Late-Start Couple Turbocharges Retirement Savings

As part of our annual Portfolio Makeover series, we help a midcareer couple optimize their retirement portfolio to emphasize ESG.

Editor’s Note: This portfolio makeover is from 2022. Keep in mind that the current market environment may be different than when this makeover was executed.

Kate and Eric’s story is heading toward a happy ending, but it didn’t always seem like it would.

After earning her doctorate, Kate, now 44, struggled to find a permanent position with benefits in her field. Her 51-year-old husband, Eric, who also has a Ph.D., encountered similar challenges on the employment front as the couple moved to support Kate’s career. The Michigan-based couple had a particularly difficult period financially after the birth of their second child: They were both unemployed for five months followed by another six months of what Kate terms “underemployment.” They cashed out of their retirement savings to make ends meet and also racked up some credit card debt during that period.

But here’s where the story takes a turn for the better. Kate recently secured a tenured teaching position at a stable college, and Eric started a consulting practice that has been thriving. Kate earns a salary of $72,000 in her new position, and Eric’s earnings will hit $200,000 this year.

The challenge today? How to make up for lost time. “This is by far the most income we’ve had,” Kate wrote, “and we are pouring it into savings.” They’ve bulked up their emergency fund, and Kate is maxing out her 403(b) (a retirement account for educators) and health savings account. Eric is contributing to a SEP IRA—or Simplified Employee Pension Plan—and they both have Roth IRAs. They’ve also purchased a house and are paying extra on their principal each month, with an eye toward having it paid off by the time they retire.

As first-generation college students, Kate and Eric have student loans, which they’ve been assiduously paying down. And owing to their own experiences, they’ve prioritized college savings for their two daughters, now 9 and 12. They’ve been saving monthly in 529 plans for much of their daughters’ lives, but they recently bumped up their contributions. “One of our goals is to have funds to support them—at least $10,000 a year each—when they go to college,” Kate wrote.

In their email to me, Kate and Eric were crystal clear about their goals: “to have at least $3 million in retirement/investments in 18 years; to establish a strong cash savings; to pay off our house by 2040; and to save $80,000-$100,000 for our children’s college education.”

Kate and Eric are also interested in environmental, social, and governance investing and would like their After portfolio to retain a heavy emphasis on ESG factors.

