Emerging-Markets Bonds Are Bit Players at Best

This sliver offers a lot of risk, and the associated rewards might not be sufficient.

Emerging-markets sovereign bonds offer higher yields relative to their counterparts issued by sovereigns in developed markets. These yields compensate investors for the greater risk they face.

Bonds issued by emerging-markets governments carry additional credit risk relative to developed-markets sovereign bonds. There is a greater amount of uncertainty regarding the ability of these governments to service their debt. Concerns over these issuers’ willingness and capacity to pay are often well-founded. Emerging-markets economies may be heavily dependent on a single industry, face political instability, or have poor fiscal and/or monetary policy. Some have a track record of defaulting on their bonds.

Emerging-markets sovereign bonds represent less than 1% of the global bond market, as proxied by ICE Bank of America Bond Indexes, so any allocation to this asset class is effectively an active--and risky--bet. Given that bonds’ best use in a portfolio tends to be as ballast to diversify equity risk, investors should consider emerging-markets bonds for a bit part in their portfolio--if they have any role at all. Here, I’ll take a closer look at this sliver of the global bond market and highlight some Morningstar Medalists that invest in this space.

A Brief History Lesson The market for emerging-markets bonds took shape with the creation of Brady Bonds in 1989. These bonds were the end product of a plan to convert emerging-markets governments' bank loans (primarily in Latin America) into standardized, readily tradable bonds. This made it easier for them to service their debt and made the market for their debt more liquid. These bonds were "hard-currency" issues. Hard-currency bonds are issued by emerging-markets governments but are denominated in developed-markets currencies, usually U.S. dollars. Hard-currency issues were more palatable to the market. They face less foreign-exchange risk, and issuing governments can't devalue their currency to reduce the burden of these debts.

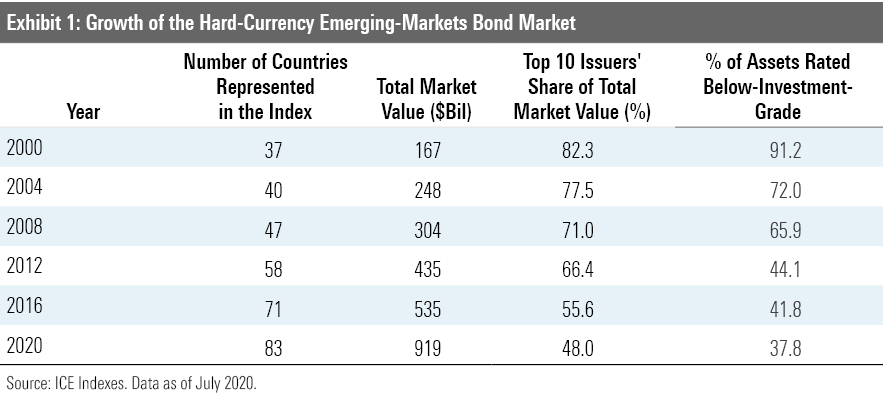

The market evolved further in the aftermath of the Asian financial crisis of 1997 and the Russian debt crisis of 1998. Outstanding issuance grew and credit quality improved. This stemmed from several factors, including greater protections for creditors, improved fiscal management, and increased political stability. The result was a larger, safer, and more liquid market. Exhibit 1 shows the growth of the total market value of the ICE Bank of America U.S. Emerging Markets External Sovereign Index between 2000 and 2020. Over the past two decades, the number of issuing countries represented in the index nearly doubled. This led to much less concentration risk. The top 10 issuers accounted for nearly half as much of the total market value in 2020 than in 2000. The most notable shift was the improvement in credit quality, as measured by issuers’ credit ratings. In 2000, more than 90% of the index was rated below-investment-grade. By 2020, that figure dropped to just under 40%.

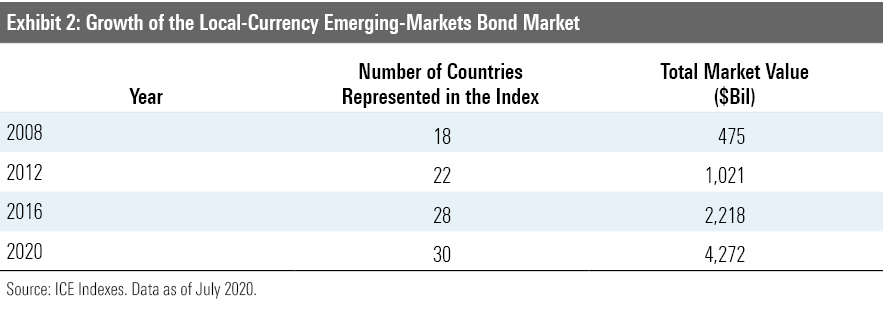

As the market grew, many emerging-markets governments became less dependent on outside investment. This spurred the development of local-currency issues, bonds denominated in the issuing country’s currency. The local-currency bond market, as proxied by the ICE Bank of America Emerging Markets Sovereign Bond Index, grew rapidly between January 2008 and January 2020, as seen in Exhibit 2.

