U.S. Fund Flows: January Kicks Off 2023 in Positive Territory

Investors returned to fixed-income and international-equity funds.

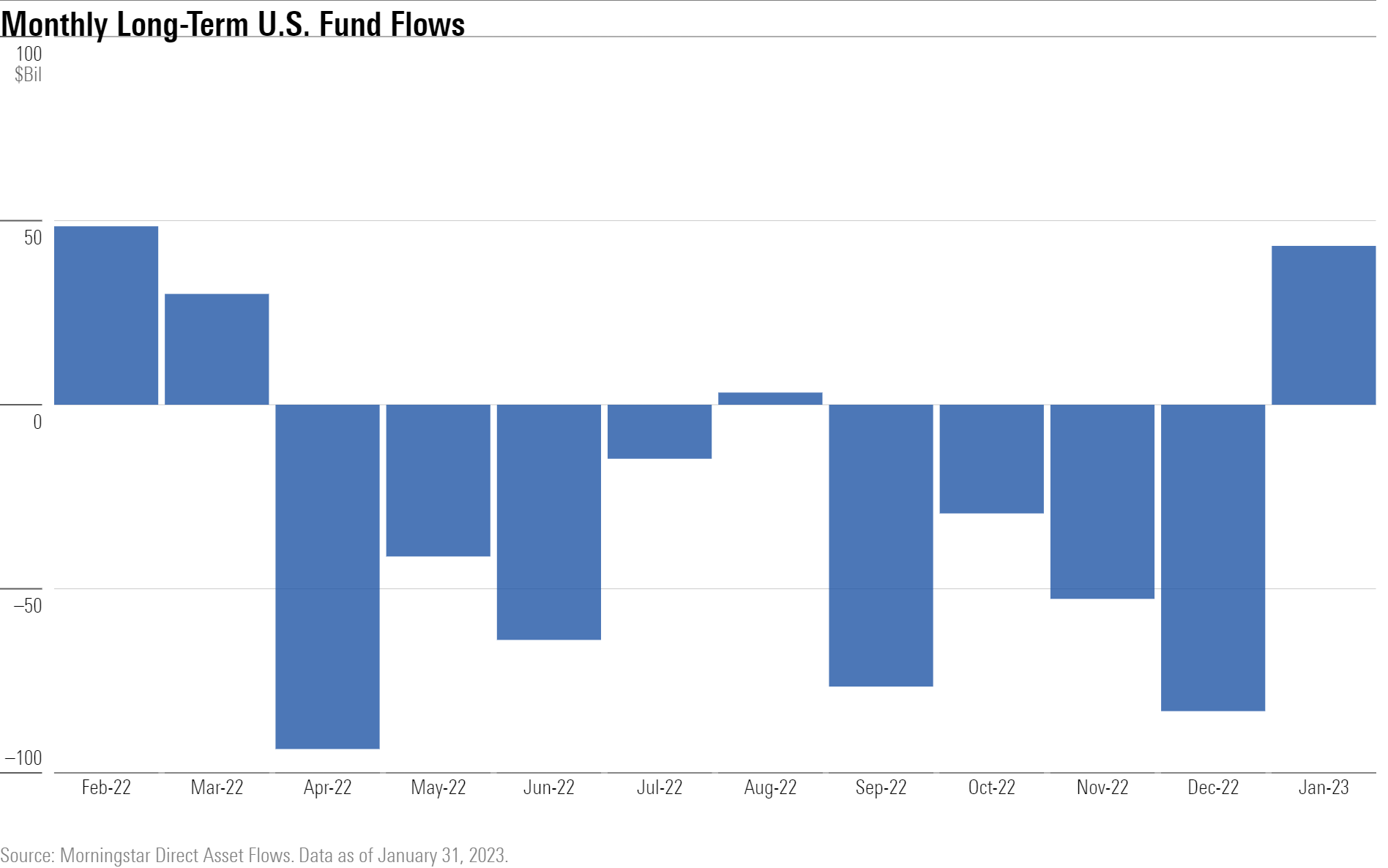

Coming off their worst year since at least 1993, U.S. funds rebounded in January 2023, collecting about $43 billion. However, the recovery wasn’t broad-based, as five out of the 10 U.S. category groups suffered outflows during the month.

