A New Role for Advisors: Helping Clients Find Financial Aid

Ways to guide your clients through this market.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it. This article originally appeared in Morningstar Direct Cloud and Morningstar Office Cloud.

As advisors, it’s our job to guide our clients through difficult times in the markets. Many of us who have been in the business for a while are well-versed in coaching clients on how to stay on track when stock and bond markets go haywire.

But this time is different.

We’re locked down at home, away from our normal support system, while dealing with fears of a contagious disease.

We’re seeing clients experience real financial difficulties, and in fact, it’s not always the clients themselves; it’s now often their children or other relatives who need help.

As a result, we have a new role: counseling clients on financial assistance.

Clients in Trouble Of course, the vast majority of my clients are well off. They range from upper middle class to well-to-do to rich to very rich. Aside from dealing with cash flow questions, in times of down markets, they are typically not at risk for serious financial crises.

Here’s John, for example. He is the sole proprietor of a vacation rental business and is in the process of developing a property as well as purchasing another. His cash flow was carefully planned to handle both new properties. In the blink of an eye, his rental income ceased. Were there any programs available to help him?

There’s Linda. She’s a self-employed bookkeeper whose husband works for an airline company. They have four sons in their early 20s, who, although they live at home, were gainfully employed. Her husband’s job seems secure so far, as his company is involved in transporting essential goods. And her business is still stable, but many of her business clients can’t pay her.

Meanwhile, three of her four children were laid off from their jobs. Linda asked us what she should do. Could she get financial assistance? What about her kids?

Finally, there’s Diane. She’s a young widow living alone, her three unmarried daughters were living independently in their own apartments. One daughter is a teacher in a lower-income public school. Although she’s officially employed, she can’t do her job because not all her students own computers or even have access to the Internet. The middle daughter is a self-employed attorney and is managing to scrape together a mediocre amount of work. The oldest daughter lost her job in Northern California and now has moved back home. Diane knows that she is the “Bank of Mom” should her kids need it. But her resources are not unlimited. Is any help available for her?

Help Available Theoretically, government relief programs are available to help all these clients.

We’ve had to become experts practically overnight in how these programs work and the new provisions, looking to see which ones can help our clients.

Business Provisions Economic injury disaster loans, or EIDL: Provided directly through the SBA and intended to cover expenses and operating costs of "small" businesses that cannot be paid because of the pandemic.

Payroll protection program loans, or PPP: Provided by banks through the SBA and available to small businesses; they can be forgiven in part or full based on spending during the eight weeks following funding.

Sick leave/family leave payroll credits: Employers are required to provide up to two weeks of sick leave and 12 weeks of family leave to employees who are directly or indirectly affected by COVID-19. Employers can be reimbursed through payroll tax credits.

Employer retention credits: A refundable employer retention credit equal to 50% of qualified wages is allowed against quarterly employment taxes to offset up to $10,000 of wages paid per employee in 2020. The maximum credit is $5,000 per employee.

Tax payment extensions: Employer payroll tax deposits for 2020 can by delayed by paying 50% by Dec. 31, 2021, and 50% by Dec. 31, 2022. Tax returns, as well as tax due and estimated tax payments, have been delayed to July 15, 2021.

Individual Provisions Stimulus deposits or checks: Up to $1,200 per individual and $500 per child. These amounts are phased out for taxpayers with adjusted gross income over $75,000 ($150,000 married filing jointly and $112,500 head of household).

RMD waivers: Taxpayers who would otherwise be required to take minimum distributions from retirement plans or IRAs during 2020 are now not required to do so.

Qualified plan loans: If allowed by the qualified plan, participants can now borrow up to $100,000 for those affected by the current crisis.

IRA distributions: IRA owners can take distributions of up to $100,000 without penalty, although taxes would still be due over three years. Alternatively, if repaid within three years, no tax or penalty will apply.

These programs all sound great, but the rules are complex and seem to change daily. One of our planners, Shalmali Kulkarni, CFP, has been keeping close track of the provisions: “Our clients had many questions and we wanted to give them accurate answers. But it was challenging to do that when the rules and requirements were being updated on an almost daily basis. As soon as I would write a blog post on the available provisions, a new one would be approved, or rules related to the first ones would be changed and I would have to rewrite the blog.’’

