Your 2020 Medicare Fall Enrollment Checklist

Contributor Mark Miller explains how to effectively and efficiently re-evaluate your prescription drug or Medicare Advantage coverage.

How often do you get the chance to save money on health insurance premiums, cut your out-of-pocket costs, or improve your access to doctors and hospitals? All of that is possible during Medicare’s fall open enrollment.

During open enrollment--which began on Oct. 15 and runs through Dec. 7--you can switch between original fee-for-service Medicare and Medicare Advantage. You also can change your Part D prescription drug coverage, whether it is stand-alone or wrapped into an Advantage plan.

If you're happy with your current coverage, you don't have to change it. But it is important to at least review what you have, says Frederic Riccardi, president of the Medicare Rights Center, an advocacy organization that provides free Medicare counseling services.

"Prescription drug coverage plans can change from year to year, so it's really important to check not only if the premium is going up or down, but any possible changes in the coverage," he says. A drug you rely on may no longer be covered or the insurer may have moved it to a different tier of coverage, which changes its cost.

Your Part D or Advantage plan provider is required to alert you to any changes of this type in the Annual Notice of Change document, or ANOC, which was mailed to enrollees in September.

Few Medicare enrollees bother to take advantage of fall enrollment. For example,research by the Kaiser Family Foundation found that just 11% of Medicare Advantage enrollees voluntarily switch plans each year. Another study, conducted in 2013 by the foundation, found that 13% of Part D enrollees switch voluntarily. Yet 46% of those who did switch plans cut their premiums at least 5% the following year.

Sometimes the savings are far more dramatic.

“One client we helped recently will save about $12,000 next year by switching her plan,” Riccardi says. “She uses a number of drugs, but one of them in particular had very high costs.” Switching to a plan that placed her drug on a different tier accounted for the savings.

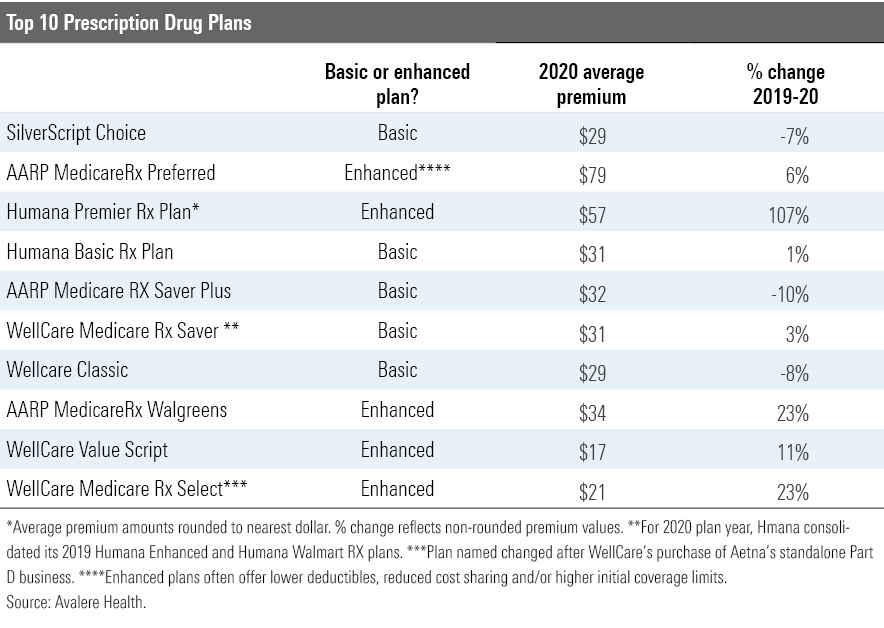

Premiums are not the only factor to consider, but they do change from year to year, as the chart below depicting the 2020 outlook for the top 10 stand-alone Part D plans (by enrollment) shows. (The amount you pay for any plan will vary by region.)

Medicare Advantage If you are enrolled in Medicare Advantage, review the drug coverage wrapped into the plan, just as you would stand-alone Part D coverage.

Medicare Advantage is the managed-care alternative to original Medicare. It offers the convenience of all-in-one coverage; you continue to pay your Part B premium, and prescription drug coverage often is provided at no extra premium. This year, 88% of Advantage enrollees are in plans that include drug coverage, and 56% pay no additional drug premium beyond their Part B premium, according to the Kaiser Family Foundation. Medigap supplemental policies are not used alongside Advantage plans, which come with their own caps on total annual out-of-pocket expenses.

Also check on whether your preferred health providers will be in your plan next year. Providers do come and go from these plans--and determining who is in-network can be a challenge.

The ANOC does not include notification of provider changes, and detailed provider directories are not included in the Medicare Plan Finder, the official Medicare online shopping website. Advantage plans offer online directories or PDFs that list providers, but studies have found these often are outdated or contain inaccuracies. So, your best bet is to contact your provider and confirm whether they will participate in your plan during the coming year.

