3 Hidden Gems Among Corporate-Bond ETFs

These ETFs have potential to deliver attractive performance over the long term.

A version of this article previously appeared in the July 2019 issue of Morningstar ETFInvestor. Download a copy here.

Big exchange-traded funds get more than their fair share of attention. The largest 10% of U.S.-listed ETFs carried about 86% of all assets invested in such funds at the end of May 2019. Investors are generally proficient at seeking out better funds. The asset-weighted performance of equity and fixed-income ETFs consistently beats their equal-weighted performance, largely because the lowest-cost funds soak up a disproportionate share of assets.

Yet there are some budding ETFs that don't get as much attention as they deserve. There's often good reason for that. Small ETFs can be expensive to trade on the secondary market, and they are more likely to be liquidated than larger ETFs. This deters many institutional investors, as well as home-office gatekeepers, who can block these funds from the approved lists of funds that their advisors can buy. Many of these funds have short records and are competing against better-established rivals, making it hard for them to gain traction.

Most small ETFs aren't worth a second look, but there are some hidden gems, particularly among corporate-bond strategies. These include iShares Edge Investment Grade Enhanced Bond ETF IGEB, Goldman Sachs Access High Yield Corporate Bond ETF GHYB, and iShares Fallen Angels USD Bond ETF FALN. These aren't the broadest corporate-bond funds around, but they all have potential to deliver attractive performance over the long term.

Asymmetric Payoff Structure It's prudent to be skeptical of any index strategy that excludes securities from the eligible market, as diversification is the only free lunch in investing. That's particularly true of stock indexes. Historically, a minority of stocks have driven most of the market's returns. Here the opportunity cost of missing out on the market's big winners often exceeds the benefit from avoiding its many losers.

In contrast, even if poor-performing bonds represent a small part of a diversified bond portfolio, they can pull the performance of the entire portfolio down, as there are likely few (or no) big winners to offset those losses. So, owning everything may not be the best strategy here.

Bonds should be priced to compensate for their risk, but the market may overvalue lower-quality bonds. This is partially because income-oriented investors tend to chase yield, which can push the prices of lower-quality bonds above their fair value. Credit-rating agencies can be another source of mispricing. Their ratings have a significant impact on bond prices, but they may be slow to recognize deteriorating credit quality. Avoiding at least some of those bonds before they are downgraded can help improve performance.

iShares Edge Investment Grade Enhanced Bond ETF IGEB This is a compelling investment-grade corporate-bond index strategy that effectively mitigates exposure to bonds at risk of being downgraded and tilts toward those with attractive expected returns relative to their risk. To do this, BlackRock (which owns the index this fund tracks) assigns a probability of default to all investment-grade corporate bonds with at least one year until maturity, using a proprietary model. The portfolio excludes up to 20% of issuers within each credit-rating bucket that look the worst on this metric.

The portfolio uses an optimizer to tilt toward the remaining bonds with the highest default-adjusted spreads. This measure controls for interest-rate risk and prepayment options (using option-adjusted spread), probability of default, and expected losses in default. Without these risk controls, the fund would just load up on the riskiest bonds remaining. Instead, it is looking for the best compensation relative to risk. It still tends to favor riskier bonds, but the portfolio has a series of additional risk constraints in place.

The portfolio's overall duration and credit risk, based on a measure called "duration times spread," are kept in line with that of the starting universe. Duration times spread incorporates both option-adjusted spread (where higher spreads are indicative of higher risk) and bond sensitivity to changes in those credit spreads. Similarly, it can't load up on individual issuers.

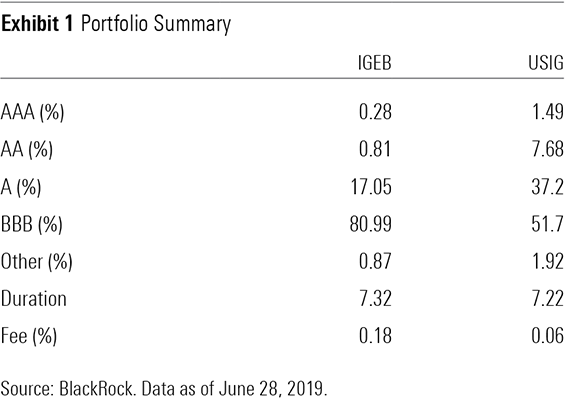

While these governors help rein in risk, the portfolio still has greater exposure to bonds at the lower end of the investment-grade spectrum than iShares Broad USD Investment Grade Corporate Bond ETF USIG, as Exhibit 1 shows. That's partially because duration times spread is a market-based measure of risk that doesn't necessarily align with how the rating agencies assess credit risk. Still, this portfolio appears to take slightly more credit risk than the broad investment-grade corporate-bond market, but it has a good chance to beat the market over the long term.

This strategy's dual focus on value and quality should steer the portfolio toward bonds poised to offer attractive returns relative to their risk. The biggest downside here is the complexity of the portfolio construction approach and the lack of transparency behind how BlackRock measures probability of default, but the same could be said of most active strategies. At least here the expense ratio is only 0.18%, not much higher than USIG's 0.06% fee.

