What 'Fallen Angels' Have to Offer

When these bonds take a tumble from the ranks of investment grade credits, they present opportunities for investors.

"Fallen angels" are corporate bonds that received investment-grade credit ratings when they were issued but have since been downgraded to junk. Historically, they have tended to exhibit greater volatility relative to the broader high-yield bond market, but they have also delivered better absolute and risk-adjusted returns. Here I will examine what makes this subset of junk bonds unique, and the opportunities they might offer to investors.

The Fallen Angel Market Fallen angels are different from ordinary junk bonds. They tend to court less credit risk and more interest-rate risk. Compared with a broad index of high-yield bonds, an index of fallen angels will have greater concentration risk. Also, the size and composition of the fallen angel market will evolve more rapidly. This is because cyclical and structural changes in the economy that precipitate credit ratings downgrades will dictate its makeup, not new issuance activity--as is the case with mainline high-yield indexes.

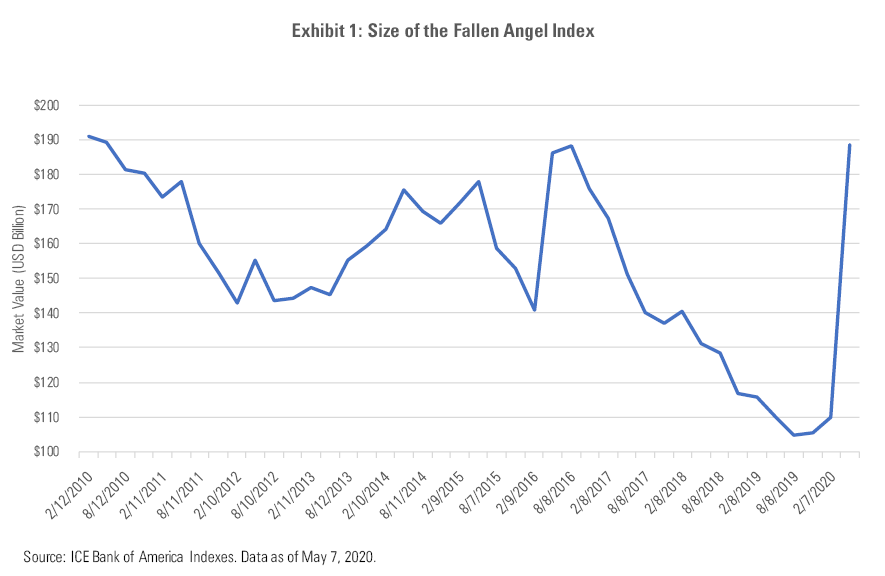

Exhibit 1 illustrates just how rapidly the fallen angel market can shift. The line plots the monthly market value of fallen angel bonds as proxied by the ICE Bank of America U.S. Fallen Angel High Yield Index, which this article will refer to as the fallen angel index. The index’s market value jumped 70% between January 2020 and May 2020, following a raft of credit ratings downgrades spurred by the fallout of the coronavirus crisis.

