7 Most Undervalued REITs With High Dividend Yields

The past year’s headwinds have left these stocks, including Kilroy Realty and Boston Properties, trading at attractive prices.

Real estate investment trusts, often called REITs, have had a rough ride over the past year. First came rising interest rates and a looming threat of recession. Then came the regional banking crisis in March, which sparked fears of a credit crunch that could make it difficult for them to borrow money. However, many are now trading at attractive discounted prices while still offering investors income through high dividend yields.

REITs own portfolios of properties—office buildings, shopping centers, hotels, apartments, and more—that generate income from rent and capital appreciation. They differ from traditional stocks in that they are required to pay out at least 90% of that income to investors in the form of dividends, making them an attractive buy for income-focused investors.

Heading into 2022, REITs enjoyed a long period of low interest rates and a booming economy, which led to steadily rising property values and rents. But the headwinds of the past year have taken their toll.

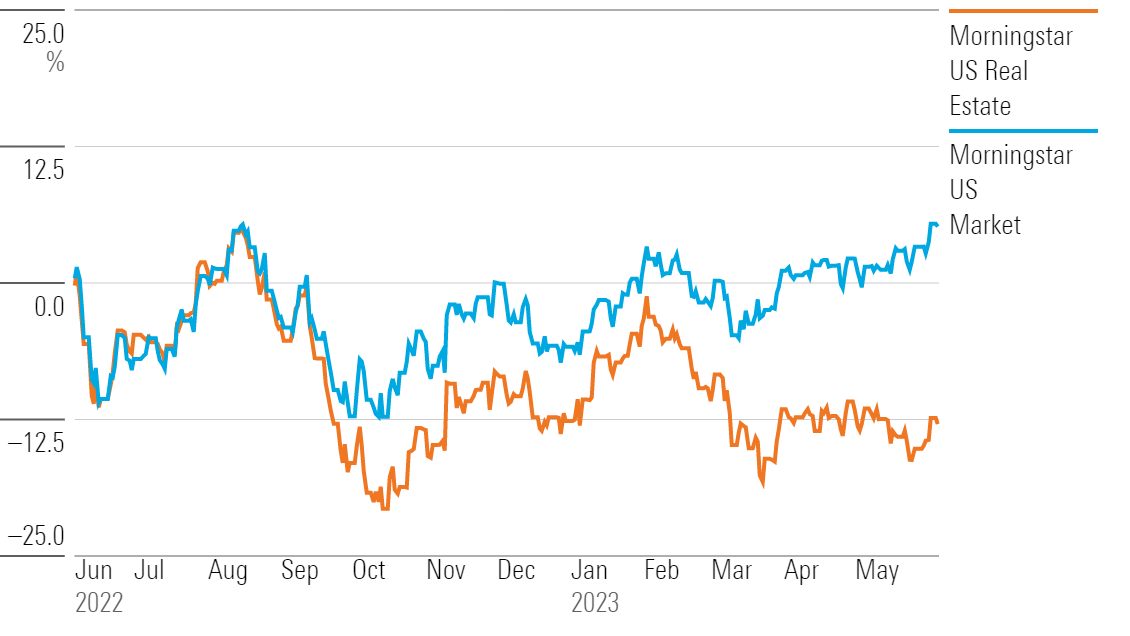

The Morningstar US Real Estate Index, which measures the performance of mortgage companies, property management companies, and REITs, has struggled even as the overall stock market bounced back. As of June 5, 2023, the index fell 13% for the trailing 12-month period, while the broader stock market fell 5.1% as measured by the Morningstar US Market Index.

Morningstar Real Estate Index

This has created a pathway for investors that’s lined with undervalued REITs that are strong contenders for long-term investors, such as communications infrastructure company Uniti Group UNIT. Of the 106 real estate stocks in the index, 14 were significantly undervalued with Morningstar Ratings of 5 stars as of June 5, 2023. Another 17 were considered undervalued with ratings of 4 stars.

