After Earnings, Is Salesforce Stock a Buy, a Sell, or Fairly Valued?

With another good quarter of revenue and profitability, here’s what we think of Salesforce earnings and stock.

Salesforce CRM released its fiscal 2024 second-quarter earnings report on Aug. 30, 2023, after the market close. Here’s Morningstar’s take on Salesforce’s earnings and stock.

Key Morningstar Metrics for Salesforce

- Fair Value Estimate: $255

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Salesforce’s Q2 Earnings

Salesforce delivered another good quarter, with revenue and profitability ahead of our expectations. Here are our takeaways:

- We raised our fair value estimate for the company’s stock to $255 from $245 on the heels of a quarter that we think will come to typify the new Salesforce.

- Margin performance continues to shine, with non-GAAP operating margin coming in at 31.6% vs. 19.9% a year ago. The plan was to hit 30% for a quarter three quarters from now, so they are ahead of schedule. Along those lines, management raised its full-year guidance to 30% from 28%, so it is now a full year ahead of schedule on the annual target as well.

- The demand environment remains subdued (which is not unique to Salesforce), but we don’t really see any negative indicators. Multi-cloud deals were strong, and we expect that to remain a theme even through next year. Data Cloud was strong, as MuleSoft has continued to rebound. Artificial Intelligence Cloud is off to a great start. Retention is stable at 92%, which is still good. All segments were ahead. Professional Services remain weak, which is a continuation of last quarter. Billings were good as well.

- Dreamforce, the company’s tech conference, is Sept. 12-14. We expect some buzz around Artificial Intelligence and Data Cloud, but not any thesis-changing news.

Salesforce Stock Price

Fair Value Estimate for Salesforce

With its 3-star rating, we believe Salesforce’s stock is fairly valued compared with our long-term fair value estimate. Our fair value estimate of $255 per share implies a fiscal 2024 enterprise value/sales multiple of 7 times, an adjusted price/earnings multiple of 32 times, and a 3% free cash flow yield.

We model a five-year compound annual growth rate for total revenue of 12% through fiscal 2028, which we think will be driven by strength in platform and marketing clouds, along with AI innovation. Our revenue forecast assumes modest revenue acceleration after depressed growth in both fiscal 2023 and 2024. We forecast non-GAAP operating margin expanding from 23% in fiscal 2023 (actual) to the low 30% area in fiscal 2028, which we think is consistent with management’s new profitability focus.

Read more about Salesforce’s fair value estimate.