Goldman Sachs Access High Yield Corporate Bond ETF GHYB Downside risk is particularly acute in the high-yield corporate-bond market, so it's more important to focus on quality than yield here. That's exactly what this strategy does. It offers broad market-value-weighted exposure to the U.S. high-yield market but excludes bonds from issuers with increasing leverage and declining capacity to service their debt relative to their industry peers.

This strategy starts with U.S.-dollar-denominated corporate bonds rated below-investment-grade with between one and 15 years until maturity. After applying an adjustment to keep the portfolio's duration in line with the broad high-yield market, the fund ranks all issuers based on the year-over-year change in their leverage (debt/enterprise value) and debt service (debt/EBITDA). It then removes issuers ranking in the bottom 15% from each industry (financials, industrials, and utilities) and weights the remaining bonds by market value, subject to a 3% issuer cap. Bonds with no leverage and debt service data are still eligible for inclusion, but their issuer cap is reduced to 2%.

The screens that the fund uses complement each other. Debt service indicates how well-equipped a firm is to handle its debt, but this is a backward-looking metric that probably doesn't pick up deteriorating credit quality as quickly as market prices. The leverage ratio incorporates market prices but says little about a firm's ability to handle that debt load. Focusing on year-over-year changes in these metrics effectively reduces the portfolio's exposure to bonds with deteriorating fundamentals. They also reduce its exposure the lowest-credit-quality bonds, which have historically delivered subpar returns relative to their risk.

While leverage and debt service ratios are widely available and should be reflected in bond prices, yield-focused investors may overvalue bonds with weakening credit quality. This could allow the fund to deliver better risk-adjusted performance than the broad high-yield corporate-bond market, even though its quality exclusion is small. This portfolio tends to offer a comparable yield and credit-quality orientation to the broad iShares iBoxx $ High Yield Corporate Bond ETF HYG. However, it should hold up a little better than HYG when spreads widen and offer competitive returns over the long term. As an added benefit, it charges a slightly lower fee.

iShares Fallen Angels USD Bond ETF FALN This fund offers low-cost, broad market-value-weighted exposure to "fallen angels," which represent an attractive area of the high-yield market. Fallen angels are bonds that were investment-grade when issued but that have since slipped to below-investment-grade.

These are the types of bonds IGEB seeks to avoid while they're rated investment-grade, but they tend to be good investments once they fall lower. That's because there's considerable forced selling when these bonds are downgraded, as many investment-grade investors aren't permitted to own lower-quality bonds. Consequently, fallen angels are more likely to be undervalued than most high-yield bonds, at least when they first fall to below-investment-grade. This fund is refreshed monthly, which allows it to quickly pick up these bonds after they fall and benefit from the potential mispricing that this selling pressure can create.

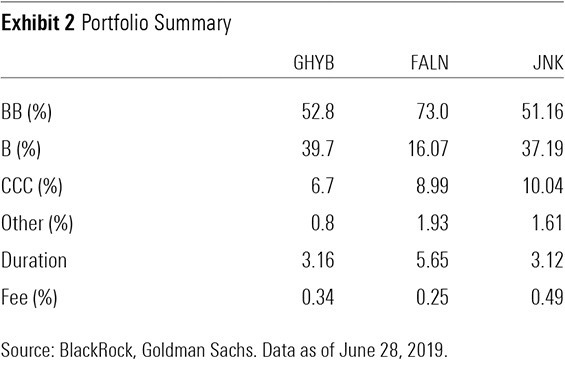

The benefit of owning fallen angels isn't just short-lived. Fallen-angel issuers have also enjoyed higher rates of subsequent upgrades to investment-grade status than other types of high-yield bond issuers, as they often seek to regain their former status, which can help their performance. These bonds tend to have a higher-quality orientation than the broad high-yield market, as Exhibit 2 shows, giving the fund less exposure to the most speculative issues in the market. That said, they do tend to carry greater interest-rate risk than most original-issue high-yield bonds, owing to their lower coupon rates, which gives them longer durations on average.

Still, the Bloomberg Barclays U.S. High Yield Fallen Angel 3% Capped Index, which this fund tracks, earned higher returns with lower risk than the index HYG tracks from its back-dated inception at the end of 2004 through June 2019. During that time, it posted an annualized return of 9.43%, compared against the benchmark's 5.93%, and tended to hold up better during market downturns. This outperformance was partially attributable to price recovery after forced selling, upgrades among fallen-angel issuers, and the index's longer duration, which paid off over this horizon.

FALN isn't the only fallen-angel ETF on the market, but it is the cheapest. VanEck Vectors Fallen Angel High Yield Bond ETF ANGL offers similar exposure for a slightly higher 0.35% fee, but it is a bigger fund that enjoys better trading volume.

Key Takeaways

• IGEB targets bonds with attractive return potential relative to their risk.

• GHYB attempts to avoid high-yield bonds with deteriorating credit quality.

• FALN offers cheap exposure to fallen angels, which are more likely to be undervalued than other high-yield bonds.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)