When It Comes to Retirement Spending, Flexibility Pays

But dynamic strategies entail trade-offs—namely, more volatile cash flows and lower ending balances.

Much of the research about safe withdrawal rates for retirement assumes that retirees want to spend the same dollar amount per year, with annual adjustments to account for inflation, over the whole of their retirements.

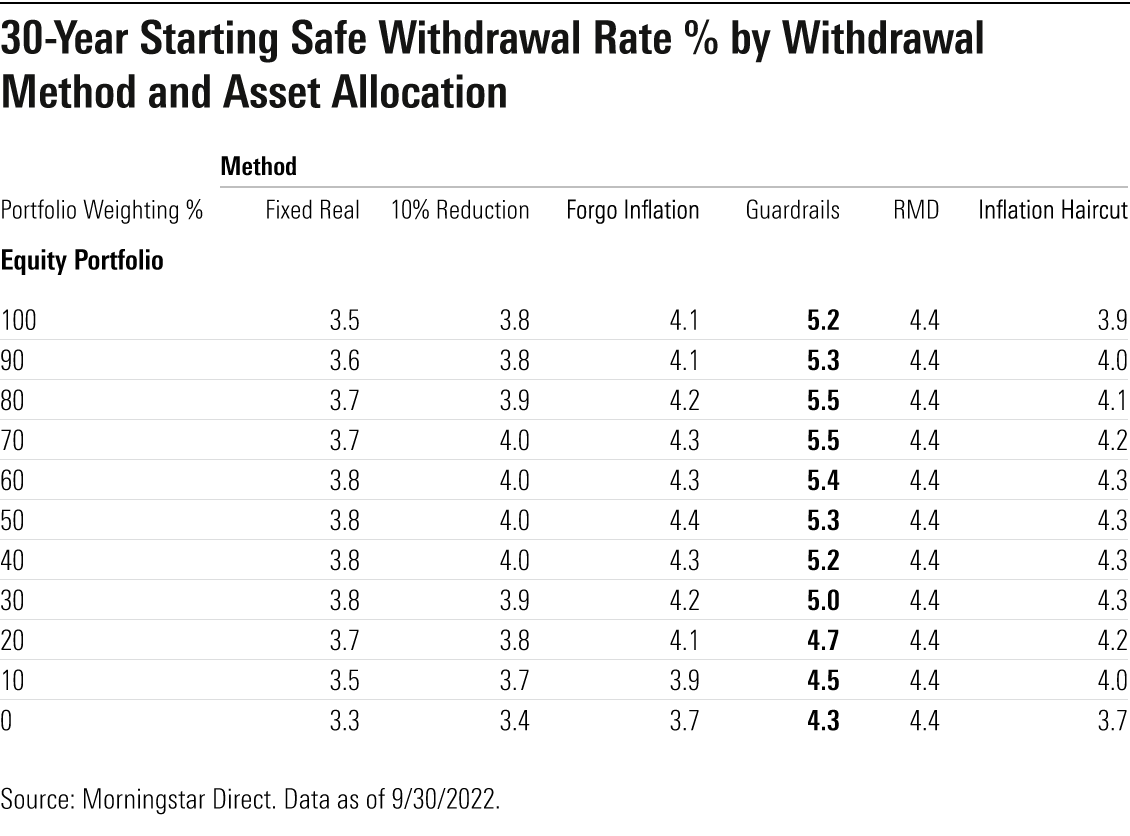

To be sure, being able to take a predictable, paycheck-equivalent stream of income from a portfolio holds appeal. But research that Jeff Ptak, John Rekenthaler, and I conducted on withdrawal rates demonstrates that retirees who are willing to be even a little bit flexible about their withdrawals can generally take a higher starting amount—and in turn higher lifetime withdrawals—than those who are wedded to a fixed real withdrawal system. For example, all of the flexible withdrawal strategies we tested supported a starting safe withdrawal percentage of 4.0% or more for balanced portfolios over a 30-year horizon. And the guardrails system—discussed below—allowed for a starting withdrawal rate of 5.3%! That represents a nice lift from the 3.8% starting safe withdrawal amount for a fixed real withdrawal system with the same balanced portfolio and 30-year horizon.

