Today’s advisor must balance two competing demands. The first is the need to manage and grow their business all while dealing with client demands for immediate service, often across multiple channels. The other is the need for hyperpersonalization to win the trust of modern investors, who, empowered with data, research, and analytics, are expecting more value for the advice that they pay for.

For the past decade, advisors have prioritized client engagement and outsourced portfolio management. To drive that client engagement further, many advisors are customizing each client’s portfolio to align with their financial plan and personal motivations.

How can advisors balance broad personalization while maintaining scale? Let’s start by looking at two increasingly popular investment approaches.

Tried and True: Model Portfolios

Model portfolios are multi-asset or single-asset-class portfolios that align with an investor’s specific risk profile, generally composed of mutual funds, exchange-traded funds, and individual equity or fixed-income securities. These model portfolios are typically offered to financial advisors by professional asset managers, the advisor’s home office central investment team, or a turnkey asset-management program. As model portfolios flood the market, model providers distinguish their offerings by attempting to solve a specific investment challenge, like managing taxes or generating income, or focusing on a particular area of interest. This level of specificity is beneficial for the advisor, who can choose a model that closely aligns to their client’s financial and nonfinancial goals.

When they make use of models, advisors also increase the efficiency of their business by freeing themselves up for focused planning, client outreach, and business development. Depending on the layering of fees of the managed accounts, models or managed accounts can also cost less than similarly structured mutual funds, which may increase investors’ returns and the likelihood of outperformance.

There are challenges that hinder everyone from getting “model mania”: For one, not all advisors are adept at creating model portfolios, or they see the use of home office or third-party models as diminishing their value proposition. As model providers compete for investor attention, there is also the growing issue of quality control. While model providers are seeking to differentiate themselves from the competition, the model's landscape is often opaque. Model portfolios are not registered, nor do they have official categories or standardized taxonomies, so apples-to-apples evaluations of models can be difficult. Integrating models with a client’s other portfolio holdings can also present challenges.

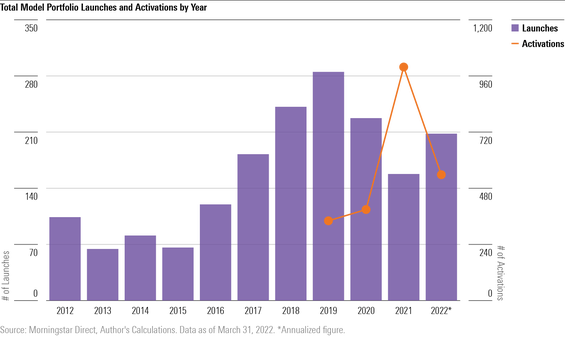

However, by and large, financial professionals are seeing the value of models to help scale their practices. As models have become more and more sophisticated, and able to support more use cases, they are increasingly marketable as a way for advisors to offer varying levels of personalization at scale to their clients.

A Competitor in the Game: Direct Indexing

The definition of direct indexing is right in the name: An investor can own the individual stocks in an index directly. The advisor, or in some cases a third-party service, is ultimately the portfolio manager and can customize the index however they like to meet the needs of their investor. As interest around sustainability and impact continues to rise, this sort of personalization power has become more and more attractive to investors who want their investing choices to reflect their preferences and values.

Until now, only large, wealthy investors have been able to access truly personalized custom index investing. But with recent technological advances, including fractional share ownership, zero-cost trading, and increasingly sophisticated portfolio software enabling scale and efficiency, a much wider range of investors are now able to access, build, and construct personal portfolios using direct indexing. As a matter of fact, some are offering direct-indexing accounts for balances as low as $5,000.

This ability to customize can be valuable apart from the sustainability angle. Investors might have other reasons to prefer a customized portfolio—including specific life circumstances, optimization needs for taxes, or sensitivity toward particular factor exposures.

