The 5 Biggest Mutual Fund Rating Upgrades of 2023

These funds’ fundamentals are on the rise.

The Morningstar Medalist Rating is all about competitive advantages. Funds that have them are able to produce exemplary risk/reward profiles, and those that don’t are more likely to enjoy occasional good moments but less attractive long-term risk-adjusted results. Shifts in these fundamentals or our comprehension of them drive upgrades and downgrades to funds’ pillar ratings and overall Medalist Ratings.

So, let’s dive into the reasons for some of the year’s most prominent upgrades so that you can update your portfolio and watchlist.

We raised T. Rowe Price All-Cap Opportunities’ PRWAX rating to Gold from Silver. Seven years in, manager Justin White continues to impress us, so we raised our People rating to High from Above Average. White has proved adept at blending T. Rowe Price’s analyst research with his own to cut a slightly different path from other of the firm’s growth managers. As you’d expect from the name, the fund has more small caps and mid-caps than peers, but White also impresses with a valuation discipline that has led to some timely stock sales. Results have been impressive as White has outperformed peers in every calendar year since taking the helm.

Rajiv Jain set out on his own, and we’ve continued to be impressed by what he’s done. Thus, we raised the People ratings to High and overall ratings to Gold on his emerging-markets and international funds. Goldman Sachs GQG Partners International Opportunities GSIHX and GQG Partners Emerging Markets Equity GQGPX have quickly become two of our favorites. Although Jain’s usually on the growth side of the Morningstar Style Box, he’s a flexible investor who will shift to value sectors if that’s where he finds the best stocks. Most managers can’t handle that much flexibility, but he makes it work, and the staff of 20 investment professionals is a big reason why. Jain has built a team of seasoned analysts and they’ve come together nicely over the years. I own the emerging-markets fund.

The closed Artisan International Value ARTKX has regained its High People rating and overall Gold rating. Manager David Samra and former manager Dan O’Keefe parted ways a few years ago, and the small supporting staff of analysts split up, too. That led us to take the fund’s People Pillar down a notch, but we like the stability and experience behind Samra enough to upgrade the fund. Samra is a fairly focused value investor from the David Herro tree of value investing. He looks for companies that have financial strength but with shares trading at a discount of at least 30% to his estimate of intrinsic value.

We also like comanagers Ian McGonigle and Benjamin Herrick as well as the five analysts supporting Artisan International Value. The portfolio is compact and the watchlist is short, so the team can go deep. That made us comfortable raising the People rating.

Staying with foreign value, we raised T. Rowe Price International Value Equity TRIGX to Silver from Bronze. We upgraded the Process Pillar to Above Average from Average as manager Colin McQueen has proved his approach. Not unlike Samra, he looks for good companies whose shares are temporarily depressed. However, he has a more diffuse portfolio of 100-150 stocks. The results have been smoother than a focused fund’s. McQueen has outperformed peers and the benchmark modestly each year since coming on board in 2019.

That steady performance is great for investors, but the fund still flies under the radar. It has $11 billion in assets under management and has had a steady trickle of outflows in most years since McQueen took over. At some point, McQueen’s success might gain notice.

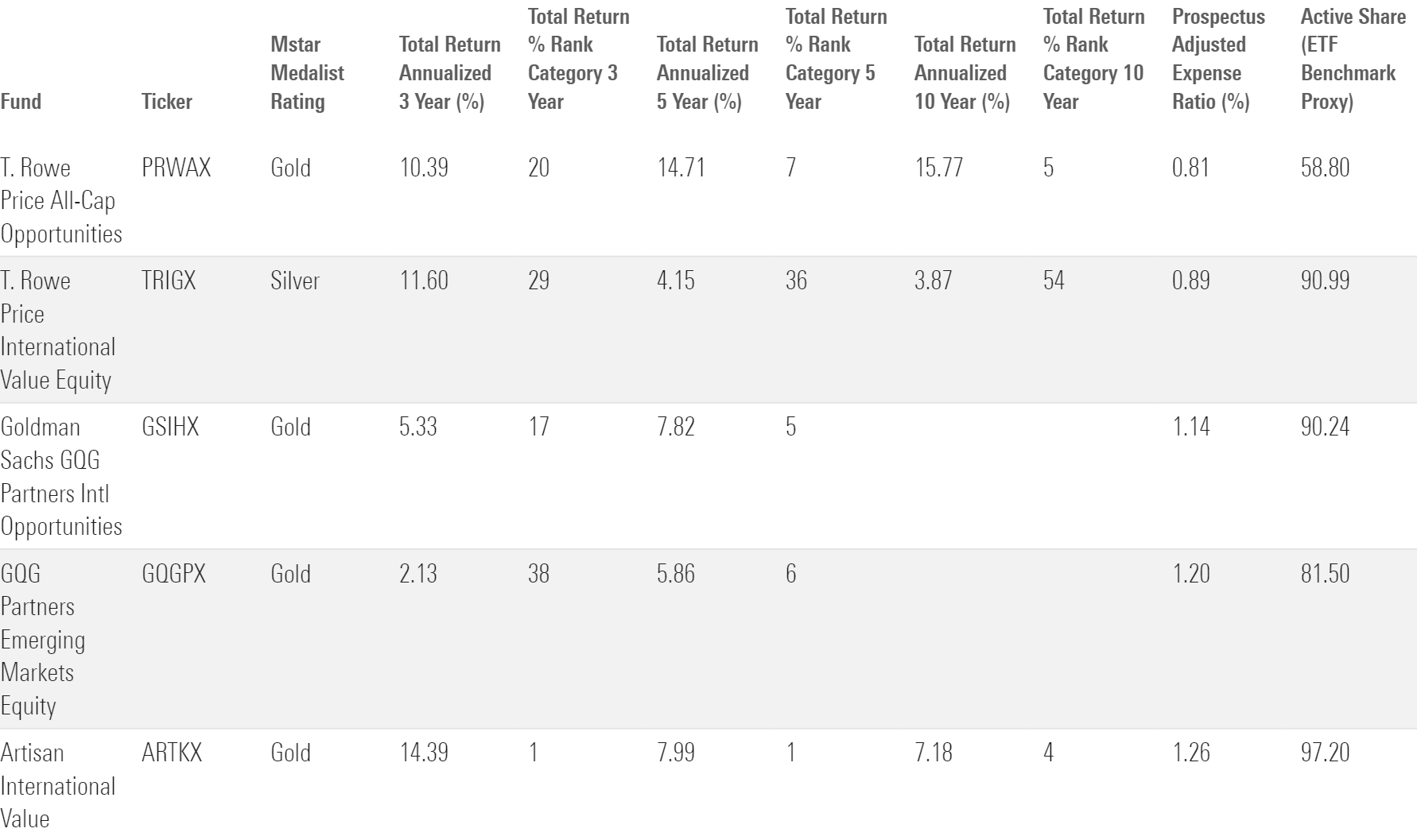

Top Upgrades of 2023

3 Most Hated Funds

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)