At the same time, variable strategies entail trade-offs. The most obvious one is that variable withdrawal systems are, well, variable—they’re best suited to retirees who are willing to spend less in lean years in exchange for the ability to spend more initially and over the whole of their retirements.

Moreover, our review of variable strategies demonstrates that they tend to result in lower residual balances after 30 years than less flexible strategies, in part because they give retirees permission to spend more when their balances are up. In other words, they may be less appropriate for retirees with a strong bequest motive.

A Review of the Strategies

For the base case in our withdrawal rate research, we followed a convention that assumes a retiree seeks to withdraw the same amount, adjusted for inflation, for every year in retirement. To use a simple example, a retiree taking a 3.8% initial withdrawal rate could withdraw $38,000 of her $1 million portfolio in year one of retirement, then inflation-adjust that dollar figure each year thereafter. If inflation ran up 3% between years one and two, she could take $39,140 in year two. And so on down the line.

That type of system delivers a pleasing consistency in cash flows. But even modest adjustments to spending, especially during periods of market weakness, delivered a nice lift to starting withdrawal amounts. In our research, we explored five variable spending strategies, as follows:

Flexible Strategy 1: Forgo Inflation Adjustment After a Losing Year

This method, advocated by (among others) T. Rowe Price, begins with the base case of fixed real withdrawals throughout a 30-year time horizon. However, to preserve assets following down markets, the retiree skips the inflation adjustment in the year following a year in which the portfolio has declined in value.

Flexible Strategy 2: Required Minimum Distributions

This method consists of dividing the portfolio value by life expectancy as of the preceding year-end. For life expectancy, we used the IRS’ Single Life Expectancy Table and assumed a 30-year retirement time horizon, from ages 65 to 94. (We employed the updated RMD calculations that went into effect in 2022.) An RMD system incorporates two key variables for retirement-spending plans—remaining life expectancy and remaining portfolio value.

Flexible Strategy 3: Guardrails

Originally developed by financial planner Jonathan Guyton and computer scientist William Klinger, the guardrails method sets an initial withdrawal percentage, then adjusts subsequent withdrawals annually based on portfolio performance and the previous withdrawal percentage. The guardrails attempt to deliver sufficient—but not overly high—raises in upward-trending markets while adjusting downward after market losses. (Our research paper outlines the guardrails strategy in depth.)

Flexible Strategy 4: 10% Reductions Following an Annual Portfolio Loss

This approach employs a schedule of fixed real withdrawals, as with the base case, but makes 10% downward adjustments in years following investment losses. That is, if a retiree’s portfolio loses money in year one, then during year two the retiree withdraws 90% of year one’s amount. This process continues until the portfolio makes money during a calendar year, at which time the spending reverts back to its original schedule.

Flexible Strategy 5: Inflation Haircut

As retirement researcher David Blanchett has noted in his studies of spending across the retirement lifecycle, retirees tend to reduce spending in the middle and later years of retirement (although in some instances their spending increases later in life because of higher healthcare costs). To incorporate this trend in spending over the retirement lifecycle, we assume that the hypothetical retiree does not adjust annual spending by the full amount of inflation but instead by 1 percentage point less than the annual inflation rate. For our 2022 research, therefore, we assume that the retiree’s spending increases by 1.84% annually, rather than the base-case inflation rate of 2.84%.

A Lift to Starting Withdrawals

As shown in the exhibit below, all of the variable methods we tested delivered a nice increase in starting withdrawal rates relative to the “fixed real” withdrawal system, our base case.

But the guardrails method supports the highest starting safe withdrawal rates across every asset allocation. This reflects the nature of the approach, which can support higher initial withdrawals by making potentially significant year-to-year adjustments to dollar withdrawals, including throttling spending down at inopportune times. With the exception of the RMD method, starting safe withdrawal rates are highest in balanced allocations like 50% stocks/50% bonds and tend to be lowest in less diversified allocations like 100% stocks.