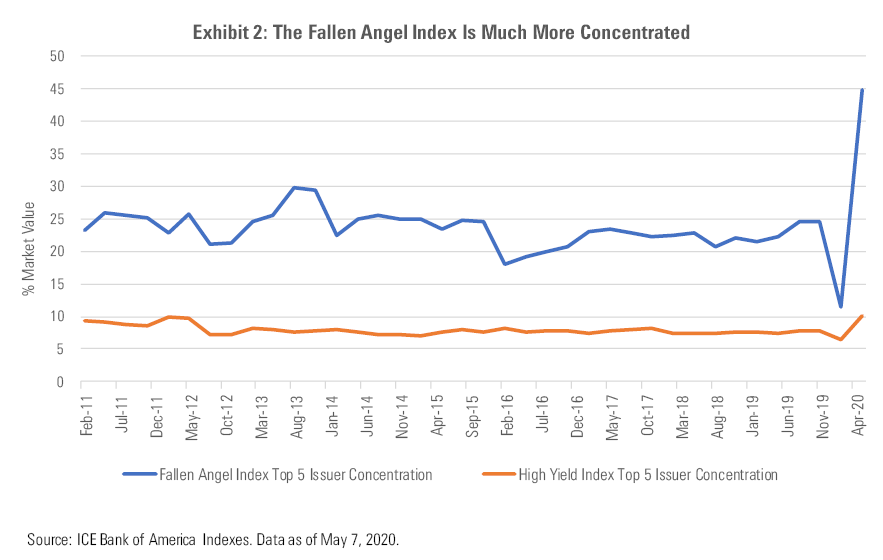

Concentration Risk Is Greater As the fallen angels' market value has mushroomed in recent months, its composition has also shifted. Bonds from issuers in the automotive and energy sectors increased their share of the index's market value by approximately 15% and 10%, respectively, between January 2020 and May 2020. The corresponding figures for the ICE Bank of America U.S. High Yield Bond Index, which this article will refer to as the high yield index, were much smaller as these sectors increased their share of market value by just 3.17% and negative 0.04%, respectively. These figures speak to the fact that the fallen angel index represents a small slice of the broader high-yield bond market. The market value of the fallen angel index represented about 15% of the market value of the high yield index as of May 2020.

As of May 2020, newly minted fallen angel issuers Ford, Kraft Heinz, and Occidental were the three largest issuers in the fallen angel index. They were also three of the five largest issuers in the high yield index. But their relative importance in either index was substantially different. Collectively, they accounted for nearly 40% of the market value of the fallen angel index and just about 7% of the high yield index.

There is greater concentration risk in the fallen angel category. Exhibit 2 plots the historical level of exposure to the top five issuers for the fallen angel and high yield indexes. The total market value of bonds from the top five issuers in the fallen angel index has typically represented about 25% of the index’s total market value. More recently, it has spike to nearly 45%. The corresponding figure for the high yield index is typically less than 10%.

Interest-Rate Risk Is Higher People are more willing to lend money for a longer period if the borrower is more likely to pay them back. That is why, on average, investment-grade bonds tend to carry more interest-rate risk than high-yield bonds. Investment-grade issuers have a better chance of repaying their obligations, so their bonds tend to be issued with longer maturities.

Given their origins, fallen angels tend to carry additional interest-rate risk relative to a traditional high-yield bond. Accordingly, the fallen angel index has traditionally courted more interest-rate risk relative to the broader high-yield sector. But the degree to which it is overweight duration has fluctuated with time. The fallen angel index’s interest-rate risk tends to jump following waves of newly downgraded issuers.

For instance, the gap between the average effective duration of the fallen angel index and the high yield index increased between February 2016 and May 2016. During this episode a plethora of new fallen angels from the energy sector pushed the average effective duration of the fallen angel index to 5.75 years from 5.25 years.

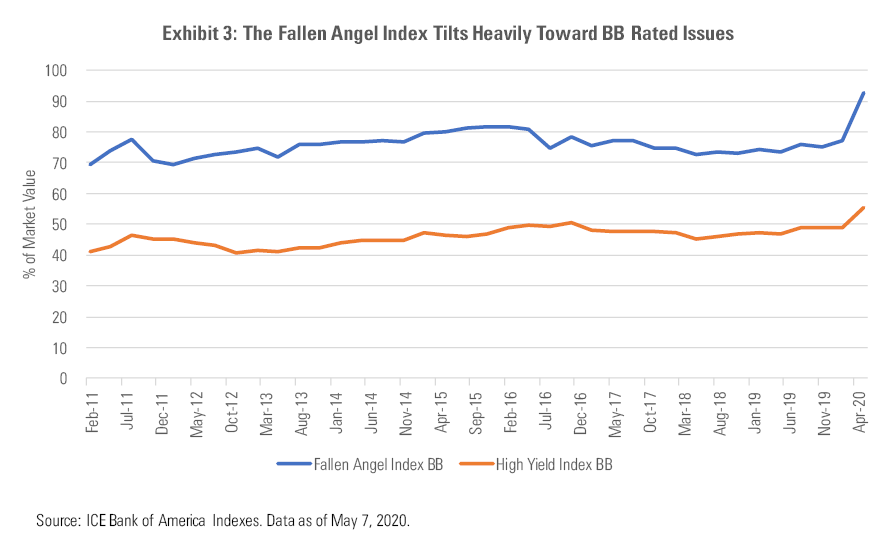

Credit Risk Is Lower Fallen angels tend not to fall far. As such, they face less credit risk relative to the broader high-yield bond market. Over the 10 years through April 2020, the fallen angel index has consistently been about 30% overweight BB rated bonds relative to the high yield index, as seen in Exhibit 3.

