Investors Flee Bond and U.S. Equity Funds in January

Bond and U.S. equity funds endure outflows as investors brace for interest-rate hikes.

Editor's note: This is adapted from the Morningstar Direct U.S. Asset Flows Commentary for January 2022. Download the full report here.

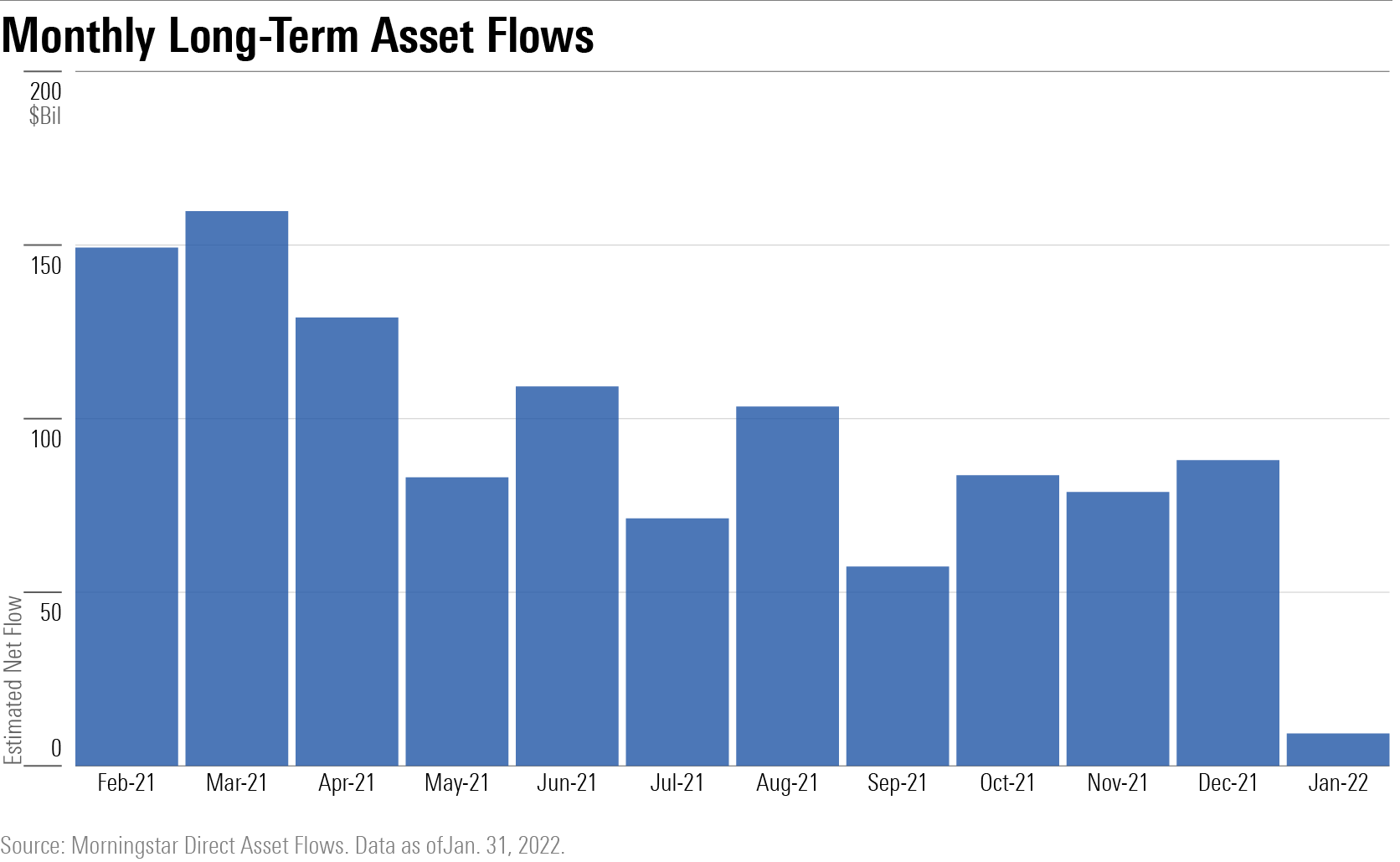

Long-term mutual funds and exchange-traded funds collected just $9.3 billion in January 2022, much less than their pace set in 2021, and the least since investors fled markets in March 2020 as the pandemic first set in.