But Keep an Eye on Cash Flow Volatility

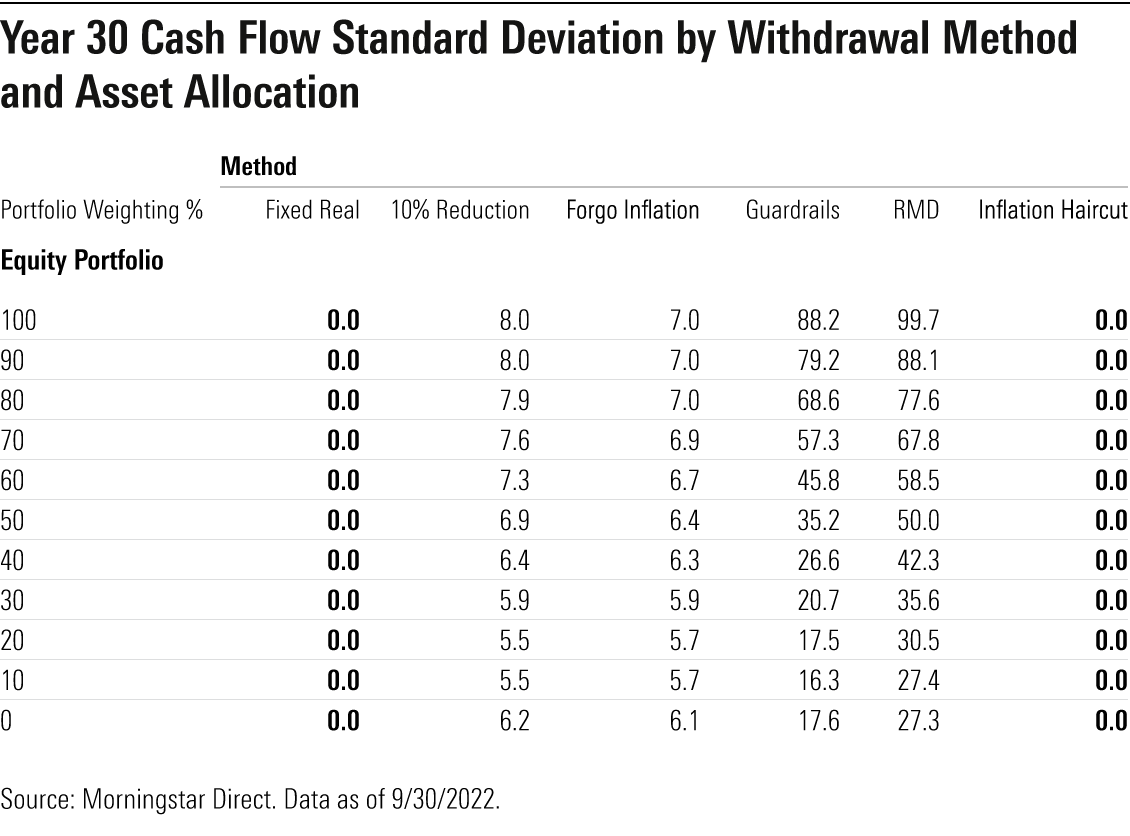

Yet it’s also worth noting that the approaches with the highest sustainable starting withdrawal amounts—the guardrails and RMD methods—also entail the most cash flow volatility, as illustrated in the exhibit below.

Such unpredictability is a natural byproduct of their rules, which can dictate higher or lower spending under certain circumstances. Thus, a retiree enticed by these methods’ high withdrawal rates must also reckon with the substantial uncertainty they can impose. By contrast, the forgo-inflation and 10%-reduction methods entail relatively little year-to-year spending change, making them more useful to retirees who prize stability and predictability.

A retiree’s mix of income sources may also influence the appropriateness of the withdrawal system. Retirees who have a significant share of their spending needs coming from nonportfolio sources—a pension and/or Social Security, for example—will have more leeway to adjust portfolio withdrawals than those who are relying on their portfolios for the bulk of their spending needs. A guardrails or RMD-type system might work for the former group, in that spending adjustments may have less of an impact on quality of life. The latter group, meanwhile, may want to lean toward a system that results in only modest year-to-year adjustments, such as the forgo-inflation and 10%-reduction methods.

