ESG Reporting Solutions

ESG Reporting

Sustainable Investing Framework

Our Sustainable Investing Framework includes six ways to incorporate sustainability into portfolios.

The framework isn’t a checklist; it’s more like a menu—what you choose depends on your appetite and taste. It provides a tool and a guide for users to evaluate existing strategies and find new ways to combine approaches to meet specific objectives.

Communicating with your clients requires more than just a one-size-fits-all approach. We’ve built our ESG reporting solutions on Morningstar’s foundational sustainable investing framework, which outlines the various paths investors can take to act on their sustainability objectives. Our reports are tailored to the nuanced motivations that make investing so personal.

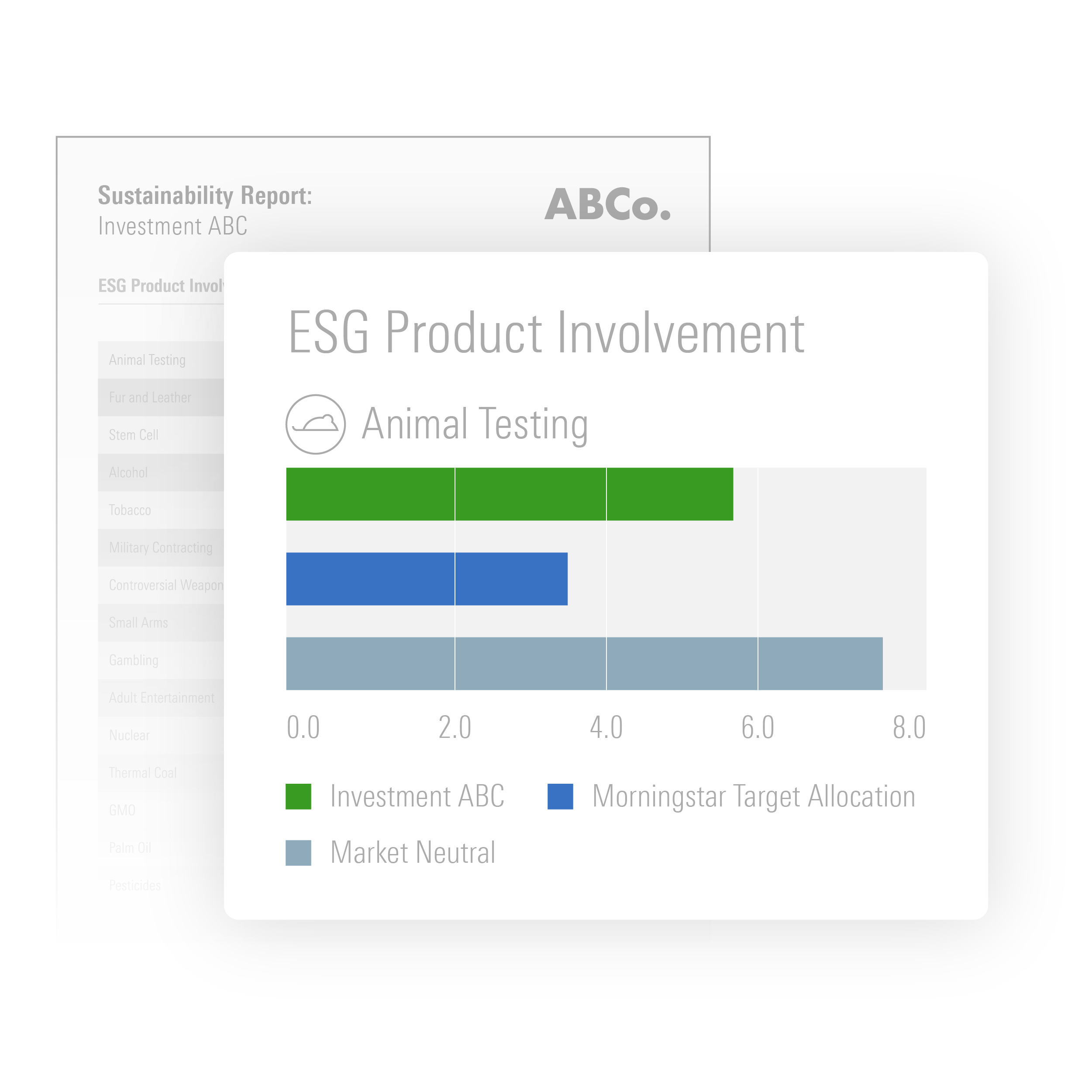

Apply exclusions

Avoids investment in companies, industries, or sectors that may negatively affect the planet or society, such as those tied to fossil fuels or tobacco.