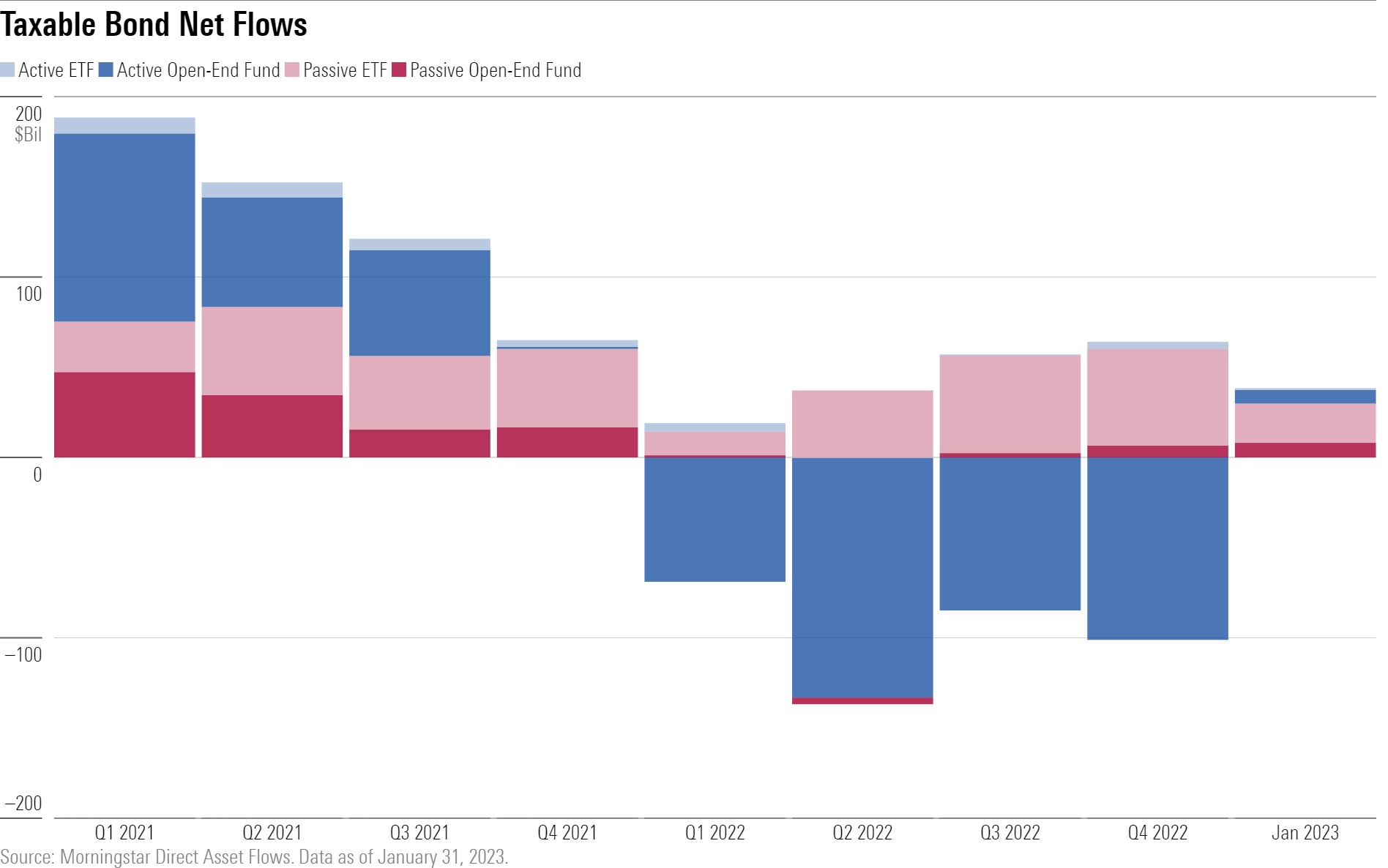

Taxable-Bond Funds Start on a High Note

Taxable-bond funds gathered more than $38 billion in January. That’s their best monthly inflows since September 2021, when healthy inflows into active funds drove a $40 billion haul. In January, passive portfolios scored nearly 80% of taxable-bond fund inflows.