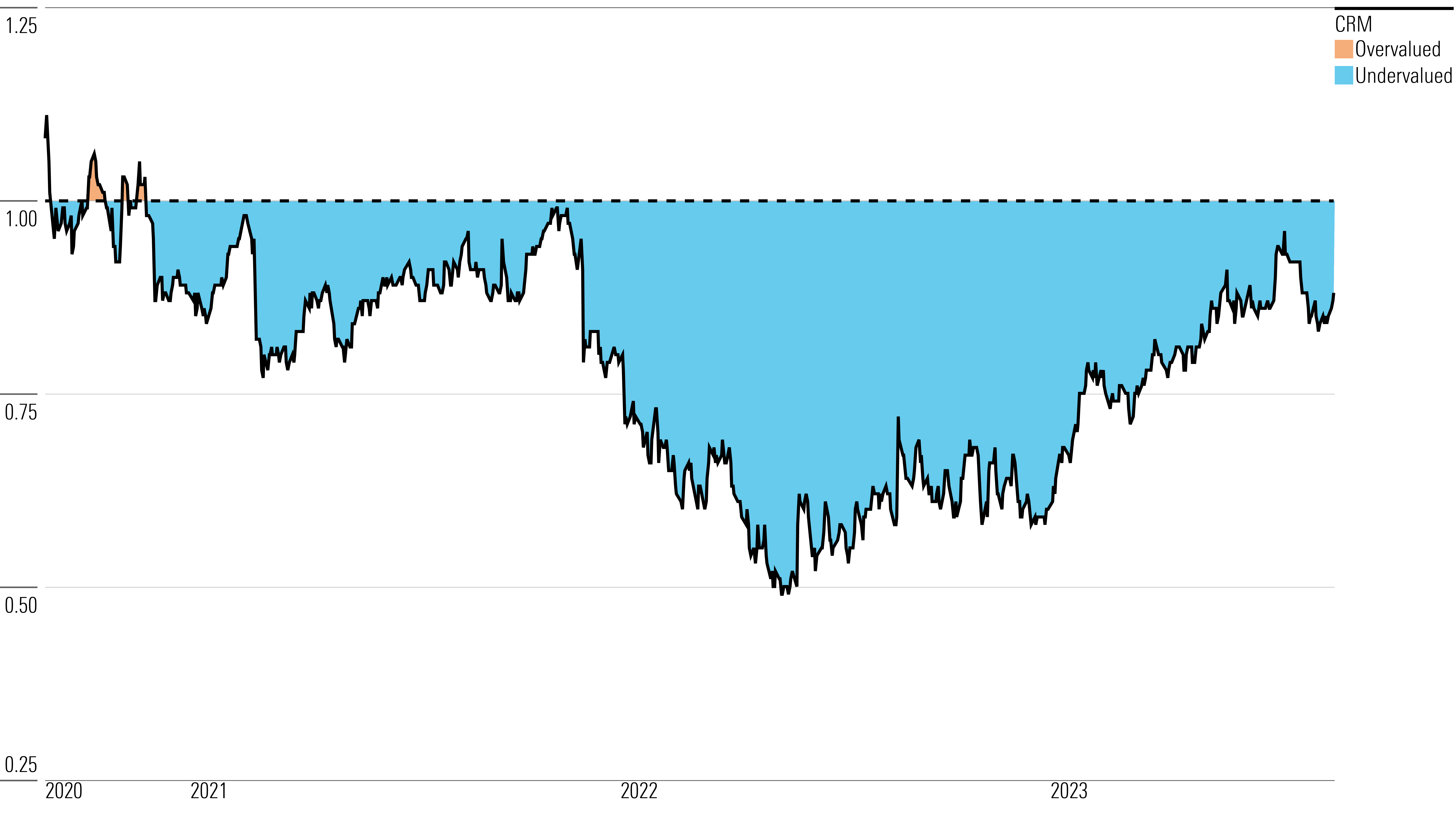

Salesforce Historical Price/Fair Value Ratios

Economic Moat Rating

For Salesforce overall, we assign a wide moat rating arising primarily from switching costs, with support from a network effect.

Salesforce revolutionized the software industry in 2000 with the release of its salesforce automation, or SFA, application. The feature set was generally similar to those offered by peers: streamlined process management for sales leads and opportunities, contact and account data, process tracking, approvals, and territory tracking. Salesforce’s critical differentiator was that the software was accessed through a web browser and delivered over the internet. Taken for granted now, this was a novel concept during the internet bubble. The company paved the way for the software industry as it exists now by first selling the concept of software as a service to prospective customers and then selling the actual SFA product.

Customers were able to avoid high up-front costs and lengthy installations or potentially painful upgrade cycles, were always running the latest version, had more predictable operating expenses and capital outlays, and were running modern best-of-breed applications. Further, SaaS vendors benefited from supporting only one product vision, having more predictable revenue streams, and eliminating piracy. Thus, a new way to consume software was born, with all parties benefiting.

Read more about Salesforce’s moat rating.

Risk and Uncertainty

We assign Salesforce a Morningstar Uncertainty Rating of High.

From a big-picture perspective, we believe Marc Benioff will be difficult to replace as CEO. He pioneered the software industry, co-founded the company, and led it to be a dominant force with a broad portfolio of sales and marketing-related solutions.

We believe the most important metric for Salesforce investors is revenue growth. Therefore, continued deceleration in the Sales Cloud, or growth that does not materialize as expected in the Service, Marketing, and Commerce Clouds or the Salesforce Platform, would likely have an adverse impact on the stock, in our view.

To help drive growth, Salesforce has also been acquisitive. While we do not believe they have been transformative, the company has certainly made some larger acquisitions to help establish an immediate or larger presence in particular solutions. Investors have been concerned at times about rich valuations and organic growth prospects, as was the case with the acquisitions of Slack, Tableau, and MuleSoft over the last several years. We believe the company is likely to continue to make acquisitions and to occasionally pursue larger deals. In these situations, valuation and integration will remain risks.

Read more about Salesforce’s risk and uncertainty.

CRM Bulls Say

- Salesforce dominates the SFA space, but still only controls 30% in a highly fragmented market that continues to grow by double digits each year, suggesting there is still room to run.

- The company has added legs to its overall growth story, including customer service, marketing automation, e-commerce, analytics, and artificial intelligence.

- Management is likely going to focus on expanding margins after years of subscale profitability.

CRM Bears Say

- As the company grows larger, it may be increasingly difficult for Salesforce to grow faster than its various end markets.

- Salesforce has entered new areas via acquisition and has arguably paid material premiums in the process. Integration risk is real, as is the risk of increasingly large, dilutive, or ill-conceived deals.

- Despite its size, Salesforce has generated substandard margins in recent years, and its renewed focus on profitability may negatively affect already-slowing growth.

This article was compiled by Monit Khandwala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/d10o6nnig0wrdw.cloudfront.net/05-20-2024/t_5525eda57f6f4f3bba31763a953c9181_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)