Forced Selling Can Create Opportunities While fallen angels differ from the broader high-yield bond market along several dimensions, the most important is the way they arrived among the ranks of junk bonds. Many institutions cannot own debt that has received a speculative grade rating. When investment-grade credits lose their investment-grade credit ratings, forced selling by these investors can push the prices of these issues below their intrinsic value. This creates opportunities for investors that can bear the risk.

A 2011 study of the corporate bond market found that the forced selling of fallen angel bonds led to an average price decline of nearly 9.0% in the five weeks following the downgrade.[1] However, the prices of those issues recovered their fundamental value by the end of 30 weeks.

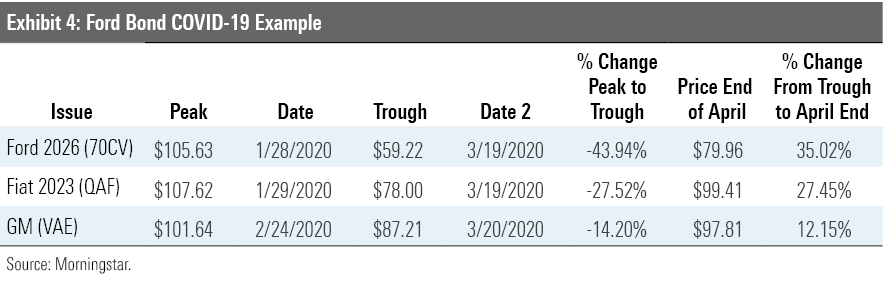

The table below features an example of this phenomena from the COVID-19 crisis. Ford’s credit rating was downgraded to BB from BBB as of March 23, 2020. The price of its 2026 issue fell precipitously. That bond is tabled against a Fiat Chrysler and a GM issue, which both mature in 2023. Fiat (BB rated) and GM (BBB rated) retained their credit ratings during the period noted in the table.

This example illustrates a few items of note. First, the price of the Ford bond began to decline ahead of the announced downgrade. Second, the Ford bond experienced the most significant peak-to-trough decline--nearly twice as severe as that experienced by the Fiat Chrysler bond. Third, while the price of the Ford bond was still trading significantly below par as of the end of April 2020, its gain off the bottom was more pronounced than the similarly rated Fiat bond.

Clearly the downgrading of a corporate bond from investment-grade to high-yield status creates an opportunity for investors to benefit from forced selling.

Fallen Angel ETFs It would be difficult for investors to build a portfolio of fallen angels on their own. Buying individual bonds can be cumbersome and costly, and broad diversification would require a hefty outlay of capital. Fortunately, there are two exchange-traded funds that offer easy access to this unique opportunity set.

VanEck Vectors Fallen Angel High Yield Bond ETF ANGL is the original fallen angel ETF. It launched in April 2012 and tracks the ICE U.S. Fallen Angel High Yield 10% Constrained Index. IShares Fallen Angels USD Bond ETF FALN launched in June 2016. The fund tracks the Bloomberg Barclays U.S. High Yield Fallen Angel 3% Capped Index. Both funds provide market-value-weighted exposure to fallen angels and should deliver similar long-term performance. The primary differences between the two are their issuer constraints and fees. FALN has a more restrictive cap on individual issuer exposure, limiting it to 3% versus 10% in the case of ANGL’s bogy. Also, at 0.25% FALN’s fee is 10 basis points less than ANGL’s.

