After Earnings, Is Verizon Stock a Buy, a Sell, or Fairly Valued?

With stand-out metrics and a focus on the wireless business, here is what we think of Verizon’s stock.

Verizon Communications VZ released its second-quarter earnings report on Tuesday, July 25, 2023, before the market open. Here’s Morningstar’s take on what to think of Verizon’s earnings and stock.

Key Morningstar Metrics for Verizon Communications

- Fair Value Estimate: $54.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

What We Thought of Verizon’s Q2 Earnings

Lead-sheathed cabling: While Verizon delivered solid second-quarter results, investors remain focused on its exposure to lead-sheathed cabling. The company has disclosed that its copper-based networks span about 540,000 miles, with a “small” percentage containing lead. The firm didn’t provide much additional information or answer questions on the matter, saying it will share details as its own investigation proceeds. We still don’t expect Verizon will face significant lead liabilities, but we have increased our capital spending estimates modestly beyond this year. We suspect Verizon and its peers will ultimately remove some lead-sheathed cabling that otherwise would have remained in place.

Stand-out metrics of Q2: Consumer wireless average revenue per postpaid account increased about 4% versus a year ago (excluding an accounting change; 6% growth as reported) and 1.5% versus the prior quarter, primarily reflecting price increases with a small contribution from fixed-wireless broadband adoption. Despite the price increases, Verizon is attracting more new customers than a year ago, and the pace of customer defections increased only slightly year over year, leaving the firm with 8,000 net postpaid phone customer additions during the quarter.

Focus on the wireless business: Wireless service revenue growth accelerated to 3.8% year over year from 3.0% last quarter. Verizon is primarily focused on the wireless business, where it has taken steps to ensure it remains well positioned, building fiber deeper into major metro areas, acquiring a huge chunk of spectrum, and ramping up spending to put that spectrum to use. We believe Verizon will deliver consistent results, but growth will likely be very modest. We don’t expect liabilities associated with lead-sheathed cabling will overly tax Verizon’s ability to generate steady cash flow, but this matter creates additional uncertainty that is difficult to quantify.

Lower phone sales: Only 3.3% of wireless customers upgraded their phones during the quarter, easily the lowest level of the smartphone era. While lower phone sales pressured reported revenue growth, lower associated costs enabled Verizon to increase adjusted EBITDA for the first time since 2021 (0.8% year over year). Capital spending is also starting to decline, as forecast, boosting free cash flow to $8 billion in the year to date. Management doesn’t usually forecast free cash flow, but it said it expects at least $17 billion in 2023 versus $14 billion in 2022.