Hard-Currency Bonds Face Considerable Credit Risk Historical improvements in fundamentals notwithstanding, bonds issued by emerging-markets governments still carry a lot of credit risk. There were at least 20 defaults by emerging-markets governments between 1999 and June 2020.

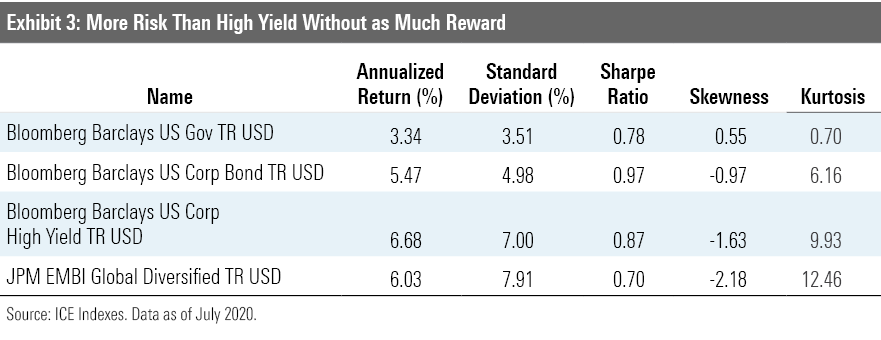

Exhibit 3 contains performance metrics for the JPMorgan Emerging Market Bond Index Global Diversified, the Bloomberg Barclays U.S. Corporate High Yield Bond Index, and the Bloomberg Barclays U.S. Government Bond Index over the trailing 10 years through June 2020.

Over the past decade, hard-currency emerging-markets bonds generated outcomes that looked most similar to U.S. high-yield bonds, despite the fact that the majority of them carried investment-grade ratings. Both markets are highly sensitive to macroeconomic conditions, and, most notably, in recent years their fates have been tied to global energy markets. This was evident earlier this year when oil prices plummeted as demand dried up.

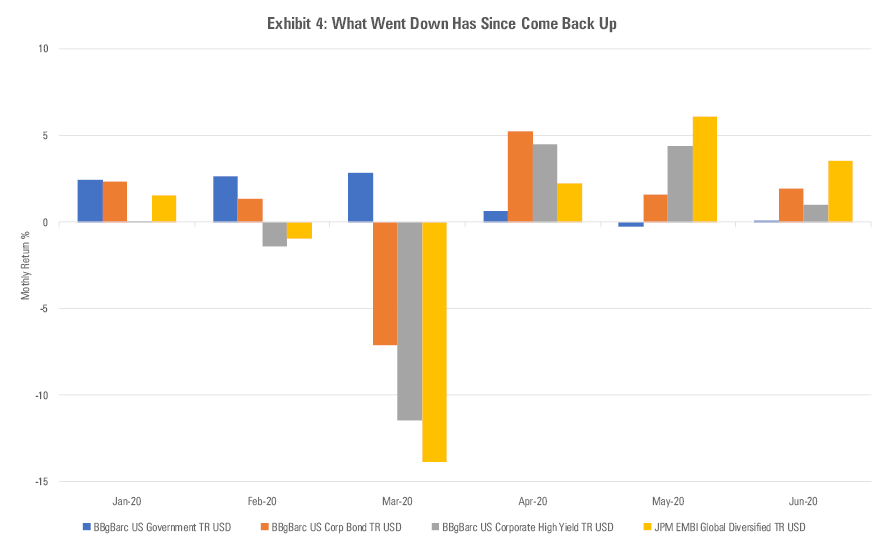

Exhibit 4 shows the monthly returns for the same four indexes featured in Exhibit 3. Between January and June, both the emerging-markets bond index and the U.S. high-yield index fell rapidly before recovering with nearly the same intensity.

- Source: Morningstar Direct.

Hard-currency bonds contain a lot of credit risk. While their performance profile has been most similar to high-yield corporate bonds, the incremental amount of risk they assume has not been comparably compensated. In the context of a diversified portfolio, this means that these bonds are generally poor diversifiers of equity risk, which can hurt in a crisis period like the coronavirus-induced drawdown from Feb. 19 to March 23, 2020.

Local-Currency Bonds Layer Currency Risk on Top of Credit Risk Credit risk is an important factor affecting the performance of debt issued by emerging-markets governments in their own currency, but for U.S.-based investors it is not their only defining feature. Local-currency bonds layer currency risk on top of credit risk, resulting in incrementally greater volatility.

