BlackRock’s Rieder: Grab High Yields on Super-Safe Bonds While You Can

‘Big regime shifts’ and short-term Treasuries yielding 5% have major implications for investors.

Rick Rieder, chief investment officer of global fixed income at BlackRock, has been in the bond market since 1987, and he’s seeing a set of opportunities arising for investors unlike any that have come before.

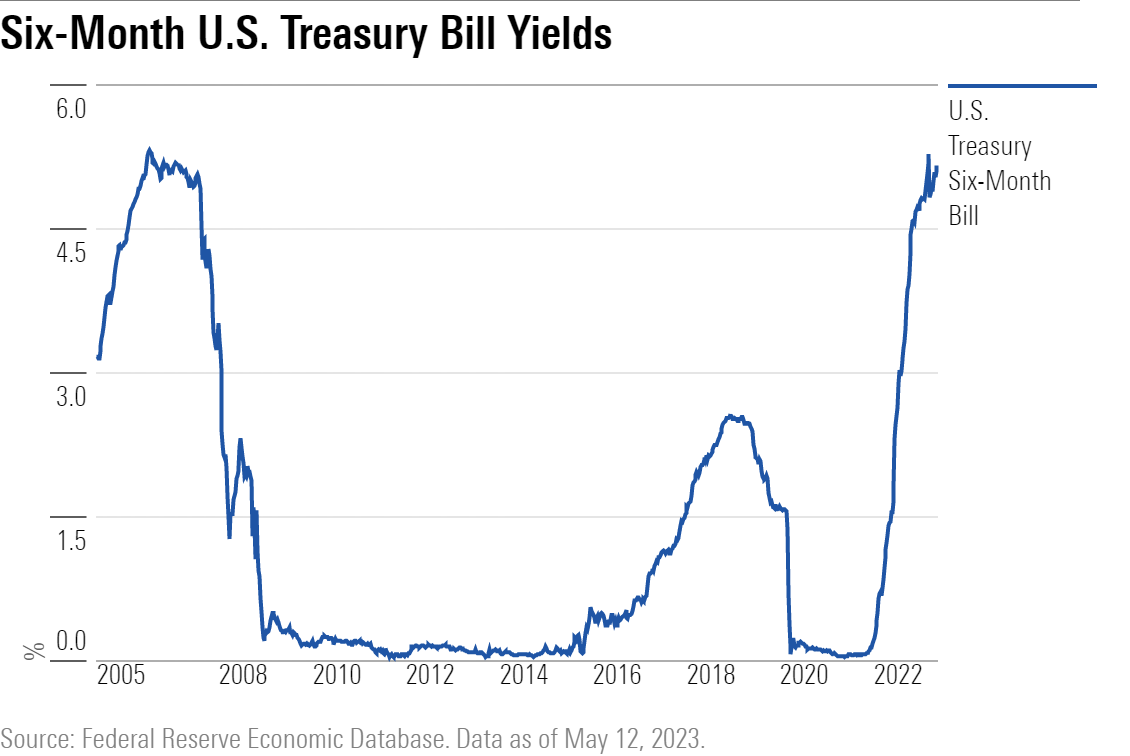

The Federal Reserve’s unprecedented interest rate increases over the past year have taken yields on a broad spectrum of what are generally considered to be safe, short-term investments to north of 5%. In some cases, investors can earn yields on safer bonds not seen since before the 2008 financial crisis.

Rieder says that with interest rates more likely than not to go lower, the current environment is not just an opportunity but potentially a game changer for portfolios, with implications beyond bond holdings.

That doesn’t mean the outlook is without risks, says Rieder, who won Morningstar’s Outstanding Portfolio Manager award for 2023. Stalled progress toward reducing inflation from its still-lofty levels could mean a longer Fed pause than the markets are currently expecting, and this could perhaps send bond yields a bit higher and prices lower again. On the flip side, a severe credit crunch rippling out from the regional bank crisis could have implications for bonds tied to commercial real estate, leveraged loans, and other credit-sensitive areas.

But for the most part, Rieder thinks the current landscape for bond yields on safe investments is ripe for investors: “I’ve been doing this for 36 years, and I don’t think I’ve ever seen a situation where you can sit in virtually no-risk assets and clip 5%-6%.”

