After Earnings, Is Verizon Stock a Buy, a Sell, or Fairly Valued?

With improvement in wireless but balance sheet building ahead, here’s what we think of Verizon’s stock.

Verizon Communications VZ reported its fourth-quarter earnings on Jan. 23. With the company’s stock up 27.8% over the last three months, here’s Morningstar’s take on Verizon’s earnings and outlook.

Key Morningstar Metrics for Verizon Communications

- Fair Value Estimate: $54.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

- Forward Dividend Yield: 6.33%

What We Thought of Verizon Communications’ Earnings

Verizon’s wireless postpaid customer additions were a bit stronger than expected, but free cash flow was also a touch higher. Verizon’s MyPlan offerings have resonated with customers, and defections have increased only modestly. Management seems confident in the momentum behind the business, announcing higher prices across a large portion of its postpaid customer base earlier this month. At the same time, the firm stated that it expects to grow this base in 2024, a sign that it anticipates the competitive environment to hold steady or improve a bit.

The company didn’t make a ton of progress on debt reduction in 2023, but it supported its dividend payouts while completing the last of the spectrum payments tied to the 2020-22 spectrum auctions. Verizon is set up to meaningfully reduce debt leverage in 2024, which should add confidence that it can maintain the dividend payouts, which remain very attractive based on yield.

The turnaround in the wireless business should continue into 2024, but not at the expense of promoting a rational competitive environment. Investors seem to now understand that as the market share leader, Verizon won’t add customers as quickly as AT&T T or T-Mobile TMUS, but it should be able to maintain its customer base or grow it slightly while also increasing revenue per customer.

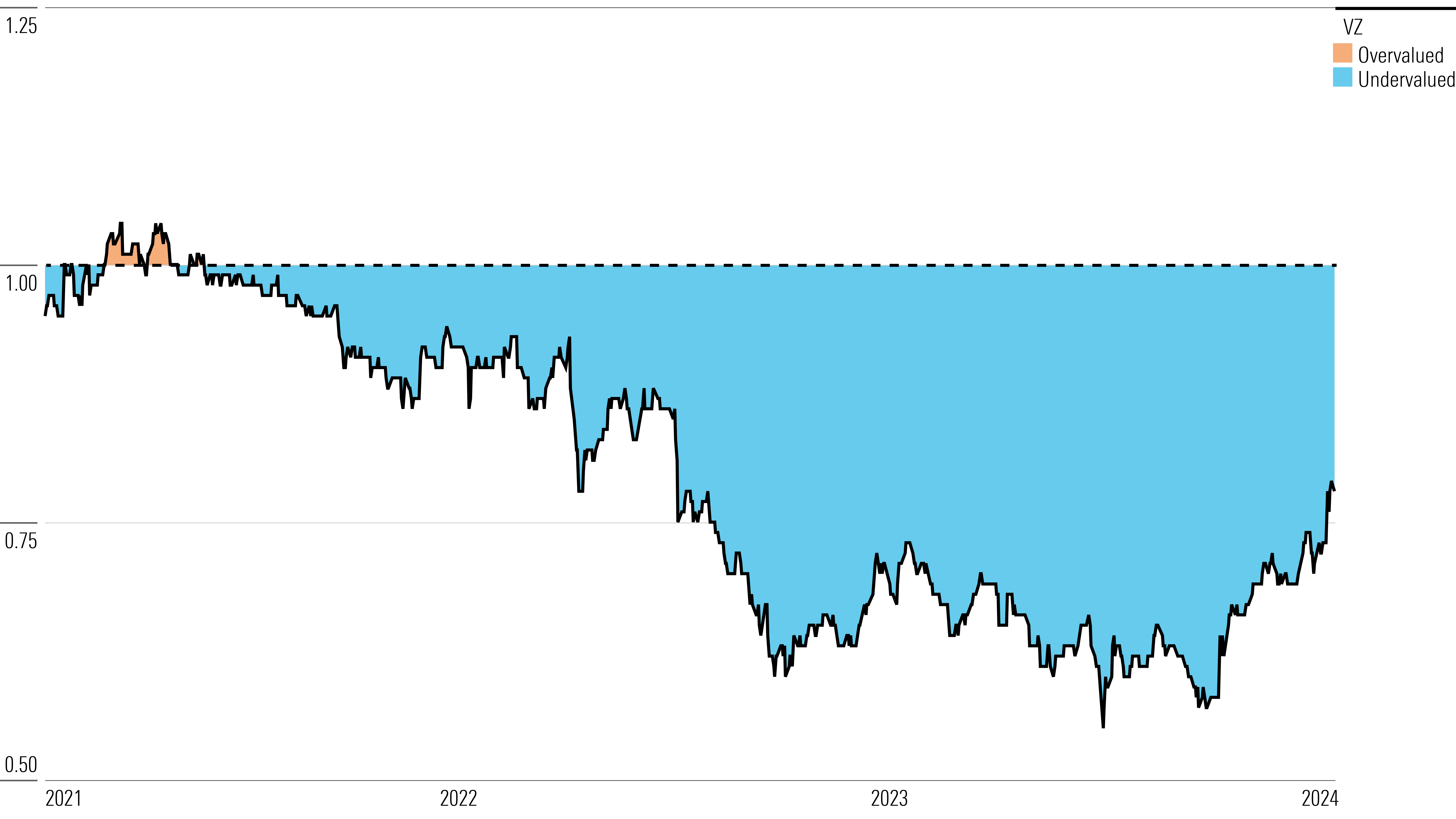

Improving the balance sheet will take center stage over the next couple of years. As a result, Verizon isn’t in a position to capitalize on the attractive valuation of its shares through stock buybacks. The company’s trading multiple has also improved recently. The figure is no longer far below normal levels the way it was over the summer, when the lead-sheathed cable issue was in the headlines. (We continue to expect lead cables will not present a major liability.)

