4 Medalist ETFs That Help You Reach for Yield With Less Risk

This dividend strategy mitigates risk and offers above-market yields.

Not all dividend strategies are alike. Some prioritize dividend growth, while others prioritize current income. Those that aggressively chase yield are often riskier than their growth-oriented counterparts, as many of their holdings offer high yields because of falling share prices often resulting from deteriorating fundamentals. Additionally, these companies may pay out a large share of their earnings and have a narrow buffer to cushion these payments if their business weakens.

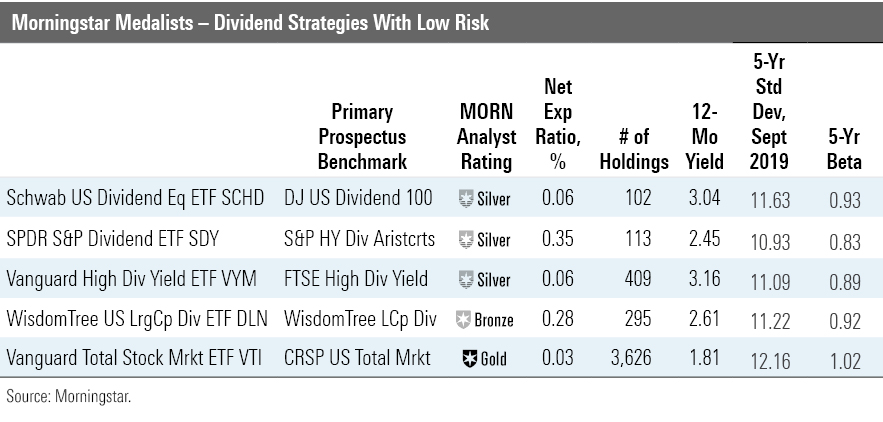

While a narrow focus on yield increases the risk of overweighting low-quality firms, a narrow focus on dividend growth is often accompanied by low current yields. A trade-off for low current yields in exchange for higher payouts in the future may result in a portfolio with only a minimal yield pickup relative to the total market. There is a middle ground of dividend strategies that mitigate risk and yet offer above-market yields. This article will illuminate some Morningstar Medalists that offer a yield pickup compared with Vanguard Total Stock Market ETF VTI, while demonstrating a history of increasing dividend payments.

What Do We Like About Them? All four funds--Schwab US Dividend Equity ETF SCHD, SPDR S&P Dividend ETF SDY, Vanguard High Dividend Yield ETF VYM, and WisdomTree US LargeCap Dividend ETF DLN--offered a higher 12-month trailing yield than VTI (1.81%) as shown in the table above. Additionally, they all exhibited lower risk than VTI over the past five years. Each fund has earned a Morningstar Analyst Rating of Bronze or higher.

Schwab US Dividend Equity ETF SCHD utilizes a quality screen that mitigates exposure to firms at risk of cutting their dividends. It screens for companies that have consistently paid dividends during the past decade and scores these consistent dividend-payers across four metrics: dividend yields, return on equity, cash flow/debt, and five-year dividend-growth rates. It then targets the top-scoring 100 names and weights them by market-capitalization. SCHD’s screens aren’t as rigorous as SPDR S&P Dividend ETF's (below); however, the resulting portfolio has a five-year beta of 0.93, less than the market. The fund levies an ultra-low 0.06% fee and earns a Silver rating.

SPDR S&P Dividend ETF SDY applies a rigorous screen, only including stocks from the S&P 1500 Index that have raised dividend payments for at least 20 consecutive years. Over the trailing 10 years through August 2019, the fund tended to hold up considerably better than the market during downturns. It also exhibited lower volatility and posted better risk-adjusted returns than the market, which is a testament to the high quality of firms that fit the bill. The fund's focus on firms that are financially healthy enough to grow their payouts favors profitable companies with durable competitive advantages and shareholder-friendly management teams. It then weights these stocks by yield, which increases its value tilt and boosts income. SDY’s dividend growth screen is among the most stringent of all dividend strategies, which leads to a highly defensive portfolio, compared with peers as evidenced by a five-year beta of 0.83 (the lowest of funds highlighted in this article). However, it levies a 0.35% fee, which is higher than its closest peers. It earns a Morningstar Analyst rating of Silver.

Vanguard High Dividend Yield ETF VYM takes a different approach to keep risk in check. It holds a broadly diversified portfolio of over 400 holdings and weights them by market capitalization. This mitigates exposure to stock-specific risk and tilts the portfolio toward larger, more mature dividend-payers. These large companies tend to be less volatile and have more stable cash flows than their smaller counterparts. While this fund may still own a few bad apples, it has tended to exhibit lower risk compared with the market, as evidenced by a five-year beta of 0.89. An ultra-low fee of 0.06% further supports the fund’s Silver rating.

Like VYM, WisdomTree US LargeCap Dividend ETF DLN is broadly diversified with about 300 holdings, which mitigates stock-specific risk. The fund weights its holdings based on expected dividend payments, which skews the portfolio toward larger names, as larger companies with robust balance sheets are more likely to maintain and grow their dividends. Although it does not employ any screen for dividend sustainability, it effectively keeps risk in check with a combination of broad diversification and fundamental weighting. The efficacy of this approach is evidenced by the fund’s below-market five-year beta of 0.92. At 0.28%, its fee is significantly higher than many of its closest peers. Nonetheless, it earns a Bronze rating.

Homemade Dividends ... As an alternative to dividend-paying ETFs, investors can create homemade dividends by investing in an ultra low-cost total market fund and selling a portion of their position as needed to generate income. While this may seem appealing, it is not without some drawbacks. Because the total market fund is riskier than the dividend ETFs profiled here, the need to sell to raise income may coincide with market drawdowns, leading to erosion of capital. Additionally, dividend ETFs with higher yields and lower risk (like the quartet featured here) automate the process of generating income, eliminating the need to sell on a periodic basis.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)