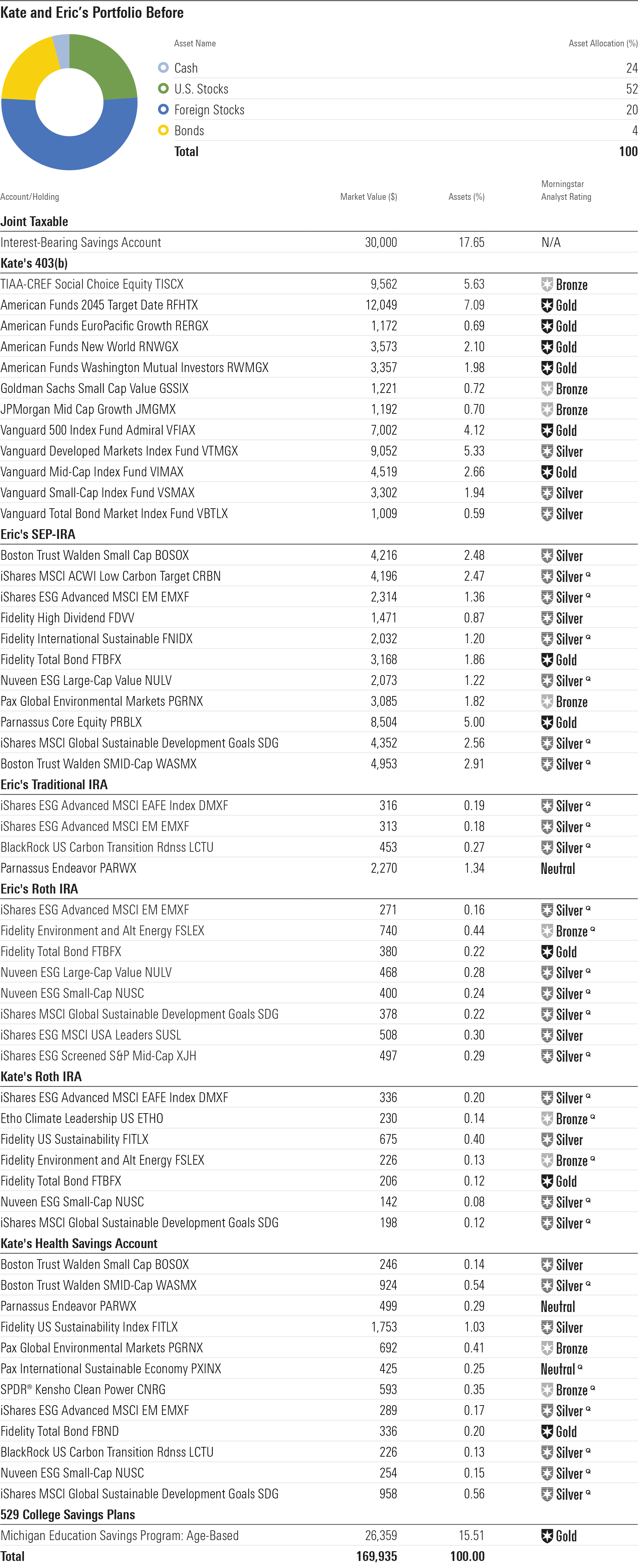

The Before Portfolio

Kate and Eric hold their assets in multiple accounts. The largest silos are Kate’s 403(b) and Eric’s SEP-IRA. A SEP-IRA is a type of retirement account for self-employed people and small business owners; it allows for more generous contribution amounts than is the case for IRAs.

Additionally, Kate and Eric each have Roth IRAs and Eric has a traditional IRA, rolled over from a previous employer. Kate also has a health savings account with a brokerage window that enables her to invest in a broad cross-section of mutual funds and exchange-traded funds.

Eric and Kate’s long-term portfolio is invested extremely aggressively, with just a 4% bond weighting and the rest allocated to stock funds. Their portfolio also has a heavy emphasis on funds and ETFs focused on ESG matters, especially climate change. Another notable feature of their portfolio is just how diffuse it is, with more than 50 holdings across their accounts. Many of those holdings overlap with one another.

Kate’s largest position in her 403(b) is a target-date 2045 fund from American Funds; she also has numerous smaller holdings from American Funds and Vanguard. Kate notes that TIAA-CREF Social Choice Equity TISCX is the sole ESG option in her 403(b) lineup. Eric’s SEP-IRA has a heavy ESG emphasis, with 10 separate ESG equity funds. The couple’s IRAs and Kate’s HSA are similarly sprawling.

