Morningstar's Allocation Categories Get an Upgrade

We're incorporating the Morningstar Portfolio Risk Score to categorize funds better.

Morningstar's U.S. allocation categories are evolving to help investors better understand portfolio risk. At the end of April 2022, we began incorporating the Morningstar Portfolio Risk Score into our categorization approach for multi-asset funds.

In the past, we primarily considered a fund’s allocation to stocks when determining the best category fit. That method failed to take into account the risk variation that exists across equity strategies but also within fixed income, commodities, and other asset classes. Consulting the Morningstar Portfolio Risk Score should help us mitigate that situation.

Our research on the gap between fund returns and investor returns has shown investors have a harder time capturing a fund's full returns when it's significantly more volatile than peers. By taking a more holistic approach to gauging a portfolio's risks, investors will have an easier time finding funds in line with their risk tolerance and a lower chance of picking funds that may have a surprising amount of volatility.

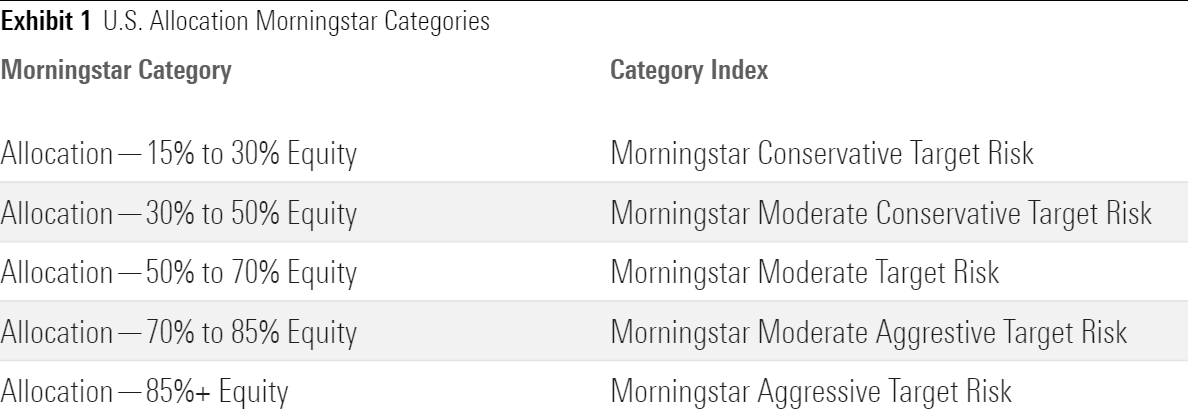

These five U.S. allocation categories are designed to help investors choose funds that match their risk tolerance. The categories span the five classic risk buckets as shown in Exhibit 1.

Exhibit 1 U.S Allocation Morningstar Categories

The equity ranges in the category names coincide with the amount of equity volatility we expect funds in those categories to exhibit over longer periods.

The Problem With Treating All Stocks and Bonds the Same

Viewing a portfolio's allocation to stocks alone gives an incomplete picture.

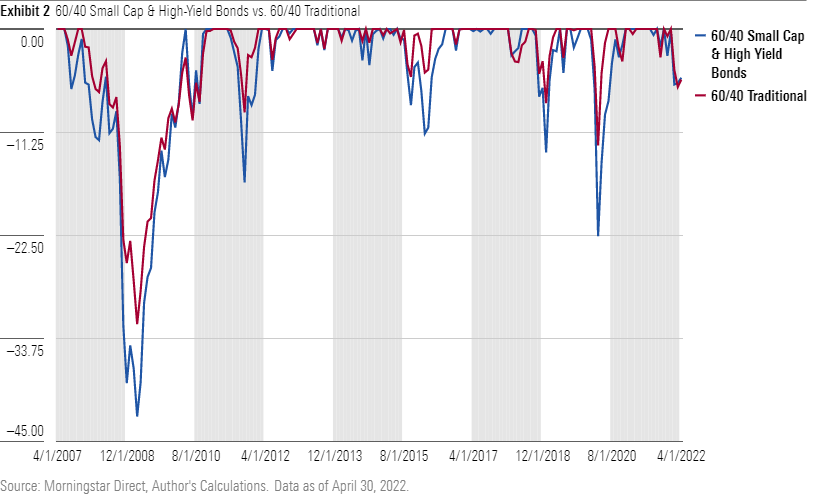

Under our previous methodology a fund with 60% in Vanguard Total Stock Market VTI and 40% in Vanguard Total Bond Market BND would be in the same category as a fund with the same level of allocations to Vanguard Small-Cap ETF VB and Vanguard High Yield Corporate VWEAX. Both examples own 60% in stocks and 40% in bonds, but in the first set, the assets are generally viewed as staid and higher quality, while the latter set taps more volatile corners of each market in exchange for higher return potential.

