Do Commodities Have a Place in Your Portfolio?

Commodities can be a good hedge when inflation spikes. That said, trying to time episodes of inflation is a fool’s errand.

A version of this article previously appeared in the November 2021 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

If you’ve been to the grocery store or stopped at the gas station lately, you’ve probably noticed that your dollar isn’t getting you as much milk or gasoline as it was just a few months ago. Inflation has spiked. And it’s not just grocery shoppers and drivers that have taken notice. Investors have, too.

In 2021, investors added $40.4 billion in new money to Treasury Inflation-Protected Securities exchange-traded funds. This was more than 3 times these funds’ prior annual record haul. Commodities funds have also seen renewed investor interest. Funds in the commodities broad basket Morningstar Category gathered $8.5 billion in net new assets in 2021. This is the largest amount of inflows the category has seen since 2009, when commodity prices surged from their postcrisis lows and inflation fears were running high.

Commodities can be a good hedge when inflation spikes.[1] That said, trying to time episodes of inflation is a fool’s errand. So, is it worth carving out a permanent spot for a commodity allocation in a diversified portfolio?

The Research Says…

In their seminal 2004 paper “Facts and Fantasies about Commodity Futures,” finance professors Gary Gorton and Geert Rouwenhorst (hereafter GR) outlined a compelling case for investing in a diversified basket of commodity futures.[2] They found that from 1959 to 2004, such a basket offered similar returns and a similar Sharpe ratio to stocks, was negatively correlated to both stocks and bonds, had less downside risk than stocks, and was positively correlated with inflation. The duo subsequently stood by their 2004 findings when they revisited them 10 years later, though they did note that correlations between their commodity basket and other asset classes had increased.[3] At first blush, their work appears to lay out a clear-cut case for allocating to what seems like an asset class with a magic touch.

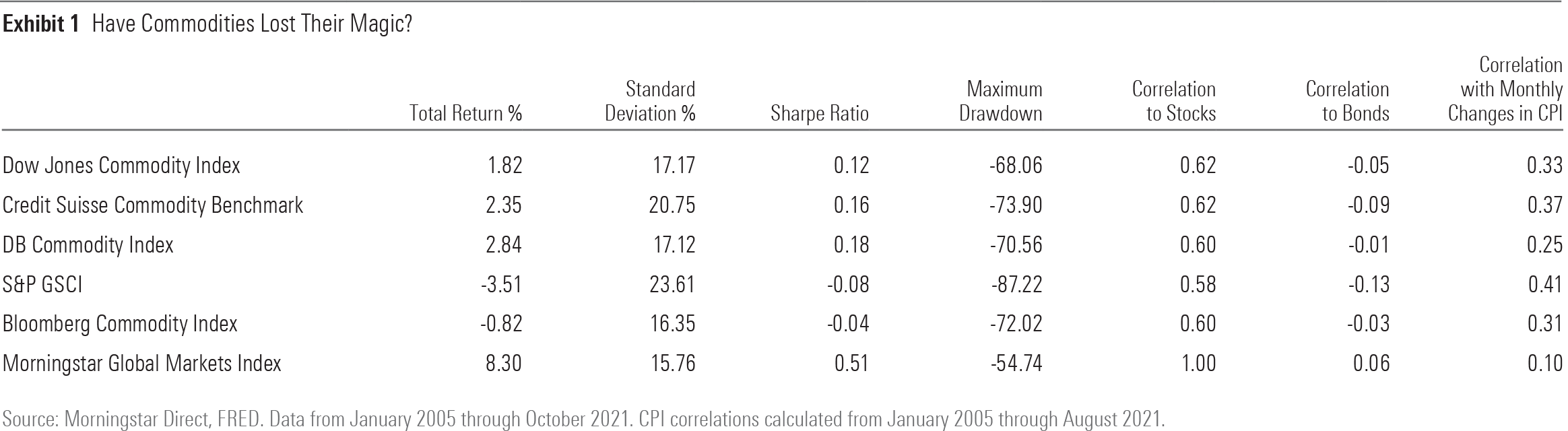

While the research was compelling (so much so that we invited Rouwenhorst to speak at our ETF conference in 2011[4]), the real-world results for investors in commodity funds have disappointed. Exhibit 1 shows how five of the most widely followed commodity futures benchmarks have fared in the years since “Facts and Fantasies” was first published. Reality hasn’t lined up with what consumers of GR’s research would have expected. Returns have been far less than stocklike, Sharpe ratios have been pathetic, drawdowns have been even more dreadful, and correlations with stocks--while not perfect--have not been particularly low. What gives?