A New, Higher Yielding Regime

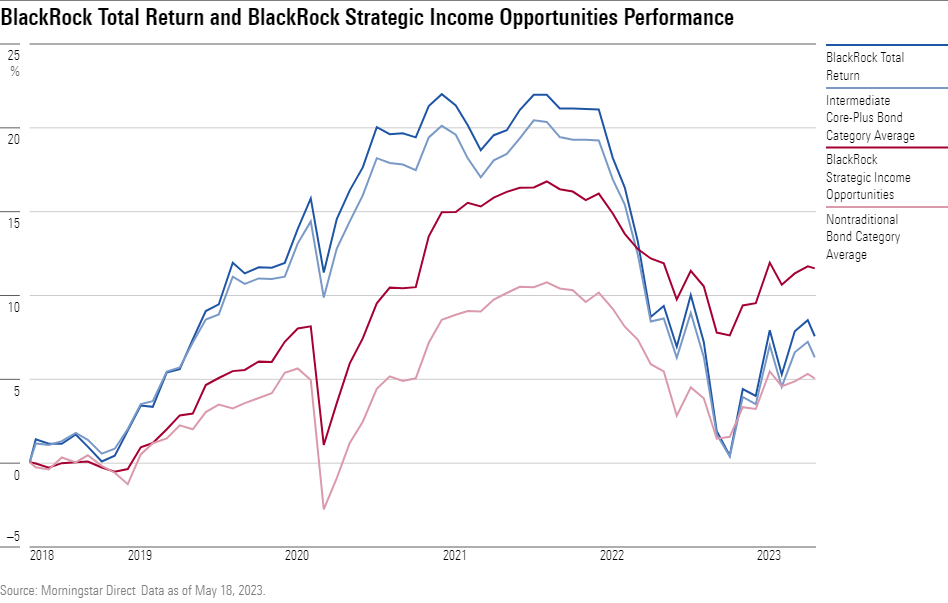

Rieder, who has been at BlackRock since 2009, is a manager on several of the firm’s largest bond funds, including the Gold-rated strategies BlackRock Total Return MAHQX, with $17.7 billion in assets, and BlackRock Strategic Income Opportunities BSIIX, with $37.4 billion. Both funds are wide-ranging strategies, with Total Return sporting five-year returns that top 70% of the intermediate core plus category funds, while Strategic Income Opportunities has a comparable five-year track record in the nontraditional bond category.

Rieder “has stayed the course with a research-intensive, risk-aware approach and delivered long-term success across various market environments in multiple Morningstar Categories,” wrote Morningstar director Dan Culloton in the Outstanding Portfolio Manager award announcement.

Still, 2022, which saw the worst bear market for bonds in history, presented a challenge, according to Rieder. Exhibit A: the never-before-seen increases in the federal-funds rate that took the Fed’s target from zero to its current range of 5%-5.25% in just over a year.

Looking back to the start of 2022, Rieder says, “It’s almost bizarre … that you were thinking maybe the Fed starts raising rates 25 basis points, maybe up to a 2% funds rate, and the next thing you know, we’re doing 75 basis points a clip at every meeting to get to 5%.”

He explains: “These are big regime shifts that we’re getting … So, it’s been about getting regime changes right and position alongside of that and what do you want to own.”

For some of Rieder’s funds, 2022 was mixed. Total Return lost 14.2%, landing it in the 67th percentile of its category for performance—its worst showing since 2011. Morningstar’s Eric Jacobson notes that Total Return’s performance was dented by losses in its high-yield bond sleeve, adding those positions were “a comparatively modest exposure and limited impact.” Strategic Income Opportunities fared better than the competition, with a 5.6% loss leaving it in the top half of its category.

In an extreme environment like last year, Rieder says a key focus would be hedging risks in the portfolio against losses: “Last year there weren’t any hedges.” He says that one bet they did get correct was positioning for a stronger U.S. dollar, since the greenback had one of its biggest rallies in years.

Even as the Fed’s interest-rate hikes have slowed this year, Rieder says the bond market has remained treacherous: “We’re getting some pretty extreme movements.”

That means paying extra close attention to asset allocation. “You’ve got to size your allocations appropriately, because the market has no conviction,” he says. That’s been evident in wild price swings on bonds, as well as a lack of liquidity in corners of the markets, which makes trading out of positions costly if the market goes the wrong way. It also means it pays to diversify a bit more than usual, Rieder says. “You’ve got to be really careful.”