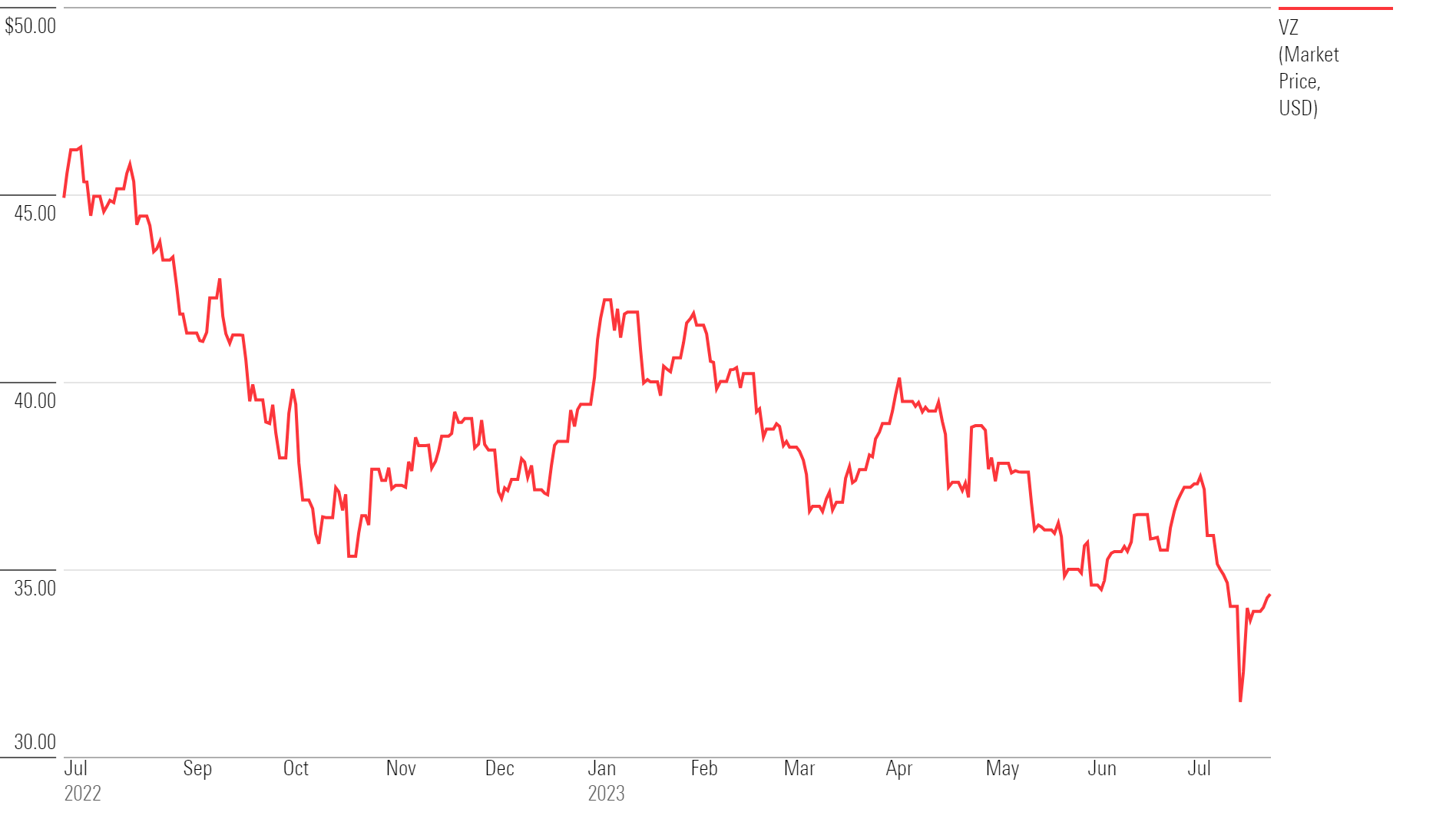

Verizon Stock Price

Fair Value Estimate for Verizon

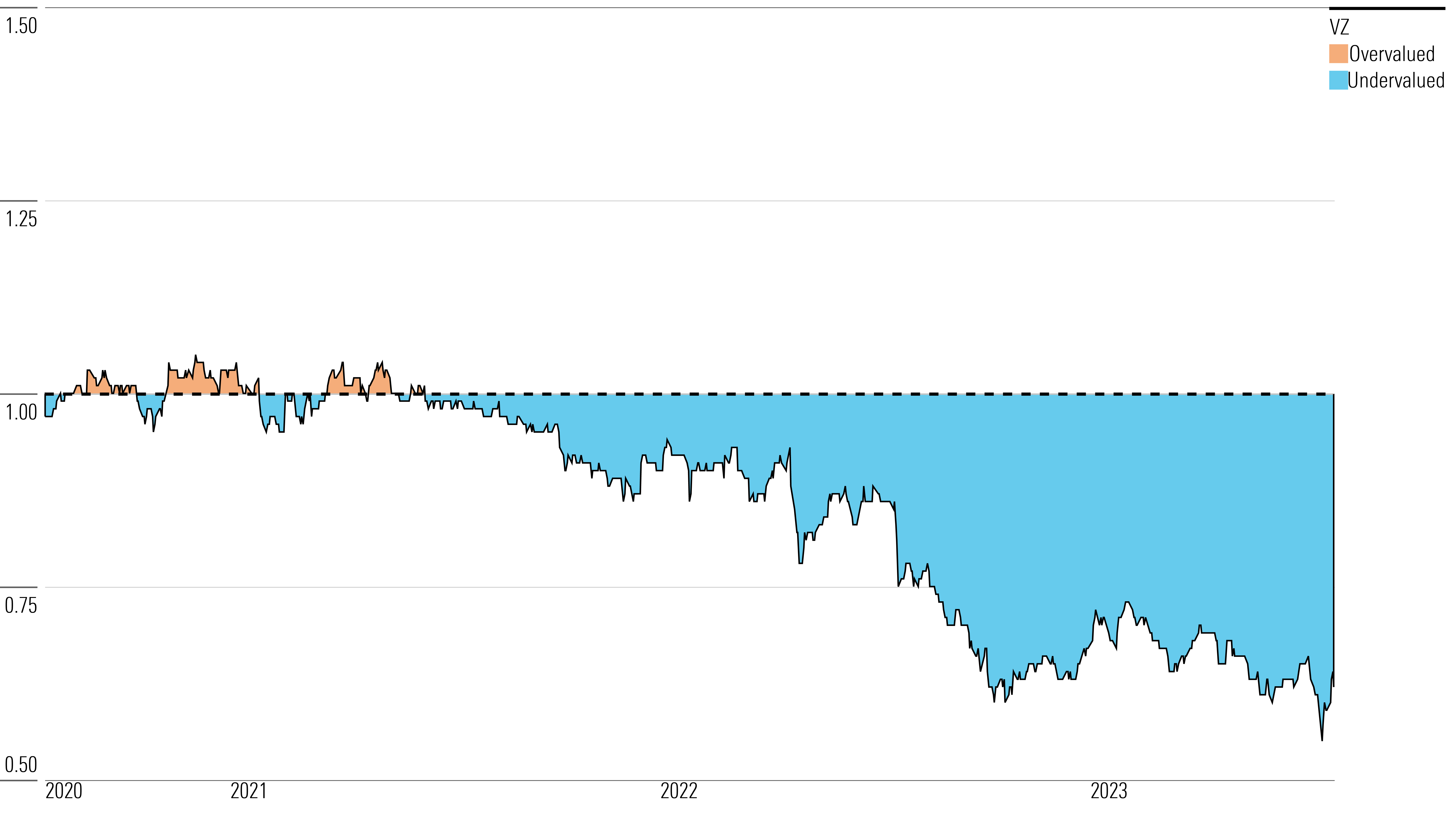

With its 5-star rating, we believe Verizon’s stock is undervalued compared with our long-term fair value estimate.

