Little Tax Pain for ETF Investors This Year

ETFs' tax-efficient structure and generally lower turnover have helped the funds avoid the relatively large capital gains distributions experienced by open-end funds this year.

Exchange-traded funds are generally touted as tax-efficient fund structures. In early November, Morningstar’s Christine Benz highlighted larger than normal estimated capital gains distributions among mutual funds in 2019, with many growth-oriented mutual funds dishing out sizable payouts. However, compared with last year, large distributions that account for more than 10% of funds' net asset values appear to be less widespread among large, widely held funds. Compared with actively managed mutual funds, fewer ETFs are set to disburse significant capital gains this year. Only two ETFs from the largest fund sponsors are expected to distribute capital gains distributions of greater than 10%, and most ETFs are not expected to distribute any capital gains.

Exchange-traded funds are generally tax-efficient vehicles for two reasons. First, most ETFs pursue lower turnover strategies than mutual funds, which reduces realized capital gains, making capital gains distributions less likely. Exchange-traded funds can also harness structural advantages like in-kind transfers. This allows ETFs to meet redemptions by transferring (low-cost basis) shares from the portfolio to market makers in a tax-free transaction. Mutual funds usually must sell securities to raise cash to meet redemptions, which can generate taxable capital gains.

2019 Capital Gain Culprits As of early December, 12 ETF sponsors have published capital gains estimates for 2019. The firms include the largest U.S. ETF sponsors: BlackRock (iShares), Vanguard, State Street Global Advisors, Schwab, Invesco, Proshares, WisdomTree, VanEck, Pimco, DWS (formerly Deutsche Asset Management), Goldman Sachs, and Global X.

Collectively, these fund sponsors represent 1,285 ETFs, with $4 trillion in assets. Of these funds, 70, or 5.4% of the sample, are projected to distribute capital gains in 2019. The proportion of funds distributing capital gains is lower this year than the estimated distribution in both 2018 (5.7%) and 2017 (7.7%). Even better, only 13 of the 1,285 ETFs in this 2019 sample expect capital gains distributions that amount to more than 2% of the fund’s NAV, as of the end of November.

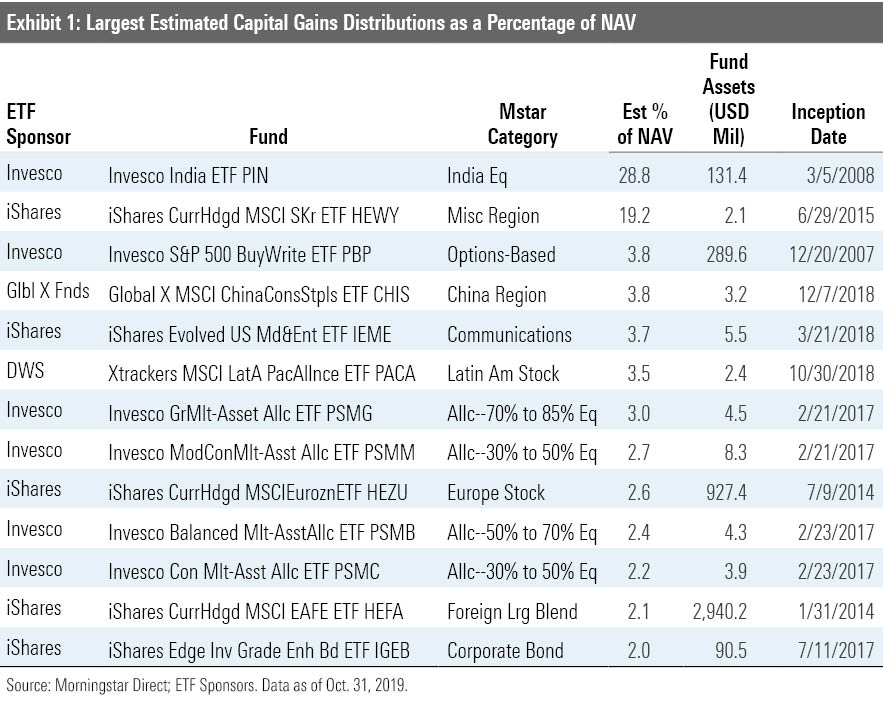

Exhibit 1 shows the 13 ETFs expected to issue capital gains greater than 2% of their NAV as of the end of November. Note that these figures are only estimates; final values are subject to change. The table shows the midpoints where fund sponsors offered a range of estimates.

