School is back in session. We’ve assigned a Morningstar Analyst Rating® to 62 college savings plans available across the United States, which represents more than 97% of assets invested in 529 plans.

Each year, we rate these plans across five key pillars: Process, People, Parent, Price, and Performance. An overview of how the industry has generally improved across these five pillars is available in Morningstar’s 529 Landscape Report, which also covered: 529 industry best practices; shared trends such as industry growth and recent expansions of tax benefits; and reviews of new Morningstar Categories for 529 plan age-based portfolios that launched in April 2019.

- a well-researched asset-allocation approach,

- a robust process for selecting underlying investments,

- an appropriate set of options to meet investor needs,

- strong oversight from the state and investment manager, and

- low fees.

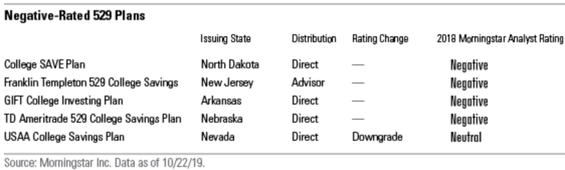

Five of the plans didn’t score so well on our report card, receiving Negative 529 ratings this year. Negative-rated plans have at least one flaw that makes them worth avoiding for most college savers, such as an unstable investment team or high fees.

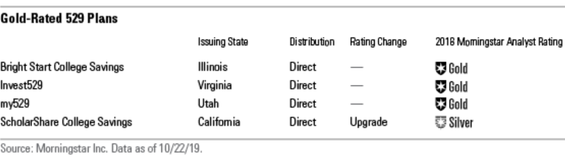

The valedictorians of 529 ratings

Four plans merited a Morningstar Analyst Rating of Gold this year. In alignment with the industry trends we uncovered in the 529 Landscape Report, these plans stand out for their low costs, strong stewardship, and exceptional investment options.

We upgraded California’s ScholarShare College Savings Plan to Gold in 2019, as its board voted to move its age-based portfolios to a progressive glide path in February 2020. That’s an industry best practice, as it smooths the transition from stocks to bonds and reduces the risk of making a large shift out of equities just after a market dip when there's the potential to lock in losses. The plan’s portfolios also rank among the most affordable in the industry within their respective categories.

Virginia’s Invest529, Illinois’ Bright Start College Savings, and Utah’s my529 continue to distinguish themselves from other plans for their excellent state oversight and program management, best-in-class investment options, and thoughtful investment philosophy.

These plans have stayed ahead of their peers by innovating in areas where most 529 plans aren’t. For instance:

- Virginia’s Invest529 plan replaced its actively managed REIT fund with a combination of two direct real estate sleeves and a passively managed fund to temper volatility.

- Utah’s my529 plan enhanced its principal protection options at the end of the age-based glide path where balances are highest.

But this group of Gold-rated plans also hasn’t fixed what isn’t broken: Each plan’s asset allocation remains consistent and well-reasoned. Both in-state residents and out-of-staters will not go wrong by investing in one of these three plans.

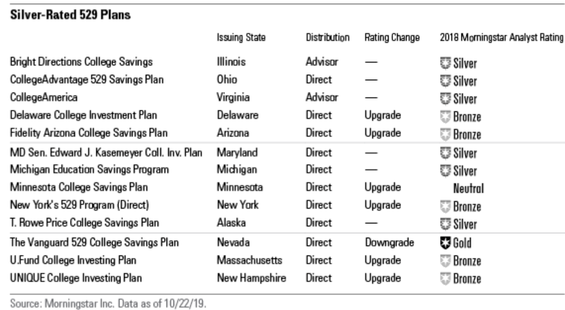

Several Fidelity and Vanguard 529 ratings make magna cum laude

The class of Silver-rated plans, outlined on the table below, saw some shakeups.

A few noteworthy callouts include:

- Four nearly identical plans managed by Fidelity were upgraded from Bronze after phasing out Fidelity’s most expensive age-based options and adding a new blended track that combined active and passive management. This move resulted in less-expensive offerings on average.

- New York’s direct-sold 529 Program, which is managed by Ascensus and Vanguard, earned an upgrade from Bronze after adopting Vanguard’s recommendation to increase its exposure to diversifying asset classes, like international stocks and bonds. At 0.13%, New York offers the fifth-cheapest age-based tracks of 529 plans under Morningstar’s coverage.

- Nevada’s The Vanguard 529 College Savings Plan failed to make the cut for Gold for the first time since 2012, when Morningstar first debuted its medalist designation for college savings plans. As the industry continues to lower fees, Nevada’s fees remain below average but haven’t kept pace with the cheapest plans, so the plan no longer warrants Morningstar’s highest 529 rating. At Silver, we still highly recommend it, owing to its lineup of stellar underlying Vanguard index funds and relatively smooth transition from stocks to bonds within the age-based portfolios.

Five plans flunk out

Plans that haven’t kept pace with the industry’s dizzying fee cuts also look unattractive, and there's little incentive for even in-state college savers to stay close to home when similar fare is offered at a much more palatable price elsewhere.

Two examples of this include Arkansas’ GIFT College Investing 529 Plan and North Dakota’s College SAVE, which are overseen by a partnership between Vanguard and Ascensus. These plans continue to earn Negative 529 ratings because of excessively high and stagnant fees layered on top of Vanguard’s typically low-cost index funds. Similarly, Nebraska’s TD Ameritrade 529 College Savings Plan offers comparable investments to Nebraska’s NEST Direct Plan, yet continues to charge a Sub-Administration fee for TD Ameritrade of 0.19%.

National trends influence 529 plan ratings by state

Although ratings for 529 plans use the same scale as the Morningstar Analyst Rating™ for mutual funds, the 529 ratings reflect the quality of the entire plan, rather than of an individual investment within the plan.

These ratings demonstrate how increasing investor appetite for lower fees, strong stewardship, and underlying fund quality are manifesting across the investments in various 529 plans.

Investors in plans that, for instance, proactively cut fees or move assets to age-based portfolios, are on track to get ahead—and those who aren’t, risk being left behind.