To illustrate this, Exhibit 2 shows the drawdowns of these two hypothetical portfolios over the past 15 years.

Exhibit 2 60/40 Small Cap & High-Yield Bonds vs. 60/40 Traditional

It is clear from the drawdowns that the 60% small-cap/40% high-yield portfolio requires a greater tolerance for losses than the more traditional 60/40 portfolio of large-cap stocks and investment-grade bonds. Making sure portfolios match investors' risk tolerances is key to helping them stick with their portfolios over the long term.

The Morningstar Portfolio Risk Score

We now incorporate the Morningstar Portfolio Risk Score, or MPRS, to improve the categorization process. The MPRS uses a returns-based style analysis using multiple asset classes to give a better sense of a portfolio’s overall risk level. An MPRS of 100 indicates the portfolio is about as risky as a well-diversified equity fund. The MRPS is highly correlated to a portfolio's realized beta(1) to a broad stock market index, like the S&P 500 or MSCI ACWI.

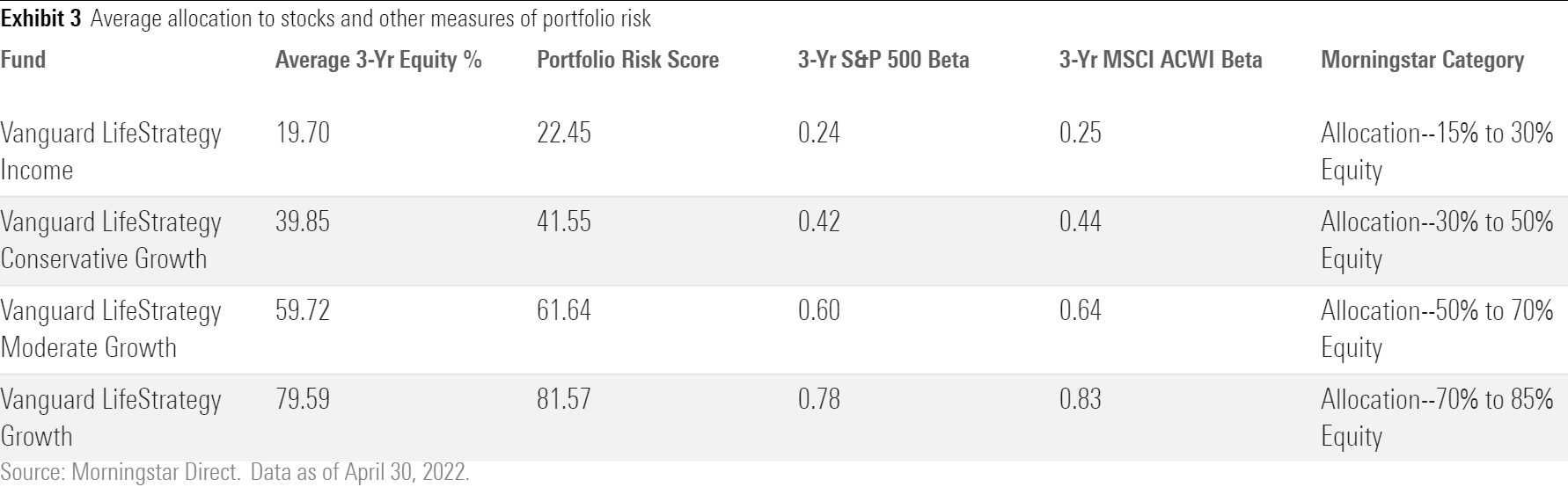

For most multi-asset funds, the allocation to stocks, the portfolio risk score, and the equity beta tend to be consistent. Exhibit 3 shows the Vanguard LifeStrategy suite of target-risk funds' average allocation to stocks over the past three years, the portfolio risk score, and the three-year beta to the S&P 500 and MSCI ACWI. This suite of target-risk funds is diversified across global stocks and investment-grade bonds.

Exhibit 3 Average Allocation to Stocks and Other Measures of Portfolio Risk

There's little variation between the funds' average allocation to stocks over the past three years and the other measures of portfolio risk. In this example, the allocation to stocks does a good job of informing investors of the level of volatility they should expect from the funds. When we look at the same metrics for the two hypothetical portfolios in the previous example, though, the benefit of including the MPRS is apparent.

