Flowmageddon: It Time Yet?

Is the spike in outflows just a spike or the start of something big?

This article was published In the July Issue of Morningstar FundInvestor. Except for Hotchkis & Wiley, all figures are through May.

In November 2018, I wrote that the impact of outflows on active equity funds was diminished by appreciation in the market. However, I continued, “the industry is very vulnerable to a bear market. If the market falls 30% and outflows accelerate to 25%, then you are looking at a tremendous decline (in fund assets).”

Well, we got our 30% market drop--about 35% to be exact, in February and March. And here come the outflows. May 2020 was the worst month for equity flows since the global financial crisis in 2008. The combination of market depreciation and outflows might put a lot of strain on some funds and fund companies.

I say “might” because the market has rebounded and fund assets have recovered somewhat, particularly in growth funds. The direction of flows and the market for the next year or so look particularly hard to predict. Clearly, the pressure of shrinking assets is rising, but we don’t yet know if it will be as bad as the scenario I outlined back in November 2018.

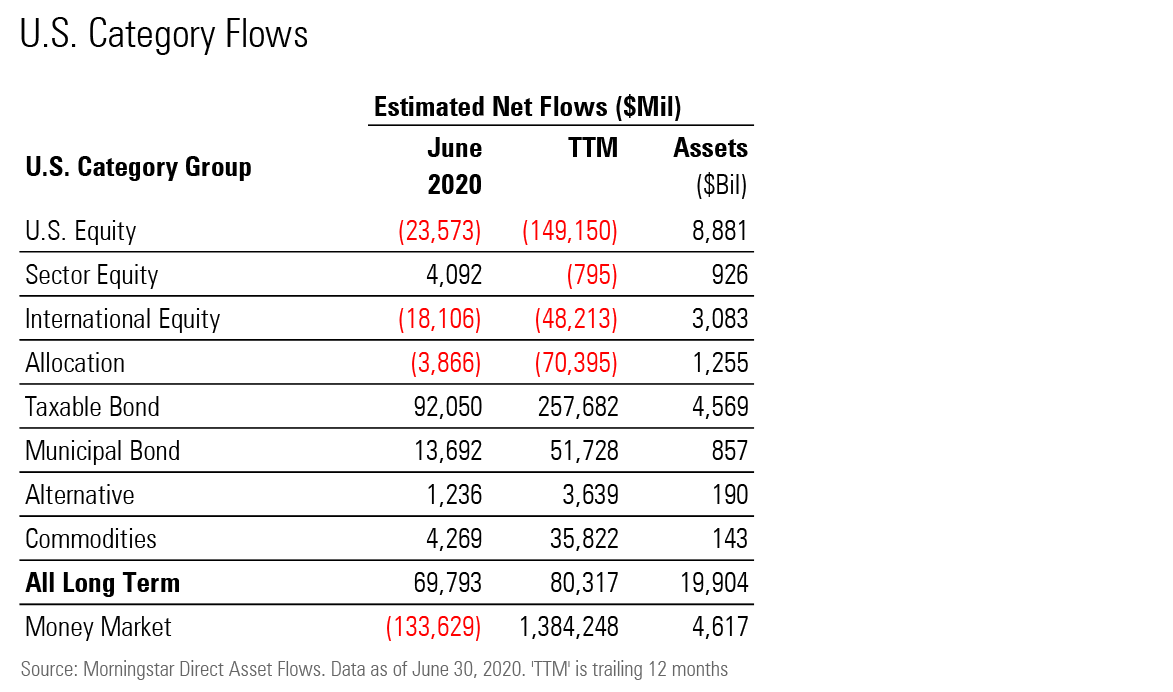

The Data on Flows Let's take a look at where things stand.

(This table came from a Fund Spy published before June flow numbers came out, but they have since come out. As you can see, outflows continued in June for equity funds while bond funds had robust inflows.)

Actively managed U.S. equity funds (open-end and exchange-traded funds) shed $11 billion in May and $243 billion in the trailing 12 months, leaving an asset base of $4.2 trillion. Active international-equity funds shed $13 billion in May and $81 billion in the trailing 12 months off an asset base of $1.8 trillion.

