U.S. Equity Funds Led All Fund Flows in February

Investors bought U.S. equity funds and sold bond funds against a backdrop of the Russian invasion of Ukraine.

Editor’s note: This is adapted from the Morningstar Direct U.S. Asset Flows Commentary for February 2022. Download the full report here.

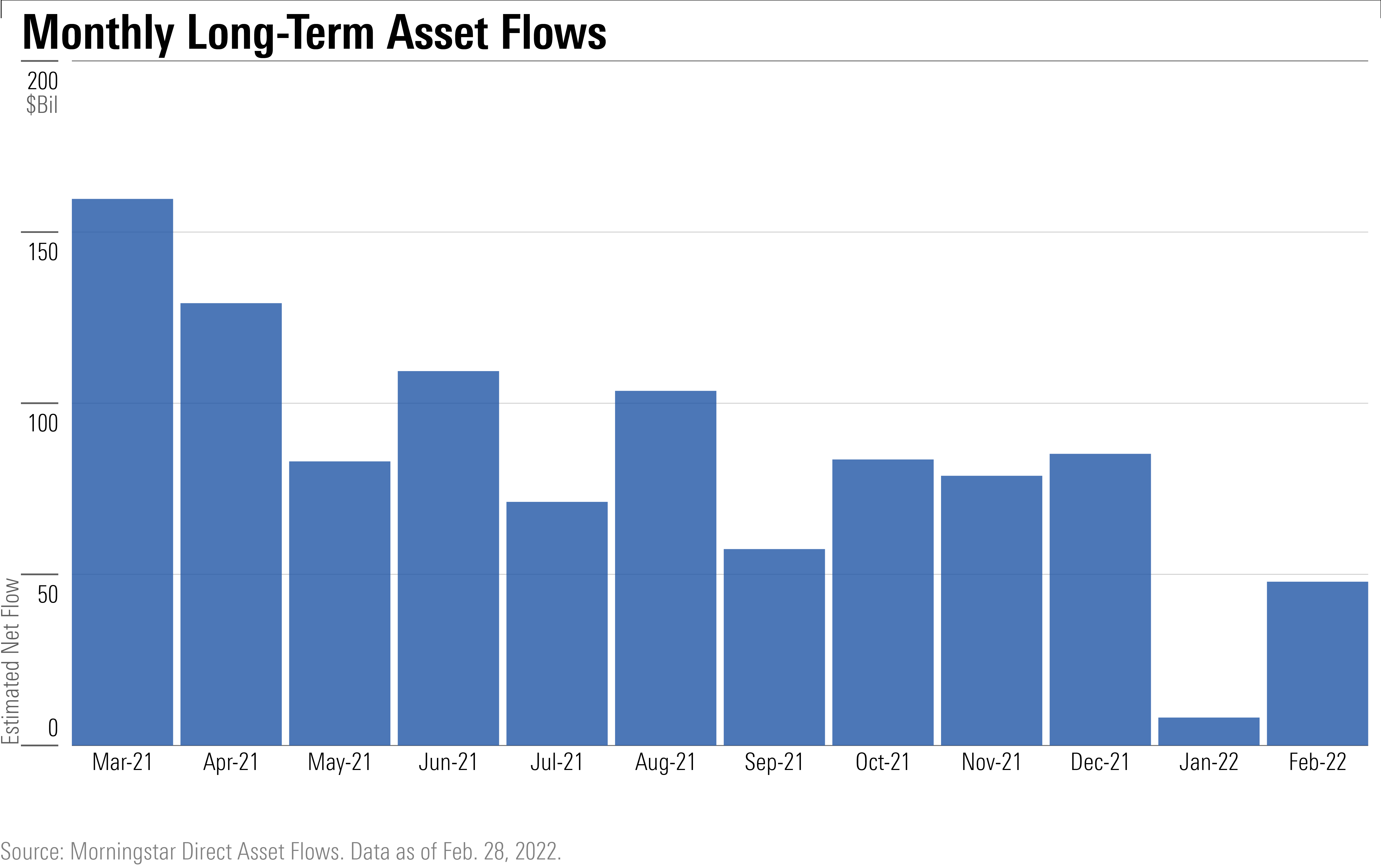

Long-term mutual funds and exchange-traded funds gathered $48 billion in February 2022, meaningfully more than January’s paltry total but still less than most months during a record-setting 2021. Equity markets’ rocky start to the year and looming interest-rate hikes may be weighing on investor sentiment.

