Mortgage-Backed Securities: A Closer Look at a Core Bond Fund Staple

These securities feature prominently in most core bond funds.

Agency mortgage-backed securities are one the largest and most liquid areas of the fixed-income market. MBS’ yield premium relative to U.S. Treasury bonds is compelling. But it doesn’t come without risk. Here, I’ll provide an overview of the MBS market and share a list of Morningstar Medalist funds that include exposure to this sector.

What Are MBS? MBS stand out among fixed-income securities because of their credit quality and optionality. Referred to as pass-through securities, MBS are pools of mortgages combined into a single asset, which pass through (on a pro rata share) the underlying interest and principal payments on those mortgages to MBS investors.

MBs’ credit quality stems from their agency backing. Most MBS transactions involving mortgage pools are blessed by a U.S. government agency or a government-sponsored enterprise, or GSE. These bonds, also known as agency MBS, effectively carry the same amount of credit risk as U.S. Treasury bonds.

Bonds backed by the Government National Mortgage Association (“Ginnie Mae”), the Federal National Mortgage Association (“Fannie Mae”), and the Federal Home Loan Mortgage Corporation (“Freddie Mac”) constitute more than 95% of all MBS transactions. If a mortgagor fails to meet their obligation, investors are made whole by the agency sponsoring the security.

Ginnie Mae is the only true government agency and is therefore the only entity directly backed by the U.S. Treasury Department. Fannie Mae and Freddie Mac (both GSEs) have been under the conservatorship of the U.S. government since 2009. In all cases, MBS issued by these entities have the direct or implicit backing of the U.S. government and therefore face virtually zero credit risk.

Prepayment risk is a defining feature of MBS. Mortgages can be paid down early or refinanced at lower rates. Either scenario is unwelcome from the point of view of fixed-income investors. Investors demand compensation for this risk. Over the trailing 10 years through July 2020, the agency MBS market has offered an average monthly option-adjusted yield premium over the U.S. Treasury bond market of 40 basis points.

Because they face prepayment risk, MBS respond differently to changes in interest rates than other bonds. For instance, as interest rates fall, homeowners are given incentive to refinance at lower rates. This gives MBS negative convexity. As interest rates fall, MBS’ value also declines. This is the opposite of the relationship between rates and prices (positive convexity) in the case of bonds that don’t face prepayment risk, such as Treasuries and most corporate bonds.

MBS and More in the Core A stand-alone allocation to MBS would likely be extraneous for most investors. MBS feature prominently in most core bond funds.

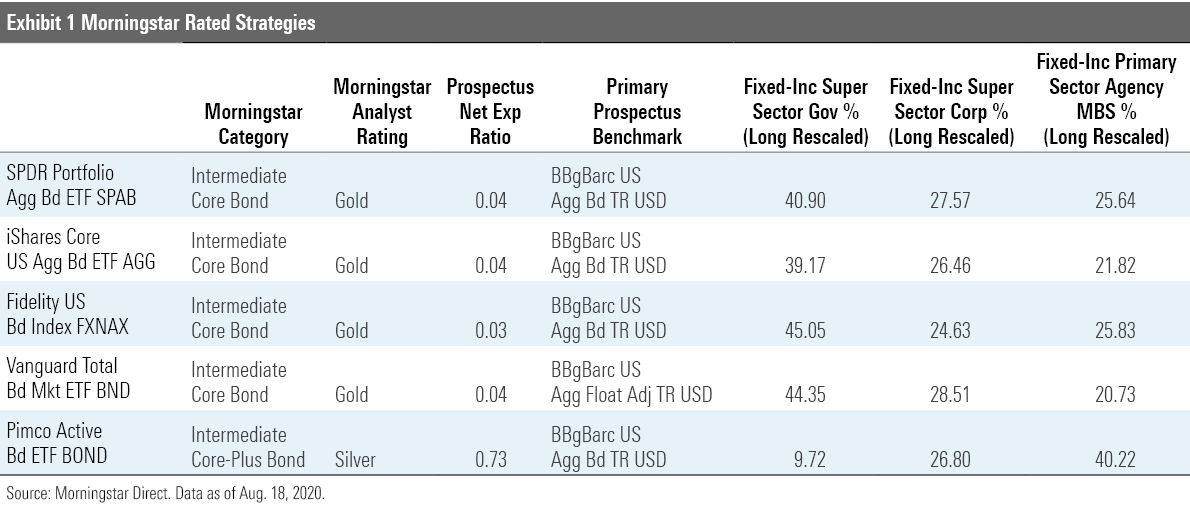

For example, as of July 2020, there were four medalist exchange-traded funds that track some variant of the Bloomberg Barclays U.S. Aggregate Bond Index. Each of these funds has more than a fifth of its assets invested in MBS. Low fees and broad diversification underpin these funds’ Morningstar Analyst Ratings of Gold.

Some active core bond funds have succeeded in being more selective in the MBS sector. Most notable among the ETFs in this bunch is Silver-rated Pimco Active Bond ETF BOND.

BOND an actively managed ETF that seeks to provide a higher stream of income relative to its Aggregate Index benchmark. It’s sensible process and strong team have delivered compelling results. BOND changed its mandate in May 2017 to focus on delivering a higher and more consistent stream of income relative to its bogy. It has since delivered on this objective. Between May 2017 and July 2020, BOND’s monthly distribution yield exceeded that of its benchmark (as proxied by those of its indexed peers featured in Exhibit 1) by an average of 60 basis points.

While BOND has latitude to delve into high-risk areas that lie outside its benchmark, like high-yield corporate bonds, it has generated most of its value versus its bogy within the nonagency MBS sector--specifically, nonagency residential MBS, private mortgage pools that do not carry either an explicit or implicit government backing.

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)