U.S. Fund Flows: April Inflows Do Little to Reverse Sluggish Start to Year

Investors retreated from most category groups.

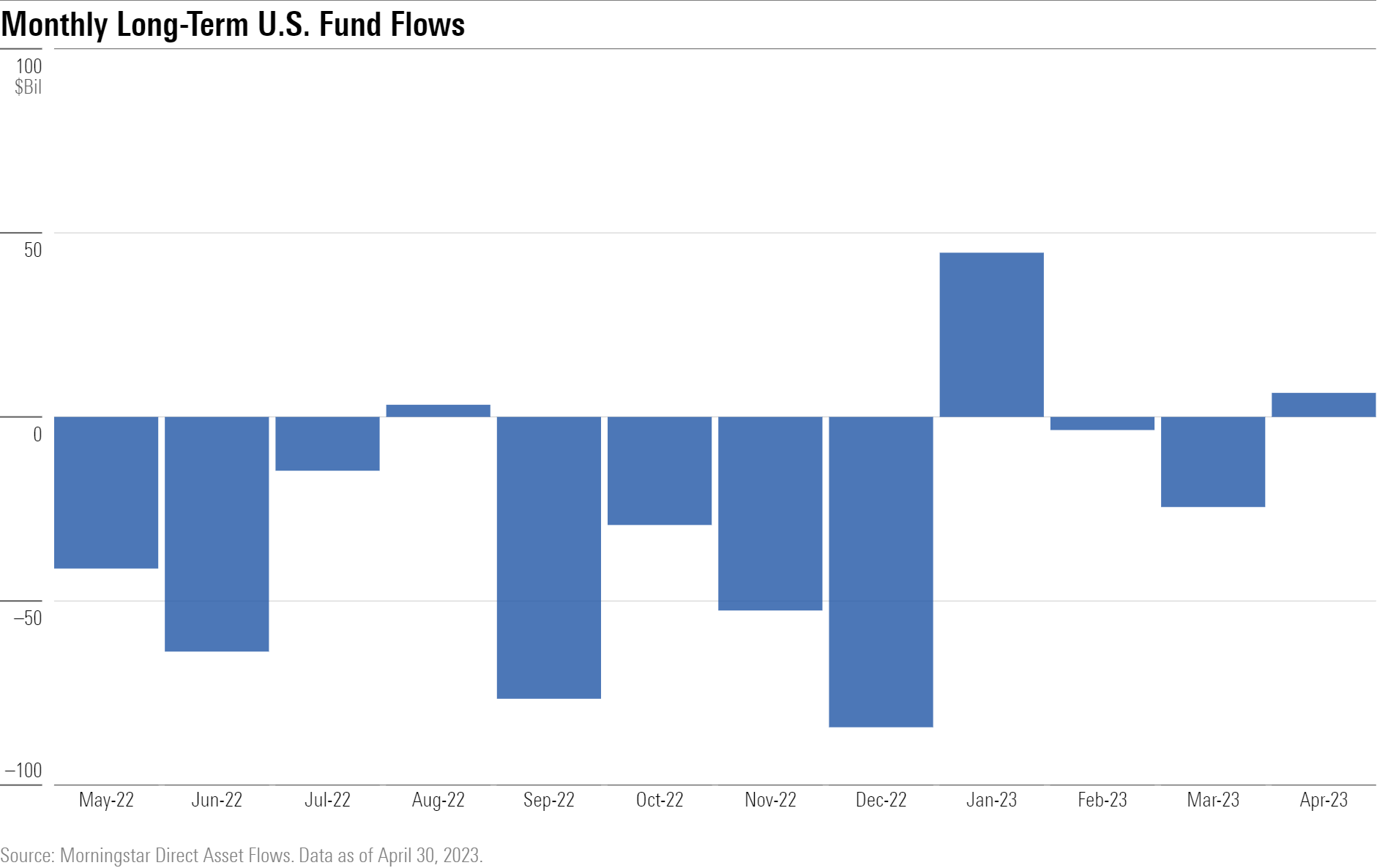

U.S. mutual funds and exchange-traded funds collected about $6.5 billion in April after two consecutive months of outflows. Sentiment remains broadly weak as seven of the 10 U.S. category groups suffered outflows during the month. U.S. funds’ 0.1% organic growth rate for the year through April is their third-worst start to a year over the same period in Morningstar data beginning in 1993.