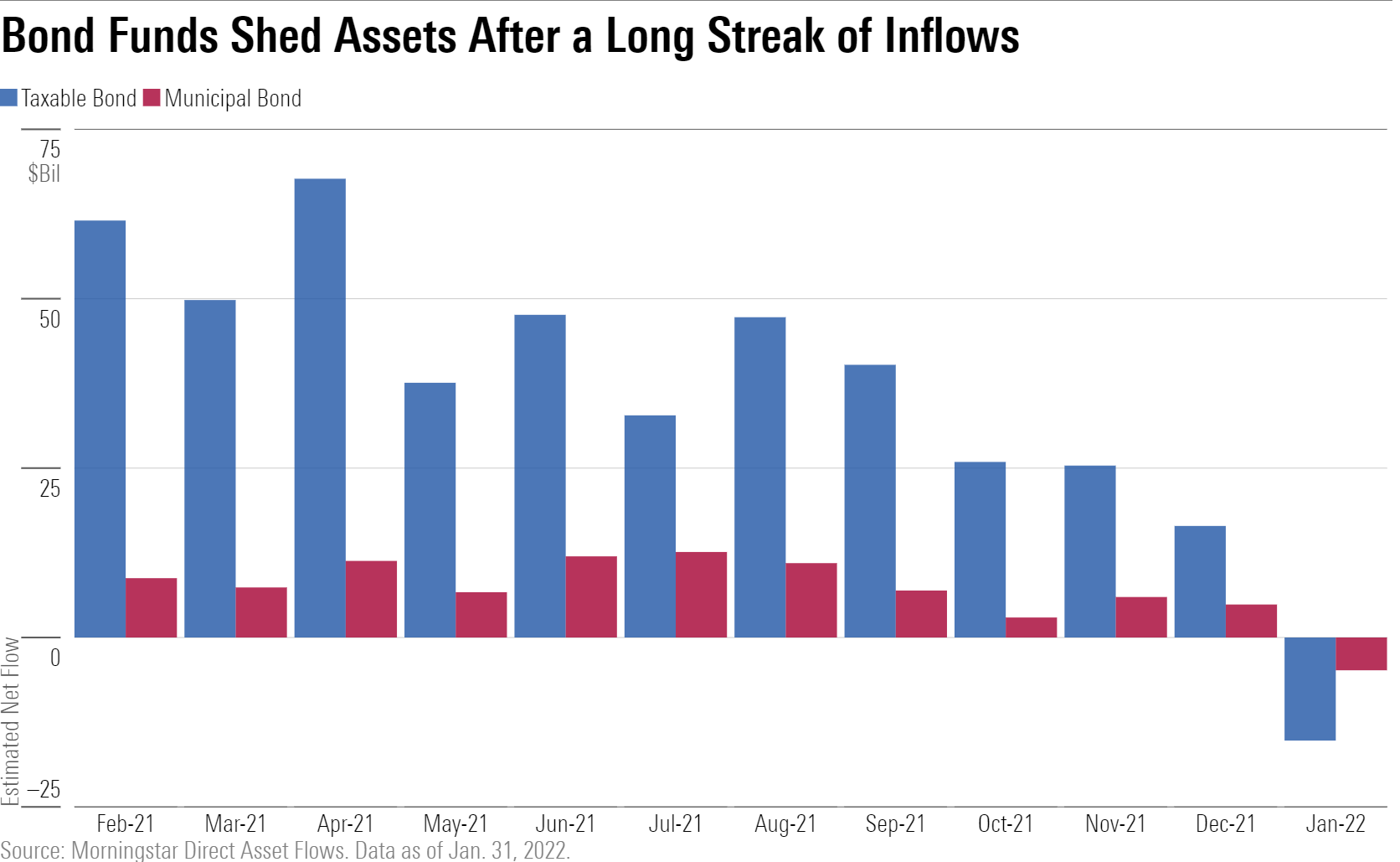

Both taxable- and municipal-bond funds endured outflows in January, snapping a monthly inflow streak that dated to 2018, excluding March and April 2020. Taxable-bond funds and municipal-bond funds shed $15.2 billion and $4.8 billion, respectively. Upcoming monetary policy tightening may have pushed some investors to the exits.

