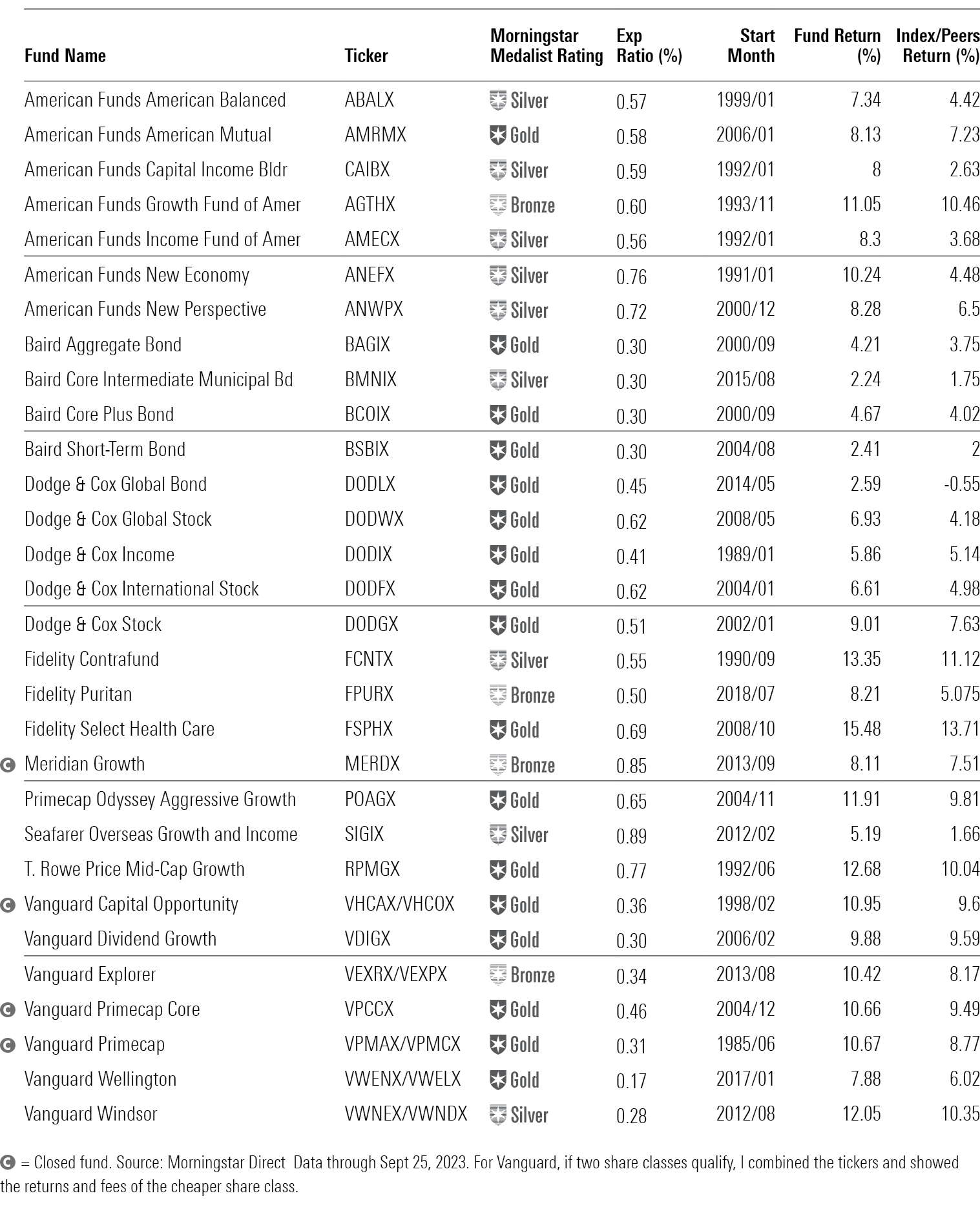

The Thrilling 30

Just a few simple tests cut the fund universe from 15,000 share classes to 30.

It’s time once again for our popular Thrilling 30 feature. As you may recall, this is a list I generate with a few simple, strict screens to narrow a universe of 15,000 fund share classes down to a short list ranging between 25 and 50. It’s purely a screen; I don’t make any additions or subtractions. So, if your favorite fund didn’t make the cut, it is because it failed a test, not because I hate it.

The basic idea: With so many funds out there, you can be choosy. It’s better to be choosy by setting high standards on the most important factors than by screening on a lot of minor data points. I emphasize fees, the Morningstar Medalist Rating, long-term performance, and fund company quality.

I also throw out funds with Morningstar Risk ratings of High because investors have a hard time using the most volatile funds well—they’re hard to hold on to in downturns and tempting to buy after they’ve already rebounded from past lows. The Morningstar Risk measure is relative to peers, meaning there are emerging-markets funds with Low risk ratings and short-term bond funds with High risk ratings. It tells you about relative risk, not absolute risk. Specifically, it tells you about downside volatility over the trailing three, five, and 10 years.

Here are the tests:

• Expense ratio in the Morningstar Category’s cheapest quintile. (I use the prospectus adjusted expense ratio, which includes underlying fund fees but does not include leverage and shorting costs. In addition, I screen out active funds charging less than 10 basis points if those funds are limited to platforms that charge other fees.)