Taxable-Bond Funds Stay Ahead of the Pack

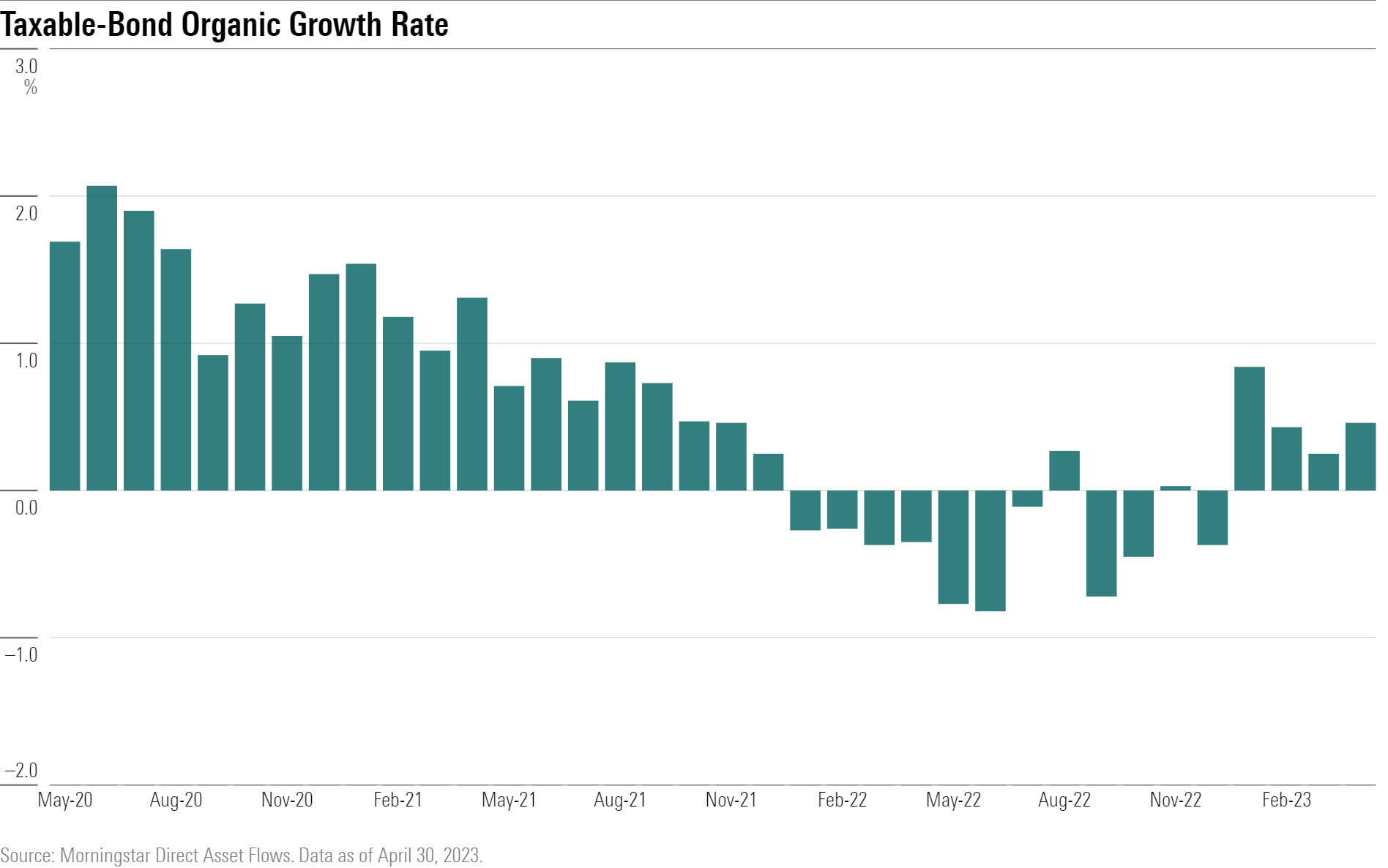

Taxable-bond funds pulled in about $23 billion in April behind solid flows into the intermediate-core and core-plus categories, which often serve as bellwethers for the broader cohort. That pushed taxable-bond funds’ year-to-date haul to $95 billion. While that sum led all category groups by a wide margin, taxable-bond funds still have work to do to claw back their 2022 outflows.

