Want to Invest Successfully? Quit Trying to Make Sense of It

Intuition usually fails us when it comes to investing.

About a year ago, Russia invaded Ukraine, an appalling act rightly condemned by the world. In the immediate aftermath, experts weighed the economic impacts, with many projecting sharply higher commodity prices. The prediction made sense: A Russian oil embargo would crimp supply, sending prices higher, or so the thinking held.

What happened? Brent crude-oil futures prices spiked at first, rising from around $94 per barrel preinvasion to nearly $130 a few weeks later. But by last summer Brent was back to its preinvasion price and has fallen further since. An investor who bought Brent futures on the eve of the invasion and held onto them now has lost nearly 9%. Whereas an investor who bought global industrial and basic materials stocks—sectors then thought to be at greater risk of higher commodity input prices—made money.

What Makes Sense?

As this example underscores, markets are unpredictable, especially over shorter spans. Yet you wouldn’t know that from how many of us approach investing, where we define “good” investments as those that made intuitive sense to us at the time—that is, the commodities that would rally after the Ukraine invasion because the supply shortfall would yield a scarcity premium. And conversely, we dismiss investments that don’t square with whatever cause-and-effect framework we’re applying.

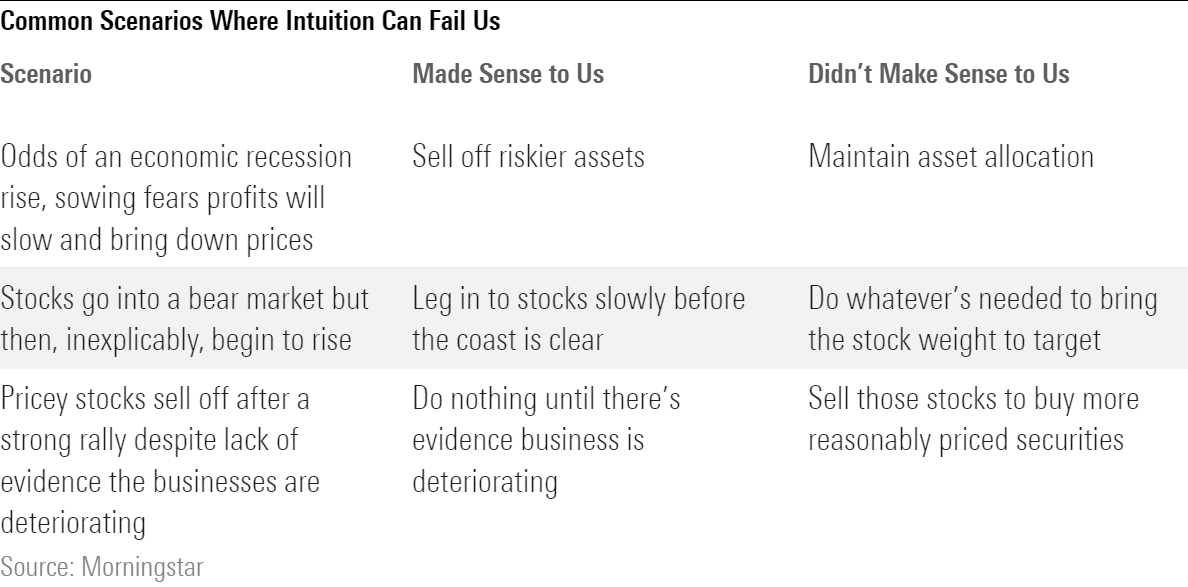

To illustrate, consider a few common scenarios, where we can hurt ourselves by going with what made sense to us at the time, instead of what might really have been sensible under the circumstances.

The Case Against Intuition

Why can’t we trust our intuition to evaluate an investment’s merit? In this piece, I’ll lay out four reasons.

Reason #1: We’re desperate to make sense of things at times when we’re uncertain or feeling frazzled

The main reason we try to make sense of our investments is to regain control of an uncertain or stressful situation. When stocks are in free fall and headlines are blaring alarms, it can be hard to imagine what could spark a rally. Yet we can come up with explanations galore for why the selling will continue unabated. In that scenario, with our emotions revved up, we’re likelier to seek safety in cash and bonds, as they fit the narrative: The selling will continue, so take shelter.

Unfortunately, we tend to be at our worst as investors at times like these when emotions are running high. When we cling to intuition, subjecting our investments to a common-sense test, we might manage to subdue our emotions for a time, but we do so at enormous cost to our investment success.

