Be Wary of State-Owned-Enterprises

Foreign governments aren't always on your side.

A version of this article previously appeared in the August 2019 issue of Morningstar ETFInvestor. Download a copy here.

Developed markets like the United States, Europe, and Japan are relatively safe from a governance perspective. Publicly traded corporations in these markets are allowed to run their businesses relatively free from direct government intervention. Emerging markets like China and Russia are a different ball game. Countries like these are home to large state-owned-enterprises: publicly traded firms partially owned by the governments in their home markets. This ownership structure is a source of risk because governments may pressure these firms to prioritize government interests over those of other shareholders.

But there's more to these firms than the potential for political influence. Below, I'll look at the pros and cons of government ownership, evaluate how markets price this risk, and provide some options for avoiding state-owned-enterprises.

What's an SOE? Broadly speaking, state-owned-enterprises, or SOEs, are publicly traded companies with equity ownership split between government and public shareholders. There is no threshold level of government ownership that qualifies a firm as an SOE, other than it must be greater than zero. The public/government ownership split varies across this cohort. In most cases, a government or government agency is the majority shareholder, but there are exceptions.

SOEs share some common characteristics. Most of these firms reside in major emerging-markets countries like Russia and China, where they are among the largest publicly traded firms. Many SOEs were spun off from branches of former communist governments, which partially explains their prominence in emerging markets. As these markets transitioned to a more capitalistic economy, the government retained sizable stakes in these companies as a means to maintain some control over their business activities.

Because of their historical government roots, SOEs tend to cluster around the financials, energy, and materials sectors because firms operating in these industries can have political and strategic value. Energy and materials firms provide access to a country's natural resources, while banks and financials are the heart of a country's financial system. A healthy banking system makes it easier for other businesses to finance their growth, which promotes higher wages, employment, and asset values across a country's wider economy.

Risky Business There are two sides to government ownership. In certain instances, SOEs can benefit from having the government on their side. As an example, Gazprom, the largest vertically integrated natural gas producer in Russia, gained a legal monopoly on gas exports in 2006. That provided the firm with a big advantage over its smaller rivals.

Those types of benefits come with some trade-offs. Governments don't always prioritize the interests of public shareholders. Instead, heads of government might use these companies to pursue personal, political, or economic agendas. These concerns are far from hypothetical.

One recent example is the massive corruption scheme that began unraveling in 2013 at Petrobras--Brazil's massive state-owned energy corporation. The scandal involved some of the firm's leaders and prominent Brazilian politicians taking bribes in exchange for overpriced construction contracts. In the ensuing fallout, Petrobras lost billions in market capitalization and was slapped with sizable legal and settlement fees.[1]

The Price Is Right Theoretically, markets should be able to weigh the pros and cons of state ownership and reflect the true value of a company in its price. Companies collectively perceived as riskier should compensate investors bearing this risk with a higher return. As such, they should trade at lower valuations than comparable firms with no government ownership.

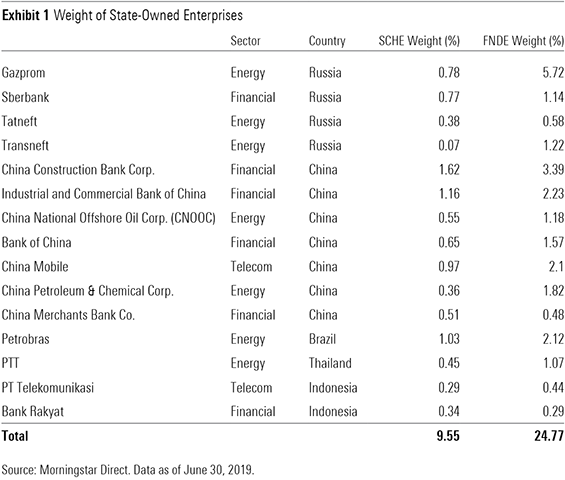

One way to test this hypothesis is to compare the weights of SOEs in an emerging-markets value strategy with their weights in a broad market-cap-weighted emerging-markets index. If SOEs are indeed cheaper than their peers, they should occupy a larger fraction of a value-oriented portfolio than the standard index. Exhibit 1 lists 14 of the largest SOEs and their weights in Schwab Emerging Markets Equity ETF SCHE and Schwab Fundamental Emerging Markets Large Company ETF FNDE (the latter is a value strategy).

At first glance it appears the market is pricing in some additional risk, because FNDE has considerably higher allocations to these companies than SCHE. Together, these 14 firms represent about 10% of SCHE and about 25% of FNDE.

There is more to consider when determining how this risk is priced, as more generic country-specific risks may also play a role. Exhibit 2 shows the price/book ratio of these stocks and the same metric for the appropriate MSCI country index.

Exhibit 2 paints a murkier picture. Not all of these firms trade at lower price/book multiples than their respective country indexes, despite their greater potential for government meddling.

The comparisons presented in Exhibits 1 and 2 only start to scratch the surface as they fail to account for other considerations that can affect stocks' prices. Additional risk factors include those specific to the individual companies, as no two are exactly alike. Sector membership also plays a role, as certain sectors, like energy and financials, tend to trade at lower prices than their respective markets. This is true not just in emerging markets, but other foreign developed markets and the U.S. as well. While political risk is present, there are multiple layers of risk that each of these companies bear. That makes it difficult, if not impossible, to determine the degree to which the risks that spring forth from government ownership may affect their valuations.

The Big Picture Precisely estimating the impact of political risk on an SOE's share price isn't necessary to make some informed decisions about investing in them or emerging markets more broadly. Government ownership of these stocks invariably creates some risk. The likelihood this risk will rear its head and the magnitude of its impact will vary across time and markets.

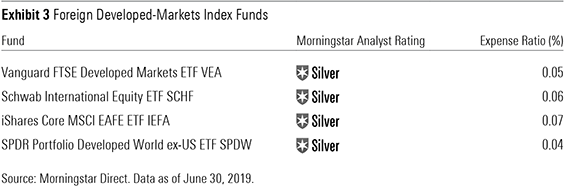

There are options for investors who want to avoid SOEs. The simplest solution is to underweight or avoid emerging-markets stocks altogether. Most fund providers offer separate developed- and emerging-markets funds, so there are many options available. Exhibit 3 lists four highly rated low-cost developed-markets funds.

There is another option for those that want to maintain their exposure to emerging markets while dodging these firms. WisdomTree Emerging Markets ex-State-Owned Enterprises ETF XSOE excludes stocks with more than 20% government ownership. Large SOEs like Gazprom, China Construction Bank, and China Mobile are absent from the portfolio. The strategy also weights its holdings by their float-adjusted market cap, which promotes low turnover and trading costs.

The sector concentration across SOEs has caused XSOE's sector weightings to differ from the MSCI Emerging Markets Index. XSOE had far less exposure to the financials sector and mildly underweights the materials and energy sectors. It has also tended to overweight consumer and technology stocks. Consequently, it has historically tilted toward growth stocks, which has aided its performance over the past several years. From its launch in December 2014 through July 2019, it beat the MSCI Emerging Markets Index by 73 basis points annually. Its 0.32% expense ratio is higher than the lowest-cost emerging-markets index funds, but it is still cheaper than most of the actively managed choices in the diversified emerging markets Morningstar Category.

[1] Beauchamp, Z. 2016. "Brazil's Petrobras scandal, explained." Vox.com. https://www.vox.com/2016/3/18/11260924/petrobras-brazil.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_68607a5db29e471d8bf1a155ea356f7c_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3WXR46JX6VF2HMOMAWQGCO67DM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)