Bond Investors Warm Up to Credit Risk

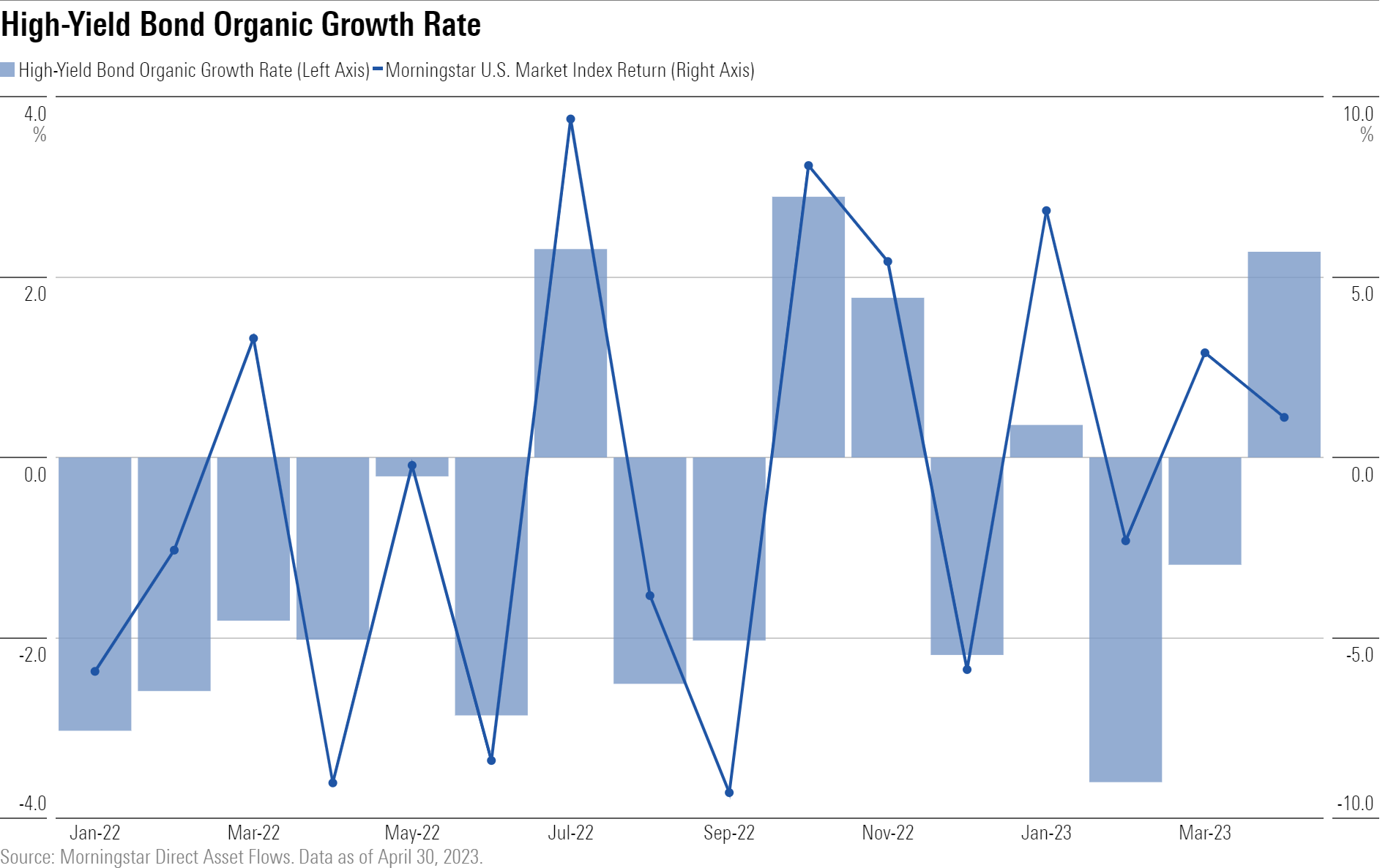

Relatively calm April markets set the stage for investors to pour about $7 billion into high-yield bond funds, which tend to collect money when stocks are up and bleed when they’re down. Conversely, safer government-bond funds posted their mildest month of inflows this year.

