5 Medalist Funds That Have Been Negatively Correlated With the Market

Using the new Morningstar Style Box for alternative funds, we look at funds that have moved the opposite way from global equities over the last three years.

We recently introduced the Morningstar Style Box for alternative funds, a new research framework for evaluating liquid alternatives investments. It is available to Morningstar Direct clients at the end of October and will be on Morningstar.com in early 2018.

We first introduced this style box last year in an article that showed how its main components of correlation and volatility can help investors quickly and intuitively gauge a fund's diversification potential. Alternative strategies come in many varieties, and funds within the same Morningstar Category that pursue very similar strategies can still have very different diversification characteristics.

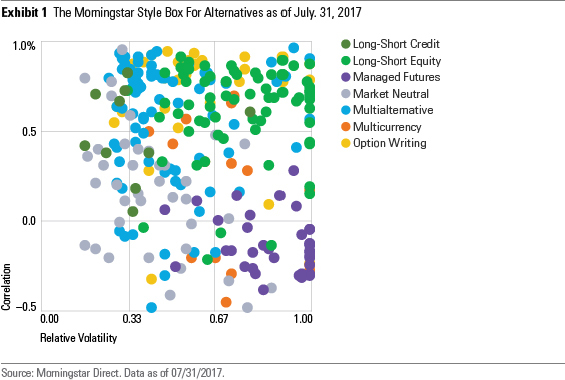

In this followup, we illustrate these features by examining funds that fall into the four corners of the alternatives style box. Yesterday, we focused on the two top corners of the style box. This article will focus on the bottom two corners. For reference, the exhibit below shows where all liquid alt funds fell in the alternatives style box as of July 2017.

Alternative Funds With Negative Correlation and High Relative Volatility The bottom right corner of the style box is composed of alternative funds that have exhibited a lower (in this case, negative) correlation to global equities and higher (at least two thirds that of the index) volatility over the trailing three-year period.

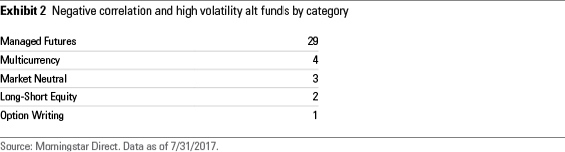

Although the style box's rightmost border ends at a relative volatility of 1--where a fund's volatility is equal to that of global equity markets--in practice some managed futures, multialternative, and long-short equity funds can be more volatile than global equities over a three-year period (we plot those funds on the style box's border). Most of the funds that fall into the lower right corner of the alternatives style box are classified in the managed-futures category. Other strategies, like Hussman Strategic Growth HSGFX, which has been net short equities via written options because the manager thinks the stock market's valuation is unsustainable, can also end up in this corner of the style box. Exhibit 2 shows the category breakdown.

While having a low or negative correlation to stocks may seem like a desirable characteristic in an alternative fund, because it shows the fund is being driven by different risk factors than equities, it is important that investors understand why a fund has acted like it has. Managed-futures funds look to profit from trends across multiple asset classes. To follow trends, managed-futures funds use futures contracts. Futures typically require a small amount of capital to be held as collateral so the funds can have higher notional leverage than strategies that rely on physical securities. Essentially, they bet that winners will keep winning and losers will keep losing. The potential to benefit from assets falling in value, like oil in late 2014 or stocks during the financial crisis, contributes to the strategy's low and sometimes negative correlation to global stocks.

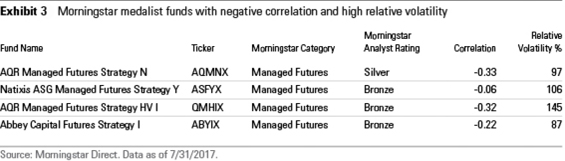

Even though managed-futures funds may have a negative correlation to global equities, trend-following has shown it can still generate positive long-term returns, which investors should expect from an alternatives strategy regardless of its correlation to equities. To be sure, that doesn't make them a replacement for high-quality bonds, which have similar diversification characteristics and much lower volatility. For investors comfortable taking on equitylike risk in their alternative fund, managed futures could be an attractive option. Other funds with a negative correlation to equities may be positioned to only gain when stock markets fall, which would be less useful over the long term given that equities generally rise over long time periods. There are four funds that fall in this style box that are Morningstar Medalists. Exhibit 3 lists the funds.

Alternative Funds With Negative Correlation and Low Relative Volatility In the bottom left corner of the alternatives style box one finds funds with a negative correlation to equities and low relative volatility. The further a fund is plotted toward the bottom of the style box, the more negatively correlated it is. It is important to remember that a negative correlation of less than 0.5 doesn't imply the strategy will always act in the exact inverse of stocks. It does signal that the strategy is not dependent on the direction of stocks to generate returns though, which can make it a useful building block for a portfolio.

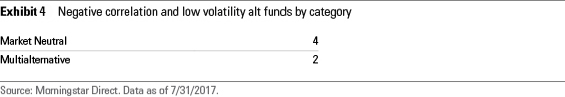

This section of the style box is the most sparsely populated. Exhibit 4 shows the category breakdown.

One of the funds is a Morningstar Medalist.

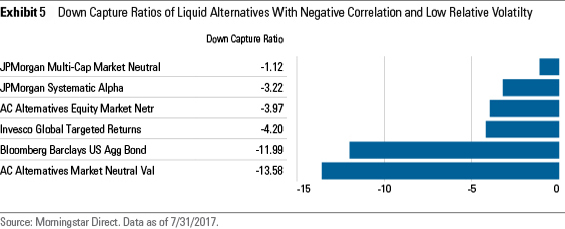

Similar to other lower volatility alternative funds, investors may see these strategies as an option to replace some fixed-income exposure. Unlike the funds in the top left corner of the alternatives style box, these strategies' negative correlations to equities show they had more of a defensive posture when equities sold off. Exhibit 5 shows the five funds' three-year downside capture ratio measured versus the global equity index and then compared with the Bloomberg Barclays US Aggregate Bond Index.

Each of the funds had a negative downside capture over the trailing three years, which means they generated gains while stocks were down, on average, over that period. That doesn't mean the funds were riskless over that period, of course. It simply means stock market risk was not the main risk driving returns. As stocks are likely the riskiest part of investor portfolios, identifying alternatives that court risks other than stock market beta is ideal.

Conclusion These examples cover a short period of time, and the results shouldn't be expected to hold in every market environment. Still, we believe the factors that investors should consider as part of their due-diligence process when evaluating an alternative strategy are unlikely to change regardless of whether the process starts today, tomorrow, or several years from now. Paying attention to how a strategy has been correlated to equity markets over time and in specific market periods, like 2015's volatile third quarter, and what kind of volatility it has exhibited relative to equities could help investors better set expectations for alternatives. As liquid alternative funds continue to develop track records, we will be able to examine how these factors change over different market environments. For now, investors should still consider these factors as part of the evaluation process.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_68607a5db29e471d8bf1a155ea356f7c_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3WXR46JX6VF2HMOMAWQGCO67DM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)