Growth Parties Like It's 1999, but Don't Rule Out Value

Morningstar style indexes reveal market divergence and opportunity.

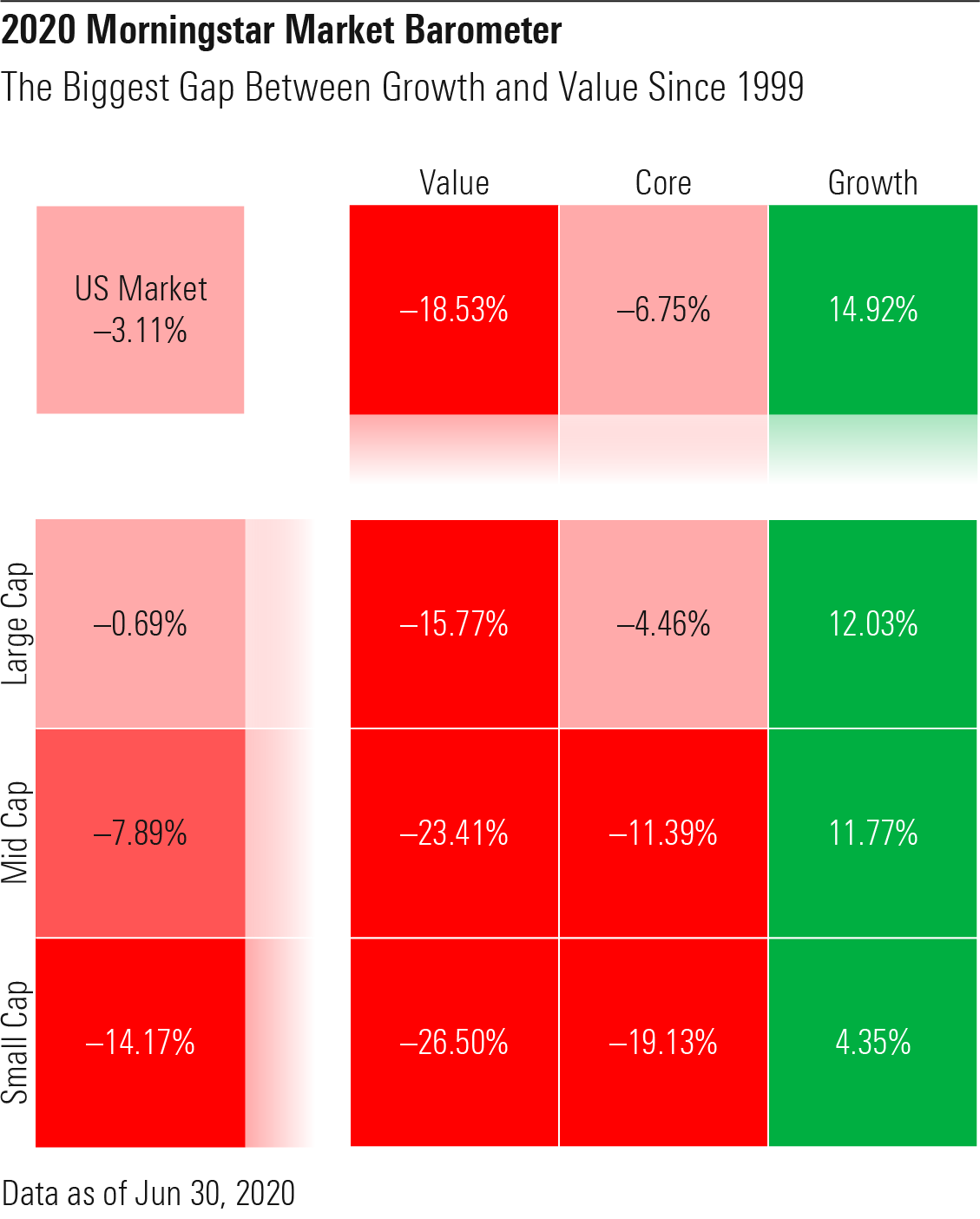

Spare a moment to contemplate the gulf between growth stocks and the rest of the market in 2020's first half. More than 33 percentage points separate the performance of the Morningstar US Growth Index from that of the Morningstar US Value Index. The sheer magnitude of this year's divergence is such that, if the year finished this way, it would be growth's largest margin of outperformance since 1999, when the Morningstar US Growth Index gained 44.5%, while the Morningstar US Value Index declined 1.3%.

Source: Morningstar.

