Sustainable investing—the use of environmental, social, and governance factors to assess investing alternatives—is no longer a trend. Rather, it represents a new class of investing that’s here to stay.

In a previous blog post, we discussed our My Sustainability Profile tool, which objectively measures a person’s interest in sustainable investing. Through the tool, we found that 72% of the U.S. population expressed at least a moderate interest in sustainable investing, and—going against common stereotypes that ESG investors are mostly millennials and women—this population comprises investors of all ages and genders.

Another common stereotype in the investing space is that advisors are uncomfortable with ESG investing and, as a result, may avoid discussing the topic with their clients. We analyzed the data to see if there is a difference between investors who work with advisors and investors who manage their own portfolios (do-it-yourself investors) when it comes to ESG investing.

The diversity of ESG investor demographics

To analyze our data of ESG investors, we started by identifying if there were any differences based on common investor demographics: income level, gender, or age.

Of these demographics, we found the only statistically significant difference is between the number of low-income investors who invest in ESG and the number of middle- and high-income investors who do. In other words, middle- and high-income investors are more likely to invest in ESG than low-income investors. However, this may be because low-income investors don’t have the funds to invest in ESG.

In general, there were no statistically significant differences between genders, age groups, and most income classes: ESG investors come in all shapes and sizes.

Do ESG investors have advisors?

Our data also allowed us to evaluate if there was a difference between investors who work with advisors and DIY investors when it comes to ESG investing.

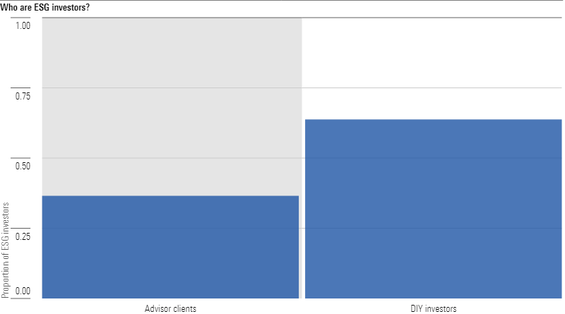

This time, we did see a statistically significant difference. As shown in the chart below, DIY investors make up a significantly larger portion of ESG investors than advisor clients.

Source: Morningstar. Data as of August 2019.

Although we can’t make any claims on the causes of this difference, these findings should prompt advisors to make the necessary changes to keep up with the ESG investing movement. ESG investing is only going to continue to grow, and the majority of ESG investors are not currently working with an advisor.

The stereotypes of ESG investing are things of the past

Research by Locke and Latham finds that the right goals can be motivating and empowering for people. Given society’s growing focus on ESG factors (in terms of both investing and day-to-day transactions), helping clients invest in vehicles they find meaningful and motivating can be a key way for advisors to demonstrate their value—and help clients stay on track when it matters most.

Our research continues to support the idea that most investors are interested in ESG topics, and containing this class of investing to certain demographic groups can be detrimental to investors and financial professionals. It suggests that there is already a significant difference in the ESG space between investors who have advisors and those who do not, and, given the momentum of ESG investing, this trend may not be in the best interest of advisors.