5 Stocks to Watch

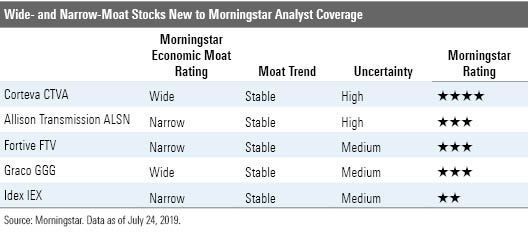

These companies are all new to coverage during the past two months--plus, they earn narrow or wide Morningstar Economic Moat Ratings.

We made a splash last month when we initiated coverage of the cannabis industry. Sector director Kris Inton noted that we expect the industry to grow 9 times through 2030, and the stocks of several of the companies are undervalued by our metrics. However, these companies will struggle to earn economic profits as they spend on growth, adds Inton. As such, none of the cannabis companies has yet carved out an economic moat.

But these five companies--also new to Morningstar analyst coverage during the past several weeks--have.

These high-quality names deserve a place on stock investors' watchlists--and one is even trading at 4 stars as of this writing. Here are our analyst notes for each.

Corteva CTVA "On June 1, DowDuPont completed the Corteva spin-off, issuing one share of Corteva for every three shares owned of DowDuPont. We are initiating coverage on Corteva with a $41 per share fair value estimate. We assign a wide Morningstar Economic Moat Rating to Corteva based on the intangible assets moat source from the firm's pricing power in its patented seeds and crop chemicals. We assign a high uncertainty rating as the company faces factors outside of its control, such as crop prices and farmer incomes, which affect farmer planting and purchasing decisions.

"In seeds, which generated 56% of revenue in 2018, Corteva will continue to lag Bayer (Monsanto). However, we forecast the firm will be able to gain market share as DuPont's direct-selling model combined with Dow's recent product wins against Bayer should entice farmers to switch seeds. Over the past couple of years, Corteva's Enlist corn and soybean seeds have won approval for import into China, while Bayer's have yet to do so.

"Further, in 2023, the royalty agreement between Corteva and Bayer for Roundup Ready seed technology expires. The agreement, which was the settlement of a lawsuit between Monsanto and DuPont, requires Corteva to pay Bayer at least $1 billion per year in royalties. Between now and 2023, Corteva will produce a greater proportion of seeds using its proprietary Enlist genetically modified platform. Once the royalty agreement expires in 2023, we expect Corteva will reduce its reliance on the Bayer technology in relatively short order. This should boost EBITDA margins to the mid-20% range from roughly 19% we forecast in 2019."

--Seth Goldstein, analyst

Allison Transmission Holdings ALSN "We are initiating coverage on Allison Transmission Holdings with a narrow moat rating and a fair value estimate of $54. Allison plays an important role in the truck manufacturing and heavy equipment industries as the only stand-alone manufacturer of commercial fully automatic transmissions. These products serve as more efficient alternatives to manual and automated manual transmissions, or AMTs. In vehicles that stop frequently, Allison's products offer superior fuel economy and a better operator experience than manual transmissions. As fuel savings and labor productivity continue to be key themes in developed markets, Allison is poised to take any market share that isn't lost by electrification. Moreover, in many developing markets, manual transmissions are dominant because of the lower up-front costs. As labor costs rise in these regions, Allison is likely to sell more of its products that command a $3,000 to $11,000 price premium over manual transmissions.

"Allison sits in an enviable position in that it is the only pure-play commercial automatic transmission provider that has over 60% of the North American on-highway share. Its brand has cachet, as the Allison name is often included with vehicle marketing materials owing to the importance of transmission options that can influence the vehicle purchasing process.

"With commercial electric vehicles on the horizon, Allison is taking steps to preserve its relevance. Electrified powertrains will not require a key piece of technology used in automatic transmissions called a torque converter, which is a type of fluid coupling that transfers power from an internal combustion engine to a series of shafts and gears that ultimately propel the vehicle. In April of 2019, Allison acquired two commercial vehicle businesses--Vantage Power and AxleTech's electric vehicle systems division. While neither business has significant revenue, they provide Allison with a broad range of electric powertrain intellectual property."

--Scott Pope, analyst

Fortive FTV "We launch coverage of diversified industrial Fortive with a narrow moat, stable moat trend, an Exemplary Morningstar Stewardship Rating, and an $86 fair value estimate. The stock is currently in 3-star territory, trading roughly 10% below our fair value estimate.