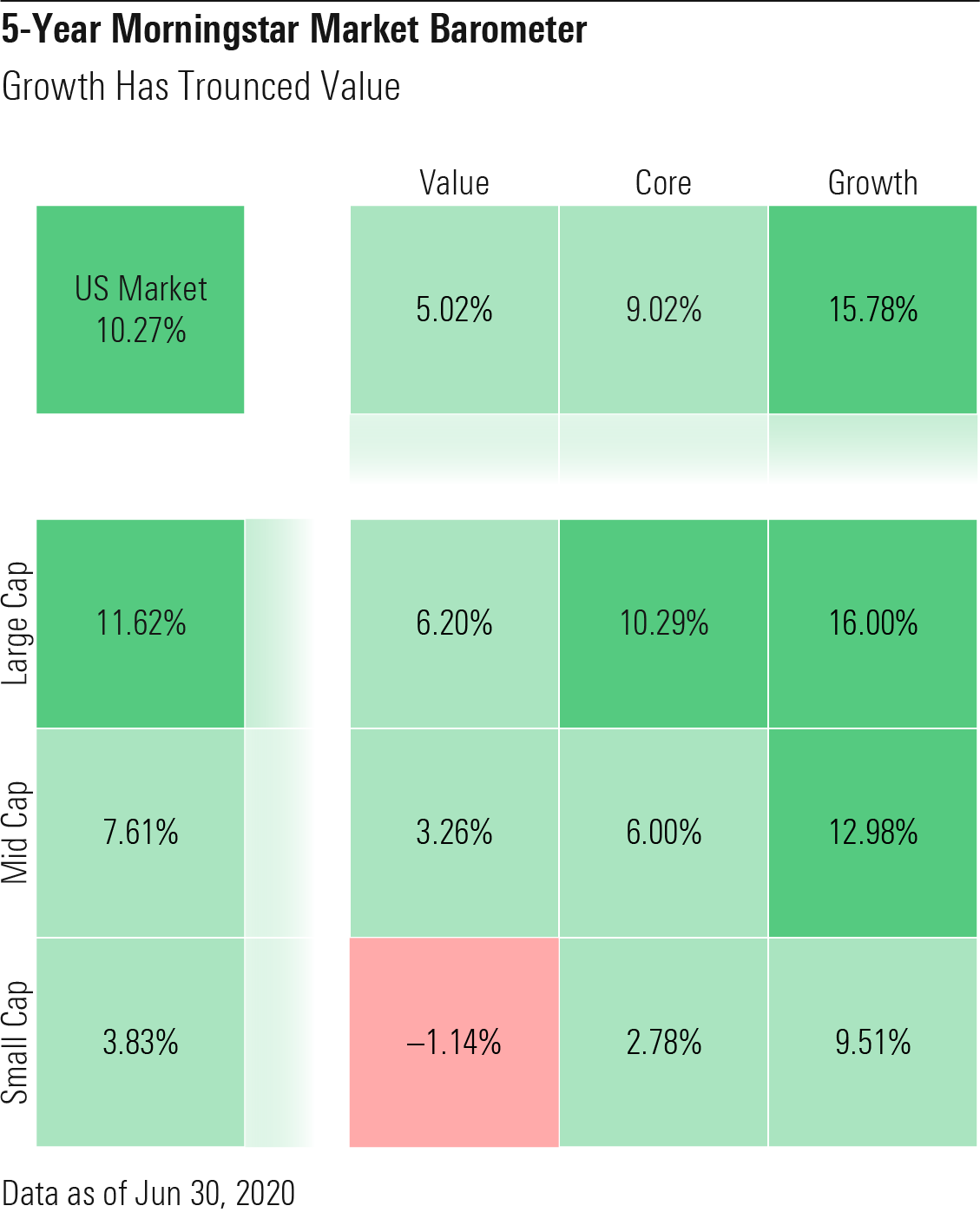

This isn't a new story. Growth has been running up the score on value for more than 10 years. If not for 2016, when U.S. election results sent value stocks soaring, the long-term gap between growth and value would be even larger. Consider the chasm between growth and value over the trailing five-year period through June 30, 2020.

Source: Morningstar.

Proponents of the value factor, the notion that value stocks outperform over the long term, continue to see their patience tested. After so many years of warnings, "mean reversion" investors increasingly sound like Chicken Littles. Could this time be different?

The answer is no, according to Morningstar equity research. Applying analyst fair value estimates to Morningstar indexes reveals opportunity on the Morningstar Style Box's left-hand side. There's real value in value right now.

Secular Growth vs. Structurally Challenged Growth's dominance over value has been well covered. The growth side of the market is home to companies like Microsoft MSFT, Amazon.com AMZN, Tesla TSLA, Nvidia NVDA, Visa V, and Salesforce.com CRM that are benefiting from secular trends. Unlike the technology, media, and telecom bubble of the late 1990s, there is significant profitability on the growth side of the market. Many of the fastest growers have wide Morningstar Economic Moat Ratings--significant sustainable competitive advantages, according to our equity analysts. This is not the market of Webvan and Pets.com, growth stocks that flamed out spectacularly in the 1990s.