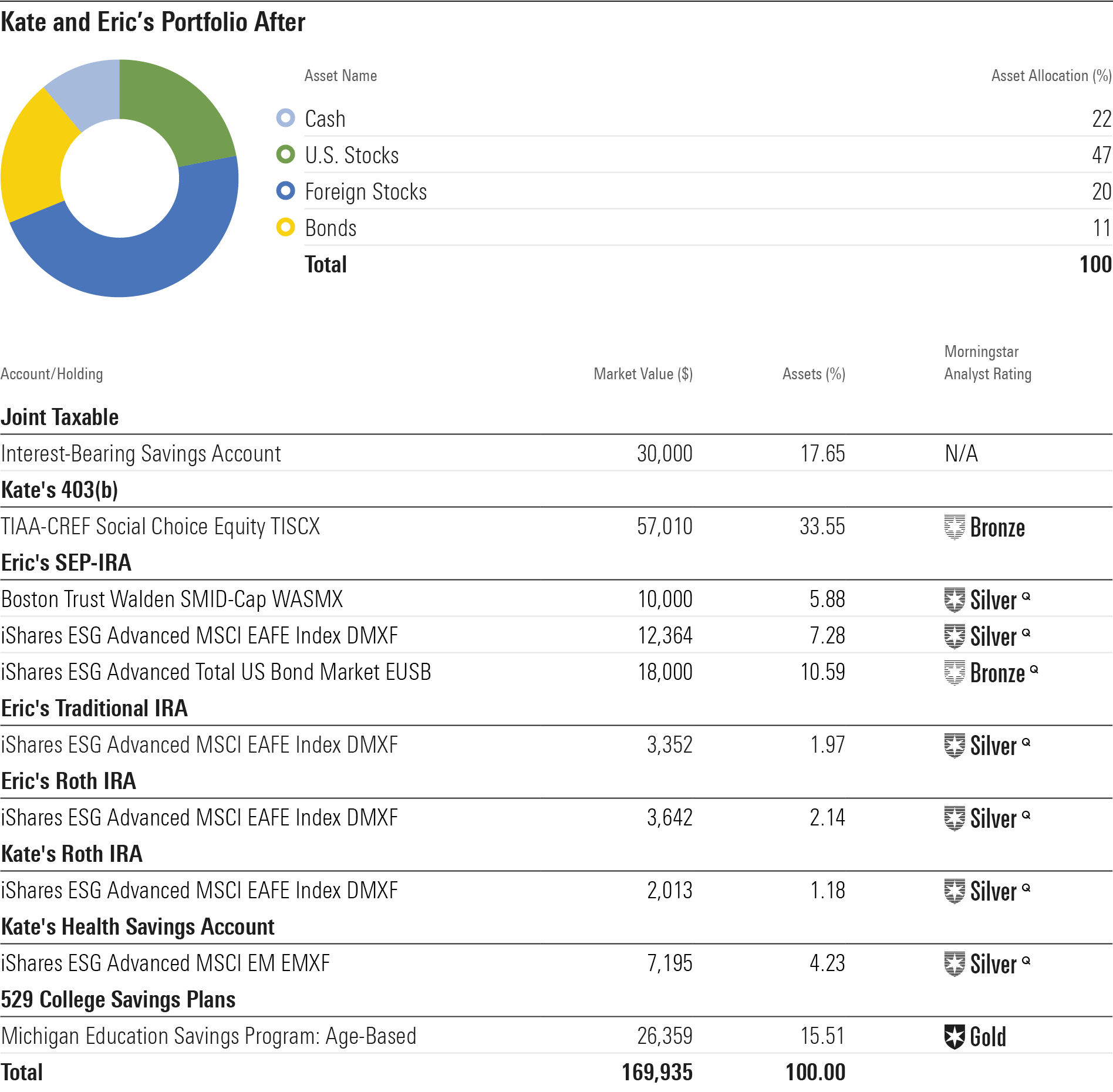

The After Portfolio

I had a few overarching goals for Eric and Kate’s revised portfolio. Given that the couple hopes to retire in 18 years, I wanted to add a bit more fixed-income exposure for stability to ensure that they can stick with their plan until that time. I modeled the portfolio’s asset allocation after Morningstar’s Moderate Lifetime Allocation 2040 Index, matching the couple’s anticipated retirement date. My After portfolio includes 60% U.S. stocks, 25% non-U.S., and 15% bonds.

Because my watchwords are “simple” and “cheap” when it comes to portfolio management, I also wanted to streamline their portfolio to eliminate redundancies and to make it more manageable. Having fewer discrete holdings can help them keep tabs on their asset allocation and allows them to put more assets behind higher-conviction funds and ETFs, all the while retaining an emphasis on ESG.

Because TIAA-CREF Social Choice Equity is the sole ESG option in Kate’s 403(b), she can reasonably hold all of her 403(b) equity investments in that fund. It delivers well-diversified large-cap U.S. stock exposure at a very low cost and rates well from a sustainability standpoint, earning a 4-globe Morningstar Sustainability Rating. The couple can then look to pick up exposure to bonds and other market sectors (non-U.S. stocks, small- and mid-cap stocks) with other parts of the portfolio where there is more latitude to invest in ESG options.

I also aimed to streamline Eric’s SEP-IRA while maintaining diversification and adding to his fixed-income holdings for stability. I retained Boston Trust Walden Smid Cap WASMX: While it doesn’t currently receive a Morningstar Analyst Rating, the same management team runs the Silver-rated Boston Trust Small Cap BOSOX. I focused on low-cost ESG index funds to build out the portfolios’ international and fixed-income exposures. IShares’ ESG Advanced lineup earns higher marks for sustainability than many other ESG index suites. Because of its heavy ESG orientation, the trade-off is that the funds’ performance may diverge significantly, for better and for worse, from broad market indexes at various points in time. In 2022, for example, iShares ESG Advanced MSCI EAFE ETF DMXF and iShares Advanced MSCI EM ETF EMXF have missed out on the energy-stock rally because they hold nothing in the sector.

Because Kate and Eric’s IRA and HSA holdings are still a fairly small part of their account, I think they can be radically streamlined while also providing diversification. Their Roth IRAs will likely be the last in their distribution queue in retirement, so they can be invested aggressively in ESG non-U.S. stocks.

Eric is an independent contractor, and his cash flows from his business could be lumpy, so it makes sense for the couple to continue to add aggressively to their liquid reserves even as they are simultaneously funding their retirement accounts. Indeed, the couple noted that their goal is to double their emergency reserves to $60,000 over the next 18 months.

Note: Names and other potentially identifying details in the makeovers have been changed to protect the investors’ privacy. Makeovers are not intended to be individualized investment advice, but rather to be illustrations of possible portfolio strategies that investors should consider in the full context of their own financial situations.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZJTW7PDXFVDWDP7YNYC4UVOHVU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OPA4TZMXZJDRLG5DYE2W6YTE7A.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-08-2024/t_f17f0449d3314a27b966dcee5d39a6cb_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)