Verizon Communications Stock Price

Fair Value Estimate for Verizon

With its 4-star rating, we believe Verizon’s stock is undervalued compared with our long-term fair value estimate of $54 per share, which equates to roughly 8 times our 2024 EBITDA forecast. That valuation also implies an 8.2% free cash flow yield based on the firm’s performance in 2023. Higher cash taxes and interest costs will likely offset business growth and lower capital spending in 2024, leaving free cash flow roughly flat for the year.

We expect Verizon will gradually lose postpaid wireless market share over time as it prioritizes pricing stability over growth. Smaller rivals T-Mobile and AT&T have similar network resources and should be able to attract roughly the same number of new customers each quarter. This parity should naturally cause the firms’ market shares to slowly converge. With a rational competitive environment allowing for stable service pricing and increasingly modest phone credits, we expect revenue per postpaid customer will grow steadily in the coming years.

We believe management will remain focused primarily on the higher end of the market, but Verizon has also used a variety of prepaid brands to attract customers. Prepaid results have been poor recently, but we believe the firm will slowly stabilize this business. We also expect Verizon will benefit from an increasing number of nontraditional devices on its network, like cars and edge computing data centers. In total, we expect a bit less than 3% average annual wireless service revenue growth from 2024 through 2028, with a very gradual acceleration throughout our forecast.

Read more about Verizon’s fair value estimate.

Verizon Historical Price/Fair Value Ratio

Economic Moat Rating

Verizon’s moat stems from cost advantages in its wireless business and the industry’s efficient scale characteristics. The firm has organized its business along customer lines, but we believe it is best understood along wireless and fixed-line dimensions. The wireless business produces about 70% of service revenue but contributes nearly all of Verizon’s profits. We estimate wireless returns on invested capital were about 16% before 2021. With heavy investment to acquire additional spectrum in the C-band auction and subsequent spending to put that spectrum to use, we estimate wireless returns on capital have declined to the low double digits, still leaving Verizon ahead of its cost of capital.

Verizon, AT&T, and T-Mobile dominate the U.S. wireless market, claiming more than 90% of retail postpaid phone customers. Providing solid nationwide coverage requires heavy fixed investments in wireless spectrum and network infrastructure. While a larger customer base does require incremental investment in network capacity, a significant portion of costs are either fixed or more efficiently absorbed as network utilization reaches optimal levels in more locations.

The benefits of fixed-cost leverage and the difficulty of providing a differentiated wireless offering create an efficient scale advantage in the wireless industry. The massive consolidation across the industry over the past 15 years and the inability of several interested parties, including Dish Network and Comcast CMCSA, to effectively enter the market with their own networks provide evidence of efficient scale. We think the T-Mobile/Sprint merger reflects both firms’ belief that they needed additional scale to earn acceptable returns on capital. We don’t believe the carriers have an incentive to aggressively poach each other’s customers, given how painfully slow market share shifts are. We also expect the high cost of maintaining nationwide coverage and its diminutive size will limit Dish’s ability to compete on a large scale over the long term.

Read more about Verizon’s moat rating.

Risk and Uncertainty

Our Uncertainty Rating of Medium reflects the volatility we think Verizon investors face relative to our global coverage. The firm primarily sees regulatory and technological uncertainties. Wireless and broadband services are often considered necessary for social inclusion in terms of employment and education. If Verizon’s services are deemed insufficient or overpriced (especially in response to weak competition), regulators or politicians could step in.

Recent reports have highlighted potential risks related to lead-sheathed cables commonly deployed in telecom networks into the 1960s. The liabilities and costs associated with removing these cables, if deemed necessary, are unknown.

Also, regulators control wireless spectrum licensing, which creates opportunities to influence the wireless industry. A flood of new spectrum availability could drive down prices, further easing entry into the wireless business. Or, as we suspect was the case in the C-band auction, the threat of entry could drive up the prices Verizon feels compelled to pay.

Read more about Verizon’s risk and uncertainty.

VZ Bulls Say

- A focus on network strength over the past 15 years has put Verizon in an enviable position. Its wireless network provides the broadest coverage in the industry, and it has a sterling reputation with customers.

- With the largest customer base in the United States, Verizon is the most efficient carrier in the industry, delivering far better profitability than its rivals.

- Verizon is relentlessly pushing forward in its core business, expanding its fiber optic network and deploying 5G wireless technology.

VZ Bears Say

- Wireless technology is dramatically lowering the cost to build and maintain a network. Rival carriers have rapidly deployed new spectrum and technology to add coverage and capacity. Verizon’s network leadership is a thing of the past.

- Verizon’s fixed-line business is a disaster, earning minimal profits and facing years of high costs necessary to support these declining businesses.

- Verizon’s balance sheet isn’t the fortress it once was. Paying down debt will limit strategic flexibility and shareholder returns. Liabilities tied to lead-sheathed cable could add another headache.

This article was compiled by Tom Lauricella.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)