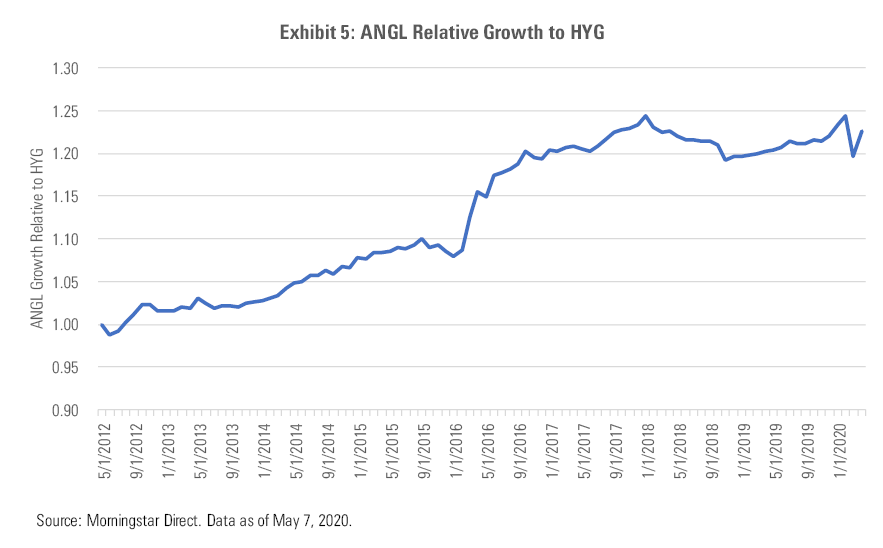

ANGL’s performance from its inception in April 2012 through April 2020, evidences the potential upside of a fallen angel strategy relative to the broader high-yield opportunity set. During that time, its 6.81% annualized return bested iShares iBoxx $ High Yield Corporate Bond ETF HYG by 2.91 percentage points. Its risk-adjusted performance was also significantly better. ANGL’s Sharpe ratio over this span was 0.78 versus 0.52 for HYG.

Exhibit 5 contains a relative wealth chart which depicts the performance of ANGL relative to HYG. When the line slopes upward, it indicates ANGL outperformed HYG, and vice versa. As would be expected, given ANGL’s outperformance, the line has generally been upward sloping since the fund’s inception. That said, there have been pockets of underperformance for ANGL.

One of those episodes came earlier this year. Between February 2020 and April 2020, ANGL and FALN experienced drawdowns of 14.14% and 17.15%, respectively. HYG's maximum drawdown during this period was 11.57%. Part of the reason ANGL and FALN struggled relative to HYG during the broader downdraft in the market was technical. Market volatility led ICE and Bloomberg[2] to skip their regularly scheduled March rebalance for their fixed-income indexes. As a result, neither Ford nor any other newly minted fallen angel were added to the fallen angel indexes until May 2020.

Even if ICE and Bloomberg had rebalanced their indexes in April 2020, the fallen angel ETFs would have missed out on the lion’s share of the price rebound experienced by the Ford 2026 bond noted above. That is because these indexes rebalance monthly. This can impede these ETFs’ ability to capture the upswing of a fallen angel issue. The above mentioned example of the Ford bond illustrates this issue. The price of 2026 issue jumped 25% between March 23 and March 31, 2020. The bond’s price appreciated another 8% in April. So, even if the indexes underpinning these funds had rebalanced at the end of March, they would have missed out on the majority of the bond’s post-downgrade rebound.

Nonetheless, fallen angel ETFs have outperformed the high-yield opportunity set for most of the past decade. The fallen angel index has outperformed the high yield index during the past two decades. From January 2000 through April 2020, the fallen angel index’s annualized return was 3.1 percentage points higher than the high yield index while exhibiting slightly greater volatility. The fallen angel index’s risk-adjusted performance, as measured by its Sharpe ratio, was much better (0.81 versus 0.61 for the high yield index).

Although there are no certainties in investing, it would be reasonable to expect a fallen angel strategy to continue to provide better risk-adjusted performance relative to the wider high-yield market. In addition to the opportunity to benefit from mispricing arising from forced selling of newly downgraded issues, a fallen angel strategy should also continue to benefit from its stronger credit quality orientation.

[1] Ellul, A., Jotikasthira, C., & Lundblad, C.T. 2011. "Regulatory Pressure and Fire Sales in the Corporate Bond Market." J. Financial Econ., Vol. 101, No. 3, P. 596. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1362190

[2] Stafford, P., Stubbington, T., & Henderson, R. 2020. "Fragile Markets Prompt Providers to Leave Benchmarks Unchanged." Financial Times. https://www.ft.com/content/7a00aa4c-a9b8-482e-ac6b-19776c432598

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)