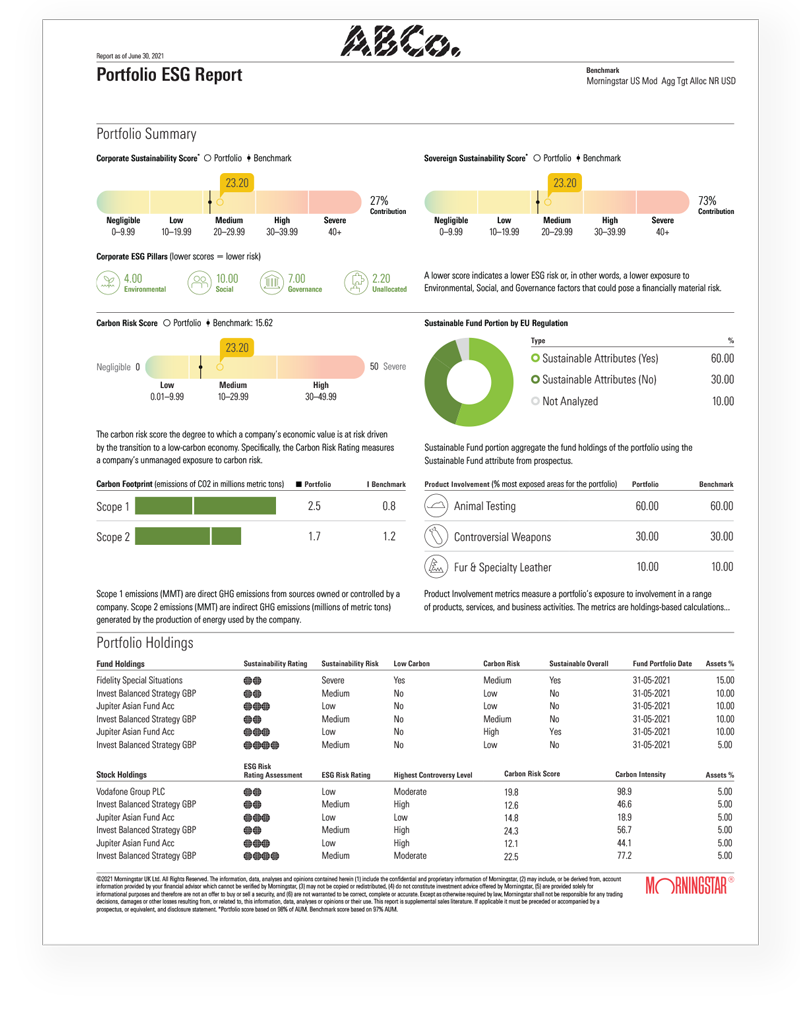

Limit ESG risk

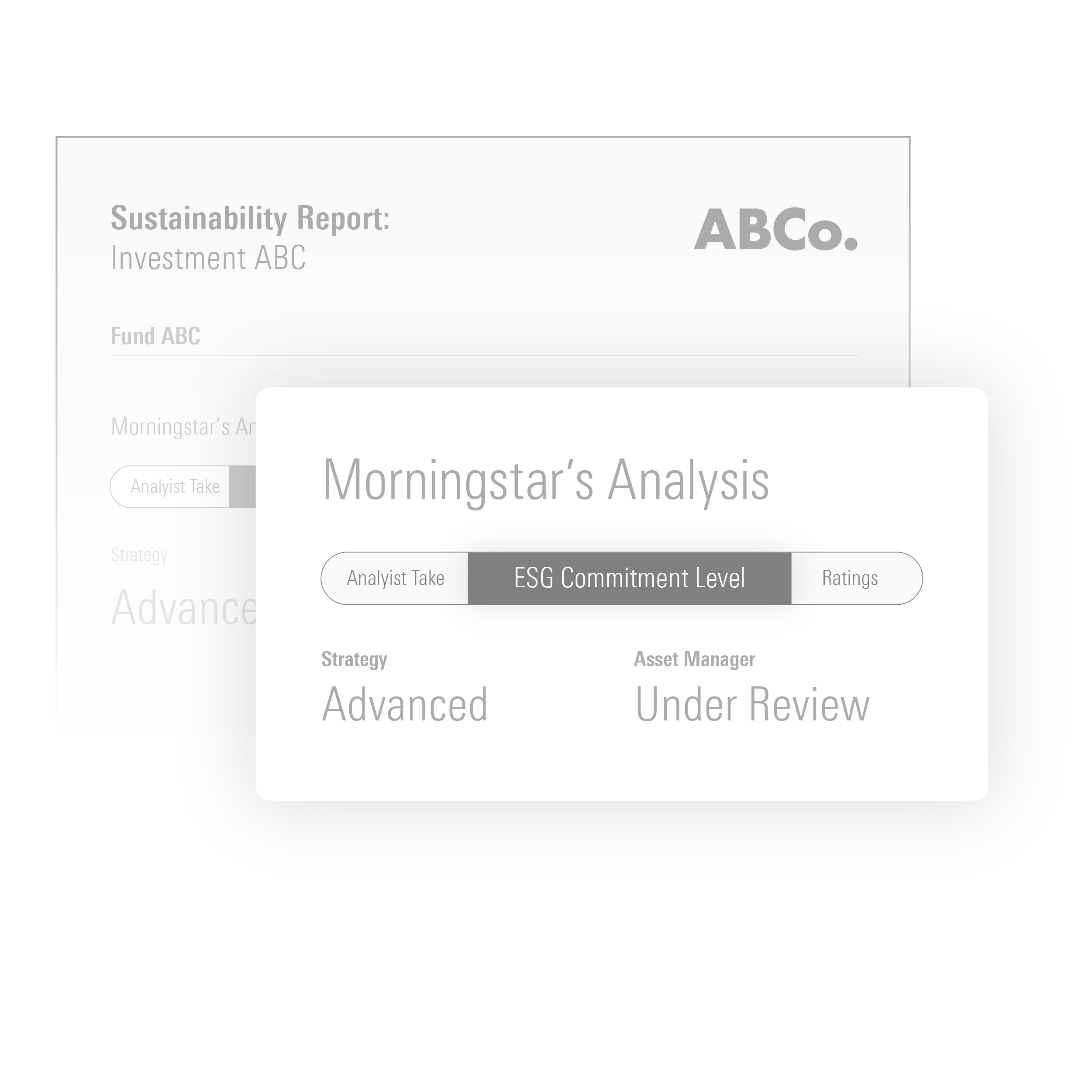

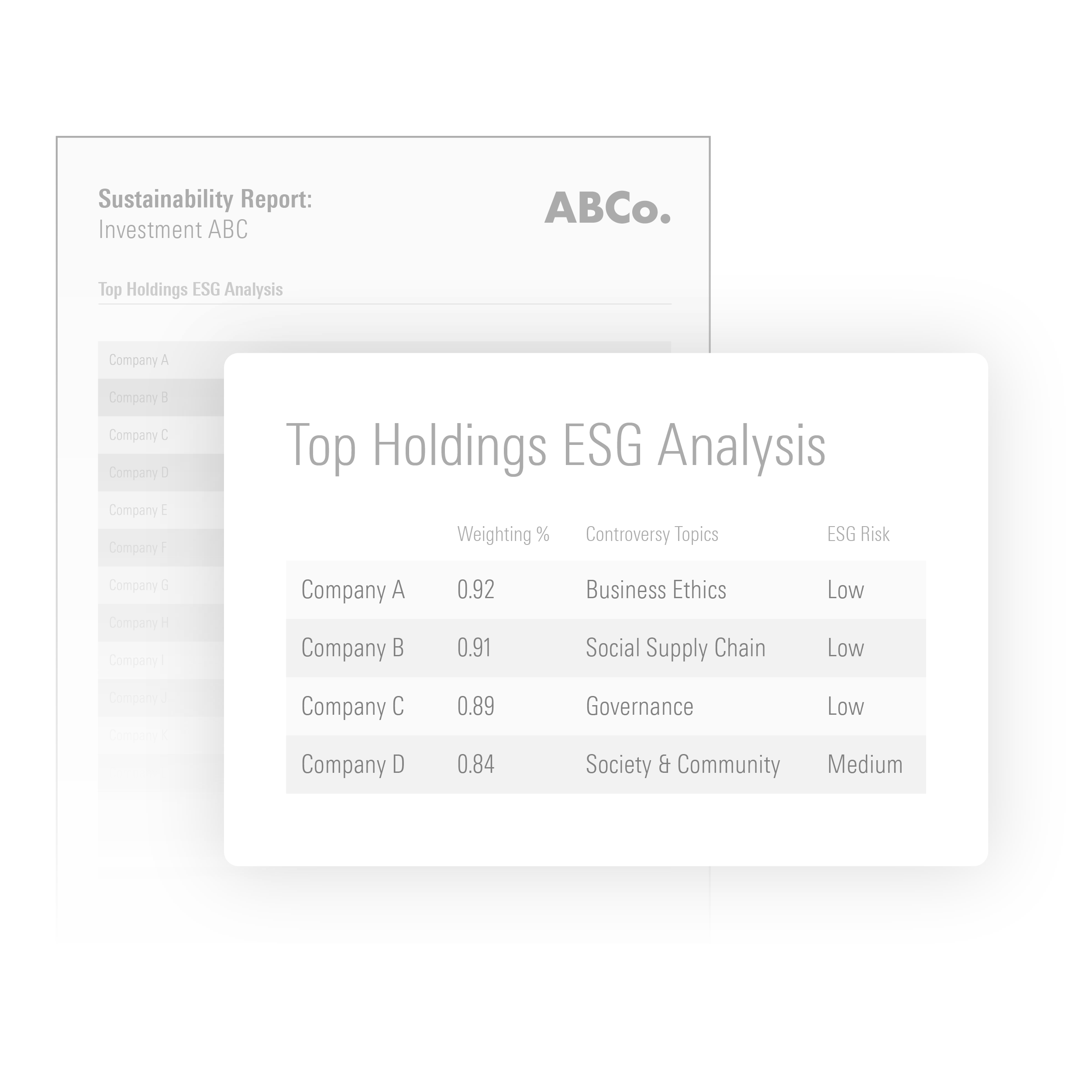

Considers industry-relevant sustainability risks that could materially affect a company’s value.

Seek ESG opportunities

Identifies the leaders in sustainability and the companies that are actively improving their ESG practices to build competitive advantage.

Practice active ownership

Focuses on investor engagement, shareholder proposals, proxy voting, and public advocacy to improve corporate sustainability, transparency, and performance.

Target themes

Focuses on investments created with targeted exposure to companies affecting long-term trends—like renewable energy, clean water, or gender equity.

Assess impact

Evaluates the social and environmental impacts of underlying investments.