Barrels to Bushels Comparisons

The biggest difference between much of the research on commodity futures and the investable funds underpinned by broad commodity futures benchmarks has to do with portfolio construction. In the case of GR, the commodity futures portfolio they built weights futures contracts equally and rebalances monthly. Equal weighting is a standard academic approach intended to represent the performance of the average commodity--not to represent of the commodity market itself. So, coffee gets the same weight as crude oil, though the market for the latter is much larger.

Weighting commodity futures equally and rebalancing them monthly creates a uniquely potent source of returns for the academics’ portfolio--a portfolio diversification return. In a 2006 paper, Claude Erb and Campbell Harvey show that by building a portfolio of volatile commodity futures with low correlations to one another and regularly cutting recent winners and adding to recent losers, the GR portfolio is effectively “turning water into wine.” It takes a bundle of assets that individually have long-run expected returns statistically indistinguishable from zero and transforms them into a portfolio with very appealing properties.[5] In fact, Erb and Harvey found that this return may have accounted for most of the GR portfolio’s excess returns.

Let’s Be Real Here

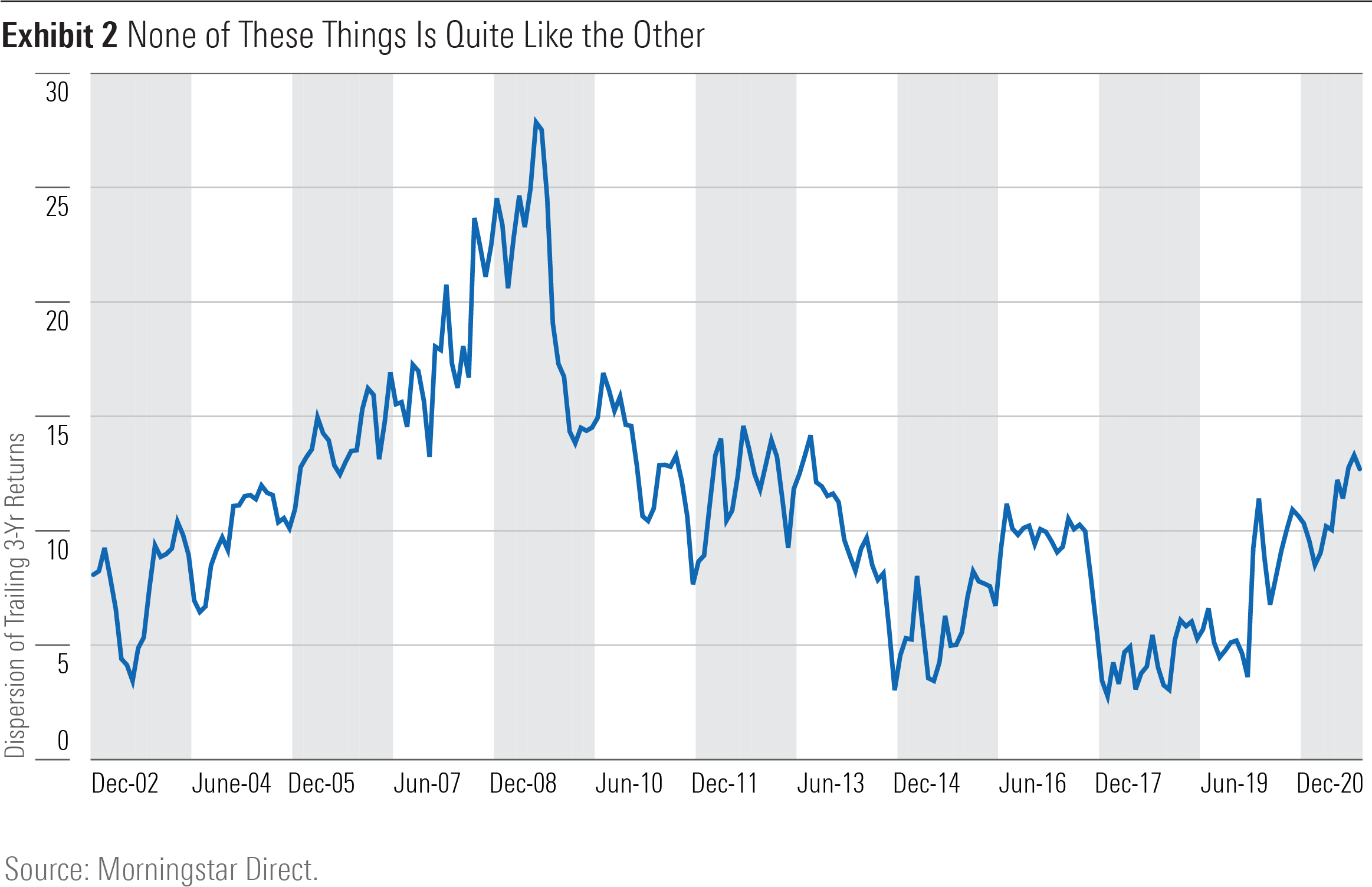

So, if the portfolios spun in the ivory towers of academia are idyllic and not realistic, where does that leave investors? As far as broad commodity futures indexes and the funds that track them are concerned, there are choices, but it’s important to understand them and how different they can be. Exhibit 2 underscores just how different the five indexes featured in Exhibit 1 are with respect to their makeup. It depicts the dispersion of trailing three-year returns for these commodity benchmarks.

Why have the historical returns for indexes that are nominally designed to track the same market been so different? These divergences are an artifact of discrepancies in the futures contracts these indexes own, how they weight them, the constraints they put in place, when and how they roll futures contracts, and their approach to rebalancing and reconstituting their portfolios. In all cases, the resulting portfolios are very different from the ones that generated the fantastical returns documented in the research that introduced commodity futures to so many investors over the past two decades. Those investors just getting to know them today should take note.