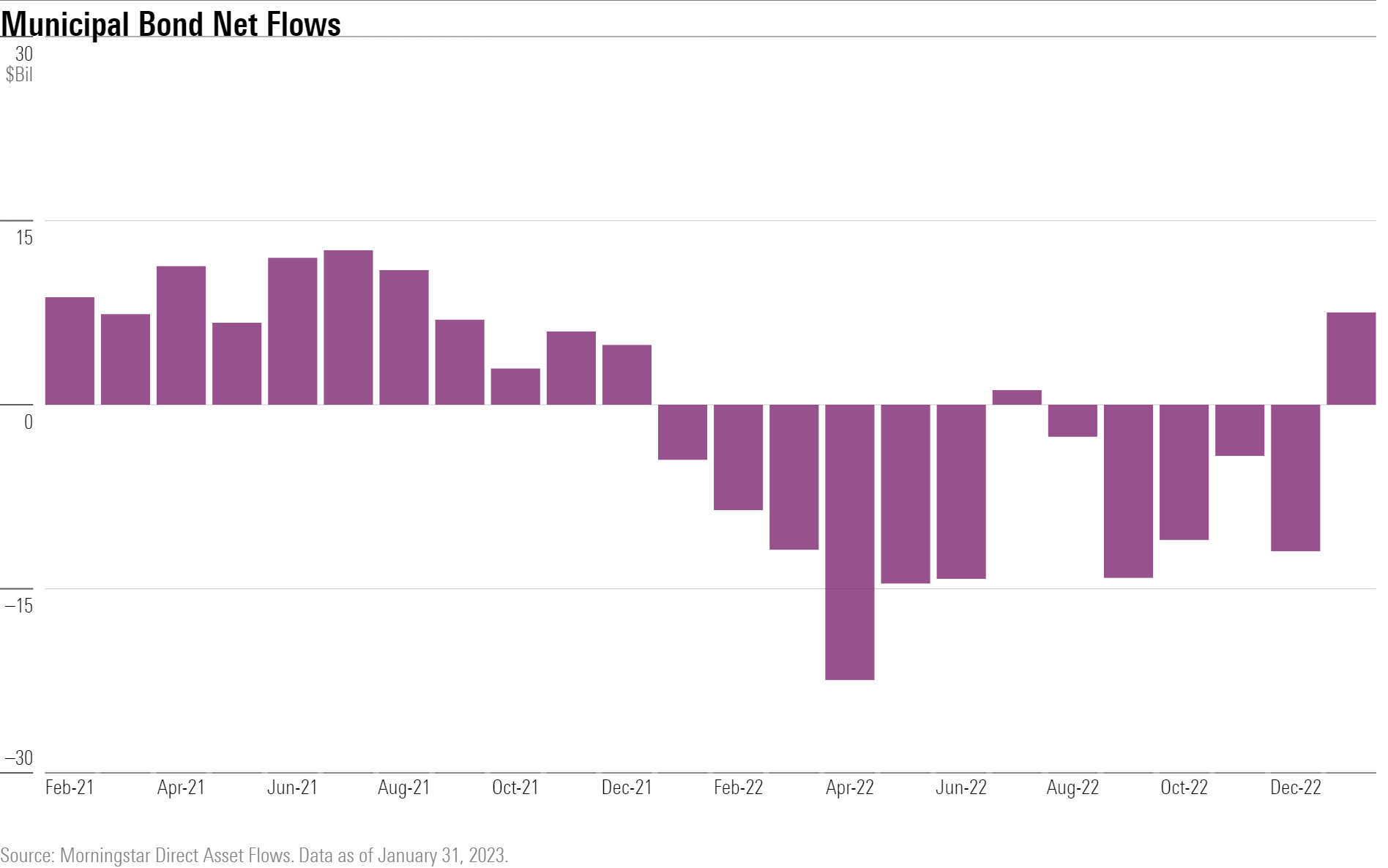

Municipal-Bond Funds Return to Form

Municipal-bond funds pulled in $7.5 billion, their most lucrative month since August 2021. It has been tough sledding for those funds, though. In 2022, outflows in 11 of 12 months translated into a negative 11.2% organic growth rate—municipal-bond funds’ worst annual rate since at least 1993. Much work remains for them to claw back those assets, but January’s rebound is a solid start.

