Sustainable investing—the use of environmental, social, and governance factors to assess investing alternatives—is gaining momentum across the industry. Although most advisors are aware of this development, many still struggle to apply it in practice.

Often, the chief obstacle to discussing sustainable investing with clients is uncertainty about which ones might be interested. This may prompt advisors to rely on common stereotypes that assume sustainable investing is a concern of only millennials and women—but our research shows that the true face of sustainable investing is much more diverse.

The research we conducted found that those who are interested in sustainable investing encompasses all genders and age groups. In other words, by not pursuing the topic with a range of clients, advisors may be neglecting—and losing out on—opportunities for many ESG investors.

A new way to identify ESG investors

Most industry surveys measure interest in sustainable investing with questions like, “On a scale of one to five, how interested are you in sustainable investing?” These types of questions, however, are subject to behavioral biases that can distort the results.

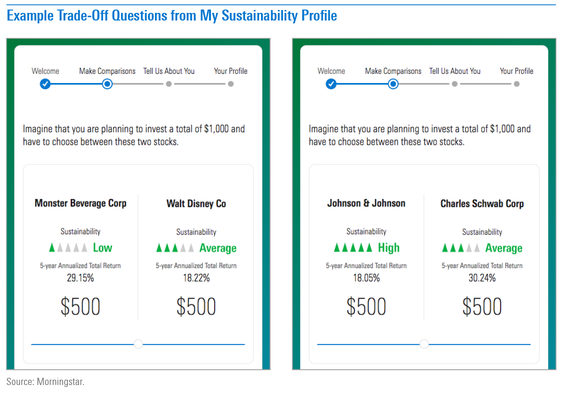

As part of our research, we developed a tool called My Sustainability Profile that works to mitigate these biases and objectively measure a person’s interest in sustainable investing. As shown below, the tool prompts users to choose one of two stocks in which to invest—a decision that requires carefully constructed trade-offs—and then calculates a sustainability-preference score based on their answers.

The scores range from zero to 100, with zero indicating no interest in sustainability, 50 indicating an aim to balance returns and sustainability, and 100 indicating that the investor is guided entirely by sustainability. According to their score, each person is then slotted into one of five different profiles:

- Returns-driven (score of 0-19): low interest in sustainability

- Returns-minded (score of 20-39): medium-low interest in sustainability

- Balanced (score of 40-59): medium interest in both sustainability and returns

- Sustainability-minded (score of 60-79): medium-high interest in sustainability

- Sustainability-driven (score of 80-100): high interest in sustainability

Which demographics include the most ESG investors?

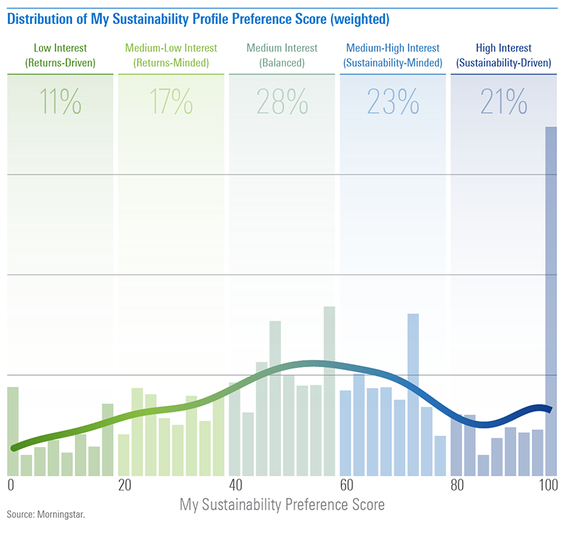

We used My Sustainability Profile to measure the sustainability-preference scores of a nationally representative sample of 948 respondents. Overall, we found that 72% of the United States population expressed at least a moderate interest in sustainable investing, qualifying as “balanced,” “sustainability-minded,” or “sustainability-driven.”

We also examined how this sustainability-preference score trended throughout different demographic groups, such as among genders and generations.

Although we did find that women had a slightly stronger preference for sustainable investing than men, the difference between their weighted averages was small (59.08 versus 53.53) and disappeared when we accounted for other sociodemographic variables like income and age.

The same was true when we compared the average sustainability-preference scores of different generations: millennials, generation X, and baby boomers. The average preference scores for millennials and generation X were statistically equivalent (60.21 versus 57.26). And while millennials, on average, showed a slightly stronger preference for sustainable investing when compared with baby boomers (51.96), the statistical significance between the two was not there after factoring in sociodemographic variables.

Reaching past sustainable-investing stereotypes

It’s time to look past the common stereotypes related to sustainable investing. Our results suggest there may be a broader appetite for sustainable investing, and advisors may be able to reach—and retain—a large untapped market by offering sustainable solutions.