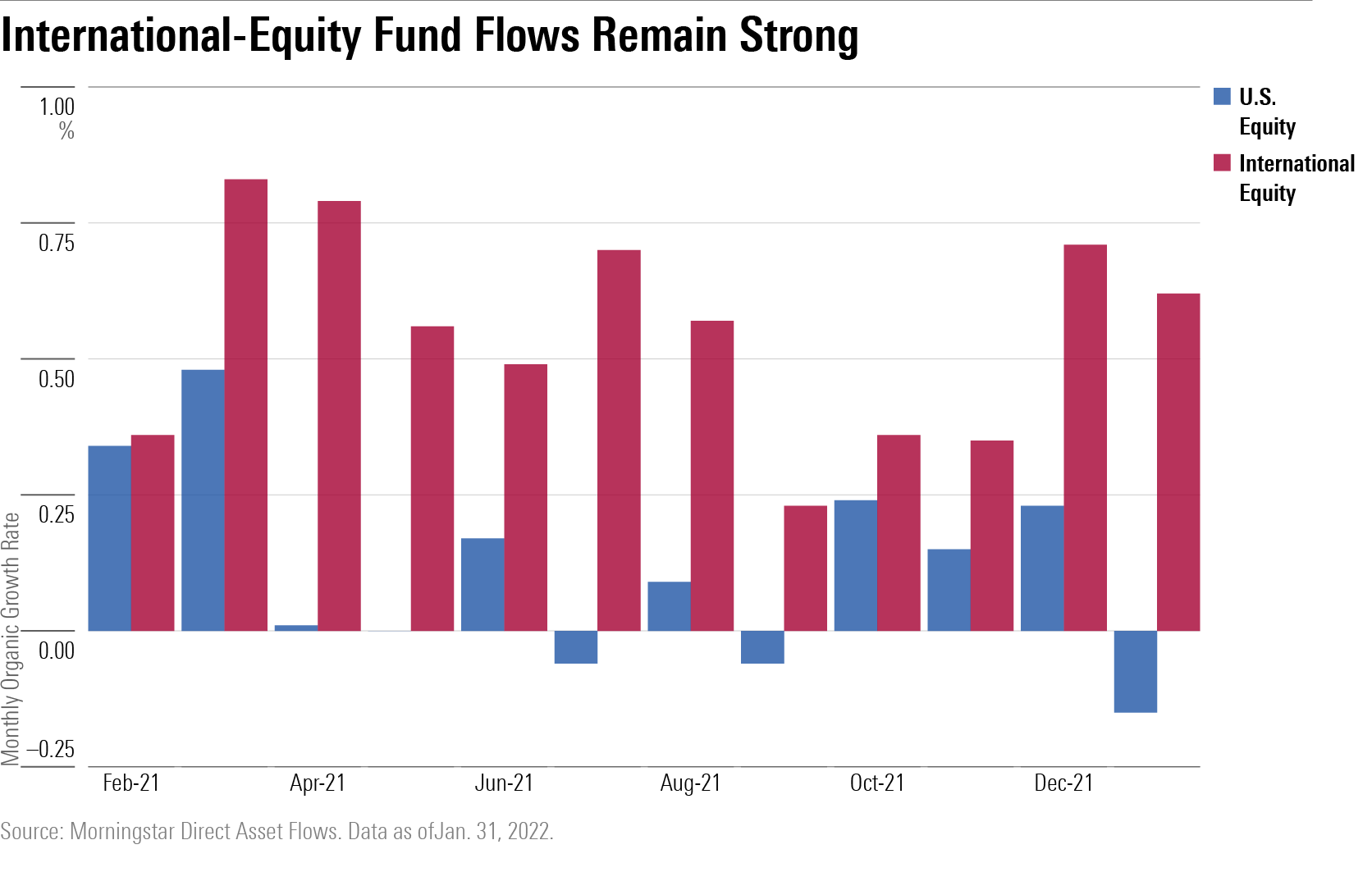

U.S. equity funds shed $20 billion in January after collecting an average of about $12.5 billion per month in 2021. Investors pulled a record $23 billion from large-growth funds as markets punished growth stocks, though the outflow was only their worst since 2017 on an organic-growth basis. Conversely, value funds saw modest inflows.