“Despite the volatility and uncertainty of the housing market over the past three years, real estate remains a valuable part of an investor’s portfolio,” writes Jeremy Pagan, a research analyst at Morningstar.

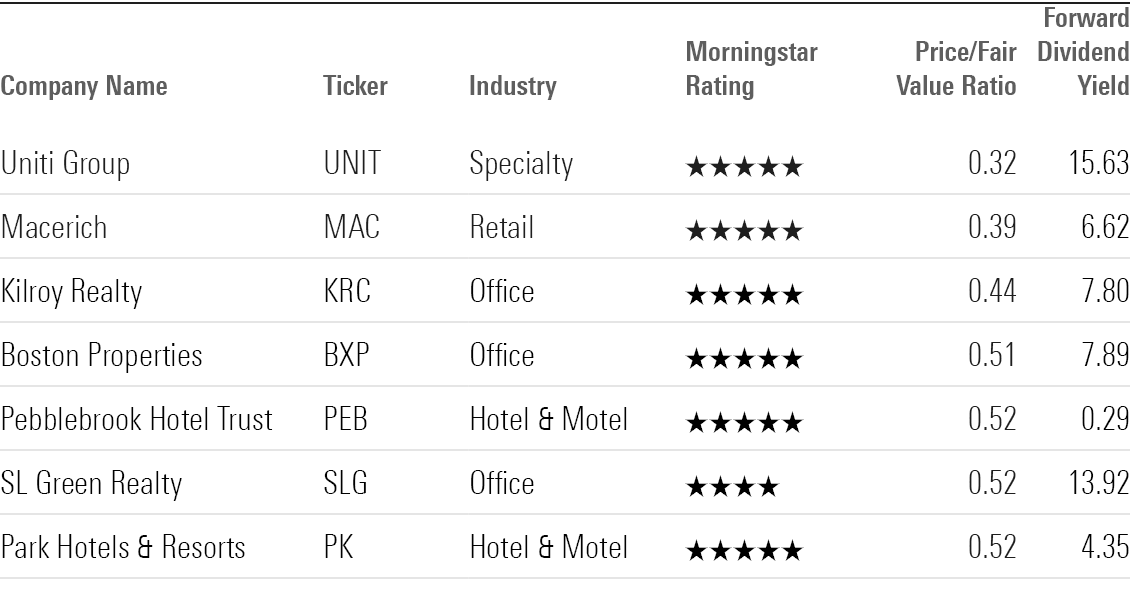

Undervalued REIT Screen

We looked for the most undervalued stocks in the Morningstar Real Estate Index that carried a 5-star rating at the time, all of which happened to be REITs. With 14 stocks trading in such territory, we highlighted comments from Morningstar analysts on the seven most undervalued names. A table showing all 14 can be found at the end of this article.

- Uniti Group

- Macerich MAC

- Kilroy Realty KRC

- Boston Properties BXP

- Pebblebrook Hotel Trust PEB

- SL Green Realty SLG

- Park Hotels & Resorts PK

Top 7 Undervalued REITs

Uniti Group

- Fair Value Estimate: $12.00

- Forward Dividend Yield: 15.63%

“Uniti is a REIT with about 135,000 route miles of fiber in the United States, primarily in the Southeast. It reports its business in two segments: leasing and fiber. Leasing currently makes up about 75% of total revenue and consists mostly of its master lease agreement with Windstream. Uniti was spun out of Windstream in 2015 with a substantial portion of Windstream’s network assets, and it immediately leased the entire portfolio back for Windstream’s exclusive use. Other leasing revenue stems from sale-leaseback transactions with other fiber holders. Uniti generates fiber revenue by leasing dark and lit fiber to wireless carriers and other enterprises.

“While Uniti’s stock has gotten crushed in 2023, the firm reported a typical first quarter. Uniti’s financial results remain very predictable, with its Windstream lease still making up most of its revenue and nearly 90% of EBITDA. There was little change to the firm’s level of investment or success in growing the non-Windstream side of the business, and the company took steps in the quarter to solidify its financial footing. While the stock had a nice pop following the results, we think the current price still reflects concern that the company will go bankrupt. We think Uniti will be able to meet its financial obligations and we are maintaining our $12 fair value estimate.”

