3 Upgrades, 9 Downgrades, and a Batch of New Fund Analyst Ratings

See what's new and what changed in February.

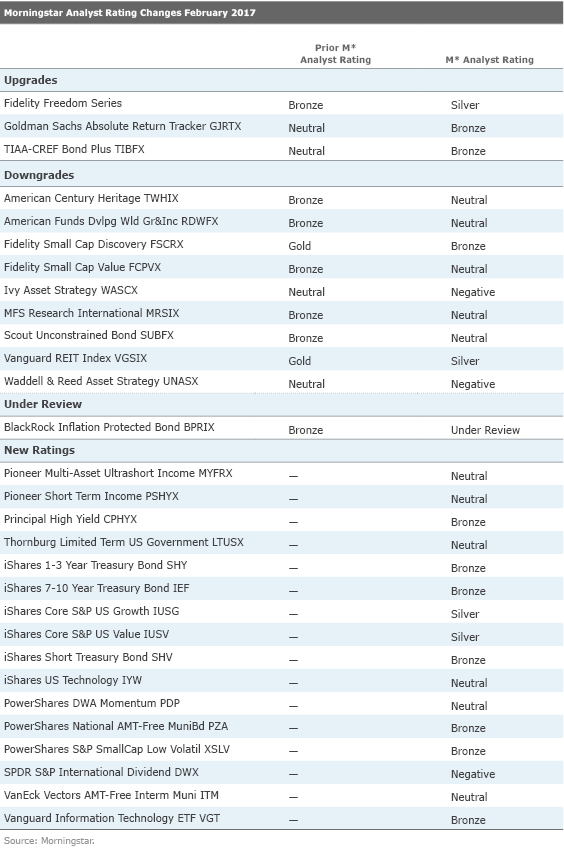

In February, we upgraded the Morningstar Analyst Ratings of three funds, downgraded the ratings of nine funds, and affirmed ratings on 75 funds. The team also assigned new ratings to four mutual funds and 12 exchange-traded funds and placed one fund under review. Below are some of February’s highlights, followed by the full list of ratings changes.

Upgrades

Downgrades

New Ratings

The strategy combines top-down economic guidance and bottom-up security selection. Senior managers create a macroeconomic outlook that is updated regularly and provides a framework for the investment team. From there, analysts conduct bottom-up credit analysis that drives industry weightings and individual position sizes.

This disciplined process particularly helped the fund during the recent high-yield sell-off. The fund’s 2.8% loss in 2015 (a difficult year for commodity-related securities and high-yield bond funds) was better than 60% of its peers. The fund went on to outperform 70% of its peers with a 15% gain when the high-yield market bounced back in 2016. In addition to the aforementioned positives, each of the fund’s share classes carries a Morningstar Fee Level of Low or Below Average relative to peers in the same distribution channel. This fund earns a Morningstar Analyst Rating of Bronze.

/s3.amazonaws.com/arc-authors/morningstar/15a9df65-8689-4043-bfce-e3748d3af498.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/15a9df65-8689-4043-bfce-e3748d3af498.jpg)