Investors consistently added to international-equity funds in 2021. They posted higher absolute inflows and organic growth rates than U.S. equity funds, and that continued into 2022. International-equity funds gathered $26.6 billion in January, the most of any U.S. category group.

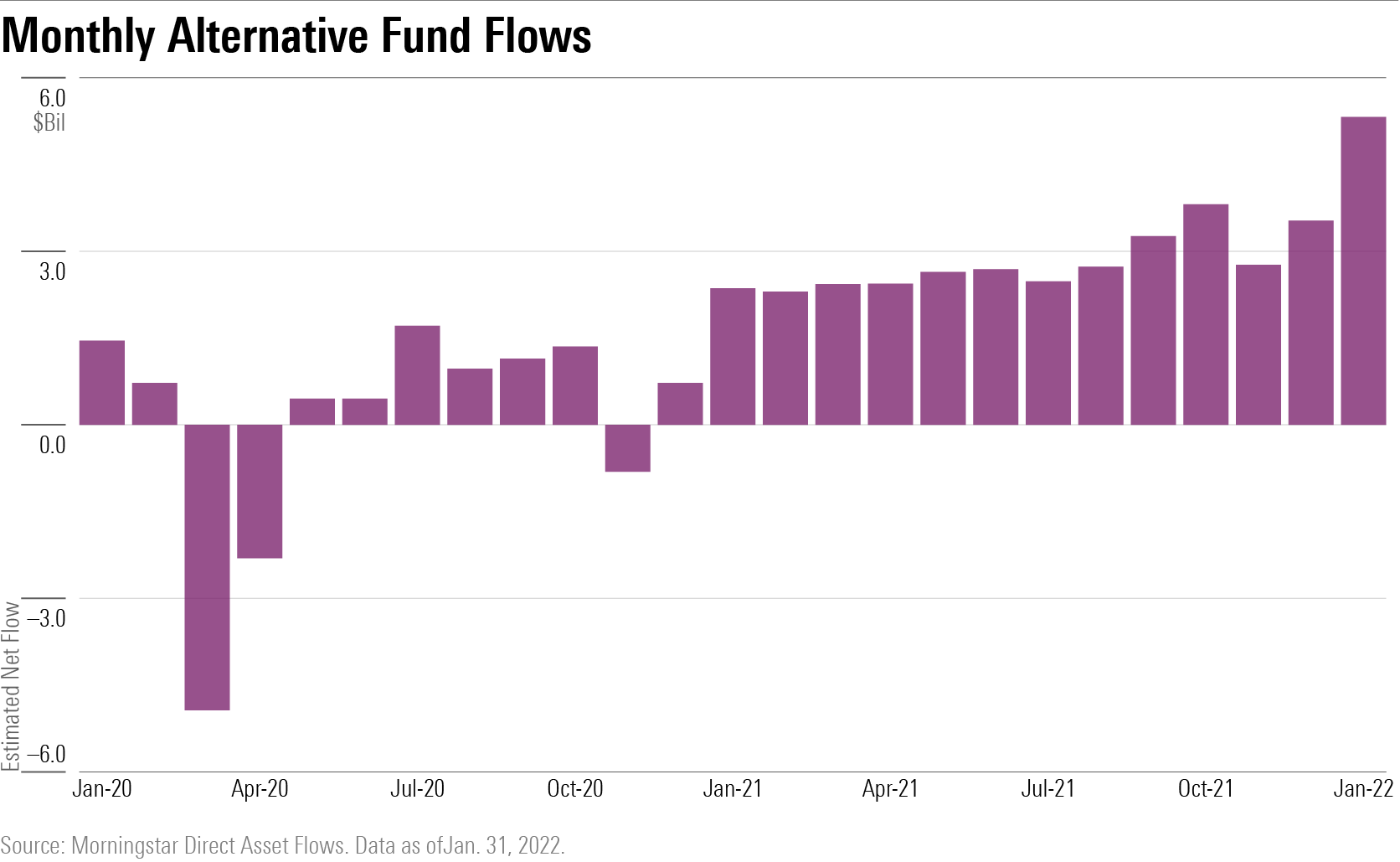

Looming interest-rate hikes and high equity market valuations might have led investors to embrace alternative funds in 2021, and they reached a new high in January with a record $5.3 billion inflow--the largest on an organic-growth basis since 2011. The options-trading category led all alternative categories with $2.1 billion in inflows.

