The Struggle Continues in Puerto Rico

Nearly a year after Puerto Rico Governor Alejandro Garcia Padilla declared that the commonwealth couldn't pay its debt, little has been resolved to give its residents or its investors any solace.

What Happened On June 29, 2015, Puerto Rico Governor Alejandro Garcia Padilla declared that the U.S. territory couldn't pay its $72 billion of debt. After years of economic contraction, population loss, staggering poverty, and heavy borrowing to pay operating costs and debt payments, officials say they're desperately low on liquidity and out of options.

Although an initial debt payment was made directly after the 2015 announcement, various commonwealth agencies have since missed payments to creditors. Last year, defaults were relatively modest in size and payments secured mainly by funds appropriated by the legislature. Because the commonwealth hasn't guaranteed repayment of such debt, investors have very little recourse when a payment is missed.

More recently, the prominent Puerto Rico Government Development Bank missed a roughly $400 million debt payment due May 1. The GDB serves as the main investment officer for the government and fiscal manager of the island's debt. With that, officials assert that the commonwealth may also miss roughly $2 billion of debt service payments due on July 1, 2016, of which nearly half is secured by Puerto Rico's general obligation pledge. Payment of the island's GO bonds are guaranteed by the commonwealth's constitution, and a missed payment here will undoubtedly be noteworthy and could spark more legal action.

Commonwealth officials continue to negotiate with the island's creditors, but to date, little progress has been made. Several debt restructuring plans have been offered by both sides, but the vast number of investor groups and interests coupled with the complexity of the deal terms will likely prevent widespread voluntary agreements anytime soon. At the same time, Congress continues to debate what role the federal government should play, if any, in the resolution of Puerto Rico's fiscal crisis. Unlike many U.S. local municipalities, the commonwealth lacks a mechanism to declare bankruptcy, and so far, officials in Washington, D.C., have said that there will be no federal bailout. Congressional proposals have included a federal oversight board to manage any debt restructurings, although none have achieved consensus yet.

Exposure to Puerto Rico in Mutual Funds: Familiar Themes Remain As we've noted before, the financial woes of Puerto Rico affect millions of municipal-bond fund investors. As in 2015, current Morningstar data show that nearly half of U.S. open-end municipal-bond funds hold some exposure to the debt of the commonwealth, ranging from less than 1% of assets to more than 50%. Of those, nearly 35 funds representing $35.7 billion in assets have exposure of 5% or greater to Puerto Rico bonds. While eight of those funds are in the high-yield muni Morningstar Category, roughly 24 are in one of the single-state muni categories. Funds in these categories are set up to invest primarily in the debt of an investor's home state; as a result, the income they pay is not subject to federal or state taxes. Puerto Rico's "triple tax-exempt status," meaning bonds issued by municipalities in Puerto Rico aren't subject to federal, state, or local income taxes, together with its high yields, made Puerto Rico a popular investment for many single-state muni funds. And because the names of the funds don't suggest the presence of such holdings, many investors might not realize how much of this distressed debt they actually have in their portfolios.

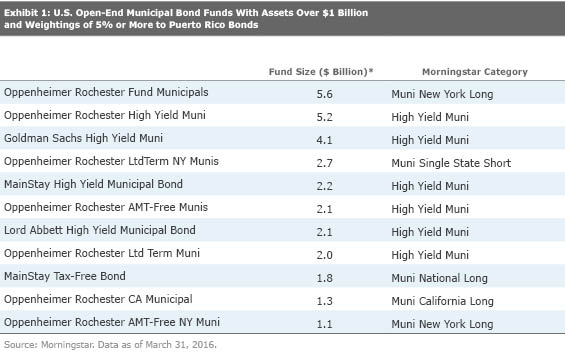

Many of those funds are comparatively small in terms of total assets, but 11 of them, listed in Exhibit 1, had assets of $1 billion or more each as of April 2016. None of these carried a Morningstar Analyst Rating.

