Morningstar’s quantitative research team recently took a deeper look at how investors choose funds.

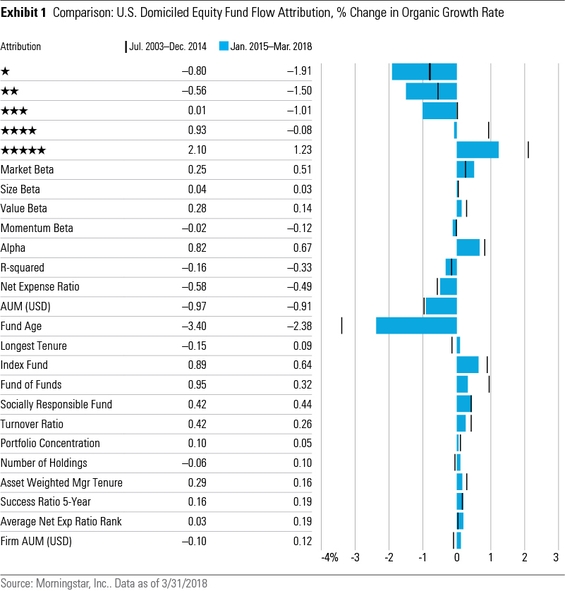

Using new data from 2015-18, we refreshed a 2015 paper, “What Factors Drive Investment Flows?”. The updated report looks at the same 26 fund characteristics to capture past fund performance, fees, manager and firm factors, and more. This latest look is limited to fund flows in U.S. open-end mutual funds, excluding exchange-traded funds and global, ex-U.S. funds

We released the results in the first edition of the Quantitative Analytics Quarterly, a new publication for the team to share their work on a more regular basis. Here’s some of what we found when we updated the data:

Investor preferences are generally consistent through time

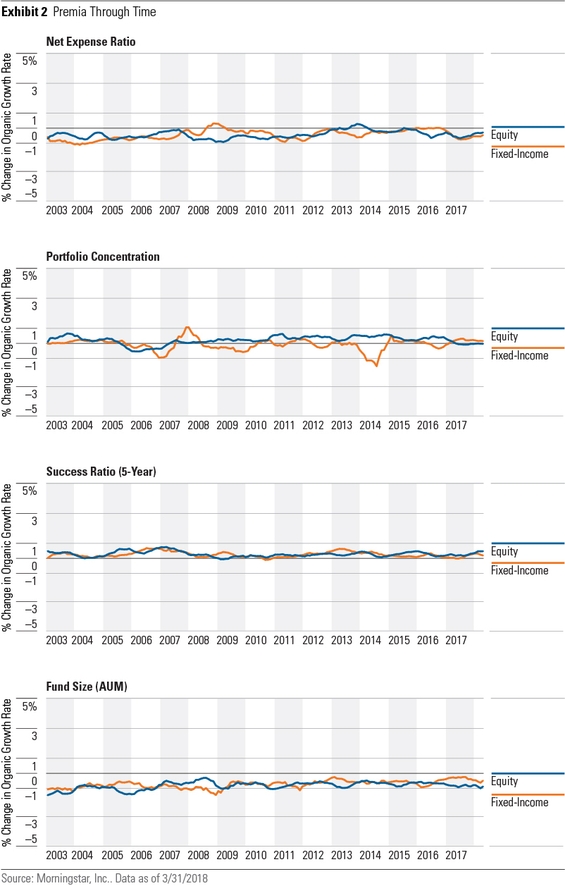

Morningstar’s quantitative analysts found that investors exhibited consistent behavior in their mutual fund selection through time across both the 2003-14 and 2015-18 time periods. For example, variables such as lower fees, greater portfolio concentration, and higher firm quality continued to capture investor preferences.

As expected, on average, larger funds will grow at a slower pace than small funds. This is demonstrated by the larger-than-average equity funds attracting .97% and .91% lower expected fund flows per month, all other variables equal for the 2003-14 to 2015-18 period, respectively.

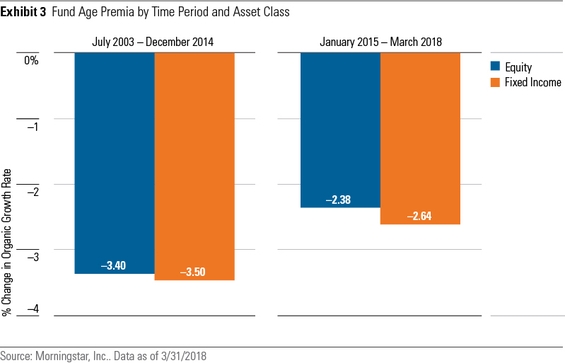

Investors prefer more established funds at a higher rate than before

Our team found that older funds continue to experience negative flows per month on average, but this rate is more positive than before. These findings indicate a shift in investor preferences over the past three years, away from new funds and toward more established funds.

Performance is less of a driver of fund flows than what we saw in our 2015 study

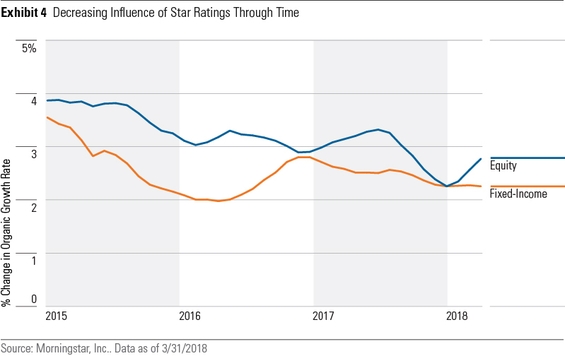

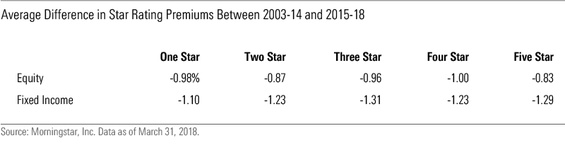

Another difference between the two time periods is that the spread between 5-star premiums and 1-star premiums.

If Morningstar Rating TM for funds, or star ratings, are an important driver of fund flows, then you would expect to see a large spread, because investors will buy 5-star funds and sell 1-star funds. However, in the past several years we’ve seen the spread decline, indicating that past performance is having less impact on future fund flows than we previously observed. This could be a potential sign that investors are reacting less to recent performance.

The final change in the star rating factors is that all five ratings had substantial declines in premiums. Declines were consistent across equity and fixed income. Strong performance (5-star) was rewarded more than weak performance (1-star). The increase in passive investing over the last several years drove these results as poor performing active funds get sold and the money often moves to a passive product. Strong performing active funds still attract new investors, but to a lesser extent than in years past.

This research uses soon-to-be-made available predictive models from Investor Pulse, our new business intelligence tool that delivers actionable insights, advanced competitive analysis, and predictive analytics to help asset managers meet investor preferences.

Madison Sargis is a quantitative analyst on Morningstar’s Quantitative Research team and Elena Zistakis is a marketer for the Morningstar software product group.