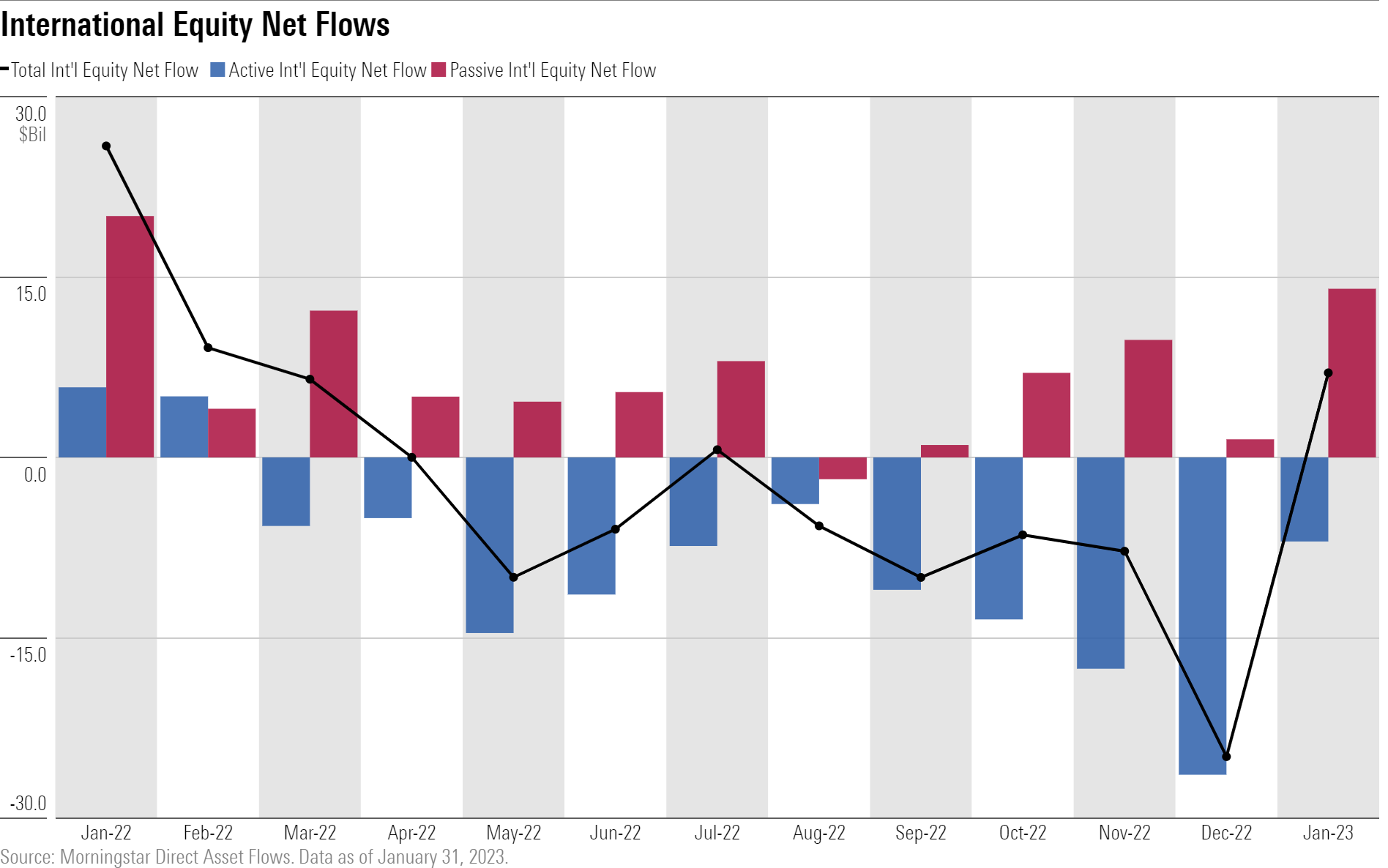

Investors Warm Up to Foreign Stocks

International-equity funds had a lackluster 2022 but sprung back to life in January with $7 billion in inflows, their largest since February 2022. Europe-stock funds led the way with a $5.2 billion intake. Passively managed funds collected $14 billion, while actively managed offerings shed $7 billion—a dynamic that has become par for the course in most equity-fund markets.

