materials Sector Picks

Albemarle Corp ALB

- Fair Value Estimate: $350.00

- Star Rating: 4 stars

- Uncertainty Rating: High

- Economic Moat Rating: Narrow

Albemarle is our top pick to play a lithium price recovery. The stock trades at a little over 60% of our fair value estimate of $350 per share. Albemarle’s main business is lithium, which generates roughly 90% of its profits. The company produces lithium from three of the best resources globally, creating a cost advantage that underpins our narrow moat rating. Albemarle also offers the lowest risk among the lithium producers under our coverage, as its plan to quadruple lithium production capacity by the end of the decade will be done largely through the replication of the company’s existing downstream conversion facilities.

Dow DOW

- Fair Value Estimate: $72.00

- Star Rating: 4 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Narrow

Dow is our top pick to invest in a commodity chemicals recovery. The stock trades at a little less than 25% of our fair value estimate of $72 per share. The firm’s growth prospects generally reflect overall GDP growth, and we expect demand recovery to materialize in early 2024 and beyond across its myriad end markets. Demand remains resilient in a handful of segments, such as automotive and agriculture, and we’re optimistic about a recovery and return to growth in the industrial and residential construction end markets over the next several years, offering material upside potential over the long run.

Corteva CTVA

- Fair Value Estimate: $70.00

- Star Rating: 5 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Wide

Our top pick to invest in strong agriculture inputs demand is Corteva. The stock trades at a nearly 20% discount to our fair value estimate of $70 per share. Corteva is an agriculture inputs pure-play company, with seeds and crop protection each generating around half of its profits. As the company develops new premium seeds and crop protection products, we forecast that it will see strong revenue and profit growth, as well as margin expansion.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZEMES5XIZBD2LHOJ4CE4VEBM6I.png)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_3bda971142bb429e90b0e551f31b1fbb_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/B26QQUGWL5BVLMVULGYK3QQASI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)