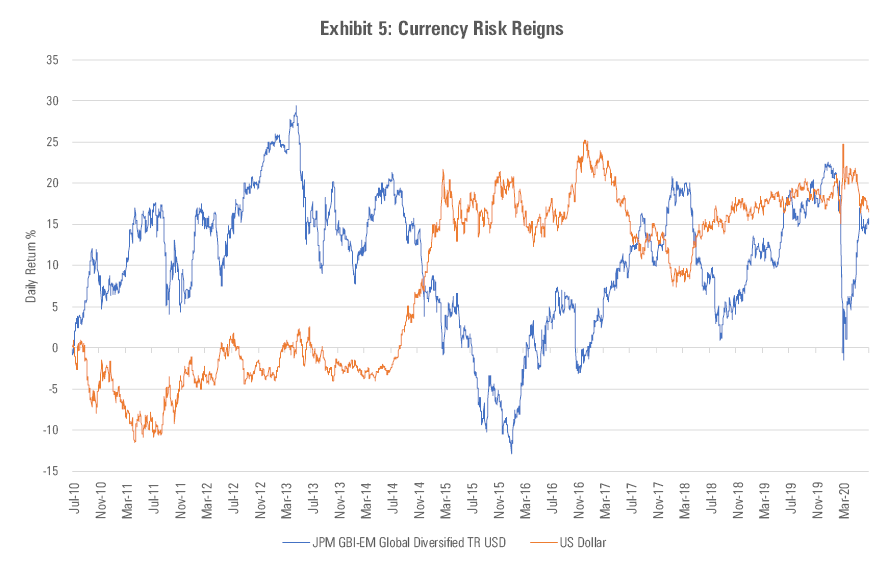

Over the trailing 10 years through June 2020, the JPMorgan Global Bond Index-Emerging Markets Global Diversified (a local-currency index) has exhibited more volatility than the JPMorgan Emerging Market Bond Index Global Diversified (hard-currency). The former benchmark’s standard deviation was 12.1% over this span while the latter’s was 10.43%. Given the zero-sum nature of currencies, over the long term, this isn’t an increment of risk that investors should expect any increment of return for taking.

Exhibit 5 plots the returns of the JPMorgan Global Bond Index-Emerging Markets Global Diversified and the U.S. dollar. While the two aren’t perfectly negatively correlated, the local-currency emerging-markets bond market typically moves in the opposite direction of the greenback, demonstrating the impact of currency fluctuations on the market values of these bonds.

- Source: Morningstar Direct.

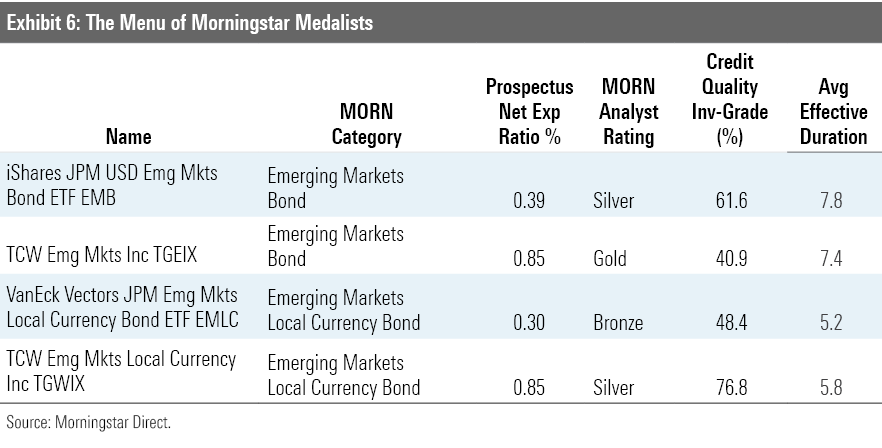

Morningstar Medalists There are eight medalist strategies in the emerging-markets bond and emerging-markets local-currency bond categories. Here, I'll briefly profile four of our top picks across these two categories, singling out an indexed exchange-traded fund and actively managed mutual fund from each.

IShares JPMorgan USD Emerging Markets Bond ETF EMB is a solid choice for exposure to hard-currency emerging-markets bonds. It earns a Morningstar Analyst Rating of Silver because it accurately captures the opportunity set within this corner of the global bond market and boasts a low fee. It tracks the market-value-weighted JPMorgan Emerging Market Bond Index Global Core.

TCW Emerging Markets Income TGEIX is an actively managed strategy offering exposure to hard-currency bonds. The fund’s Institutional shares are rated Gold. Its experienced and talented group of portfolio managers has successfully implemented a process that prudently layers on additional credit risk. This is done by allocating a sleeve of the portfolio to emerging-markets corporate bonds. Taking more credit risk is not always going to be rewarded, and it hasn’t been thus far in 2020 (through June). That said, the combination of flexibility and sensible guardrails has kept the portfolio well-diversified.

VanEck Vectors JPMorgan Emerging Markets Local Currency Bond ETF EMLC tracks the JPMorgan Global Bond Index-Emerging Market Global Core, a market-value-weighted index that generally reflects the composition of the market for local-currency emerging-markets bonds (though it caps its exposure to China). But this fund has struggled to closely mirror its benchmark. It lagged its bogy by 51 basis points annually over the trailing five years through June 2020. So, while the strategy harnesses the market’s collective wisdom about the relative value of each bond in assigning their weight, which is a sensible approach, its inability to track its benchmark with greater precision limits its Analyst Rating to Bronze.

TCW Emerging Markets Local Currency Income TGWIX has earned a Silver rating. The fund benefits from a flexible and cautious approach to investing in local-currency bonds and is helmed by the same team that manages TCW Emerging Markets Income.

Exhibit 6 contains key information on these four medalists.

-

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)