Opportunities Seen in the Industrial Sector Amid Economic Headwinds

Aerospace, defense, and waste management have led the Morningstar US Industrials Index’s outperformance.

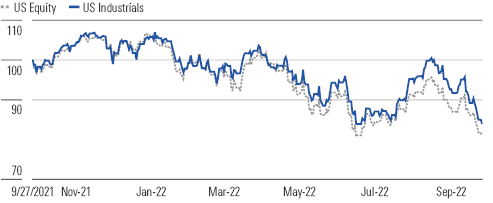

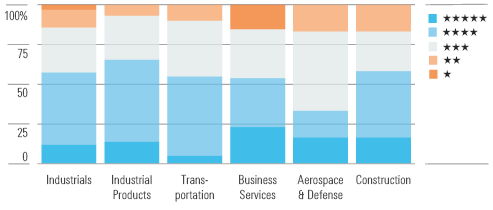

The Morningstar US Industrials Index modestly outperformed the Morningstar US Market Index during a tumultuous third-quarter 2022, while extending its trailing 12-month outperformance to nearly 300 basis points. Year to date, the aerospace, defense, and waste management industries have led the Morningstar US Industrials Index’s outperformance. Contrarily, the business services, transportation and logistics, and industrial products industries have lagged the market.

The aerospace and defense and waste management industries have attracted investor flows as a decline in risk appetite has led to outperformance among industries with dependable cash flows and shareholder-friendly capital allocation policies.

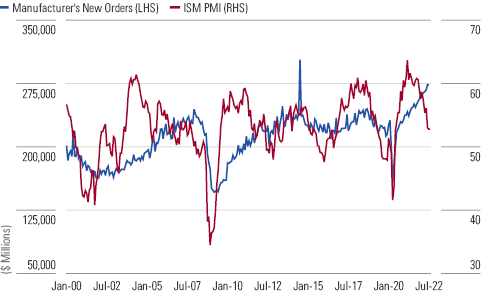

Record stimulus and spending triggered robust industrial activity in 2021, as companies spent heavily to keep pace with demand and expand production capacity. However, concerns of an imminent economic recession have led to a precipitous sell-off in the industrial products industry. While we expect slowing economic growth near-term, we believe the industry now offers several attractive investment opportunities for patient investors.

We prefer businesses with strong brand-related intangible assets, exposure to growing end markets, and exposure to consistent aftermarket sales channels. Notably, we believe ITT and Pentair satisfy the aforementioned factors within the industrial products industry

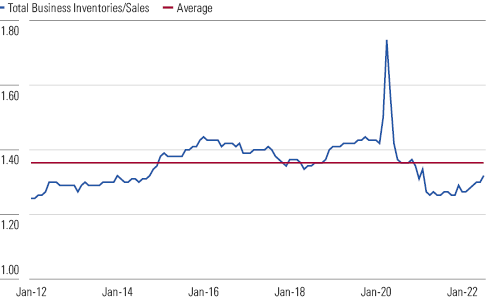

A robust economy and unwieldy supply chains enabled unprecedented pricing power and financial performance for the transportation and logistics industry in 2021. Share prices have since fallen from elevated levels amid recession fears, rising inventory levels, and declines in spot transportation rates. While we expect a continued normalization in supply chain and transportation fundamentals, we believe attractive opportunities are available.

Air travel has also rebounded from 2020 lows and continues to approach prepandemic levels. Despite the rebound, concerns of a weaker economy and prolonged labor shortages have weighed on investor sentiment of the airline industry, which we believe now offers attractive investment opportunities. We anticipate a continued ascent in leisure and business air travel volume, with revenue per available seat mile surpassing 2019 levels by 2024.

Top Picks

We view ITT as a high-quality industrial manufacturer with underappreciated exposure to favorable end markets such as automotives and aerospace. ITT manufactures various components such as brake pads, valves, pumps, and connectors for various industrial customers. We believe the market underappreciates the economics of the highly engineered brake pad business, as the company holds valuable relationships with OEMs that should prove beneficial as new electric vehicle models are rolled out. A rebound in aerospace activity and potential margin expansion through operational efficiencies also provides a catalyst for earnings growth.

ITT ITT 5-Stars

Price (USD) 66.22

Fair Value (USD) 100.00

Uncertainty Medium

Market Cap (USD B) 5.50

Economic Moat Narrow

Capital Allocation Standard

Pentair manufactures various water treatment and pool equipment to residential and commercial customers. The company carries a strong brand reputation and generates most sales in the aftermarket, limiting reliance on new installation. Residential water treatment and pool products exhibited robust volume growth during 2021 due to exceptional stimulus and consumer spending. However, volume growth has stalled in recent quarters, prompting a precipitous decline in share price. Despite near-term growth headwinds, we believe Pentair’s robust install base and favorable aftermarket exposure is underappreciated by the market.

Pentair PNR 5-Stars

Price (USD) 40.82

Fair Value (USD) 65.00

Uncertainty Medium

Market Cap (USD B) 6.68

Economic Moat Narrow

Capital Allocation Standard

Delta Air Lines operates one of the largest airlines in North America, serving both the leisure and business travel markets. We anticipate a continued recovery in passenger volumes from the pandemic induced lows and expect long-term secular growth to be consistent with GDP. The company provides favorable product segmentation enabling premium options for customers, along with traveler benefits such as co-branded credit cards and frequent flyer miles. Despite an increasingly commoditized and fragmented industry, we believe Delta remains the highest quality legacy carrier and trades at an attractive valuation.

Delta Air Lines DAL

Price (USD) 28.50

Fair Value (USD) 57.00

Uncertainty Very High

Market Cap (USD B) 17.97

Economic Moat None

Capital Allocation Exemplary

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SIEYCNPDTNDRTJFNF6DJZ32HOI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)