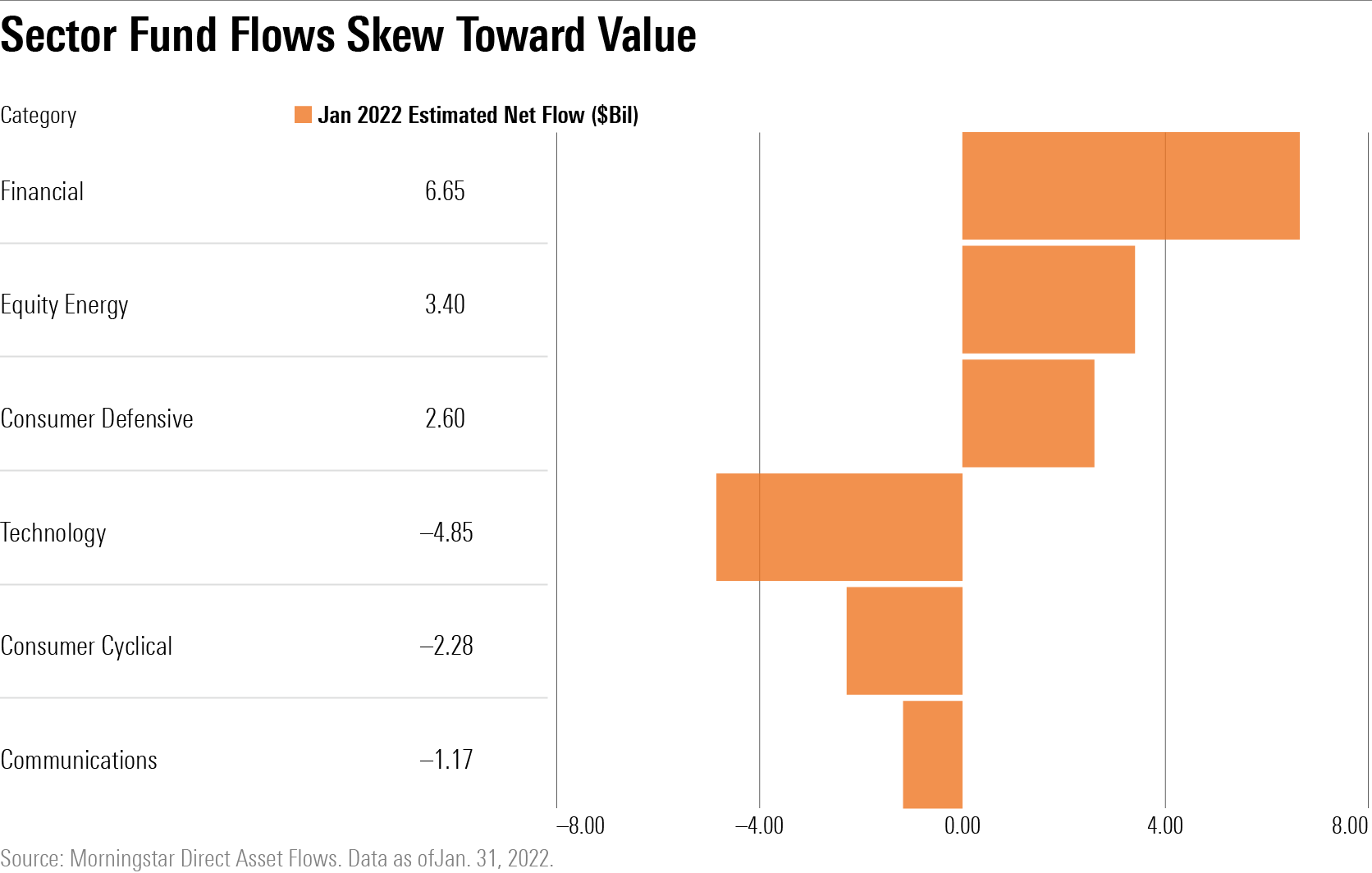

Sector-equity funds absorbed $7.1 billion--their largest haul since April 2021--as investors rotated into value-oriented sectors and away from faster-growing corners of the market.