Among these, tax optimization is one of the largest motivations. Direct indexing can lead to higher aftertax returns, with active tax management techniques such as tax-loss harvesting without triggering wash-sales, tax-efficient transitions and gains-realization deferral, and tax-aware rebalancing.

While customization and tax optimization can be attractive, direct indexing comes with its own risks as well. Not only can costs rack up, the more complicated an investor’s customization choices, the more difficult it is to keep track of all the moving parts of the portfolio.

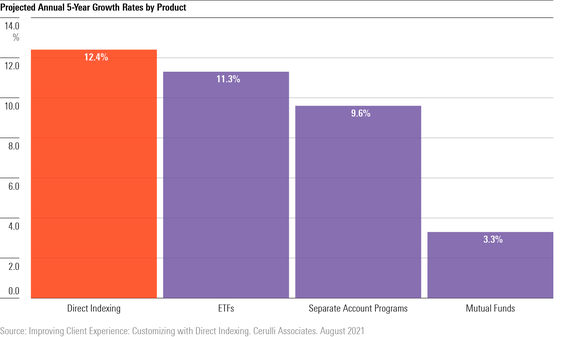

Despite these risks, the race to offer direct indexing is picking up steam. Fidelity, Schwab, and Morningstar have developed their own services, while Morgan Stanley, BlackRock, and Vanguard bought direct-indexing providers.

The Personalization Equation

While these two approaches may not have much in common at first glance, their increasing popularity speaks to different ways the market is responding to shifts in investor preferences. Investors want personalization and immediacy, and, in a way, both solutions are trying to offer them just that.

While both approaches offer some level of personalization, they sit on opposite sides of the scale. Savvy financial advisors must be able to discern which approach is most appropriate for their client, and most investors will fall somewhere between the two extremes.

Model portfolios may be most appropriate for early investors, those with smaller balances and less experience in the market, or those with less interest in actively managing their investments.

Direct Indexing would be more appropriate for clients with more-complex motivations. To benefit from direct indexing, clients need to be in a high enough tax bracket to benefit from tax-loss harvesting and have external gains that would be offset.

To truly determine which path is best, we should rely on the personalization equation. The equation is complex, unique to each individual, and the outcome is not always known in advance.

Advisors need a comprehensive toolkit that helps to solve the personalization equation. First, the equation depends on a holistic view of a client's current accounts and financial situation—including their investing preferences, tax needs, and past spending habits. In today’s financial landscape, gathering and analyzing investor data is more than just a necessary first step. It's how advisors can learn the financial life stories of their clients: where they’ve been, where they are, and where they could go. Accurate, comprehensive data builds trust with clients and inspires confidence that their advisors fully understand their goals and how to achieve them. Once trust is established, an advisor will be in a better place to work with clients to develop a goals-based financial plan.

That’s where financial planning software can be a helpful resource. Financial planning software often creates and automates processes that discern and document a client’s risk profile, financial situation, and monetary habits. With the right financial planning software, advisors can determine the right approach to help their clients set and attain meaningful goals.

There are many paths to achieving the goal of personalization at scale, which makes sense given the diversity of investors that advisors serve. But with the personalization equation, advisors can illuminate the way forward, by grounding their advice in a data-driven, holistic picture of their clients.

A financial plan should always be the foundation, but the process must begin with the advisor understanding and documenting their clients’ goals. As the client’s financial circumstance is established, advisors should keep in mind their goals, tax issues, concentrated holdings, values, desires for impact, and any other relevant factors. From there, advisors can determine whether a model portfolio, direct-indexed portfolio, or combination provides the best solution for each client.

It is important to make sure we have the right balance between hyperpersonalization and maintaining scale. The trade-off considerations are not just from a profit or operating margin perspective, but also the time the advisor needs, making sure that scale does not interfere with an advisor’s ability to engage clients individually, reinforcing the objectives of the client's plan, and ensuring that they are delivering on the key goals and empowering their success. That is the path to personalization at scale.