OppenheimerFunds and Franklin Templeton Investments remain two of the largest holders of the commonwealth's debt with some of the largest concentrations in single-state muni funds. The Oppenheimer funds in particular hold some of the heaviest weightings to the commonwealth's debt. Based on their latest portfolios, 19 of the 20 Oppenheimer Rochester funds had some exposure to Puerto Rico, and 16 had weightings in the double digits ranging from just over 10% of assets to more than 50% of assets.

Effective March 24, 2016, the firm closed eight of its single-state muni funds to new investors, including funds focused on investments in Arizona, Maryland, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, and Virginia. These funds, which list some of the largest concentrations in Puerto Rico debt in the open-end municipal mutual fund market, have suffered net outflows of assets over the past several years, leaving them with fund assets of less than $85 million as of April 2016. The exception is Oppenheimer Rochester Minnesota Municipal OPAMX, which lists nearly $143 million in assets as of April 2016 and a less than 2% weighting to Puerto Rico debt.

Allocations in the Franklin funds, while still meaningful, remain much smaller. Of the 32 funds in the Franklin municipal-fund complex as of March 31, 2016, 25 funds listed some exposure to Puerto Rico bonds. All but one of these 25 funds had allocations ranging from less than 0.3% of assets to 4.0% of assets as of March 31, 2016. The exception here was Franklin Double Tax-Free Income, which held nearly 50% of assets in Puerto Rico debt as of the end of the first quarter of 2016. The fund experienced significant net outflows during the past several years and was reorganized into the firm's $8 billion

Noticeably absent from the list of large investors in the island's debt are some of the largest stewards of capital in the municipal-bond space. The fixed-income teams at Fidelity and PIMCO haven't held large stakes in Puerto Rico for some time, and recent portfolios continue to show no exposure. Exposure to Puerto Rico in other firms with significant muni fund assets, such as Vanguard, Nuveen, BlackRock, and T. Rowe Price, were also relatively modest.

Overall, Demand for Munis Remains Strong Although Puerto Rico continues to make headlines, the commonwealth's financial crisis hasn't led to significant widespread trouble for Morningstar's municipal categories. As of the end of April 2016, U.S open-end municipal bond funds have recorded seven consecutive months of net inflows pushing the total net assets held here to over $625 billion. Despite some larger struggling issuers that continue to make headlines such as Puerto Rico, the cty of Chicago, and the state of Illinois, the fundamental credit quality of most in the muni market remains strong, default rates remain low, and muni bonds are in demand. With that, trailing-12-month returns through April 2016 are solid.

For funds that have a higher exposure to Puerto Rico, results have been more mixed. Many struggled relative to their peers in 2015, especially in the months following the governor's initial announcement. Although other factors beyond Puerto Rico exposure may be affecting those portfolios and some losses have been recovered more recently, it's worth noting that several of these funds have ranked near the bottom of their respective Morningstar Categories in the past 12 months. Some also continue to experience meaningful outflows and above-average volatility, making it a very bumpy ride for investors.

What Does This Mean for Fund Investors? With little improvement in the financial crisis unfolding in Puerto Rico in the past 12 months, it is widely expected that bondholders will have to accept significant haircuts on the par value of bonds issued by the commonwealth and its agencies. How extreme those haircuts will be relative to what the market is already pricing in and when they'll be implemented remains a huge question. Given all the uncertainty here, funds that still hold sizable exposures to Puerto Rico could continue to experience volatility as creditors (including the growing presence of distressed debt hedge funds) and policymakers continue down the rocky path toward resolution. Should outflows continue, they could pose another risk to investors, as funds, especially those with the largest stakes, could be forced to sell at bargain-basement prices in order to satisfy redemptions. For high-yield muni funds with higher risk and return objectives, some well-timed Puerto Rico bets could ultimately pay off. Whatever the case, it's clear that this remains a volatile and complicated ride, and muni-fund investors should make sure they know what they own.

/s3.amazonaws.com/arc-authors/morningstar/11772336-913b-401e-8a52-aceef6752c90.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11772336-913b-401e-8a52-aceef6752c90.jpg)