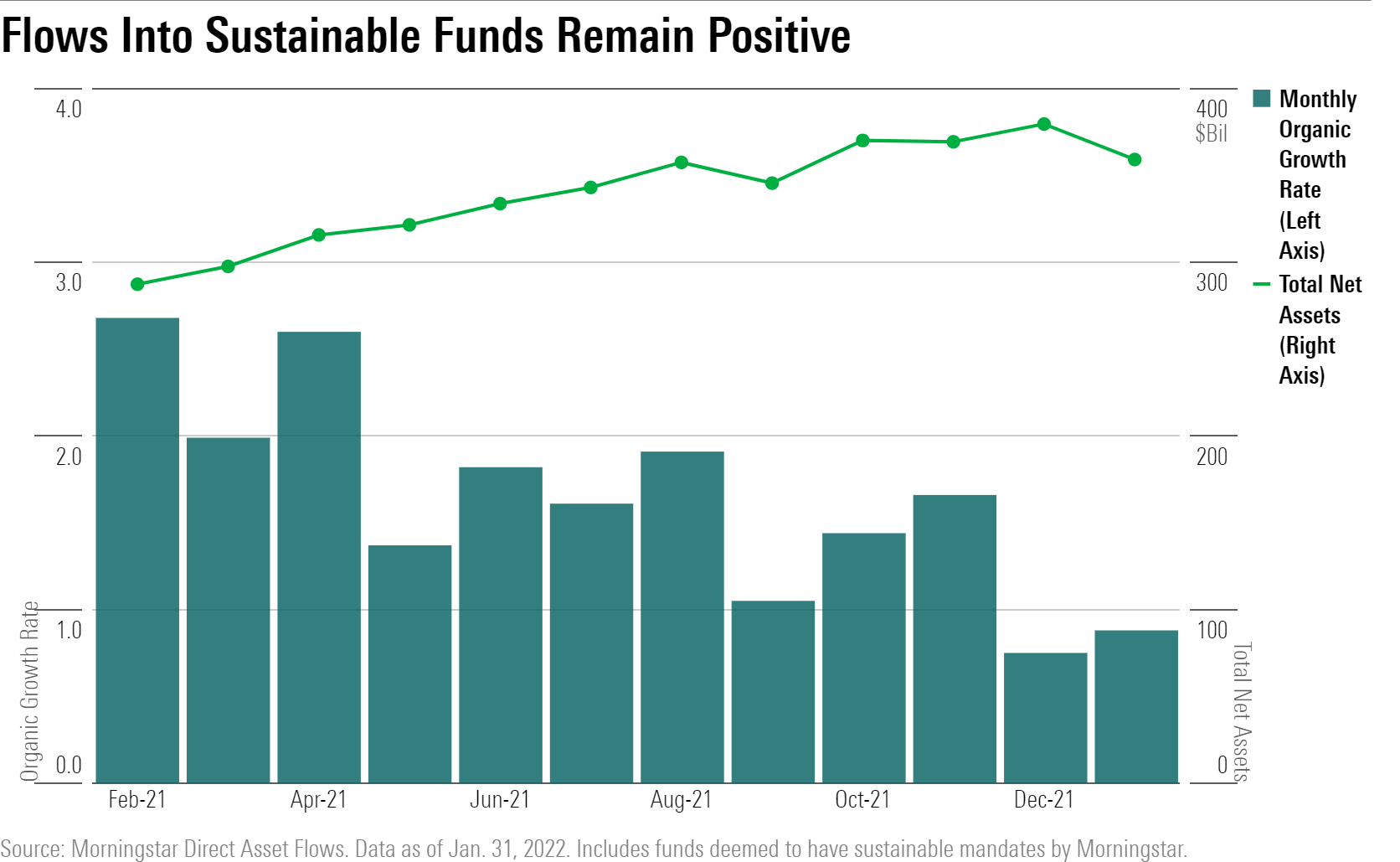

While demand for sustainable funds has waned somewhat, they've still consistently gathered inflows. Sustainable funds collected $3.5 billion in January, led by flows into foreign large-blend funds, large-blend funds, and bank-loan funds. Their 0.88% monthly organic growth rate was the second-lowest tally over the past 12 months but still ranked ahead of most category groups.

