There Is a Better Way to Push for Better Labeling of ETPs

I agree with the spirit of the ETP industry coalition's proposal, but not the specifics.

Not all types of exchange-traded products, or ETPs, are created equal. But oftentimes investors unwittingly treat them as though they are. There are important differences in how different types of ETPs are structured as well as the exposures that they provide. The recent rout in the oil markets and the knock-on effects on oil-related ETPs was a not-so-gentle reminder of this fact.

Investors need to be aware of these differences. I believe that better labeling is long overdue and would help investors to more confidently navigate the menu of more than 2,300 ETPs.

Today: ETFs + ETNs = ETPs At present, ETPs generally fall into one of two buckets. The first contains exchange-traded funds. ETFs represent the majority of ETPs by count and the lion's share of assets. So, it's unsurprising that "ETF" has often been used as a catchall term in much the same way that Kleenex is used to refer to all facial tissue. Most ETFs are mutual funds, subject to the same rules and regulations as traditional mutual funds. A handful, including the granddaddy of them all, SPDR S&P 500 ETF SPY, are unit investment trusts. Others, mainly those that invest in commodities, are structured as grantor trusts. In all cases, irrespective of their structure, these various types of funds are currently referred to as ETFs.

The second bucket of ETPs contains exchange-traded notes, or ETNs. Notes are not funds. They are, in effect, IOUs written by banks. These IOUs trade on a stock exchange. In the case of ETNs, the issuing bank promises to deliver the return of an index to investors in exchange for a fee. These notes do not directly hold the securities that make up their underlying index, and they may or may not be backed by collateral that would protect investors in the event the issuing bank were to default. Thus, ETN investors are subject to credit risk--the risk the issuing bank will go bust. Also, the terms of the note tend to favor the bank. Most notably, the banks backing these notes can (and have) call off the bet they are making in the event the costs of keeping them become too great.

Kicking the Can, Shopping Venues In October 2018, in response to the SEC's request for comment on the proposed Rule 6c-11 ("The ETF Rule"), the Fixed Income Market Structure Advisory Committee's ETFs and Bond Funds Subcommittee submitted a proposal that would create greater granularity, consistency, and clarity in ETP labeling. The proposed taxonomy was the spitting image of one previously put forth by BlackRock, sponsor of the iShares range of ETFs. Indeed, Ananth Madhavan, the firm's global head of research for ETFs and index investing, was a member of the FIMSAC subcommittee that proposed this measure. Other commenters were similarly supportive.

Ultimately, the SEC wound up kicking the can in the final draft of the ETF rule:

We agree that these issues need to be examined and discussed in more depth before the implementation of an ETP naming system. We will continue to consider the comments we received and, if appropriate, will take steps to address investor confusion relating to ETF and ETP nomenclature. … We encourage ETP market participants to continue engaging with their investors, with each other, and with the Commission on these issues.

ETP market participants didn't need much encouraging. On May 13, 2020, a coalition of some of the largest ETP sponsors, including BlackRock, Charles Schwab, Fidelity, Invesco, and State Street Global Advisors, put forth a new proposal that is virtually identical to the one that's long been championed by BlackRock. The key difference with this latest proposal is that these firms have locked arms with the stock exchanges (Cboe, Nasdaq, and the New York Stock Exchange) to build out this new taxonomy. If at first you don't succeed, try asking someone else. I take issue with this approach. I believe that the SEC needs to own any decision relevant to ETP labeling. Further fragmenting the already disjointed and overlapping mosaic of regulations that governs the ETP ecosystem wouldn't be good for anyone.

These firms' advocacy of this framework could be construed as inherently self-interested--and I'd argue that's absolutely the case. As some of the largest global sponsors of ETFs, they all have a clear interest in defending the ETF "brand." But I would also argue that this measure would be in investors' best interests as well. Investors would be better served by a clearer set of standards and expectations as to what they can expect from an ETF, as well as other types of ETPs. While I agree in principle with this proposal, I take issue with some of the specifics.