• Manager investment of more than $1 million in the fund (the top rung of the investment ranges reported in SEC filings).

• Morningstar Risk rating lower than High.

• Morningstar Medalist Rating of Bronze or higher.

• Parent Pillar rating better than Average.

• Returns greater than the fund’s category benchmark over the manager’s tenure for a minimum of five years. In the case of allocation funds, I also used category averages because benchmarks are often pure equity or bond and therefore not good tests.

• Must be a share class accessible to individual investors with a minimum investment of no greater than $50,000.

• No funds of funds.

• Funds must be rated by Morningstar analysts.

Subscribers to Morningstar Direct, our institutional fund database, can run these screens for themselves by using our Fantastic Funds notebook. The only difference is that I didn’t screen out institutional share classes. Look for the Fantastic Funds notebook in the Analytics Lab. For those who don’t have Morningstar Direct, there’s a simple tool on the Morningstar FundInvestor site that lets you enter a ticker and see how your fund stacks up on the tests.

The New List

There was not much turnover this year. We had three additions. Let’s start with the newbies.

We just added Baird Core Intermediate Municipal Bond BMNIX to coverage, and just like that, it is in the Thrilling 30. Launched in 2015, the fund is led by seasoned managers Duane McAllister and Lyle Fitterer. As with their taxable funds, they aim to match the duration of their benchmark and add value through issue and sector selection. The team is quite focused on risk, and the fund lost much less than its peers in 2022 because of muted credit and interest-rate risk.

Guess who’s back? Will Danoff is back on the list because Fidelity Contrafund’s FCNTX expense ratio has fallen to 0.55% from 0.81% a year ago. The fund has a pendulum fee that raises or lowers based on returns versus the fund’s S&P 500 benchmark. In 2022, growth funds did much worse than the S&P 500. Although this fund did a little better than its peers, it was about 900 basis points worse than the S&P 500. Still, the fund is a relative bargain. Danoff boasts a strong record from inception versus the S&P 500 and the Russell 1000 Growth Index thanks to his skill in picking stocks while managing a ton of assets.

Seafarer Overseas Growth and Income SIGIX is a timely addition as many value investors are pounding the table for emerging markets. (Caveat: Value investors are often early and sometimes just wrong.) You may remember Andrew Foster from his days at Matthews. He’s joined here by Paul Espinosa and Lydia So, who cover the value and growth sides of the portfolio, respectively. The fund’s emphasis on defense and income has led to fine risk-adjusted returns. Although this share class is institutional, it has a minimum investment of $25,000.

Who Fell Out

Fidelity Asset Manager 20% FASIX and Fidelity Asset Manager 40% FFANX had their People ratings downgraded to Average owing to turnover in the ranks of underlying sleeve managers; their overall ratings dropped to Neutral.

Fidelity Growth & Income FGRIX manager Matt Fruhan’s record has fallen behind the benchmark for a familiar reason. His value bias relative to the index cost the fund about 500 basis points in the first half of 2023, and the fund has an 11.0% annualized return versus 11.9% for the benchmark over Fruhan’s tenure.

Fidelity New Millennium FMILX is enjoying a great year—up 13.05%. So, returns are not the issue. Rather it’s that John Roth has retired and handed the reins to Dan Sherwood. Now the fund fails the record and manager investment tests. We took our rating down to Neutral.

T. Rowe Price Equity Income PRFDX saw its expense ratio bounce up by 4 basis points to 0.67% from 0.63%. That put it on the wrong side of the cutoff point. We still rate the fund Silver, however.

2 Upgrades

Two funds that were on the list a year ago have been upgraded, so I figured I would call them out.

We raised Baird Core Plus Bond’s BCOIX People rating to High from Above Average and its Medalist Rating to Gold from Silver. The fund now has the rare distinction of earning Highs for all three pillars. Stability and experience led us to upgrade People even though the firm doesn’t boast quite the same breadth as giants like Pimco and BlackRock. Other than retirements, the fund hasn’t lost a manager since it launched in 2000. Although intermediate core-plus bond is a bold category, this rather mild-mannered fund focuses on adding value with security selection, sector allocation, and yield-curve positioning. Despite those constraints, the fund has beaten more-aggressive peers.

American Funds New Economy ANEFX was boosted to Silver from Bronze as it looked more competitive against the global large-stock growth universe. In 2020, the firm broadened the fund’s mandate by upping the maximum it can own outside the United States to 50% of the fund and changing the benchmark from the S&P 500 to the MSCI All Country World Index. That mandate better suits the fund’s focus on finding innovators from around the world. The fund is very much a growth fund, though it has more in small- and mid-cap names than peers and the benchmark.

Although the fund’s longest-serving manager, Timothy Armour, is set to retire at year-end, we’re comfortable with the managers who will remain.

Conclusion

You can create your own version of these tests. The key is to make sure you are focusing on important factors that drive returns and that you keep the screens to a small number. It’s better to raise the bar on a few important screens than to have an unwieldy assortment of screens with less proven data points.

The Thrilling 30

A version of this article was published in the July 2023 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)