Original or Advantage? During fall enrollment, you can not only switch Advantage plans but can also move from Advantage to original Medicare. (There's also a special Medicare Advantage Open Enrollment Period from Jan. 1 through March 31 each year, during which anyone enrolled in a Medicare Advantage Plan can switch between plans or switch to original Medicare, with or without a Part D plan.)

Let’s weigh the pros and cons of these two fundamental Medicare choices.

Original Medicare is fee-for-service, and it remains the gold standard for the breadth of providers who accept it. Coupled with a Part D drug plan and a Medigap supplemental policy, you get the highest predictability on your total costs. For example, if you purchase one of the most comprehensive Medigap plans (D or G), nearly all out-of-pocket expenses are covered.

Advantage plans offer the convenience of a single plan, and they offer some additional benefits that are not available in original Medicare. These often include some level of dental, vision, and hearing care and gym memberships. And next year, some plans will begin to experiment with a new class of nonmedical services under the Chronic Care Act, approved by Congress last year. This law set the stage for Advantage plans to begin paying for services such as grocery deliveries, caregiver support, and the retrofitting of homes to support older adults with chronic conditions.

Advantage plans are not required to offer the new services, and they will be available on a very limited basis during 2020. Joining a plan that offers the new nonmedical benefits does not guarantee that you’ll receive them. The new benefits are targeted to enrollees with serious chronic illnesses or functional limitations, and Advantage plans will determine who qualifies.

Moreover, Riccardi cautions that it is critical to look closely at any extra benefits in Advantage plans. “Is the dental coverage basic or comprehensive? What type of hearing benefit is provided?” he says.

In Riccardi’s experience counseling enrollees, he has found two primary reasons that people decide to disenroll from Advantage and take original Medicare.

One is unexpected costs.

Advantage plans are required to cap total out-of-pocket spending. Plans can set this cap as high as $6,700 this year, but most set their caps somewhat lower. In 2019, the average cap among all plans for enrollees in HMO or PPO plans is $5,059 for in-network services, according to the Kaiser Family Foundation. So, if you experience high costs in a given year, your out-of-pocket expenses could far exceed any savings you pocketed from an included drug plan.

The other key reason enrollees leave Advantage plans, Riccardi says, is restriction of health providers. “We often work with people who are experiencing a health crisis or some other type of issue that are unable to receive the type of care that they wish,” he says.

Advantage plans tend to attract younger, healthier people at the point of initial enrollment. Many of them are comfortable with managed care from their experience with workplace insurance--and some respond to the blizzard of mail promotions targeting them as their 65th birthdays approach or to the frequent television ads they see. The extra benefits sound attractive, and they are not thinking ahead to a time when serious illness could occur.

“Later on, they develop a chronic condition and need to use more care,” Riccardi says. “They may be referred to a specialist or to a hospital or a provider that's out of network. And so we receive phone calls from people in particular individuals with cancer who are looking to receive treatment at a given cancer facility, but that facility is not in the network. That is a really tough conversation to have with someone.”

The Caveat Unfortunately, fall enrollment is not the best time to select original Medicare. This is best done when you first sign up for Medicare Part B.

That's because of Medicare's guaranteed issue rules, which forbid Medigap plans from rejecting an enrollee or charging higher premiums due to any pre-existing condition. The guaranteed issue protection is available when you first sign up for Part B. After that, Medigap plans in most states are permitted to reject applications or charge higher premiums, with the exception of four states that protect Medigap applicants beyond the open enrollment period: Connecticut, Maine, Massachusetts, and New York. These states have continuous guaranteed issue rules.

If you live in one of these states, moving from Advantage to original Medicare won’t be a problem. Elsewhere, you’ll need to explore what Medigap plans are willing to offer you, depending on your age and health.

Some employers provide supplemental coverage as a retirement benefit; if your former employer changes that benefit, 28 states will require insurers to issue a Medigap policy on guaranteed issue terms.

Shopping Help In case you haven't noticed yet--this stuff is complicated. That is why Riccardi urges everyone to get some expert help on enrollment decisions.

“Both Part D and Medicare Advantage are so inherently complex that people who use the Medicare Plan Finder still may need assistance,” he says. “There are so many different factors to take into account.”

One great resource is the national network of State Health Insurance Assistance Programs, or SHIPs, a national network of federally funded programs that provide free Medicare counseling using volunteers. Find your local SHIP program here. And the Medicare Rights Center provides free counseling via its national assistance line, 1-800-333-4114.

Several for-profit counseling services will provide assistance for a fee. These include Allsup Medicare Advisor andGOODCARE.com.

For more on fall enrollment, check out my recent podcast interview with Fred Riccardi.

Mark Miller is a journalist and author who writes about trends in retirement and aging. He is a columnist for Reuters and also contributes to WealthManagement.com and the AARP magazine. He publishes a weekly newsletter on news and trends in the field at Retirement Revised. The views expressed in this column do not necessarily reflect the views of Morningstar.co

Mark Miller is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)