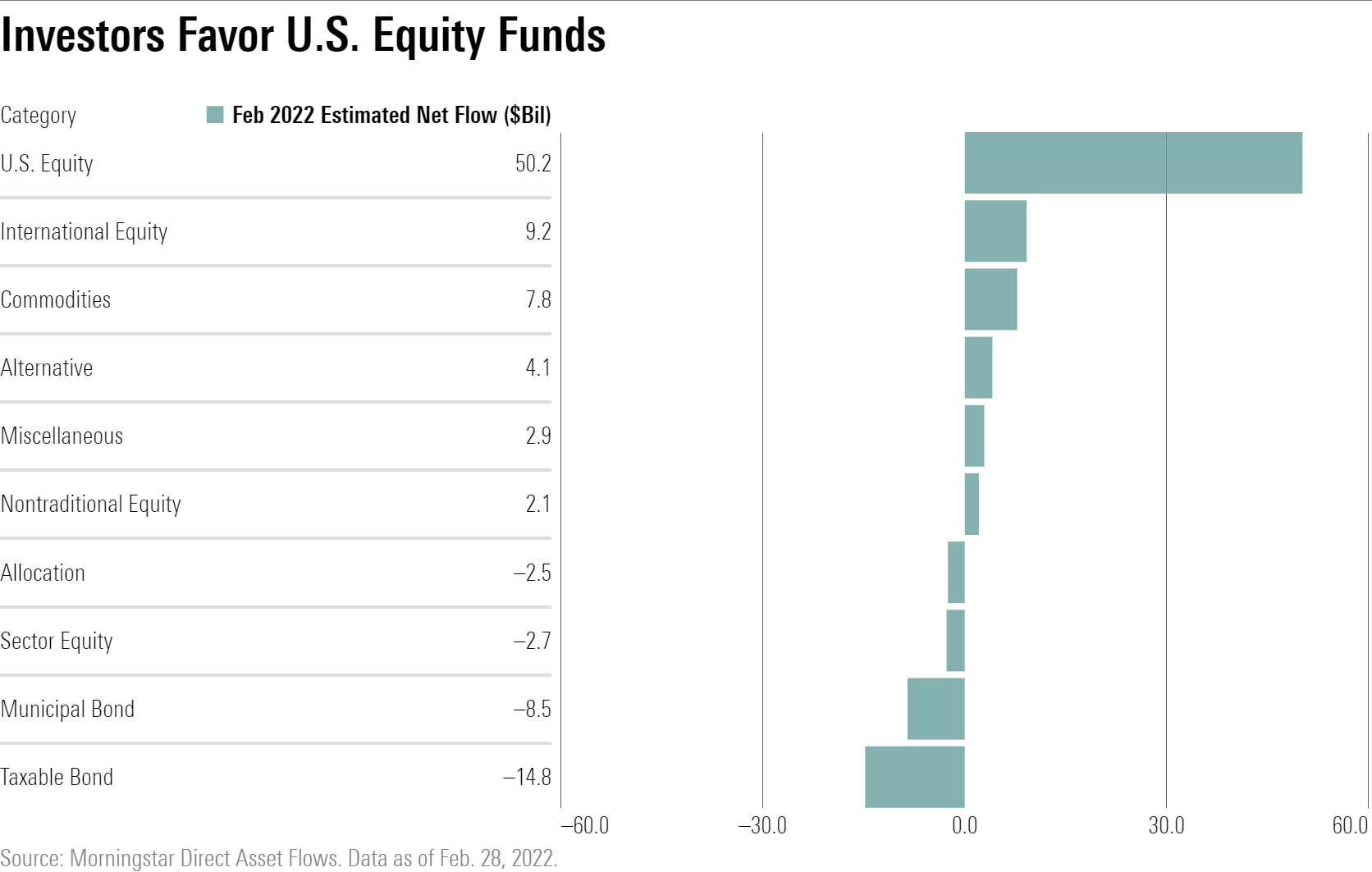

U.S. equity funds took in $50 billion in February, the largest inflow into any U.S. category group and far ahead of international-equity funds’ $9 billion inflow. Large-blend funds collected $38.5 billion to lead all Morningstar Categories.