On the value side are companies facing both cyclical and secular challenges. These include many in the energy and consumer sectors--names like Exxon Mobil XOM and Procter & Gamble PG. Financials like JPMorgan Chase JPM and Wells Fargo WFC have had a miserable 2020, as have real estate concerns like Simon Property Group SPG. Lower down the capitalization spectrum, retailers like Macy's M have seen their decline accelerated.

There's Value in Value But growth stocks are always more comfortable to own. The secret to value stocks is that they underpromise but overdeliver. Meanwhile, growth stocks carry the burden of high expectations. The market punishes them when they fail to live up.

Investors should remember that growth and value go through cycles. The value factor's demise was also proclaimed in the late 1990s, when the "New Economy" was being created. Noted value investors gave up waiting and retired.

Then after the TMT bubble burst, value trounced growth for years. In 2000, the Morningstar US Value Index gained 10% while the Morningstar US Growth Index lost 28.5%. Value suffered far less than growth in the early 2000s bear market, it outpaced growth during the rally of 2003-07, and it lost less in 2008.

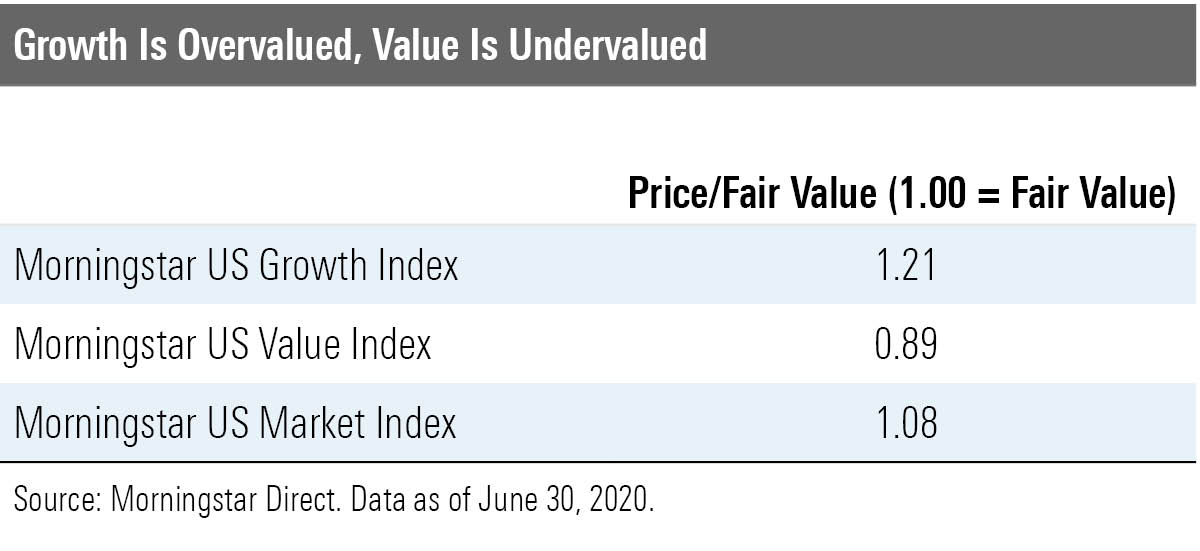

Looking forward, what do current valuations in the U.S. market tell us about growth and value's prospects? By definition, growth stocks are more richly valued on measures like price/earnings. But Morningstar equity analysts assign forward-looking price/fair value estimates to stocks by measuring share price against a business' intrinsic value. Over the long term, we expect price and fair value to converge.

Growth appears overvalued and value undervalued. Rolling up analyst estimates to the index level shows the Morningstar US Growth Index trading at an 21% premium to fair value, while the Value Index is seen as 11% undervalued. The Morningstar US Market Index, a broad measure that spans investment styles, is 8% overvalued. One caveat: Morningstar analysts cover roughly 90% of each of these indexes' weightings.

Morningstar's Market Fair Value Tool measures only the universe of analyst-covered stocks. The median covered stock in the growth-leaning technology sector was 13% overvalued as of June 30. On the flip side, analysts viewed the financial-services, energy, industrials, and consumer defensive sectors--traditional value sectors--as undervalued.

When will value come back? No one knows. Lots of forces beyond valuation move markets in the short term. But investors who neglect value do so at their peril. If 2020 has taught us anything, it's that market inflection points can be rapid, violent, and unpredictable.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)