How to Handle a 401(k) Hardship Withdrawal

Before you pull out retirement funds, understand the long-term costs.

Life happens. Your reliable job disappears. A healthy spouse endures a medical crisis. Your landlord decides to sell. And your child’s college tuition is about to come due.

If you have been able to build an emergency fund, that money might be enough to support you through one of these events. But if multiple financial pressures collide—or if you have no savings at all—you could be tempted to tap your retirement money. It’s yours, isn’t it? And it’s just sitting there?

Can I Just Withdraw Money From My 401(k)?

Ahead of actually retiring, 401(k) loans and withdrawals are the most familiar ways to pull money from retirement accounts. According to the Transamerica Institute, 30% of workers have taken a 401(k) loan and 21% have taken an early and/or hardship withdrawal.

A 401(k) loan can make sense in certain situations: You pay the interest back into your account rather than to a bank, so it’s not the worst source of funds if you find yourself in a financial bind. As a rule, however, 401(k) withdrawals of any kind should be avoided. Designed as long-term investment plans, they’re structured to discourage preretirement deductions. A withdrawal is almost always taxed as income, which could make your next income tax bill substantial. In addition, a 10% penalty will apply in most cases.

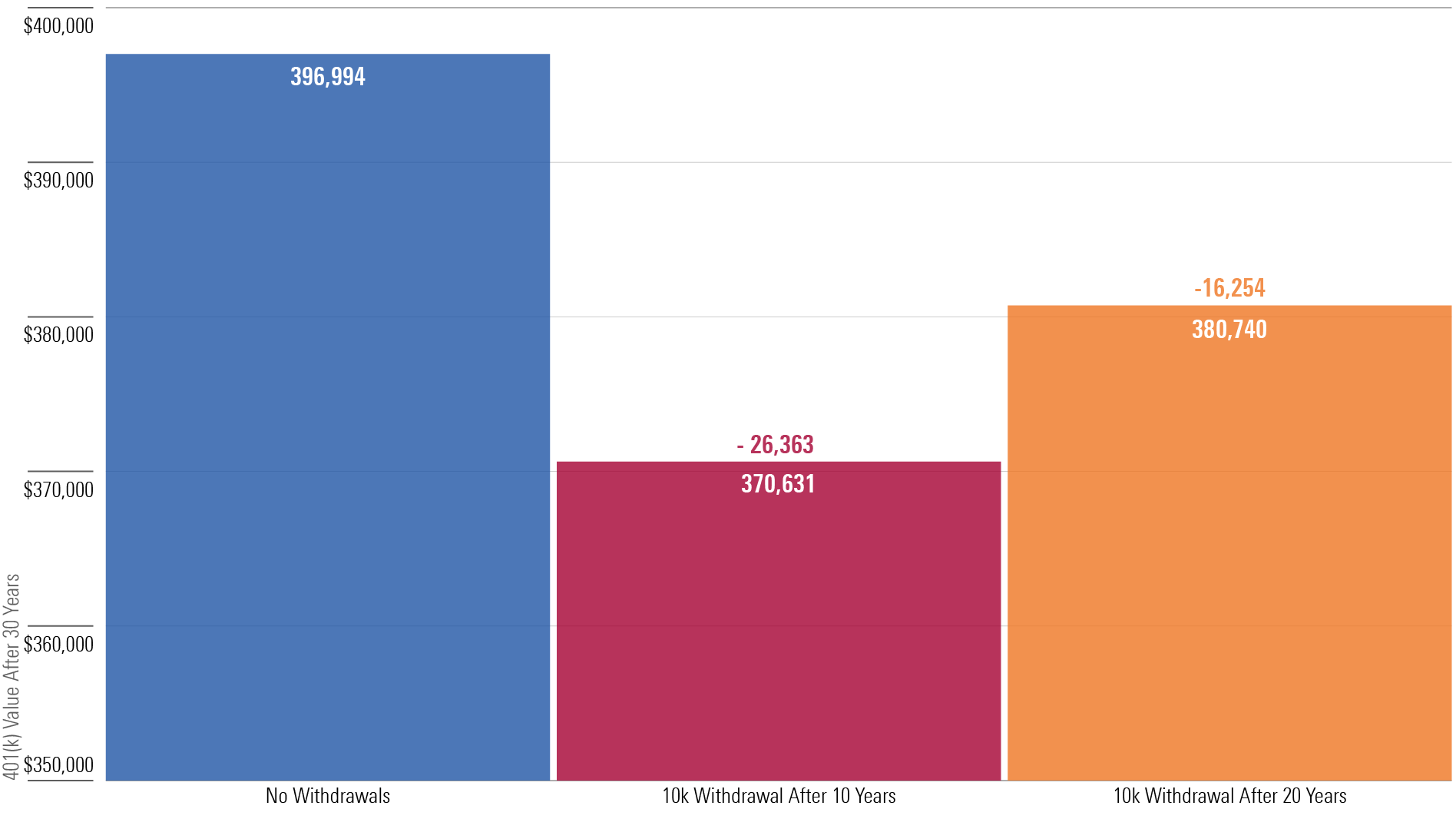

There’s also a long-term cost: Taking 401(k) money doesn’t just spend retirement funds—you also lose the compounded earnings that money would have generated from being in the market over time.