- 65% of all mutual funds are in outflows for the trailing three months.

- 1,086 actively managed equity funds are below $100 million in assets, and 63% are in outflows.

- 2,010 actively managed equity funds are below $500 million, and 65% are in outflows.

- 225 funds have been liquidated or merged away in the first half of 2020.

What It Means To me, the spike in outflows in May is the most important figure. It suggests that outflows could surge relative to 2019.

I’m also struck by just how many small funds there are. Nearly two thirds of actively managed funds are below $500 million in assets. Put the two together and there’s the potential for many funds to be merged away--and even some fund companies, though at this point it would be only very small fund boutiques.

Why Outflows Can Be a Problem for Your Fund A number of bad things can happen because of outflows. Most of them have only a slightly negative impact, but occasionally they can be significant.

When a fund has a shrinking asset base, it may be merged away or liquidated. The first problem is that this has created labor for you: You have to find a new investment to fill that role in your portfolio or at least investigate the fund it was merged into. Ideally, funds should be merged only into very similar funds so that you aren’t stuck with something different. However, because fund companies don’t want to give those assets back, they might still opt to merge a fund into something quite dissimilar. Another problem with mergers or liquidations is that they may trigger taxable events. A manager of a doomed fund might move into cash or make trades (and thus realize capital gains) as he tries to make the fund similar to the one it is merging into.

Probably the biggest problem is when a fund with illiquid holdings in its portfolio is hit with significant outflows. In these cases, the manager is in a tough spot. Selling the illiquid holdings in proportion to their place in the fund would likely require selling them at a big discount because only a few brave buyers are left. But then the manager has taken a loss on the holding and must further mark down illiquid holdings that are still in the fund. That in turn triggers losses and may spur more outflows. On the other hand, the manager could sell the fund’s most liquid holdings in order to avoid taking a haircut. But that would leave the fund with an even bigger weighting in the illiquid holdings. If the tide of outflows withdraws, then the gamble works. But if it doesn’t, the manager has magnified the problem. The good news is that most funds are careful to keep truly illiquid names to a small portion of the portfolio, although it does happen.

Much more common is when a fund has less-liquid (rather than illiquid) holdings such as small caps and high-yield bonds. The managers of small-cap and high-yield bond funds buy and sell every day. There is almost always some liquidity, but there may be a sizable bid-ask spread that causes slight losses. Normally, the managers and their traders have enough control over the situation that they can wait for times when those spreads are slight. But in a bear market with major outflows, a manager may need to sell in a way that depresses the price. Thus, you can have a negative cycle of outflows causing losses and losses causing outflows.

A milder problem is that outflows can cause a fund’s fees to rise. Most actively managed funds charge management fees based on the total assets in the fund. A fund might charge 0.90% on the first billion, 0.80% on assets between $2 billion and $5 billion, and 0.70% on assets above $5 billion. As the fund grows, that brings the expense ratio down, but losing assets causes fees to rise.

Why Outflows Might Not Be a Problem for Your Fund Outflows are generally manageable and not much of a problem for a fund. Think of American Funds EuroPacific Growth AEPGX and Fidelity Contrafund FCNTX. These two have 12-month outflows of about $9 billion and $19 billion, respectively, on asset bases well over $100 billion. That amounts to modest percentages of total assets, and these are funds that invest in extremely liquid large-cap stocks. Given their asset sizes, those outflows may even be a positive, as the funds are bloated and present a real challenge for managers to find enough good ideas.

The same is true for most large high-quality bond funds. High-quality bonds are very liquid and therefore easy to sell if needed.

Why Outflows Can Hurt a Fund Company Outflows are a minor nuisance for giant fund companies most of the time, but smaller companies can feel the bite. When a small firm shrinks significantly, it can lose key investment professionals because it has less money to pay them and they likely place a reduced value on equity in the firm. Here are some firms of note. The asset figures cited are for each company's mutual funds only.