Modest Outflows Persist for U.S. Equity Funds

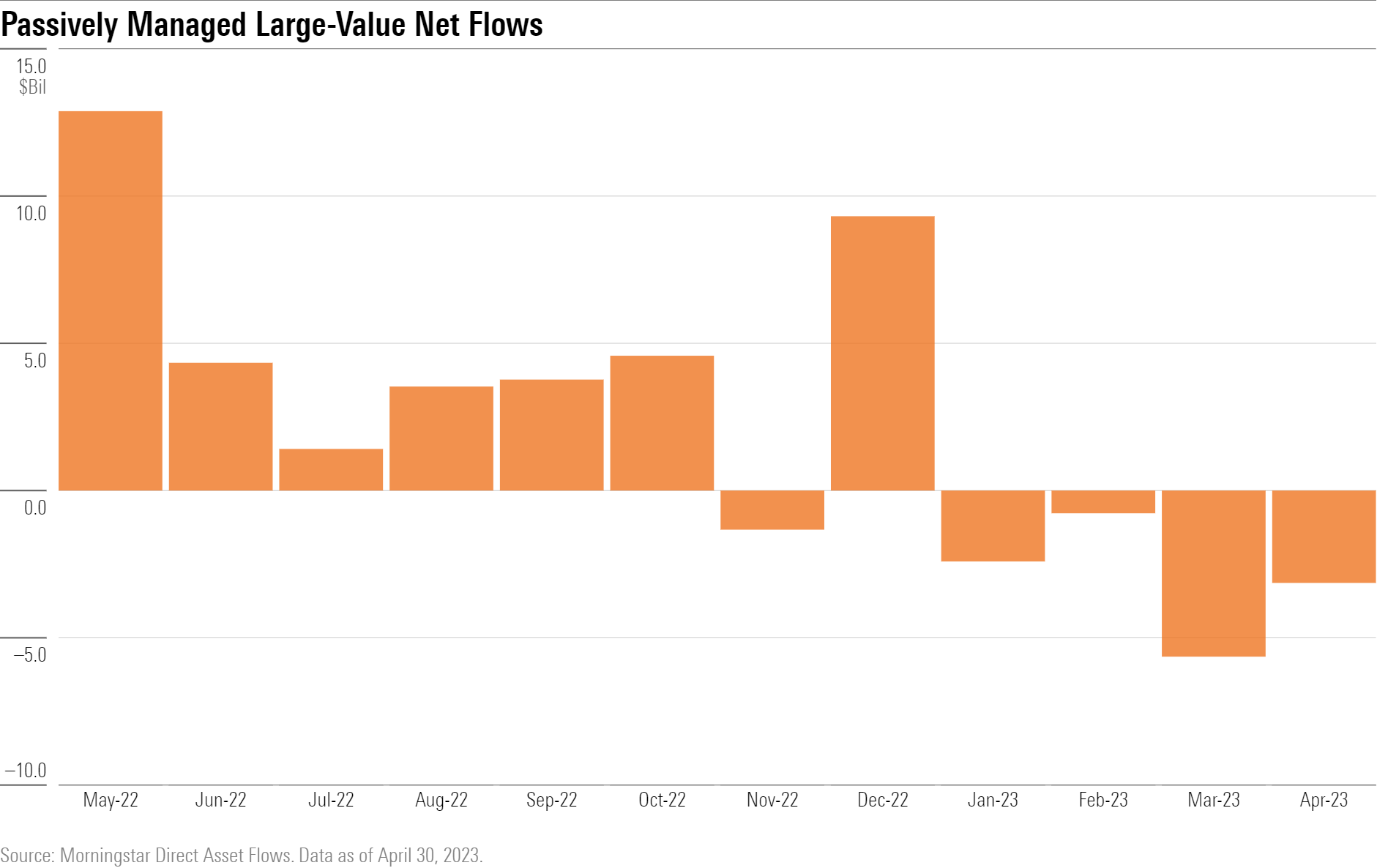

U.S. equity funds shed about $5 billion in April—their sixth consecutive month of outflows. Large-value funds suffered the heaviest outflows during the month, dropping $6.9 billion. They’ve dropped more than $20 billion for the year to date. Momentum for these funds might be waning as growth stocks have rebounded in 2023. Even passive large-value funds have shed assets in 2023.