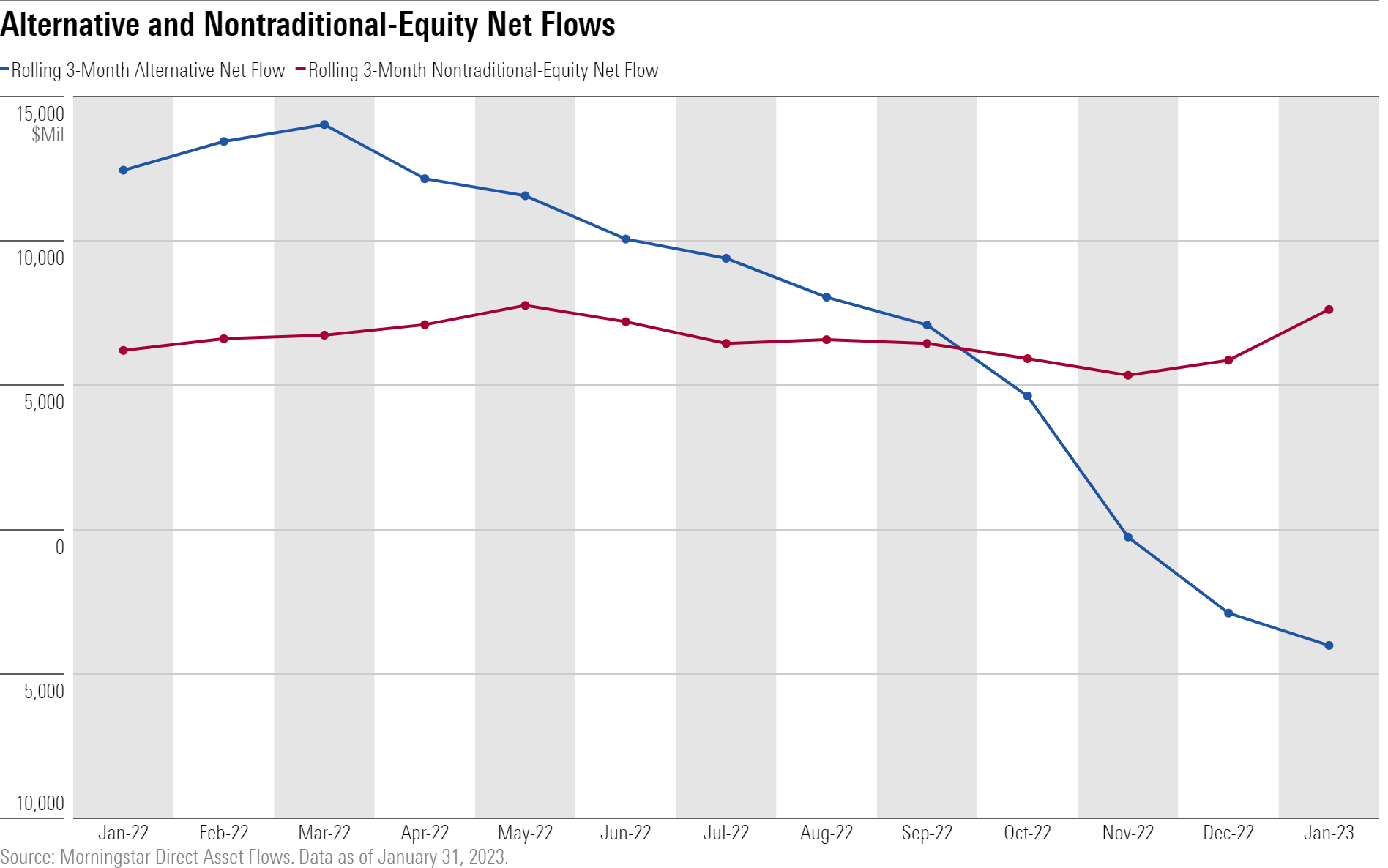

Diverging Diversifiers

Both alternative and nontraditional-equity funds offer strategies that either mute or modify equity market risk, but investors have turned away from the former and toward the latter. Demand for alternative funds peaked in early 2022 but has steadily declined. Nontraditional-equity funds have been more resilient. A $3.4 billion January inflow was their largest in Morningstar data since 1993.