I’m not worried yet, but Oakmark has had a dramatic drop in assets, as $17 billion in outflows over the past 12 months paired with losses at its funds have pared assets under management to $48 billion from $70 billion. It’s a small firm with plenty to go around for its investment professionals, and it has a big parent company behind it in Natixis. Still, you wouldn’t want to see that decline continue at that pace.

It’s a much bigger issue for firms further down the AUM charts. When those firms fall to $2 billion or $1 billion, clients and employees alike may leave, sometimes leading the firm to shut down or continue in a diminished way.

IVA has fallen to $5 billion from $9 billion in a year. Again, it’s a small shop without a lot of overhead, so I’m not worried yet, but it is another value firm that’s facing challenges. (After I wrote this, comanager Charles de Lardemelle left the firm and we placed our Morningstar Analyst Ratings on IVA Worldwide IVWIX and IVA International IVIQX under review.)

Davis Advisors has gone to $10 billion from $12 billion as it has been ebbing for quite a while. Again, I’m not worried yet.

I’m a little worried about Hotchkis & Wiley, which has seen its U.S. mutual fund business shrink 42% to $3.3 billion, because its deep-value style has suffered terrible performance. Barring a great rebound in deep value, it would seem likely that it will be in outflows for the rest of the year. However, the firm has more of its business outside U.S. mutual funds. It started the year with $33 billion, and that fell to $24 billion in the first half. That's a lot of money, so, I wouldn’t expect it to go away. But keeping and attracting good investors is likely getting tougher.

Gotham Funds has gone to $1 billion from $3 billion because of the value slump. It is another firm worth watching closely if you have money there.

Small Funds Under the Gun Let's look at some funds with assets under $1 billion and one-year outflows of 40% or more.

Becker Value Equity BVEFX has had outflows of 58% over the past 12 months, leaving it with $120 million in assets. The fund’s three- and five-year returns are bottom-quartile, though its one-year return is at least second-quartile. The firm runs money outside the fund, so I would guess it will not be shutting soon. It’s a large-cap fund, so liquidity won’t be a problem.

Hotchkis & Wiley Mid-Cap Value HWMAX has had outflows of 51%, leaving it with assets of $294 million. Deep value is the firm’s style, so the whole firm is under pressure at this point.

Matthews India MINDX has seen 49% of AUM leave, taking total assets to $557 million. We have rated it Bronze, so obviously we think it’s still a good investment. Presumably, the firm didn’t expect this fund to be its biggest, so I’m not too concerned here.

AllianzGI Small-Cap Value PCVAX shed 45% of assets to take the fund’s size down to $522 million. The Neutral-rated fund has lost a bit less than its peers, but its longer-term record is subpar, and it’s been in outflows for 10 consecutive years. In addition, that’s a lot of selling pressure to manage in a small-cap fund.

Third Avenue Real Estate Value TAREX saw 44% of assets leave, and it’s down to $552 million in assets. The fund’s preference for real estate operators over REITs has hurt returns. We still rate it Bronze, and it has enough assets to keep going.

Neutral-rated Aberdeen U.S. Small Cap Equity GSXAX also has enough assets to keep going, but managing a 43% outflow in a small-cap fund has to be a real challenge. I’d be wary of getting in until outflows have stopped.

T. Rowe Price International Bond RPIBX had 41% of assets leave, but it still has $992 million. We don’t rate this fund, but I expect it should be able to handle outflows pretty efficiently.

Harbor Mid Cap Value HIMVX is under pressure because of a particularly big loss so far this year. However, this quantitative fund runs a diffuse portfolio of 150-plus names, which should make flows fairly manageable. Each of its positions in its top 10 holdings represents less than one day’s trading volume.

Conclusion It's hard to say whether outflows are about to accelerate, but we'll be watching for signs of Flowmageddon.

If you own funds with less than $1 billion in assets and slumping performance, you’ll need to be extra vigilant. Watch for flows and any indications that flows are changing the portfolio.

If one of your funds is being merged away, seize the initiative and find a better replacement immediately rather than waiting to see how things work out at the successor fund.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)