"Fortive was spun off from Danaher DHR in 2016. The firm's business model, Fortive Business System, is an extension of the successful Danaher Business System and is rooted in the continuous improvement philosophy. Fortive's strategy involves acquiring moat-worthy companies, driving operating margin expansion through lean manufacturing principles, and redeploying cash flows into further merger-and-acquisition activity.

"Although M&A is an integral part of the firm's strategy, we believe that the individual businesses in Fortive's portfolio also merit narrow moats on a stand-alone basis because of customer switching costs and intangible assets. Fortive has relatively high recurring revenue, which currently composes over 30% of sales, and benefits from a large installed base across all its businesses. Furthermore, recent acquisitions have focused on boosting recurring revenue and enhancing the firm's software capabilities. Fortive seeks to combine its large installed base of equipment with complementary software and offer customers an integrated package, which we think will enhance customer stickiness.

"Lastly, we believe Fortive's management merits an Exemplary stewardship rating. CEO James Lico has over two decades of experience at Danaher. Despite being a relatively young company, Fortive has an experienced management team with an impressive track record of capital allocation and improving margins of acquired companies. Considering its Exemplary stewardship and narrow moat, we think Fortive is likely to continue outearning its cost of capital for many years to come."

--Krzysztof Smalec, analyst

Graco GGG "We are launching coverage of industrial firm Graco with a wide moat rating and a $47 fair value estimate. We also assign the company Standard stewardship, medium uncertainty, and stable moat trend ratings. Our fair value implies a multiple of approximately 23 times our 2019 earnings-per-share estimate, and we view the stock as fairly valued at current levels.

"Graco has consistently generated lucrative returns on invested capital, averaging 25% over the past decade. We believe the company has established a wide economic moat based primarily on customer switching costs and secondarily on intangible assets. Graco is a leading manufacturer of equipment used for managing fluids, specializing in hard-to-move liquids. Many of its products perform mission-critical functions and are integrated into a customer's production process, but often account for only a fraction of a customer's production costs. As such, customers are less likely to switch to a cheaper but less proven alternative, since the cost of unscheduled downtime could far exceed cost savings. For example, an auto assembly plant is unlikely to skimp on a paint system. Graco's large installed base also generates a stable stream of recurring revenue, as aftermarket parts account for roughly 40% of sales.

"The main concern for Graco remains growth. We view Graco as a GDP-plus business and expect that the firm's commitment to innovation and healthy research-and-development spending will continue to drive additional sales from new products and adjacent markets, as well as market share gains. We project organic revenue to grow at a mid-single-digit rate on average, which implies that management will have to rely on acquisitions to reach its targeted 9%-10% growth rate. Historically, acquisitions have not depressed the firm's operating margins or ROICs, which gives us comfort that management will remain patient and avoid overpaying for acquisitions. Still, relying on M&A carries acquisition risk."

--Krzysztof Smalec

Idex IEX "We launch coverage of diversified industrial firm Idex with a narrow moat rating and a $140 fair value estimate. We also assign the company Standard stewardship, medium uncertainty, and stable moat trend ratings. Our fair value estimate implies a multiple of approximately 24 times our 2019 EPS estimate.

"We believe Idex has carved a narrow moat based primarily on customer switching costs and secondarily on intangible assets. Idex has a portfolio of moaty businesses that typically hold the number-one or -two market share across a variety of niche end markets. Its products often account for a small fraction of a customer's costs but perform mission-critical functions in areas where the cost of failure is high, such as monitoring wastewater collection systems, fire suppression, and rescue tools. As any product failures could lead to costly business disruptions or even safety risks, customers are relatively less likely to switch to a cheaper but less proven alternative. Idex's large installed base also drives a relatively stable stream of recurring revenue, which can constitute around 30% to 40% of sales, depending on the business line. The company's moat is supported by intangible assets, which include strong brand names (for example, the name Jaws of Life has become synonymous with emergency rescue tools in the United States), patent portfolio, and reputation for quality.

"Idex's narrow moat has allowed it to consistently deliver strong returns on invested capital, which have averaged around 16% over the past 10 years. We believe the firm's moat sources are intact and think that Idex is more likely than not to continue outearning its cost of capital throughout the next decade. We view the stock as modestly overvalued at current levels, with shares trading in 2-star territory, and would prefer sitting on the sidelines and waiting for a more attractive entry point. That said, we think Idex is a solid business and deserves a spot on investors' watchlists."

--Krzysztof Smalec

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)