—Matthew Dolgin, equity analyst

Macerich

- Fair Value Estimate: $26.50

- Forward Dividend Yield: 6.62%

“Macerich has successfully repositioned over the past decade as a true owner and operator of Class A regional malls. Over the past 10 years, the company has sold over $4 billion in mostly lower-quality assets, either directly owned or owned through joint ventures, and recycled the capital into acquiring new Class A malls, buying out its partners’ shares in the unconsolidated portfolio or redeveloping its own portfolio. As a result, the company’s portfolio should produce higher tenant sales productivity, occupancy levels, and rent, and it is in a much better position to face the economic headwinds of e-commerce. We expect Macerich to continue improving its portfolio through redevelopment, opportunistic acquisitions, and asset sales, which should deliver strong earnings growth over time.

“One of the biggest concerns the market has for Macerich is that the company will have difficulty refinancing debt as it comes due and will have to accept higher interest rates, restricting the company’s ability to renovate its portfolio. While the new debt issued during the quarter is above Macerich’s total debt average of 4.80%, it is below the 6.50% rate on the new debt we assume for the company, so we view the rates the company achieved positively.

“While Macerich is still dealing with the fallout of the COVID-19 pandemic, fundamentals have begun to rebound. Shopping at brick-and-mortar locations fell as some consumers shifted purchases to e-commerce platforms, but foot traffic has since almost returned to pre-pandemic levels, leading to a recovery in sales growth. Macerich’s revenue is protected by long-term leases, and while occupancy fell around 89% in 2020, it has started to recover. We believe Class A malls will remain dominant in brick-and-mortar retail, with high-quality malls eventually returning to their prior occupancy and rent levels.”

—Kevin Brown, senior analyst

Kilroy Realty

- Fair Value Estimate: $63.00

- Forward Dividend Yield: 7.80%

“Kilroy owns, develops, acquires, and manages premier office, life science, and mixed-use real estate properties in Los Angeles, San Diego, the San Francisco Bay Area, Seattle, and Austin. It owns 119 properties consisting of approximately 16 million square feet. The company has positioned itself to benefit from the burgeoning life sciences sector with material exposure in its current portfolio and future development pipeline. We also welcome management’s focus on ESG as it aligns its office portfolio to meet the sustainability requirements of its clients.

“We think the current share price of the company reflects excessive pessimism. Kilroy is trading at around $29 per share after releasing its first-quarter results, which implies a 6.5 times 2023 FFO multiple. We think a 6.5 times FFO multiple for high-quality office properties with low leverage offers an attractive entry point for patient investors who can stomach short-term volatility. We agree that it will take several years for the office sector to recover, but the patience of prospective investors will be duly rewarded. We are maintaining our fair value estimate of $63 per share after incorporating Kilroy’s first-quarter results.”

—Suryansh Sharma, equity analyst

Boston Properties

- Fair Value Estimate: $98.00

- Forward Dividend Yield: 7.89%

“Boston Properties develops, owns, and manages Class A office properties that are mainly concentrated in six markets: Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, D.C. It owns over 190 properties consisting of approximately 54 million rentable square feet of space. The company has positioned itself to benefit from the burgeoning life sciences sector, as it owns approximately 4.6 million square feet of life sciences space and has an additional 5 million square feet of future development potential.

”We think the current share prices of our office REIT coverage reflect excessive pessimism. Boston Properties is trading at around $51 per share after releasing its first-quarter results, which implies a 7 times forward FFO multiple. We think a 7 times FFO multiple for high-quality office properties offers an attractive entry point for patient investors. We are maintaining our fair value estimate of $98 per share for Boston Properties after incorporating first-quarter results.”