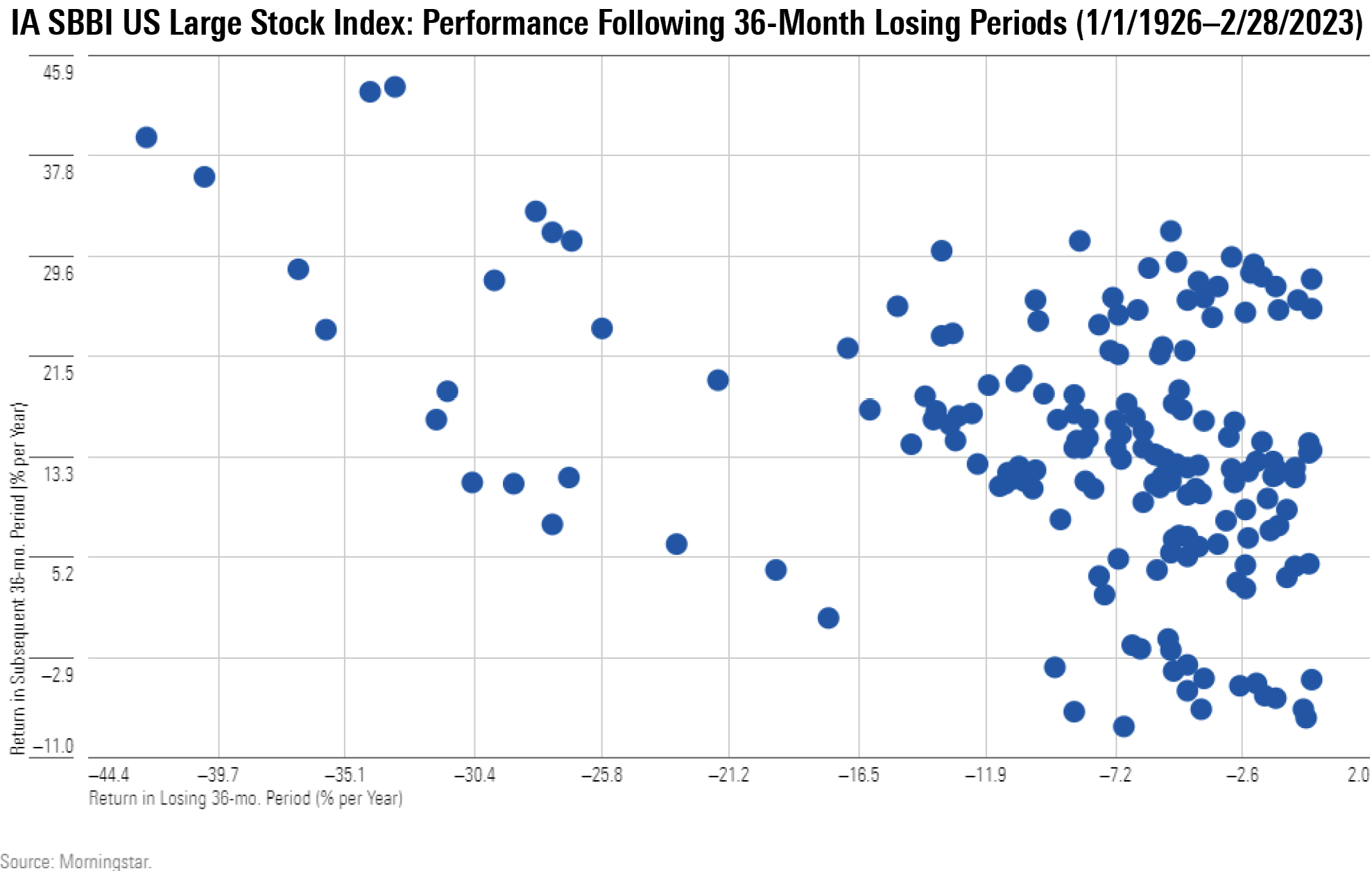

To illustrate, consider the following chart, which shows U.S. large-cap stocks’ returns in the 36 months that immediately followed a three-year period in which they lost money. (Since 1925, there have been 176 rolling three-year periods in which U.S. large-cap stocks have posted a negative return.)

These stocks suffered two consecutive losing 36-month periods only 19 times. What’s more, they usually rebounded strongly, earning about 14.2% per year, on average, in the three years following a losing 36-month period. That was especially true of the 25 worst three-year periods for U.S. large-cap stocks. In the three years that followed these episodes—which included the Great Depression, the global financial crisis, and the bursting of the internet bubble—stocks rose by roughly 22% per year, on average, more than double the average return in all other 36-month periods over the past century.

In all 176 of these instances, investors would have tried to make sense of their stock allocations, asking themselves why, amid all the pessimism, losses wouldn’t beget losses in the years ahead. And in nearly every instance intuition would have failed them, with stocks roaring back.