According to TIAA’s Early Withdrawal Calculator, for a 50-year-old planning to retire at 67, a $10,000 withdrawal:

- Nets you only $7,800 today, after penalties and taxes.

- But would be worth $26,928 if left in the account until retirement.

While getting money in hand might answer a short-term financial urgency, what looks like “pulling even” on your expenses is an illusion. Now you’re actually behind, with no money to fill the gap and fewer years to replace it.

The chart below demonstrates the long-term cost of removing money from your 401(k) over 30 years.

Effects of a $10K Withdrawal on a 30-Year 401(k) Account

Can I Get a Hardship Withdrawal?

Of the ways you can pull out 401(k) funds, hardship withdrawals are becoming an increasingly common move for people with urgent bills and limited options. A hardship withdrawal is a one-time, fixed amount of money pulled from your 401(k), intended to cover what the IRS calls an “immediate and heavy financial need.” Compared with a 401(k) loan, a hardship withdrawal carries more negatives and fewer benefits. Here are some points to consider:

- A hardship withdrawal must meet certain conditions established by your plan administrator.

- Your plan administrator or employer is not required to offer hardship withdrawals, and they will be the ones approving your request.

- The amount of any hardship withdrawal is limited to only your immediate financial need, which you’ll have to prove.

- You may also be asked to certify that you cannot provide the money another way.

- Since it’s not a loan, the withdrawal can’t be paid back.

- The withdrawal counts as taxable income. Your employer will withhold 20% of the withdrawal for taxes, and you may have additional taxes depending on your income.

- The withdrawal is subject to a 10% penalty if you are younger than 59 1/2.

The Next-to-Last Resort: Examine Your Options First

Before applying for a hardship withdrawal to cover a funding gap, you may want to consider your alternatives. Some plans will require you to exhaust these and possibly other options before approving any withdrawal request.

Reconfigure your finances: Review your budget and spending. If you can, enlist a financial professional to help adjust your cash flow to cover your expenses.

Look at other income sources: Do you have other assets you could sell or ways to earn some additional funds? Is there insurance that could provide coverage? If you happen to have a Roth IRA, that could be a better option. Because your Roth contributions have already been taxed, withdrawals won’t face the same tax and fee requirements. According to Christine Benz, Morningstar’s director of personal finance, “It almost certainly would be a better choice. A withdrawal from a taxable brokerage account would also be better.”

Consider a 401(k) loan, or a personal loan: While a 401(k) loan will have to be paid back, the interest goes back into your own account. A personal loan might also be worth considering.

Explore company assistance: Under the Secure 2.0 Act, as of Jan. 1, 2024, some employers will allow you to set up an emergency fund from which you can take short-term, with no penalty withdrawals. Note that this only works if you set it up before a money shortfall. If your financial situation currently feels precarious, now may be the time to investigate this path.

Secure 2.0 also provides some other (limited) avenues. Plan sponsors can offer an “emergency withdrawal” of retirement money up to $1,000 for personal or family emergencies. The withdrawal is exempt from the 10% penalty. Sponsors can also now offer situation-specific withdrawals for victims of domestic abuse or federally declared disasters.

Contact your creditors: Medical bills and other debts can sometimes be negotiated. Creditors may be open to setting up a payment plan that will spare your retirement funds.

Moving Forward With a 401(k) Hardship Withdrawal

Let’s say you’ve run through these steps and have opted to take a 401(k) hardship withdrawal.

Applying for a hardship withdrawal is done through your employer or 401(k) plan administrator. As mentioned, you will have to prove that your request is “due to an immediate and heavy financial need.” Any amount will be limited to what is necessary to cover the shortfall.

Know Your 401(k) Plan's Restrictions

In some cases, IRS regulations allow for what are called “safe harbor distributions,” hardship categories that automatically meet the government’s “immediate and heavy financial need” standard. These include such things as medical bills, preventing foreclosure, and tuition payments. Under the safe harbor designation, some of these may also be exempt from a 10% withdrawal penalty.

What Happens After a 401(k) Hardship Withdrawal

Once you’ve navigated the process of a hardship withdrawal, you may wonder what comes next. You’ve paid the debt or managed the crisis, but you’ve depleted your retirement money.

You can’t repay the retirement money that you withdrew. You can, however, keep contributing to your 401(k)—and you should.

What’s harder is mending the hole you’ve dug in your funds: You can increase the percentage of your contributions, or open an IRA. But both of those require breathing room in your budget, which might not be an option for some time.

Once your cash flow has stabilized, establishing an emergency fund (even a small one) may help stave off future withdrawals.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b418f4d5-8a46-4539-9800-d07e9fd86963.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TZEZ6FJNTZEZRC3FBWCWXTXVOQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b418f4d5-8a46-4539-9800-d07e9fd86963.jpg)