Stock Market Outlook: Finding Opportunity Beyond Mega-Caps

Although the market’s largest names are pricey, we see several pockets of value.

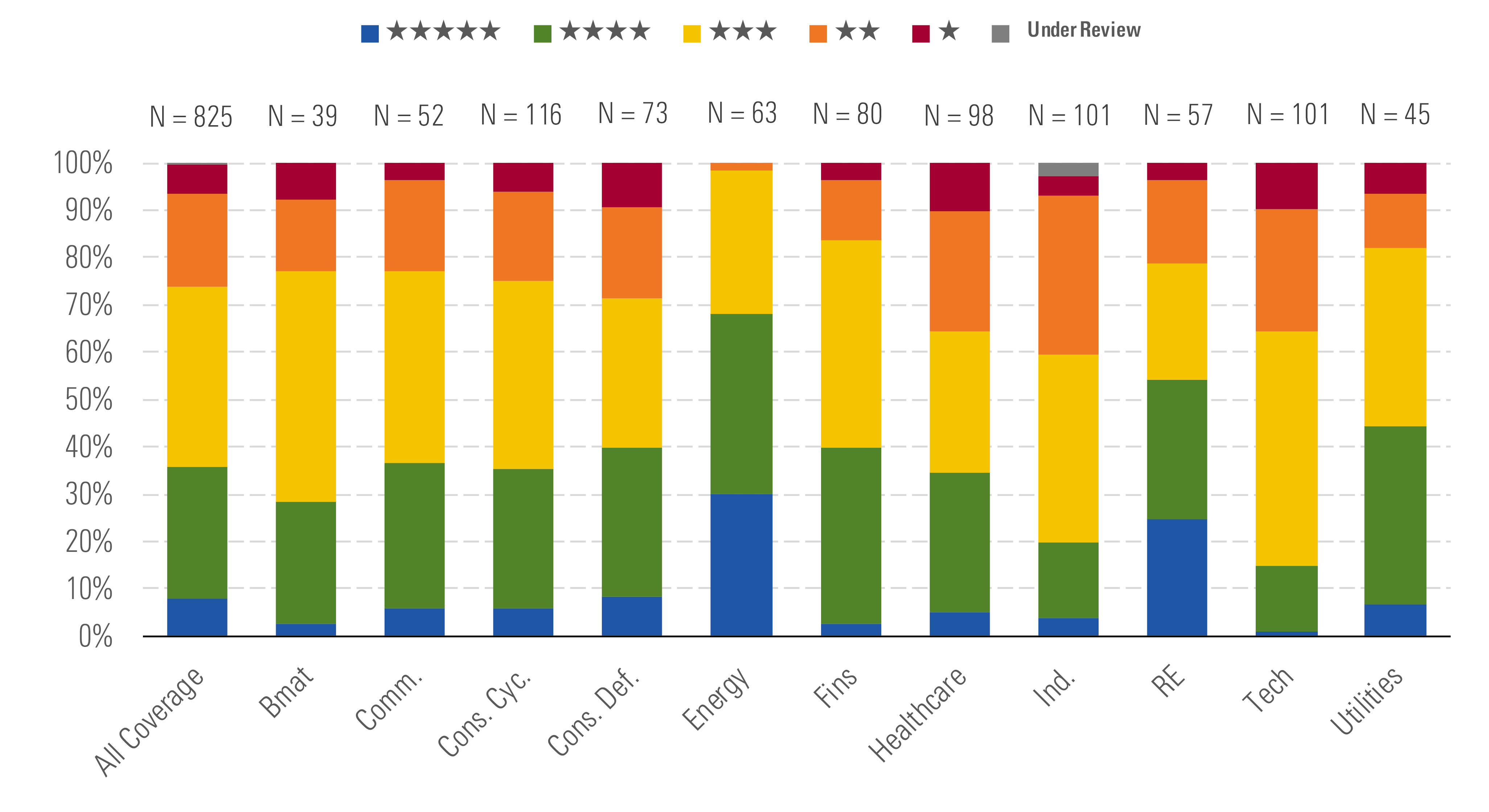

During the third quarter, broad market indexes continued their march higher. Quarter to date through Sept. 25, the Morningstar US Market Index has risen 7.8%, which places it in the green, with a year-to-date return of 3.8%. By aggregating the fair value estimates of the 825 stocks in our North American coverage, we see the broad equity market trading near fair value. However, the broad market-cap-weighted valuation is upwardly skewed by several significantly overvalued mega-cap stocks. Still, pockets of undervaluation remain. Across our North American coverage, we rate 36% with 4 or 5 stars. Analyzing our coverage with the Morningstar Style Box reveals that the greatest number of undervalued stocks reside in the mid-cap category and that the highest percentage of 4 or 5 stars are found in the small-cap space.

- Energy is by far the most undervalued in our coverage, as almost 70% of the stocks trade at 4 or 5 stars.

- While prices retreated in September, technology remains the most overvalued sector in our coverage, as there is only one 5-star-rated stock and 14 4-star stocks, accounting for only 15% of our coverage.

- The greatest number of undervalued stocks resides in the mid-cap space, accounting for 36% of our mid-cap coverage. Of our small-cap stock coverage, we rate 50% with 4 or 5 stars.

Broad Equity Market Trading at Fair Value; Over One Third of Our U.S. Coverage Remains Undervalued - source: Morningstar

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)