Our $54 fair value estimate equates to roughly 8.1 times our 2023 EBITDA forecast. Our valuation also implies a 7% free cash flow yield in 2023. We expect free cash flow will increase roughly 20% for the year thanks to sharply lower capital spending as the bulk of the C-band wireless spectrum deployment effort wraps up. We have lowered our cash flow estimates slightly in 2024 and beyond to reflect potential costs to remove lead-sheathed cables from Verizon’s network. Cost estimates are extremely rough, but we assume spending ramps up to $500 million annually by 2027. We assume spending tapers off beyond our explicit forecast, but we have still modestly increased our predicted long-term investment rate.

We expect Verizon will gradually lose postpaid wireless market share over time as it prioritizes pricing stability over growth. Smaller rivals T-Mobile and AT&T have similar network resources and should be able to attract roughly the same number of new customers each quarter as Verizon. This parity should naturally cause the firms’ market shares to slowly converge. With a rational competitive environment allowing for stable service pricing and increasingly modest phone credits, we expect revenue per postpaid customer will grow steadily in the coming years.

Read more about Verizon’s fair value estimate.

Verizon Historical Price/Fair Value Ratios

Economic Moat Rating

Verizon’s narrow moat stems from cost advantages in its wireless business and the industry’s efficient scale characteristics.

Verizon has reorganized its business along customer lines, but we still believe it is best understood along wireless and fixed-line dimensions. The wireless business produces about 70% of service revenue but contributes nearly all of the firm’s profits. Verizon’s restructuring has made it difficult to parse returns on capital, but we have pegged its wireless returns on invested capital at about 16%, or about 18% excluding goodwill prior to 2021. With heavy investment to acquire additional spectrum in the C-band auction and subsequent spending to put that spectrum to use, we estimate wireless returns on capital declined to about 11% in 2022, still leaving Verizon ahead of its cost of capital.

Verizon Wireless has been built nearly entirely via internal growth since its founding in the late 1990s as a joint venture with Vodafone. The acquisition of Alltel in 2009 stands as the only major deal in firm history, accounting for most of the unit’s goodwill. Alltel was strategically important, increasing the size of Verizon’s customer base by nearly 20%, placing it head and shoulders above even AT&T and T-Mobile in terms of scale while also adding strong geographic coverage in smaller towns and rural areas, extending the firm’s strong network reputation.

Read more about insert company’s moat rating.

Risk and Uncertainty

We have changed our Morningstar Uncertainty Rating to Medium from Low to reflect the volatility we think Verizon investors face relative to our global coverage. Verizon primarily faces regulatory and technological uncertainties. Wireless and broadband services are often considered necessary for social inclusion, in terms of employment and education. If Verizon’s services are deemed insufficient or overpriced, especially in response to weak competition, regulators or politicians could step in.

Recent media reports have highlighted potential risks related to lead-sheathed cables commonly deployed in telecom networks into the 1960s. The liabilities and costs associated with removing these cables, if deemed necessary, are unknown today.

Also, regulators control wireless spectrum licensing, which creates opportunities to influence the wireless industry. A flood of new spectrum available could drive down prices, further easing entry into the wireless business. Or, as we suspect was the case in the C-band auction, the threat of entry could drive up the prices Verizon feels compelled to pay.

Read more about insert company’s risk and uncertainty.

VZ Bulls Say

- A focus on network strength over the past 15 years has put Verizon in an enviable position. Its wireless network provides the broadest coverage in the industry, and its reputation with customers is sterling.

- With the largest customer base in the United States, Verizon Wireless is the most efficient carrier in the industry, delivering far better profitability than its rivals.

- Verizon is relentlessly pushing forward in its core business, expanding its fiber-optic network, and deploying 5G wireless technology.

VZ Bears Say

- Wireless technology is dramatically lowering the cost to build and maintain a network. Rival carriers, especially T-Mobile, are rapidly deploying new spectrum and technology to add coverage and capacity. Verizon’s network leadership is a thing of the past.

- Verizon’s fixed-line business is a disaster, earning minimal profits and facing years of high costs supporting declining businesses.

- Verizon’s balance sheet isn’t the fortress it once was. Paying down debt will limit strategic flexibility and shareholder returns. Liabilities tied to lead-sheathed cable could add another headache.

This article was compiled by Monit Khandwala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MDU4HC5CP5GJJPLC3BY2WUHXO4.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-14-2024/t_e7f0bafb888746519ea89cd25275fd5b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KFWIBRDMEZEAXJKNN2NO5JCV2Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)