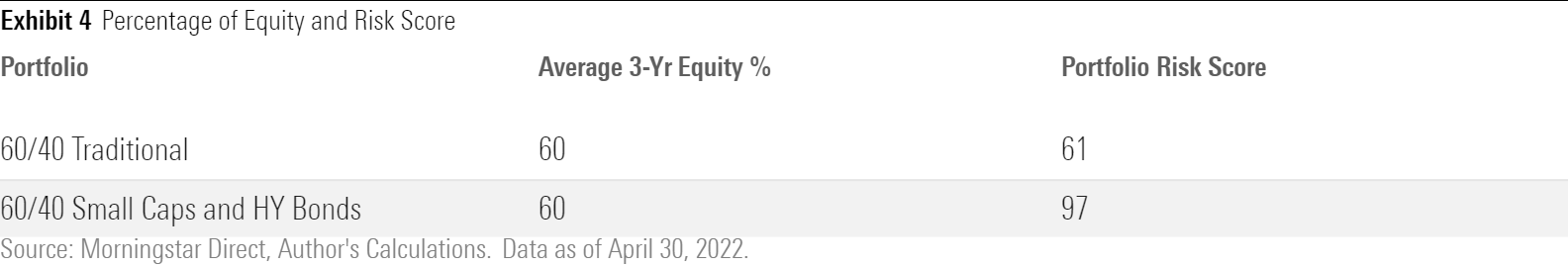

Exhibit 4 Percentage of Equity and Risk Score

Since the MPRS looks at factors beyond stocks, it captures the additional risks coming from the small-cap stock and high-yield bond portfolio. Its best fit is for the allocation—85%+ equity Morningstar Category, which includes allocation funds appropriate for an investor with a high tolerance for volatility.

Notable Funds Changing Categories

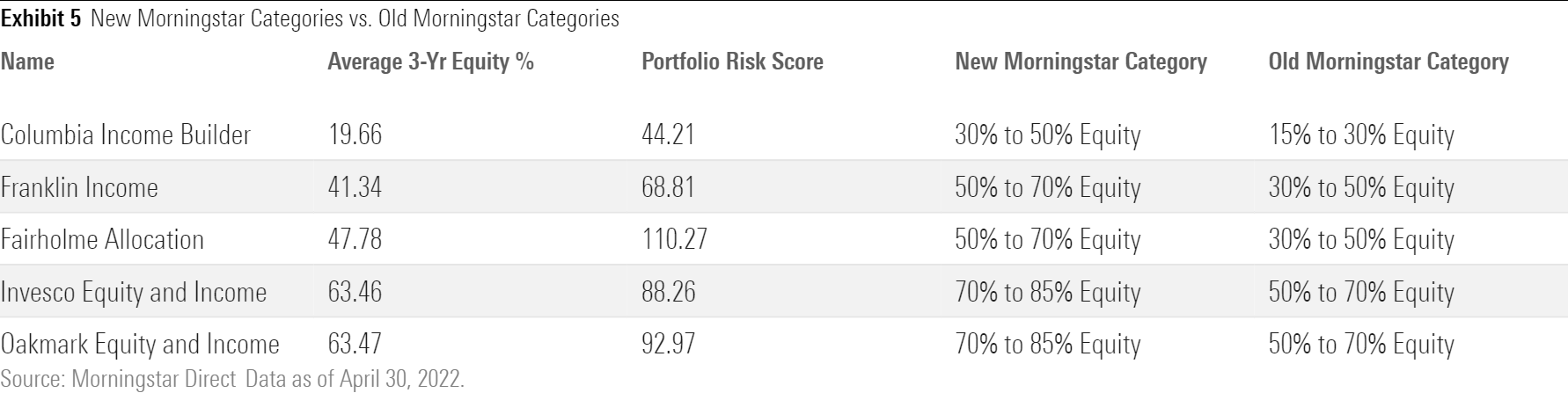

The funds most impacted by the enhancements to our categorization process are those with large allocations to below-investment-grade credit, convertible bonds, or very concentrated portfolios. Exhibit 5 shows a handful of funds whose categories changed in April 2022 as a result of the new methodology.

Exhibit 5 New Morningstar Categories vs. Old Morningstar Categories

A common theme across funds that moved categories is a focus on income. These funds tend to have a greater allocation to high-yield securities that are more sensitive to the same economic factors as stocks, such as recessions, than the typical core-bond fund. We've previously addressed the challenges this can lead to, but now we have the tools to put these funds in the proper context relative to their peers.

(1)Beta is a measurement of a security or portfolio’s sensitivity to changes in the reference benchmark. A beta of 0.5 to the S&P 500 would indicate a fund should capture about 50% of the S&P 500's upside and downside before adjusting for any excess returns or losses from security selection.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SIEYCNPDTNDRTJFNF6DJZ32HOI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)