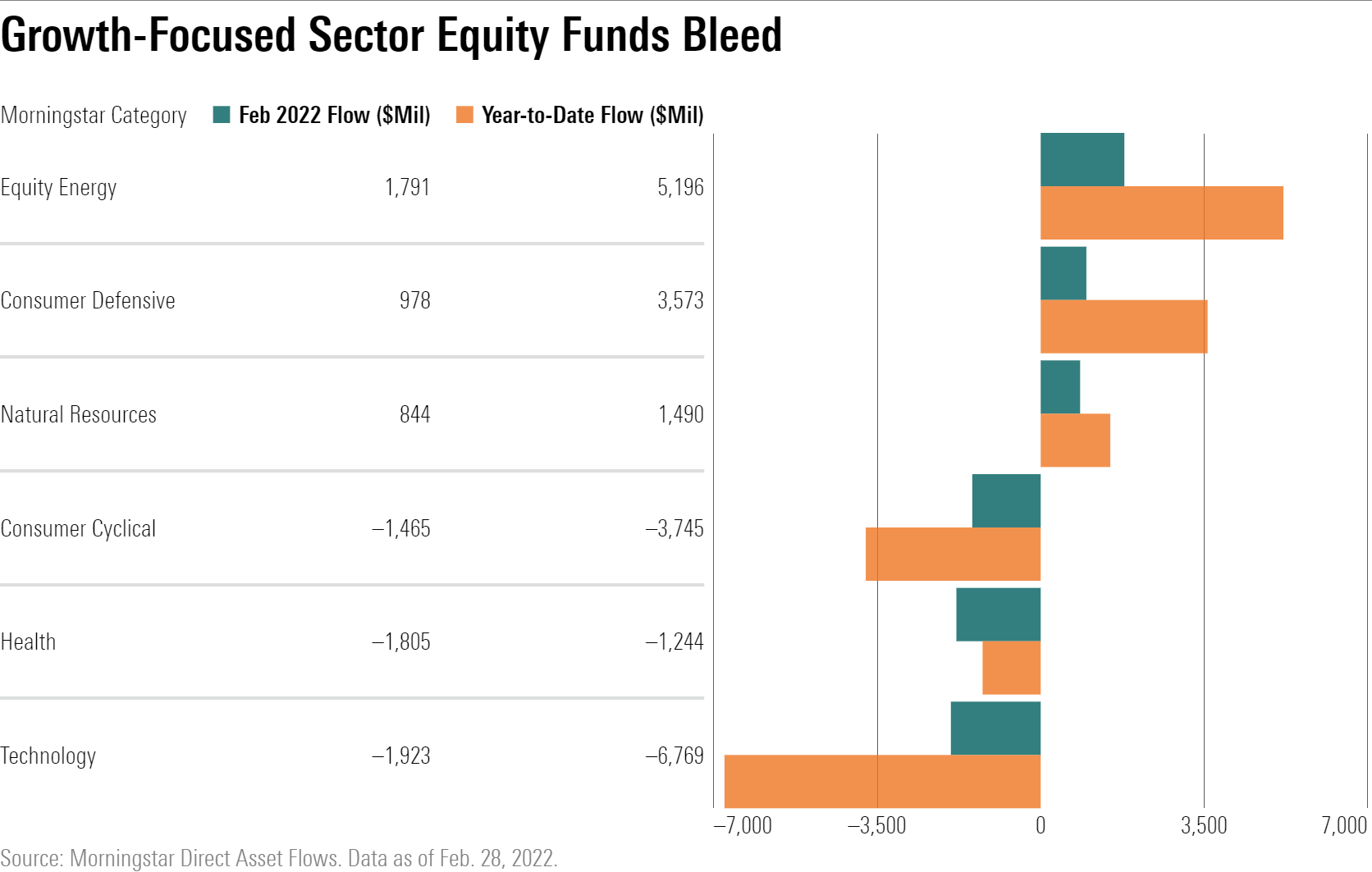

Sector-equity funds shed $2.7 billion in February, breaking a streak of four consecutive months of inflows. Investors embraced value-oriented categories such as equity energy, natural resources, and consumer defensive but fled high-growth categories such as technology and consumer cyclical to a greater degree.