Four of the 13 funds with high estimated capital gains distributions in Exhibit 1 use derivatives. These funds roll their options contracts each month and may generate capital gains (this is especially the case with currency-hedged funds) in the process, as in-kind redemptions of option contracts often aren’t allowed.

Three of the four ETFs that use derivatives are currency-hedged strategies. To hedge against fluctuations in foreign exchange changes, these funds’ portfolio managers roll forward currency derivatives contracts regularly. Invesco S&P 500 BuyWrite ETF PBP is subject to higher capital gains distributions because of its strategy of writing covered calls.

Investors in ETFs that focus on India or China, like Invesco India ETF PIN and Global X MSCI China Consumer Staples ETF CHIS, are also at greater risk of receiving capital gains distributions. Regulations in China (and some other countries like South Korea, Malaysia, and Taiwan) prohibit in-kind redemptions. Forcing ETFs to meet redemptions by selling securities for cash puts them in the same boat as open-end mutual funds.

Most ETFs expecting large capital gains distributions are new funds without many assets. Nine of the 13 have less than $50 million in assets. Distribution from these small funds will likely affect few investors. This is consistent with the general trend of larger funds being more tax-efficient than smaller funds.

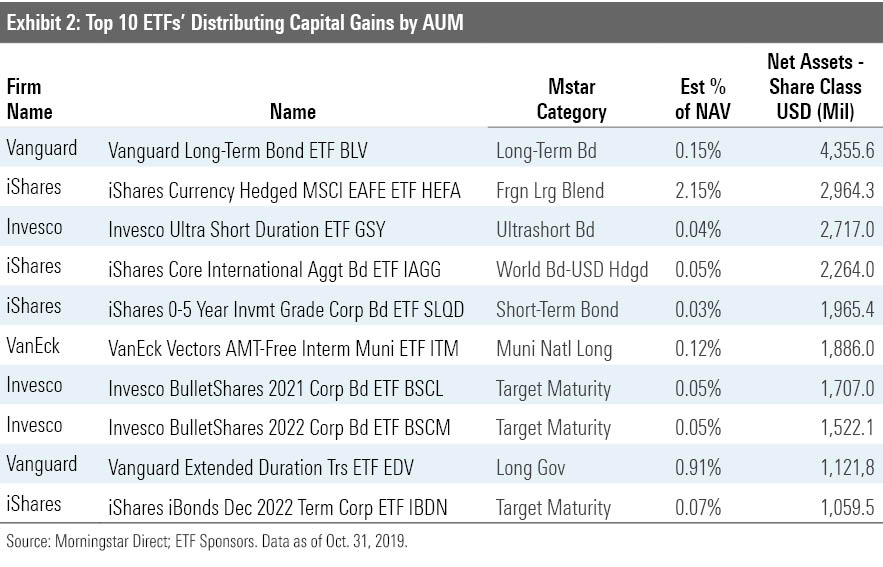

Which Big ETFs Expect Capital Gains? Switching the focus to the biggest funds with estimated capital gains shows what funds will affect many investors. Exhibit 2 shows the top 10 funds by assets under management that expect to distribute capital gains in 2019.

Nearly all of these funds’ estimated distributions amount to less than 2 percentage points of their respective NAV. IShares Currency Hedged MSCI EAFE ETF HEFA is the exception. This is the second-largest fund ranked by assets expected to issue capital gains in 2019. And its distribution of 2.15% of NAV is expected to be slightly larger than other large peers.