Ending Balances Are Another Swing Factor

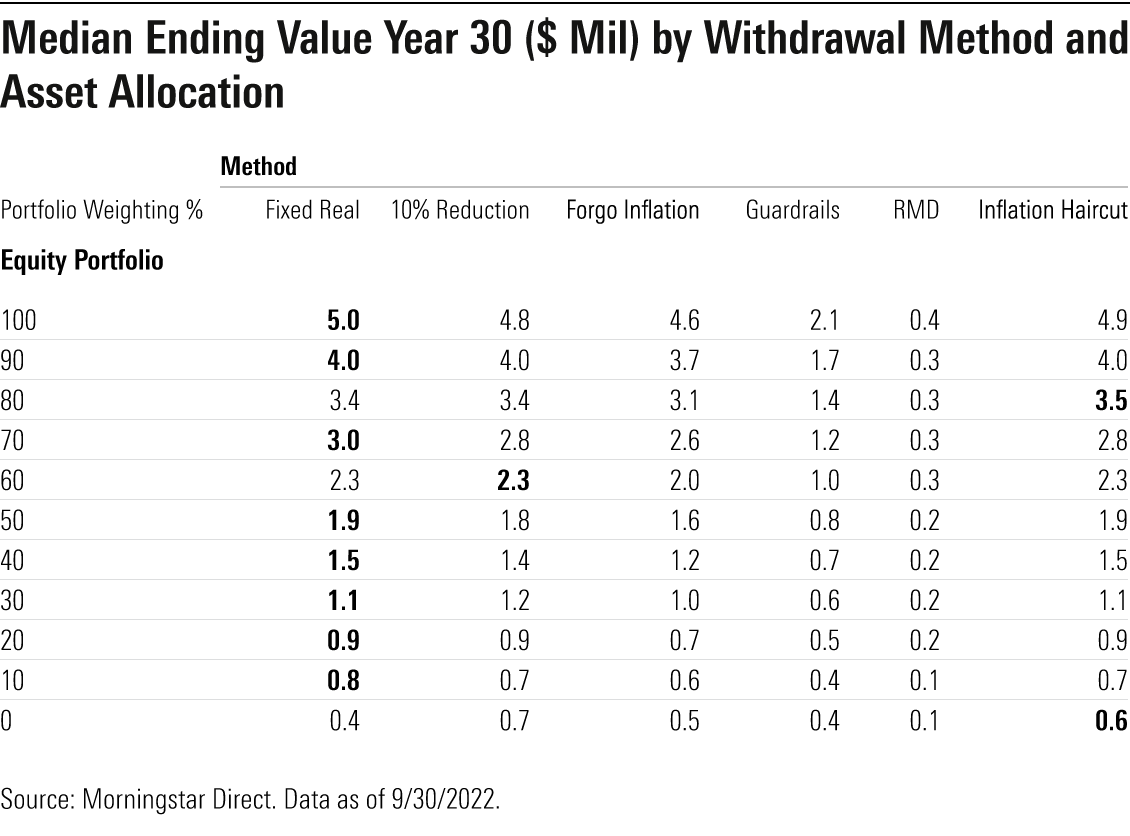

Another factor in the mix is how much of the portfolio is likely to be left over at the end of 30 years—the base-case spending period for all of our research. A system of taking fixed real withdrawals creates some of the highest median balances at year 30.

In other words, retirees using such a strategy may well underspend during their lifetimes. That attribute depresses potential spending but may appeal to bequest-minded retirees. Among the flexible withdrawal methods, the approach of not fully adjusting spending for the effect of inflation produced the highest values in year 30. At the other extreme, the RMD method resulted in the lowest ending values. That is because it spends down most of the retirement capital by design. The guardrails approach splits the difference between a more aggressive, freer-spending method like RMD and thriftier methods that curtail, but never increase, spending.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/d10o6nnig0wrdw.cloudfront.net/07-24-2024/t_99436285e257449398ad25308659356e_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)