What Higher Yields Mean for Portfolios

However, the result is that the bond market offers a yield dynamic unlike any in recent market history.

For example, the U.S. Treasury’s six-month bill—one of the safest investments around—is yielding 5.3%, just down from a recent peak of 5.34% on March 8.

These are some of the highest yields on six-month bills since 2006 and 2007, when they hovered around the 5% mark for roughly a year, topping out at 5.32% in July 2006. Investors have to go back to late 2000 to find bill yields that were markedly over 5% for a prolonged period.

Rieder says that he recently bought commercial paper—generally high-quality, short-term unsecured debt from large corporations and financial companies—that has yielded 5.5%-6%. Trades involving short-term, investment-grade European credits are yielding 6%.

“If you think about how in 2021, you would be buying high-yield [bonds] at 3.5%, it’s pretty incredible,” he says.

The higher yields available on short-term bonds have broader implications for a diversified portfolio, Rieder says: “Even if you have a return target of 5%, 6%, or 7%, it’s a given now that you can capture what I would say is a pretty safe 6%.”

As Rieder puts it, “The beauty of this is you get pretty darn close to your target return without taking much risk—the exact opposite of where we were for years … You had to take liquidity risk, equity risk, or whatever form of risk to get to your return.”

More Room for Risk

The current yield landscape opens the door to take on more risk elsewhere in the portfolio that could potentially boost returns even further. “It allows you to say, ‘OK, I’m going to do a bunch of [safe] investments,’ but I can actually take a bit more risk [elsewhere], and now you have more of a barbell in your portfolio,” he says.

In addition, when interest rates do start to come down—and bond prices rise—those already-meaty yields will translate into even higher total returns, Rieder says: “It doesn’t take much for some of these high-quality assets to get to an 8% or 9% return here.”

There are areas of the bond market where you should tread carefully, Rieder cautions—particularly those closely tied to the availability of credit in the banking system in the wake of the regional bank crisis. That includes commercial real estate debt, along with leveraged loans and small-business lending.

He’s also careful with debt that’s lower down in the capital structure of companies, which makes it more vulnerable to default. Among higher-risk assets, “I think you’ve got to be a bit wary until you get a better feel for the economy in the back of the year.”

High Yields Can Help With Diversification

Meanwhile, Rieder says, the higher yields on safer bonds also enable fixed income to return to its role as a diversifier against losses in a significant down market for stocks. That would mark a welcome change after 2022′s experience for investors, where rising interest rates led to double-digit losses on bonds that worsened the damage for many portfolios instead of cushioning them against the bear market in stocks. This performance led some in the markets to question the utility of so-called 60/40 portfolios—diversified strategies with 60% stocks and 40% bonds.

But at higher interest rates, bonds are now working again as diversifiers. “As you’re getting closer to the point where the Fed would consider any easing … I do think that that fixed income acts as a much better hedge,” Rieder says.

However, with rates likely near or at their peaks, he says it may be time to begin locking in current yield levels with bonds further out on the maturity spectrum.

Rates to Move Lower, but Not Quite Yet

Where the bond market goes from here depends on the economy and Fed policy, of course.

The bond futures market, where traders place bets on the direction of interest rates, has been signaling that the Fed could cut rates as soon as September, and most likely by November. According to the CME FedWatch Tool, the chances of a rate cut by the November meeting are 77%.

Rieder thinks that direction is correct but the timing is off. “The market has gotten a bit over its skis in its pricing” of a Fed ease within just a few months of the May rate increase, he says.

The market has “gone from anticipating a slowdown to really anticipating a problem” in the economy, “which is not consistent … with the credit markets or the equity markets,” Rieder says. “I think the Fed is going to ease, but I don’t think it’s going to be until next year, or maybe in December.”

Rieder pegs the chances of a moderate recession with inflation coming down at 60%-70%. However, he also sees a 15%-20% chance that inflation stays high, leading the Fed to move rates higher than what is currently expected.

For now, investors can take advantage of the interest rate environment created by the Fed. “The Fed is trying to slow down the economy, and the only way they can do it is a blunt tool … and that is interest rates,” Rieder says. “So why not take advantage of it?”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)