Reason 2: We seek reassurance from others who share our view

It’s not just that we tend to try to apply intuition at inopportune times; it’s also that we form our views of what does, and doesn’t, make sense based on what we see and hear from others at those times.

Many of us would like to think that we’re contrarians, boldly going our own way, consensus be damned. We’re not, though. We usually seek out confirming views, with the market itself serving as our proxy for the consensus view at a given moment.

In that way, using intuition to assess an investment is a bit like chasing one’s own tail. We gauge the investment’s merits based on how it’s performed or the way we see other investors responding to it. Then we construct a narrative that explains the mental picture we’ve formed, in which a “good” investment is one that’s risen and a “bad” investment one that’s fallen. When markets inevitably move in ways that defy our predictions, we recast “good” and “bad,” repeating the cycle.

Reason 3: We fail to consider what’s already priced in

When you take the first two reasons together—our tendency to apply intuition at times when we’re feeling frazzled and our need for reassurance from others at those times—we blind ourselves to another reality: Markets price in a potential scenario well before we can act on it.

Take the example of a looming recession. Typically, by the time data begins to show signs of a cooling economy, the market has already begun its pullback, anticipating worsening profits and other fundamental deterioration. Yet, we typically aren’t going to act on the first sign of trouble such as a surprisingly bad nonfarm payroll number. Instead, we’ll wait for consensus to form, which usually doesn’t happen until more data arrives, by which time the market has moved on to the next matter.

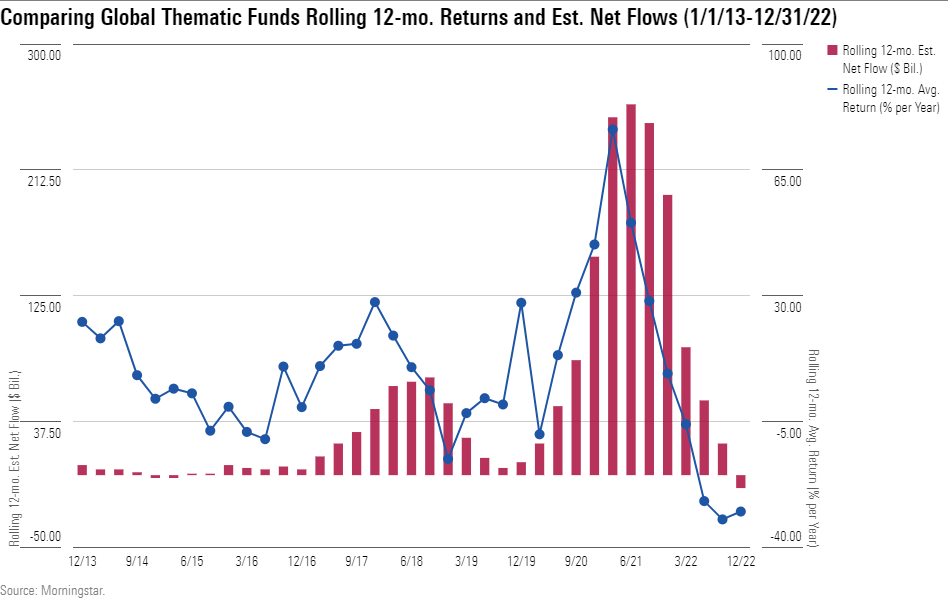

This works in reverse, too, a great example being “thematic” stocks. These are typically businesses that boast breakthrough technology and know-how, or which operate in fields sitting at the cutting edge. Many of us find stories like these irresistible. Unfortunately, by the time we conclude these stocks can’t miss, the market has beaten us to it, pushing valuations to nosebleed levels and limiting future returns.

That’s apparent when we compare global thematic funds returns’ to the flows these funds have received from investors over time. The pattern is unmistakable: Returns impress, flows follow, only for performance to dramatically fall off, burning investors who had chased returns into these funds in the first place.

Reason 4: We fool ourselves

There’s a wealth of research that finds we are not reliable narrators of our own investing journeys. We have a propensity to repress painful memories, such as costly mistakes, while we exaggerate whatever successes we’ve achieved along the way, blowing them out of proportion.

The truth is that successful long-term investing demands resolve and a healthy constitution for uncertainty. Much of the time we’re not going to be able to explain the market’s gyrations. Those of us who are willing to surrender to that unknowability stand to earn higher returns, which is the market’s way of compensating us for the bewilderment we experience along the way.

But when we make intuition an acid test for investments, we presume otherwise. We see cause and effect where there is none; we chalk up a favorable result to factors that, in reality, were incidental at best to the outcome; and we rationalize our failures, attributing them to uncontrollable forces or actors (like the Federal Reserve keeping rates extraordinarily low for longer) in ways that avoid a true accounting.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)