—Suryansh Sharma, equity analyst

Pebblebrook Hotel Trust

- Fair Value Estimate: $27.00

- Forward Dividend Yield: 0.29%

“Pebblebrook Hotel Trust is the largest U.S. lodging REIT, focused on owning independent and boutique hotels. In the wake of Pebblebrook merging with LaSalle Hotel Properties in December 2018, the company owns 51 upper-upscale hotels, with more than 12,700 rooms in urban gateway markets. Pebblebrook’s combined portfolio has a higher revenue-per-available-room price point and EBITDA margin than its hotel REIT peers.

“The recent merger with LaSalle provides Pebblebrook with some new avenues to create value for shareholders. The company doubled in size while taking on only a portion of the general and administrative costs, making the combined company more efficient. CEO Jon Bortz previously ran LaSalle and acquired many of the hotels in that portfolio. His knowledge of those hotels, combined with management’s demonstrated ability to maximize margins, should allow him to implement cost-saving initiatives that drive up margins. Additionally, management has begun an extensive renovation program across both the LaSalle portfolio and the legacy portfolio that will drive EBITDA gains over time.”

—Kevin Brown, senior analyst

SL Green Realty

- Fair Value Estimate: $45.00

- Forward Dividend Yield: 13.92%

“SL Green is a real estate investment trust engaged in the acquisition, development, repositioning, ownership, and management of commercial real estate properties, principally office properties. Most of the companies’ properties are in the Manhattan area. The company held interests in approximately 35 million square feet, which includes ownership interests in 26.7 million square feet in Manhattan buildings and 7.2 million square feet securing debt and preferred equity investments. The company’s strategy is to maintain a high-quality portfolio of buildings in desirable locations and focus on creating value through new developments, capital recycling, and joint-venture investments. For example, its $3 billion megaproject One Vanderbilt was completed amid the COVID-19 pandemic and has already achieved high occupancy rates.

“The dire predictions about the death of office space in the early days of the pandemic have not really materialized. Multiple surveys have shown that employers want their employees to come back to the office. We are already starting to see companies sign long-duration leases, demonstrating confidence in the long-term future of the office. In the long run, we believe that offices will continue to be the centerpiece of workplace strategy and play an essential role in facilitating collaboration, harnessing innovation, and maintaining company cultures.”

—Suryansh Sharma, equity analyst

Park Hotels & Resorts

- Fair Value Estimate: $26.50

- Forward Dividend Yield: 4.35%

“Park Hotels & Resorts is the second-largest U.S. lodging REIT, focusing on the upper-upscale hotel segment. The company was spun out of narrow-moat Hilton Worldwide Holdings at the start of 2017. Since the spinoff, the company has sold all its international hotels and 15 lower-quality U.S. hotels to focus on high-quality assets in domestic gateway markets. Park completed the acquisition of Chesapeake Lodging Trust in September 2019. This complimentary portfolio of 18 high-quality, upper-upscale hotels should help diversify Park’s hotel brands to include Marriott, Hyatt, and IHG hotels.

“Revenue from the group business segment continues to show steady improvement. Starting in 2020, group business saw a dramatic decline, with many organizations unwilling to commit to booking hotel rooms because of the uncertainty surrounding COVID-19. As a result, group business fell to just 7.2% of Park’s revenue mix in the first quarter of 2021—significantly down from the 35.0% Park reported in the first quarter of 2019. Since then group business has rebounded, representing 32.7% of Park’s revenue in the first quarter of 2023. We expect that the number of bookings will continue to improve over the next few quarters, and that Park should return to 2019 levels by 2025.

“We think Park has some opportunities to create value. Management has only had control of the portfolio for three years, and we think there is some additional growth that can be squeezed out of current renovation projects. The Chesapeake acquisition should provide an additional source of growth as the company drives higher operating efficiencies across this new portfolio. We also think the pandemic created additional ways for Park to increase margins across the portfolio.”

—Kevin Brown, senior analyst

Top 14 Undervalued REITs

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

/d10o6nnig0wrdw.cloudfront.net/06-06-2024/t_6ad2ed1419124328812f5f64967d142a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)