The Past Is Not Prologue

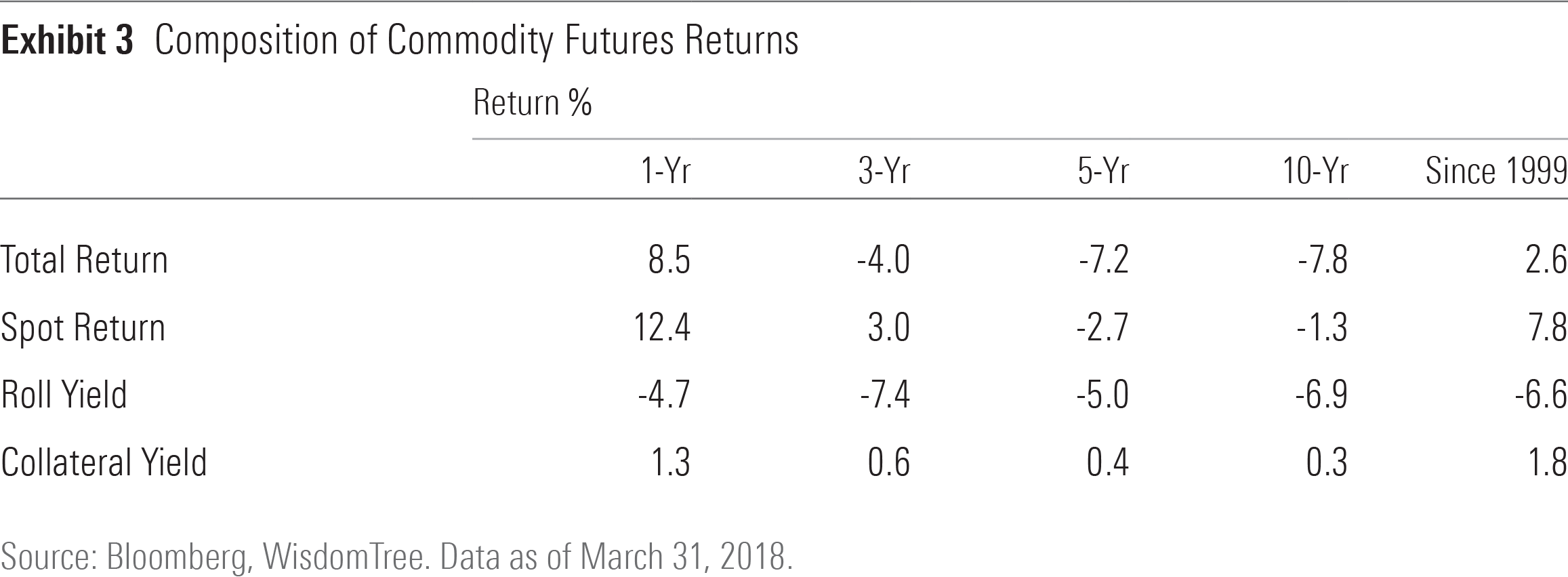

There are more reasons to take a dim view on a diversified basket of commodities futures. I’ll dissect them along the lines of the components of their returns. Exhibit 3 shows the three principal pieces of commodity futures returns, featuring the contribution of each to the total return of the Bloomberg Commodity Index from 1999 through March 2018.

Collateral Yield. Investors in futures contracts post cash collateral, which is typically invested in short-term Treasuries. The yield on that cash collateral used to be much higher than it is today. As of this writing, short-term Treasuries' nominal yields were near zero and firmly negative in real terms. This leg of commodity futures returns is going to be lame as long as yields remain low.

Roll Yield. Futures contracts expire. To maintain exposure, investors must regularly sell the contracts they own and buy new ones, a process known as rolling. If the next contract is priced above the current one (a state known as contango) the return from this regular rolling (the roll yield) will be negative, as investors are forced to sell low and buy high. When the opposite occurs (a situation referred to as backwardation) the roll yield is positive, as investors are selling high and buying low.

