What are an investor's odds of selecting an active fixed-income fund that is likely to outperform its benchmark after fees, and in which categories is it preferable to choose a low-cost passive option instead?

To explore these questions, we looked at expected excess returns for fixed-income funds based on historical excess return distributions in 25 Morningstar Categories. This study, “ Excess Return Expectations for Fixed-Income Funds,” spans a period of nearly 16 years, from January 2002 to October 2017, and includes funds from Morningstar's U.S., Europe, Asia, and Africa categories.

Here, we take a look at some of the highlights from our study.

4 key takeaways about the impact of bond fund fees

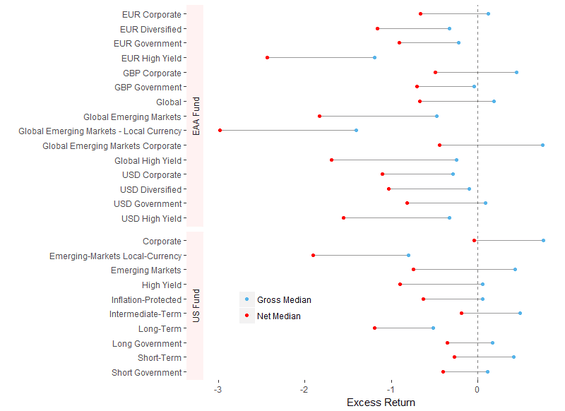

1. Bond funds’ fees are the largest driver behind most chronic underperformance against their indexes. We found that in 13 out of the 25 categories, the median fund typically outperformed its category’s index on a gross of fees basis, suggesting that at least in some cases active management has added value. However, once fees are factored in, odds of outperformance drop dramatically. In fact, in none of the 25 categories studied did the median fund beat the category benchmark after fees, a dismal picture for the active bond fund investor.

2. Success ratios provide better insight into the investor experience. Because funds tend to liquidate or merge over certain periods of time, success ratios—the percentage of funds that both survived and outperformed category index in a given period—are a better reflection of investors’ actual experience the. Across categories in our study, success ratios ranged from 9% to 49%, with some of the lower success ratios in high-yield and emerging market bonds categories. The full analysis is shown on the chart below.

3. Lower -risk bond categories are more suitable for indexing. Our study identified certain categories where costs actually had a greater impact on net returns than manager skill, which makes the case for low-cost passive investments. These are mostly investment-grade government or diversified bond peer groups, where returns are lower and there’s comparatively little dispersion between the best and the worst active funds. In more diverse peer groups, a low-cost passive option is often superior to the typical active fund, but there’s still room for manager skill to add value—if bond fund fees are reasonable.

4. There are certain categories where both active and passive funds fall short. In universes where volatility and transaction costs are high, we found that both active and passive funds struggle to keep up with the index, but for different reasons. For instance:

- High-yield bonds. In this category, passive funds, which typically focus on the largest, most-liquid issuers, have missed out on a large portion of the benchmark’s returns. Active managers, meanwhile, are somewhat better armed to exploit the market’s inefficiencies and illiquidity premiums. Thus, even if it fails to beat the benchmark index, the median high-yield active fund is still preferable to a passive vehicle.

- Emerging-market bonds. In this category, most active funds are simply too expensive to succeed. Even funds in the top quartile of these categories have underperformed a comparable exchange-traded fund after fees, suggesting that passive offerings are relatively more compelling even if they are not able to exactly match the index’s returns.