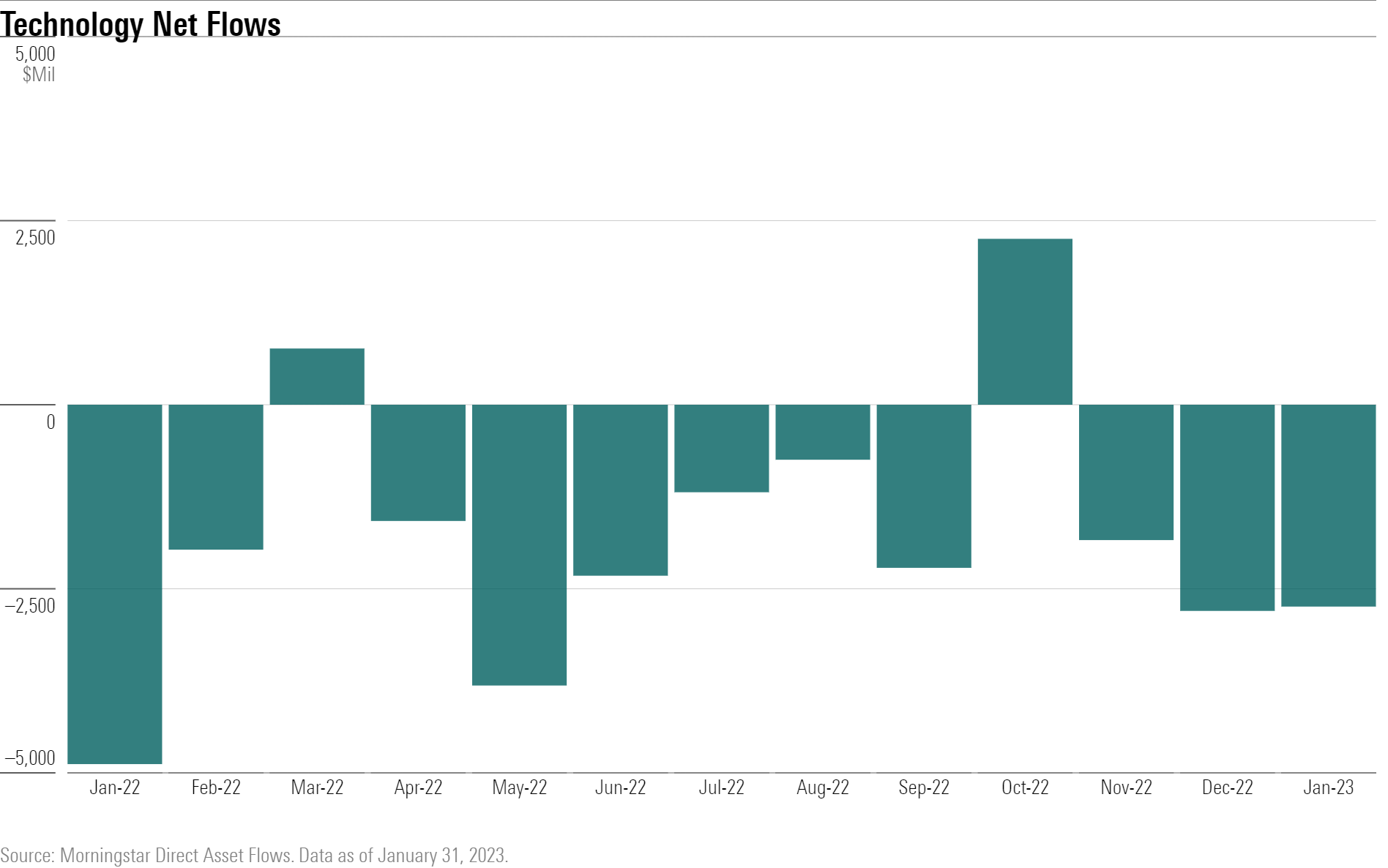

Tech Fund Slump Continues Into 2023

After shedding about $20 billion in 2022, technology funds saw more money leave in January—to the tune of $2.7 billion, the worst among the 16 categories in the sector-equity group on an absolute and organic-growth basis. Investors haven’t re-embraced tech funds despite the average fund in the technology Morningstar Category gaining 12.4% in January.

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for January 2023. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)