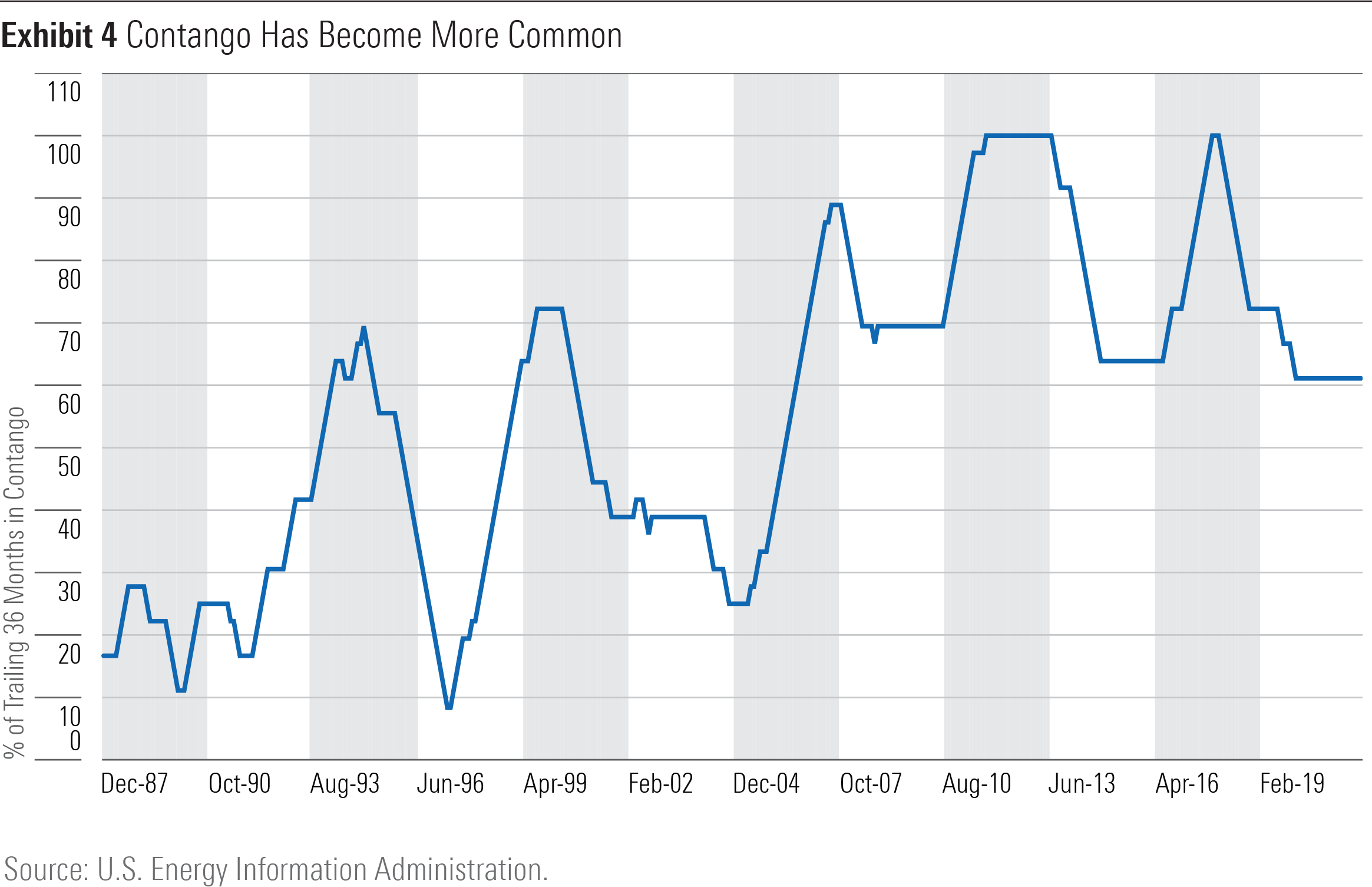

Roll yields are a significant contributor to commodities futures returns. As you can see in Exhibit 2, the negative roll yield for the Bloomberg Commodity Index was nearly as large as the positive contribution from spot price returns from 1999 through March 2018. The headwind from negative roll yields has gotten even stiffer for some commodities in recent years, and it may not abate any time soon. Exhibit 4 shows the percentage of months over rolling 36-month periods when crude oil futures were in contango. What had been a relatively rare phenomenon a few decades ago has become common. Some argue that this has been driven by increased participation among speculators and investors in the futures markets, though there is no smoking gun. Whatever the case might be, should oil and other futures markets see persistent and pronounced contango, the future (no pun intended) returns for investors in these markets will be less than what they’ve been in the past.

Spot Prices. The final contributor to commodity futures performance is movements in spot prices. Commodity prices are volatile and unpredictable. Over the long term, average spot price appreciation across all commodity contracts has been statistically indistinguishable from zero, which speaks to the fact that commodities don't pay dividends or coupons and most