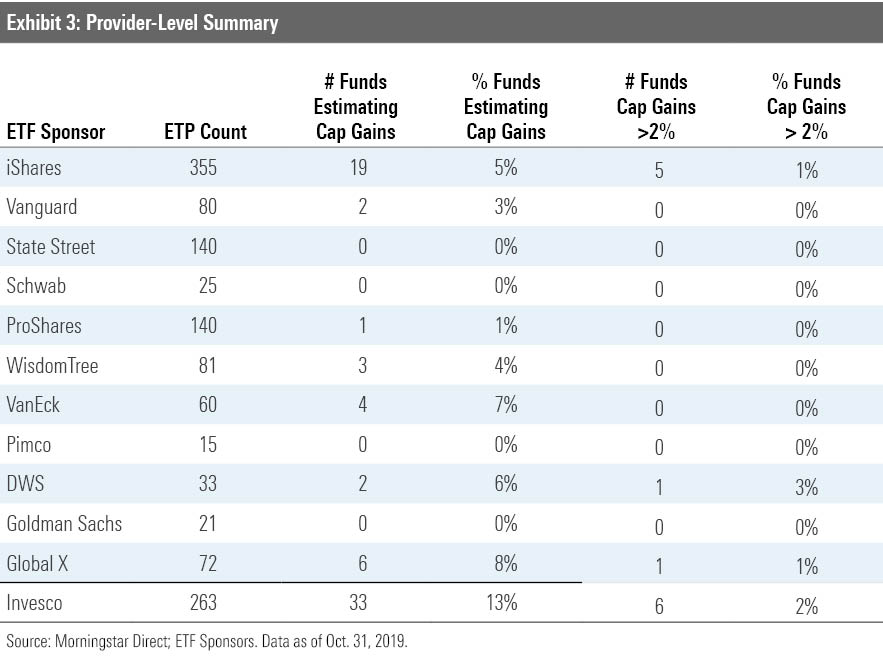

ETF Sponsor Report Cards Some fund families are more susceptible to capital gains distributions than others. For example, fund sponsors that offer more currency-hedged strategies will likely have a higher proportion of funds that distribute capital gains during years in which the U.S. dollar appreciates. Exhibit 3 shows the count and percentage of ETFs in each of the 12 sponsors' lineup that expect to distribute capital gains in 2019.

State Street, Schwab, Pimco, and Goldman Sachs estimate zero capital gains distributions across their ETF lineups. State Street notably improved the tax efficiency of its ETFs compared with its performance last year. This was due to an increased focus on tax-efficient portfolio management and improvements to both its basketing process and operational infrastructure. In contrast, Invesco estimates that at least 10% of its offerings will distribute capital gains in 2019. Some of these estimates amount to less than 2% of the funds’ NAV. Invesco has about six funds that are expected to distribute capital gains of more than 2% of NAV.

BlackRock and Invesco lead the pack with the number of funds expected to throw off capital gains greater than 2% of NAV. BlackRock expects five funds, or 1% of its offerings, to post capital gains greater than 2%, while the corresponding number for Invesco is six. Three of these funds are currency-hedged strategies and four are multi-asset funds. It is not surprising that this lot will distribute capital gains in 2019.

The Big Picture Exchange-traded funds aren't impervious to distributing capital gains, but most have a leg up when it comes to tax efficiency because of their low turnover and in-kind redemption mechanism. There are several characteristics that make some ETFs more prone to distributing capital gains. For example, ETFs that use derivatives that periodically reset are susceptible to capital gains distributions. This usually means currency-hedged strategies, but this year, one option-writing strategy made the top distributors list.

Bond funds can also be more susceptible to distributing capital gains. These funds must sell bonds as they approach maturity, which can result in recognizing a gain if the fund added the bond below par value. Emerging-markets funds are another tax-prone lot because some countries prohibit in-kind redemptions.

Most ETFs, especially those that track broadly diversified, market-cap-weighted indexes, are very tax-efficient. Exchange-traded funds that move beyond the area of plain-vanilla may be more susceptible to capital gains distributions. Tax-conscious investors would do well to understand the tax implications of more-complex ETF strategies and scrutinize the tax record of these strategies before investing.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)