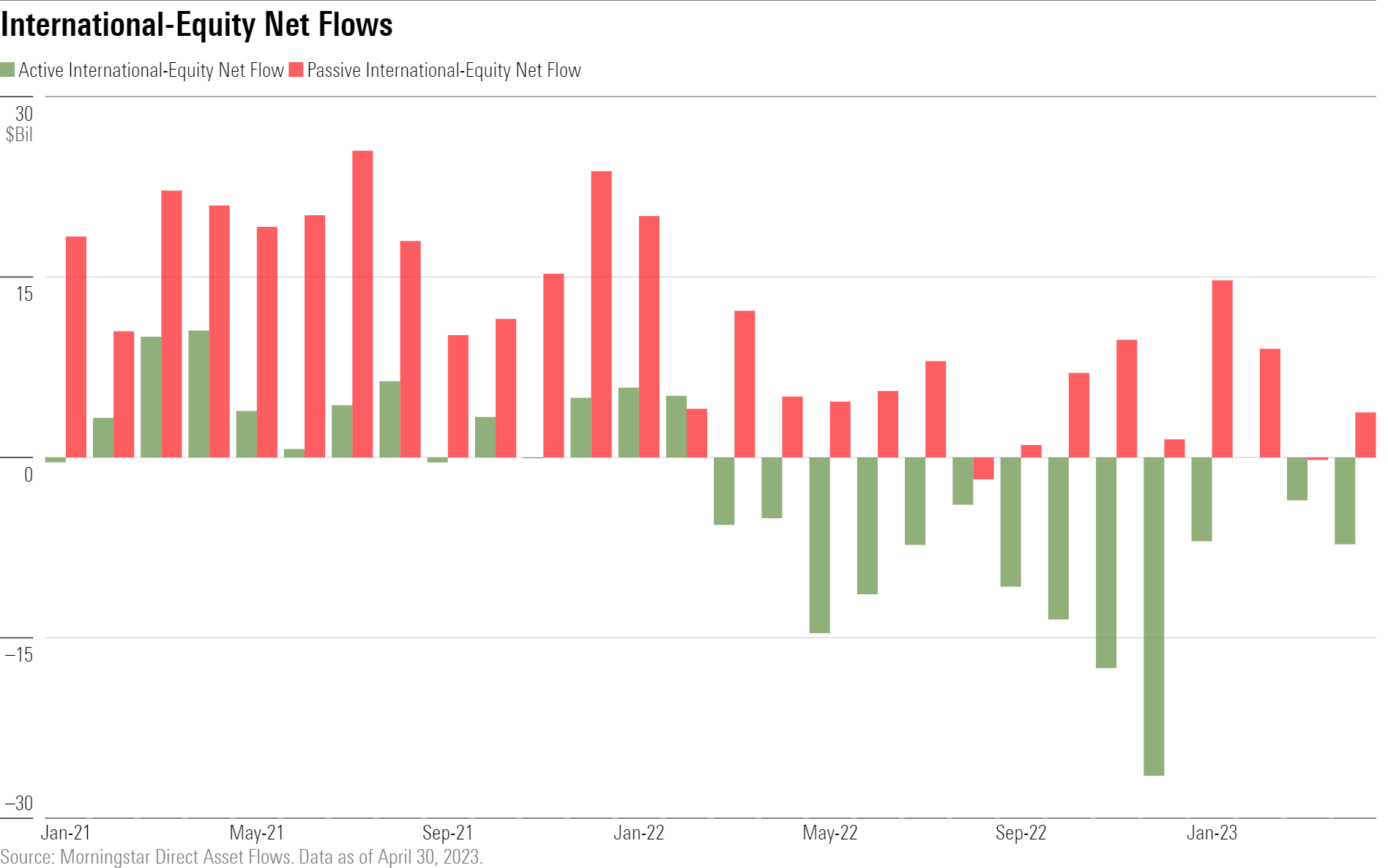

International-Equity Slowdown Continues

After regularly taking in more than $20 billion on a monthly basis in 2021, international-equity funds have struggled to stay in positive territory. January and February inflows in 2023 gave some hope that investors were warming up to the asset class, but outflows in March and April have squelched that narrative. Actively managed funds have seen the sharpest swing in sentiment.