are ultimately either burnt or eaten. But on account of their spot price volatility, diversified commodity futures portfolios will continue to enjoy some amount of the rebalancing returns mentioned earlier--though not to the same degree as the equal-weighted, monthly rebalanced portfolios like GR's.

All told, I think there’s little reason to believe that common commodity indexes and the funds that mimic them will do investors much good over the long haul. And there are plenty of reasons to believe that they have lost any of the magic touch they may or may not have had to begin with.

[1] Ari Levine, A., Ooi, Y.H., Richardson, M., & Sasseville, C. 2018. “Commodities for the Long Run,” Financial Analysts Journal, Vol. 74, No. 2, P. 55.

[2] Gorton, G., & Rouwenhorst, G. 2006. “Facts and Fantasies about Commodity Futures.” NBER Working Paper 10595. June 2004, Revised March 2006.

[3] Bhardwaj, G., Gorton, G., & Rouwenhorst, G. 2015. “Facts and Fantasies about Commodity Futures Ten Years Later.” NBER Working Paper 21243.

[4] Morningstar.com. 2011. "Getting the Most From Commodity Investments." https:// www.morningstar.com/articles/395305/getting-the-most-from-commodityinvestments

[5] Erb, C.B., & Harvey, C.R. 2005. “The Tactical and Strategic Value of Commodity Futures.” NBER Working Paper 11222

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)