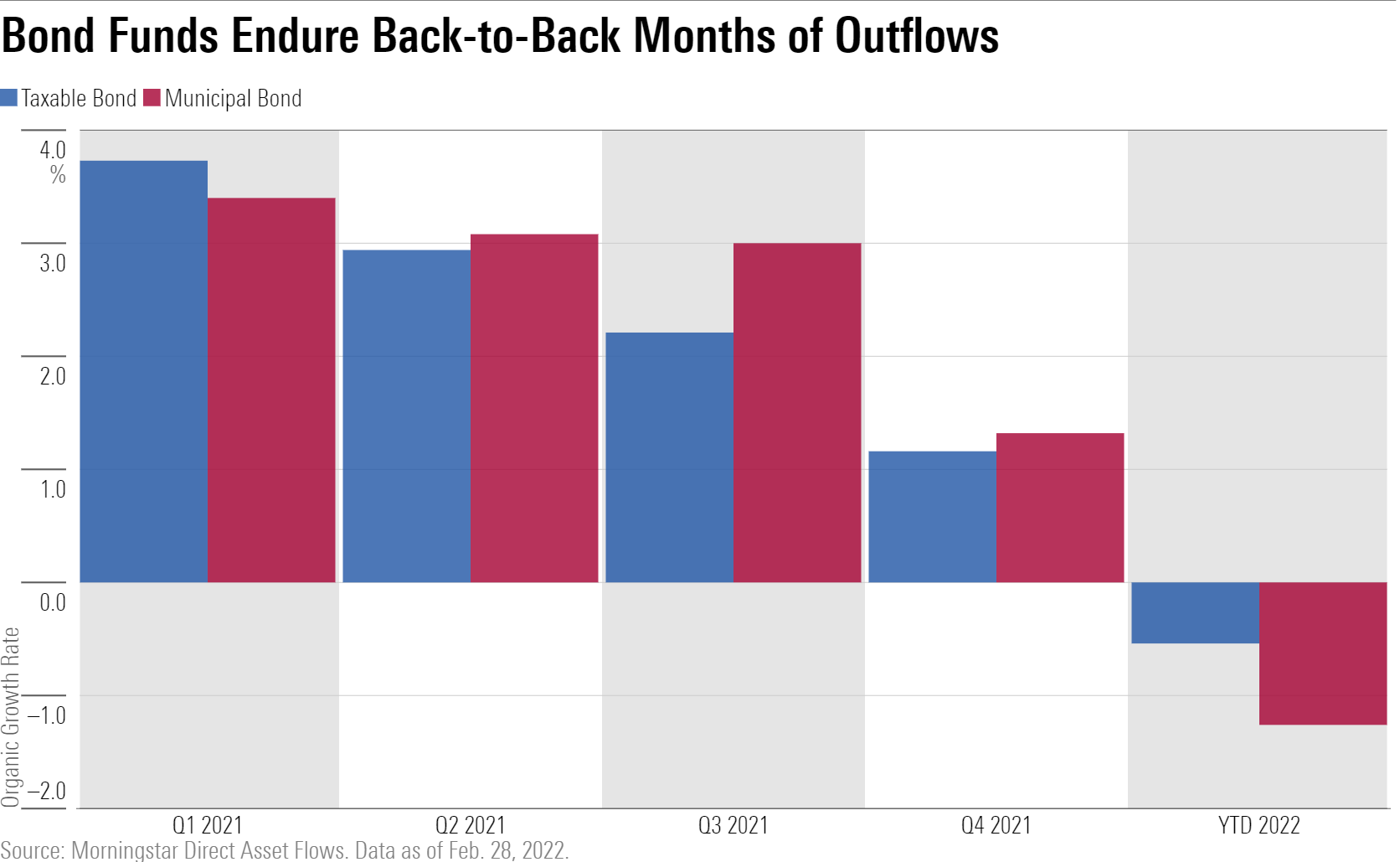

Both taxable- and municipal-bond funds saw their second consecutive month of outflows in February, shedding $14.8 billion and $8.5 billion, respectively. These category groups haven't posted a quarter of negative growth since first-quarter 2020.

