10 Rebel Funds to Diversify Your Portfolio

These rebels have a cause.

Diversification is a valuable tool for investors. The main idea is to spread investments across asset classes so that the overall portfolio is less volatile because its components will have losses and gains at different times. But diversification can go beyond the broad asset classes to pick up investments that don’t move in sync with the market.

These are largely niche players and should be given a fairly small weight to avoid having the tail wag the dog. To find good diversifiers, I looked for funds with the highest tracking error. Tracking error tells you how far a fund moved away from a benchmark. I ranked Morningstar 500 strategies that have Morningstar Medalist Ratings of Gold, Silver, or Bronze by three-year tracking error through April 2023 versus broad market indexes to find the most independent-minded funds around.

I’ll look at the merits of these funds and examine why they veer so far from the broad market indexes. A couple of data points that shed light on this are the R-squared versus the best-fit index and the standard deviation. The R-squared tells us if a fund is behaving differently because it is following an index that’s very different from the broad index or whether it is truly cutting its own path. The standard deviation tells us if a fund is different because it takes very bold and focused bets like big weights in top picks and sectors, or if it is different because it takes steps to reduce risk.

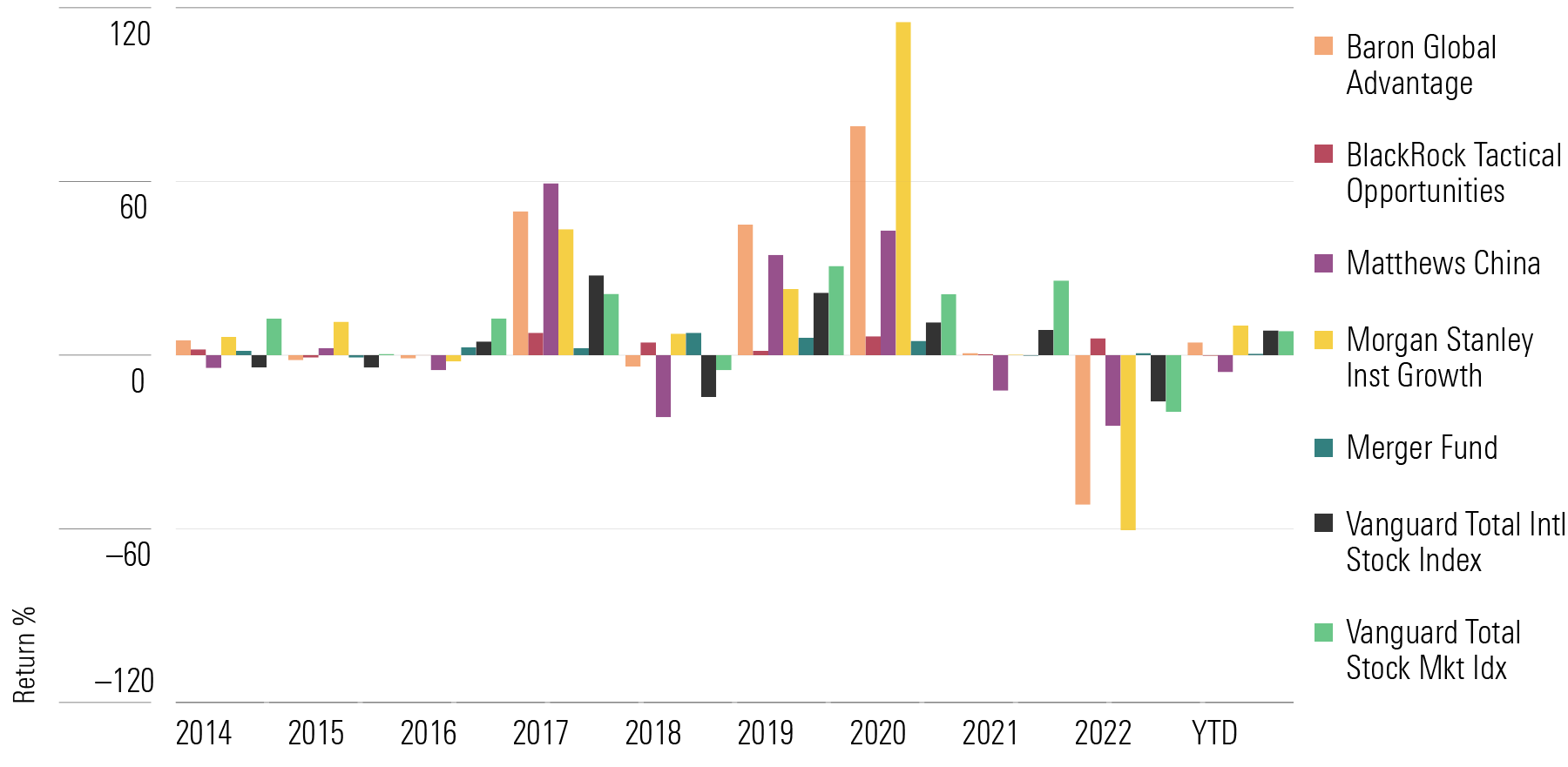

To illustrate the benefits, I produced a bar graph showing the yearly returns of some of the diversifiers alongside broad market returns.

After we look at our super diversifiers, I’ll flip the table to look at some actively managed funds with low tracking errors. Are they closet indexers or useful investments?

High-Tracking-Error Funds

Most of the funds on this list are so volatile that it’s not too different from just buying a single stock. So, if adding spice to your portfolio appeals, you’ll find a number of ideas. If you want a lower-risk diversifier, I’ve got a couple of those, too.