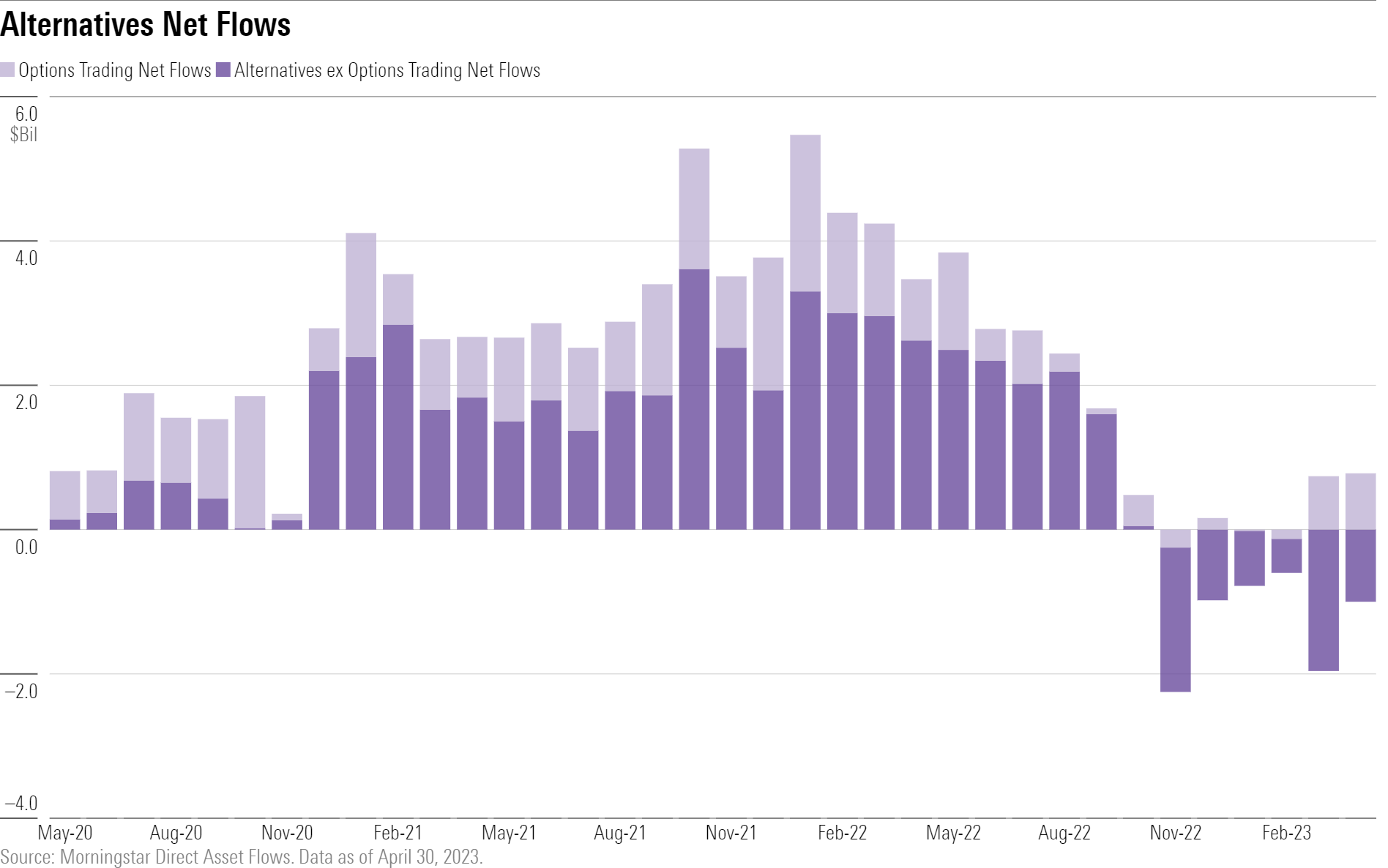

Defined-Outcome Funds Buffer Alternative Outflows

Long a popular trade, alternative funds have shed money for six consecutive months after mild April outflows. But flows into options-trading funds haven’t run out of gas. This category includes defined-outcome funds whose 2022 breakout spilled into 2023, collecting $1.4 billion for the year through April as the rest of its cohort shed $4.2 billion.

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for April 2023. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)