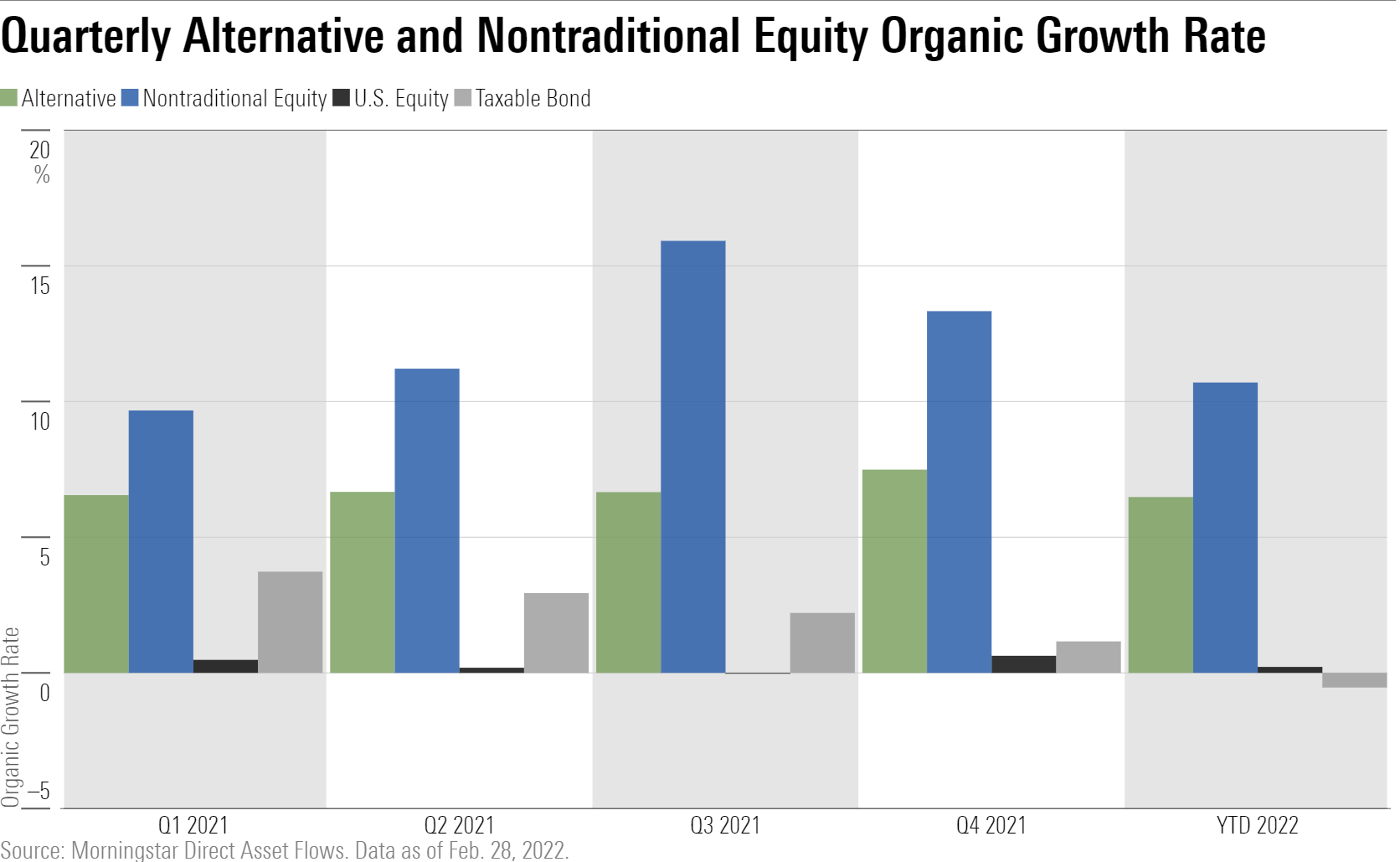

Investors have continued to allocate to alternative and nontraditional equity funds at a strong clip amid threats of higher interest rates and broader market volatility. Nontraditional equity funds’ 10.7% year-to-date organic growth rate through February ranked first among category groups, while alternative funds’ 6.5% ranked third.