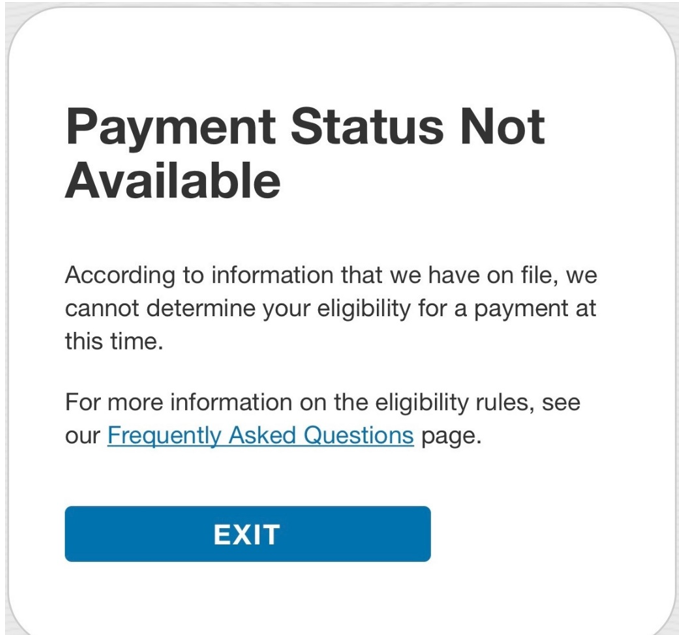

Putting This Into Practice We thought that the first and "easiest" benefit would be the stimulus payment. Yet, it hasn't been as easy as we hoped. Some people have seen deposits into their accounts, but others haven't received what they calculated they should. Some people have had to scramble to file tax returns to qualify, while others are kicking themselves for filing early--and showing income in excess of what would qualify for the payment. Many people are seeking electronic deposits, not wanting to wait additional weeks for paper checks. For all these people, we recommended checking the government site "Get My Payment."

Linda’s sons and Diane’s daughter turned to the website for help. Here is what they all got--after hours of trying to get through:

What could we do to help? Nothing. We could only advise our clients to try again later or just wait it out.

For those who own businesses or are self-employed, we recommended either EIDL or PPP. But, as has been widely reported, these programs have been plagued with issues.

We steered self-employed clients to EIDL because that would likely result in a greater benefit than the payroll-based PPP. And even if they weren’t approved for a loan, the $10,000 grant would be helpful.

Linda applied for an EIDL, and after a week or so, I received an email from her saying, “So I applied for the $10K SBA loan/advance (forgivable grant) and if I get anything, it looks like it would only be $1,000. I don’t think I will even get that and that is so not what they said the program was!”

In fact, new guidance on this program says that funds will be distributed “within days” and that aid will be limited to $1,000 per employee up to $10,000. (In a letter to Congress and the SBA this week, the NFIB said that its research found that 99% of EIDL applicants have not received any funds.)

PPP loans have been a dead end for most applicants as well, as the finite amount of funds available was sucked up within days by larger companies and businesses that had pre-existing relationships with participating banks.

John applied for a PPP loan but was locked out when the funds ran out. He originally worked through a loan broker who was assembling information for the loan package submittal. Unfortunately, the final version of the law disallowed payments to loan brokers. Now, with no financial incentive to complete the process, the loan broker turned over the paperwork in progress to the bank he planned to work with. Because of the delays in seeking additional information, the bank was not able to fund the loan in time.

Congress recently passed additional funding for PPP loans. Assuming that this is signed into law, clients will need to revise their applications because the qualification requirements have changed. New rules require applicants to submit their completed 2019 Schedule C business income form, even though tax returns are not due until July 15.

So, now business owners who are desperate to receive cash must gather their information and pay their accountants to essentially complete their tax returns as quickly as possible or face being locked out of the second round of funding. The point of the July 15 deadline was to relieve stress for taxpayers amid the challenges faced by the pandemic. Apparently, Congress felt that business owners didn’t need stress relief.

Although most of my clients have not yet been approved for PPP loans, it hasn’t been a total disaster. I know of two businesses and one nonprofit that did receive PPP funds.

What We Have Learned Because of the complexity and numerous changes to the various COVID-19 relief packages, we have assigned two professionals on our team to closely follow and update everyone on the rules. This has been a challenge, but it's the best we can do.

We’ve also given more attention to “guaranteed” benefits that clients might utilize. For example, we’ve recommended to some clients that they take advantage of the $100,000 IRA distribution, planning to repay it before the three years are up. For others, stopping RMDs will eliminate a big chunk of tax while also opening a window for Roth IRA conversion. Some of our business clients are simply planning to take advantage of the employer retention credit. These provisions don’t require “winning the lottery” to get approval.

Piecing together the best solution or combination of solutions must be tailored to each client. It takes a lot of time, a lot of dealing with red tape, a lot of patience combined with the need to act quickly, and a lot of flexibility to deal with the ever-changing rules. Whether it’s helping a client’s child to get a stimulus check or assisting in applying for a PPP loan, our job is to help our clients no matter what.

Sheryl Rowling, CPA, is head of rebalancing solutions for Morningstar and principal of Rowling & Associates, an investment advisory firm. She is a part-time columnist and consultant on advisor-focused products for Morningstar, and she continues to actively run her advisory business, from which Morningstar acquired the Total Rebalance Expert software platform in 2015. The opinions expressed in her work are her own and do not necessarily reflect the views of Morningstar.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TZEZ6FJNTZEZRC3FBWCWXTXVOQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)