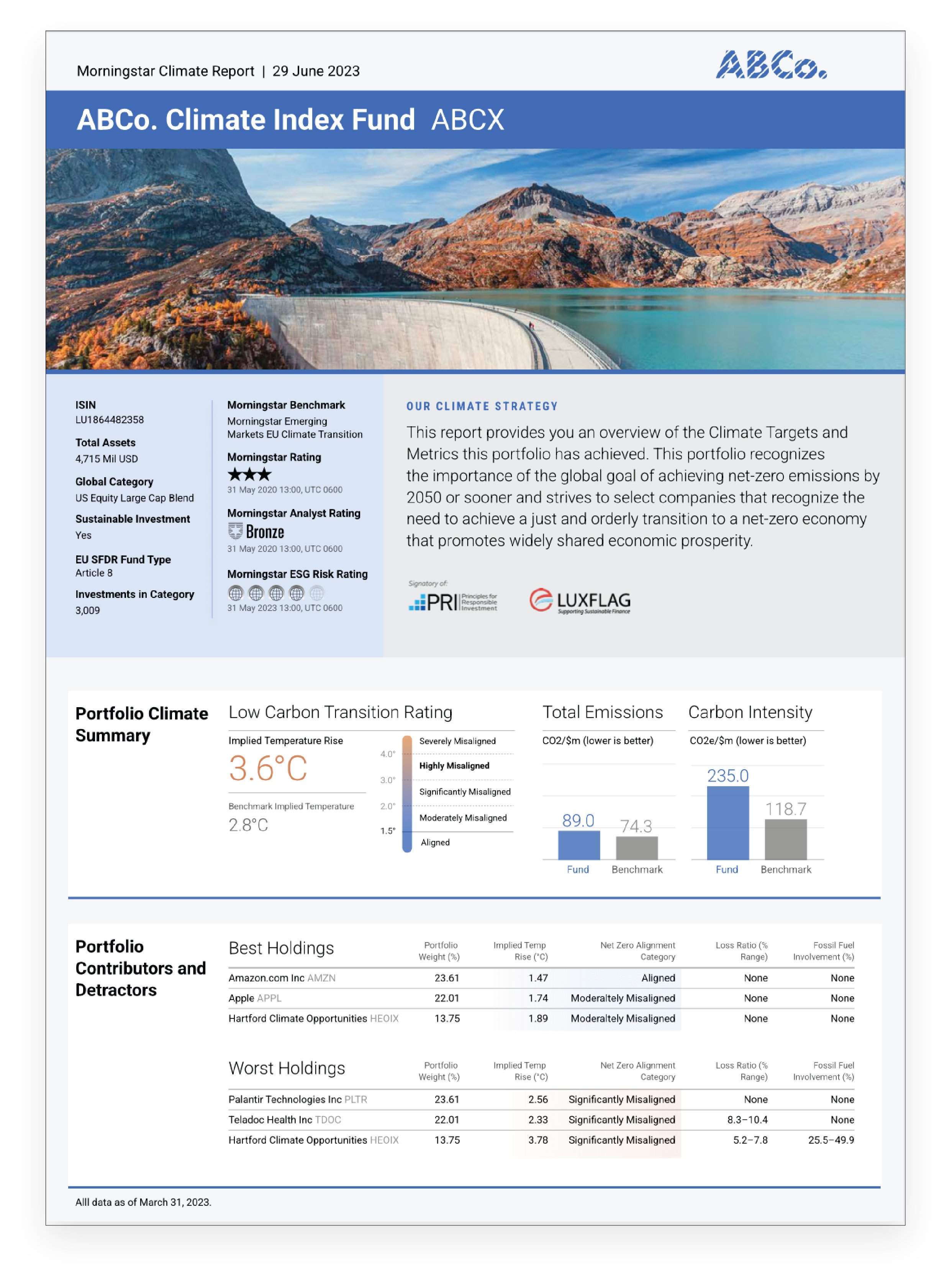

Climate Reporting

All of our reporting solutions include Morningstar’s climate research, data, and ratings. Present personalized portfolios, identify climate risks and opportunities, and tell stories with reports that resonate with investors.

Explore Our ESG Reporting Offerings

Sustainability Reporting Templates

Custom Branded Factsheets

TCFD-Aligned Climate Reports

Portfolio Analysis Reports

Climate Investing Reports

Ready to See for Yourself?

Learn more about which reporting capability can meet your firm’s needs.