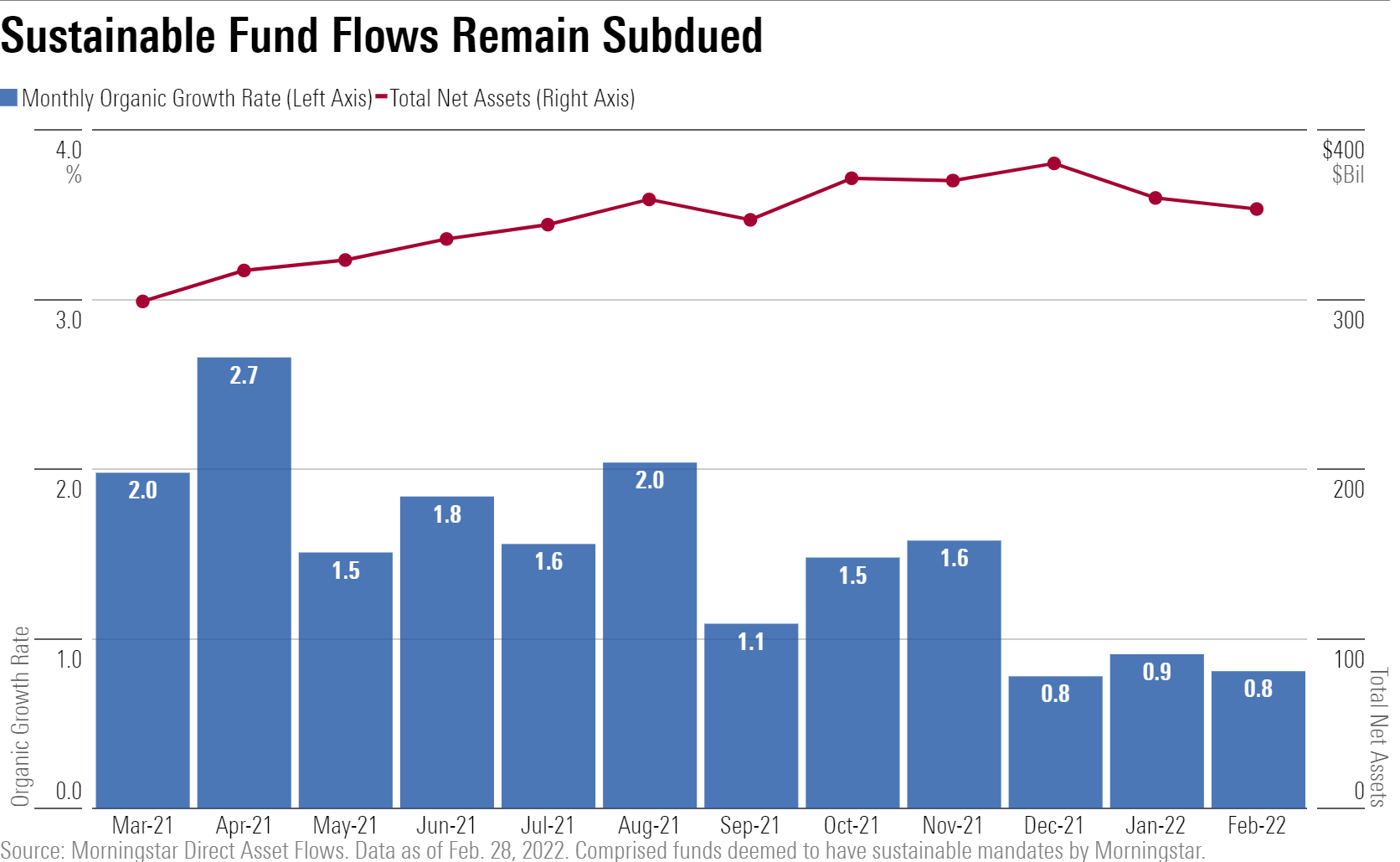

Sustainable funds took in $2.9 billion in February, good for a 0.8% monthly organic growth rate. After gathering about $5 billion to $10 billion per month from late 2020 through the first half of 2021, they haven’t quite captured the same degree of interest in 2022. Performance factors may be partially to blame. Themes such as clean energy performed extremely well in 2020 but have since faded.

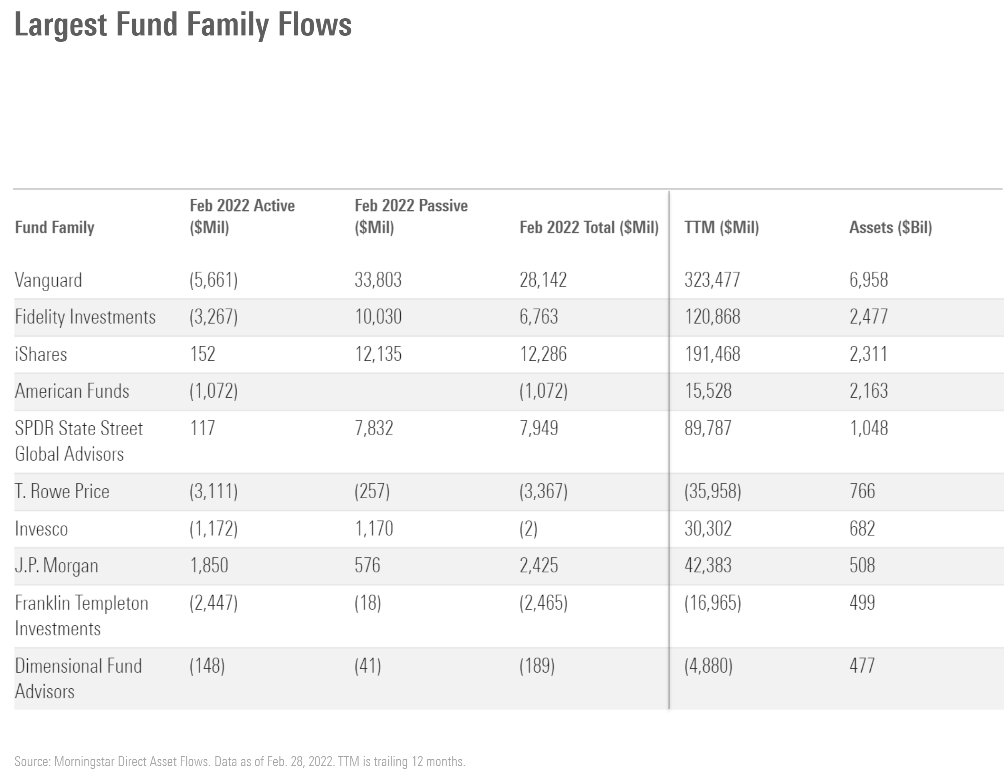

Vanguard’s passive offerings drove its $28 billion in inflows in February to lead all fund families.

Note: The figures in this report were compiled on March 11, 2022, and reflect only the funds that had reported net assets by that date. The figures in both the commentary and the extended tables are survivorship-bias-free. This report includes both mutual funds and ETFs, but not funds of funds unless specifically stated. It does not include collective investment trusts or separate accounts. Morningstar Direct clients can download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)