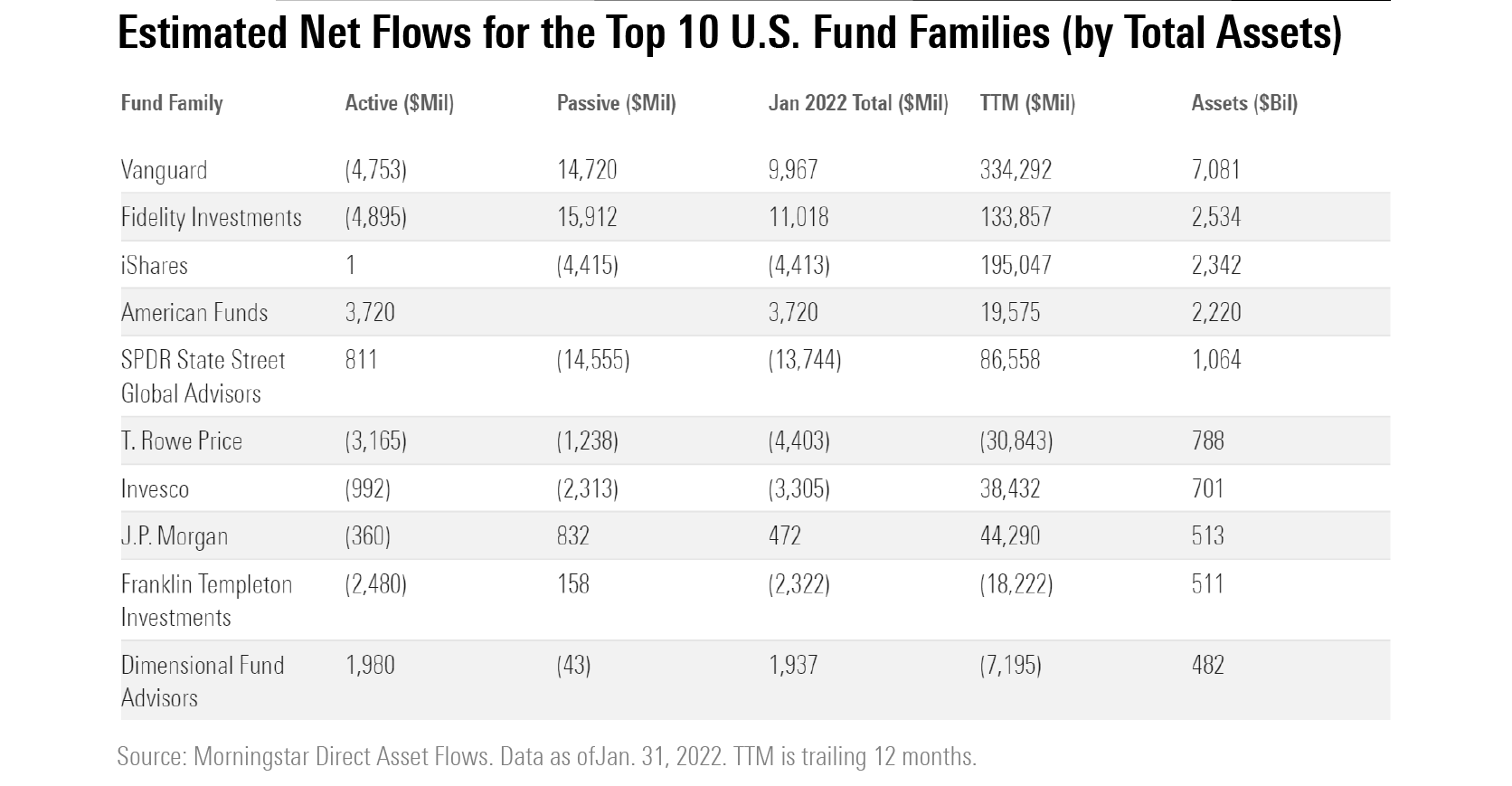

Among fund families, Fidelity's lineup of passive funds powered its industry-leading $11 billion inflow in January.

Note: The figures in this report were compiled on Feb. 10, 2022, and reflect only the funds that had reported net assets by that date. Artisan had not reported and Matthews Asia had not fully reported. Morningstar Direct clients can download the full report here.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)