Dennis Lynch’s super-aggressive funds take the first and third positions on the list. Morgan Stanley Institutional Discovery MACGX and Morgan Stanley Institutional Growth MSEGX focus on very fast-growing companies, many in social media or similar industries. They have huge tracking errors of 31% and 27%, respectively. Their R-squared figures versus best-fit indexes are below 80, telling me these funds are true mavericks.

Talk about bold! Morgan Stanley Institutional Growth’s top holdings are Snowflake SNOW, Uber UBER, The Trade Desk TTD, Cloudflare NET, Shopify SHOP, and Roblox RBLX—all have weights over 6%, and all are super high risk/high reward. The fund is up 10% this year and lost 60% in 2022. So, you get a portfolio of extreme growth that might behave differently than the market but will also get pummeled from time to time.

Matthews China MCHFX is rated Silver for its expertise in Asia and has a three-year tracking error of 28% because China has been behaving quite differently from the MSCI EAFE Index. That’s partly because China’s crackdowns on certain industries and corporate leaders have caused some selloffs. The fund’s R-squared versus the MSCI China Index is 92, however, so we can see the fund isn’t that bold relative to China. Again, you have big potential but big risks.

Baron Global Advantage BGAFX is a bit like a global version of Lynch’s Morgan Stanley funds. It owns Snowflake and Shopify, too, along with some foreign growth names. Alex Umansky is very focused on companies with the greatest growth potential. A standard deviation of 26 tells me this fund is a pretty wild investment.

Delaware Mid Cap Growth Equity DFCIX is a more normal mid-growth fund. It actually pays attention to valuation and stock weights. The fund has an R-squared of 85 versus the Russell Midcap Growth Index, further underscoring my point that this fund is less of a renegade than the above funds. The Bronze-rated fund is a fine choice, but I wouldn’t add it if I already owned a mid-growth fund.

Diversification Comes in Very Different Forms

Jackson Square SMID-Cap Growth JSMVX is a similar story. It’s a Bronze-rated mid-growth fund with high tracking error, but it isn’t so different from the Russell Midcap Growth Index.

Artisan Developing World ARTYX is very much a bold diversifier. Under Lewis Kaufman, the fund has had success investing in fast-growing companies in emerging markets, the United States, and other developed markets. The fund is in the diversified emerging-markets Morningstar Category, but it straddles the emerging-markets and global equity groups. Its best-fit index, the MSCI ACWI ex USA Growth, has an R-squared of only 74 versus the fund.

BlackRock Tactical Opportunities PCBAX is our first lower-volatility diversifier. The fund has a super low standard deviation of 5.1 and a best-fit R-squared of just 8. The fund is designed to be a good diversifier. Phil Green combines a thematic portfolio with long and short positions across the world. In 2022, the fund gained 5.8%, and in most years, it has posted low-single-digit returns. So, the diversification is great, but you won’t get big returns.

Alger Small Cap Focus AOFAX is another entry in the category of aggressive growth with high tracking error. Amy Zhang owns a relatively concentrated portfolio of companies with healthy balance sheets and the potential for rapid growth. The fund’s R-squared of 84 versus the Russell 2000 Growth Index indicates that it’s a decent diversifier.

Merger Fund MERFX is our second low-volatility diversifier. The fund has been around forever because it does a simple thing well. It buys shares of acquisition targets and shorts the acquirer’s shares. If the deal goes through, there’s a bump in both directions. If the deal doesn’t, both sides fail. But the movement has little to do with the stock market, so the fund has just an R-squared of just 31 relative to the Russell 2000 Value Index.

Low-Tracking-Error Funds: Index-Huggers or Worthy Investments?

If you follow investment articles, you’ve probably come across the term “index-hugger.” It describes an actively managed fund that closely tracks an index but charges like an active manager and is thus deemed to be an awful fund run by awful people.

There are index-huggers out there, but mostly this is just a diversionary tactic by focused stock fund managers with high fees who want to make someone else sound like the bad guy. Among Morningstar 500 funds, there are some pretty appealing choices with low tracking error.

Most of them are bond funds because bonds are less volatile than stocks, and all tend to move in sync even if some returns are a little more or less than others.

Fidelity California Municipal Income FCTFX has a tracking error of just 0.52, but so what? Active funds generally do better than passive in municipal bonds, and this fund is run in a risk-averse manner, meaning that it loses less than most of its peers in downturns.

Baird Aggregate Bond BAGIX deliberately stays near its benchmark and focuses on making small gains through issue selection. It has a tracking error of just 0.61 and an R-squared of 99 versus the Bloomberg U.S. Universal Index. It consistently beats its peers and its benchmark by a modest amount. Diversification is nice, but a well-run core fund is even nicer.

Let’s move up in tracking error a bit to see what equity funds we can find.

Bronze-rated ClearBridge Appreciation SHAPX has a tracking error of just 3.23 and an R-squared of 97 versus the S&P 500. A little like the Baird fund, this one has mostly added value on the downside. Managers Scott Glasser and Michael Kagan look for clean balance sheets and competitive advantages, and those kinds of companies hold up well in most bear markets.

MFS Research MFRFX really is a bit of an index-hugger, though fees are reasonable, and it is a decent if unambitious fund. The idea is to have analysts pick stocks directly for the fund rather than have a manager filter their ideas of the best names. However, you still have to decide how much is designated to each sector, and this fund just matches the weights of the S&P 500. MFS has good analysts, so the fund is not awful, but it is rather betwixt and between.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)