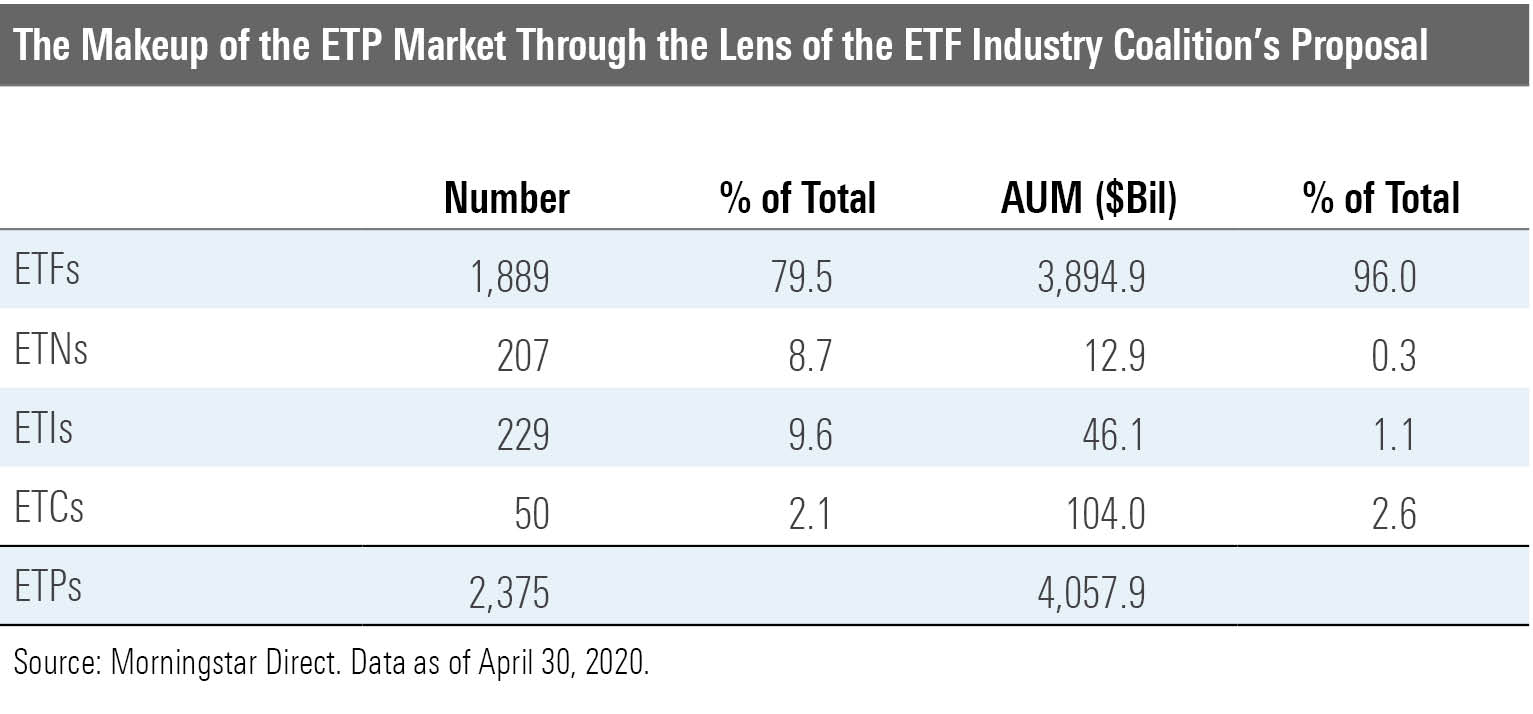

Tomorrow: ETFs + ETNs + ETIs + ETCs = ETPs? The new labels put forth by this coalition of ETP sponsors and ETP trading venues would introduce a pair of new buckets to further sort ETPs. The two new groupings would be exchange-traded commodities, or ETCs, and exchange-traded instruments, or ETIs.

The ETC grouping would include the various legal structures, like grantor trusts, that are not registered investment companies. These products seek to deliver the performance of a commodity or basket of commodities using futures contracts or by way of owning the physical commodity. ETNs offering commodity exposure and products offering leveraged or inverse exposure would be excluded from this grouping. Isolating this cohort and labeling them ETCs would allow investors to more readily group ETPs offering exposure to commodities. This is the least controversial of the two new buckets. These products can be neatly cordoned off from the rest, and the labeling is simple and intuitive.

In addition to applying the ETC label, I believe investors would benefit from standard disclosures around how these products achieve exposure to the underlying commodity or commodities. Investors should be able to readily ascertain whether these products own physical commodities or achieve commodity exposure through futures contracts and/or other derivatives. These products should also better disclose information about the regulations and risks unique to the instruments they use to achieve their investment objectives (futures contracts, for example). Finally, more transparency around these products' tax treatments, which can vary depending on a variety of factors, including the types of assets and/or derivatives these products own, would help investors better understand the unique nature of these products.

ETIs, like ETFs, are registered investment companies. Many of these funds offer leveraged or inverse exposure to their underlying benchmark. We have long taken a dim view of these products. While these funds have generally performed as they should, many investors' expectations of how they should perform have often been miscalibrated.

While ETIs are funds, I believe that applying a distinct and more explicit label to this group to call attention to their unique features would further protect investors against potentially misunderstanding and misusing them. That said, I have two beefs with how the coalition of ETF sponsors has defined this bucket. First, the label isn't sufficiently descriptive of its contents. "Exchange-traded instruments" is vague to the point of being near useless. Second, the bucket is too broad. As it has been defined by this coalition, the ETI category would encapsulate not just leveraged and inverse ETFs, but many other funds that pose far lesser risks and are less likely to be either misused or missold. These include ETFs that deliver options-based strategies like covered-call writing. The emerging class of defined-outcome ETFs offered by Innovator ETFs and First Trust also fall into this bucket. I don't think this is right.

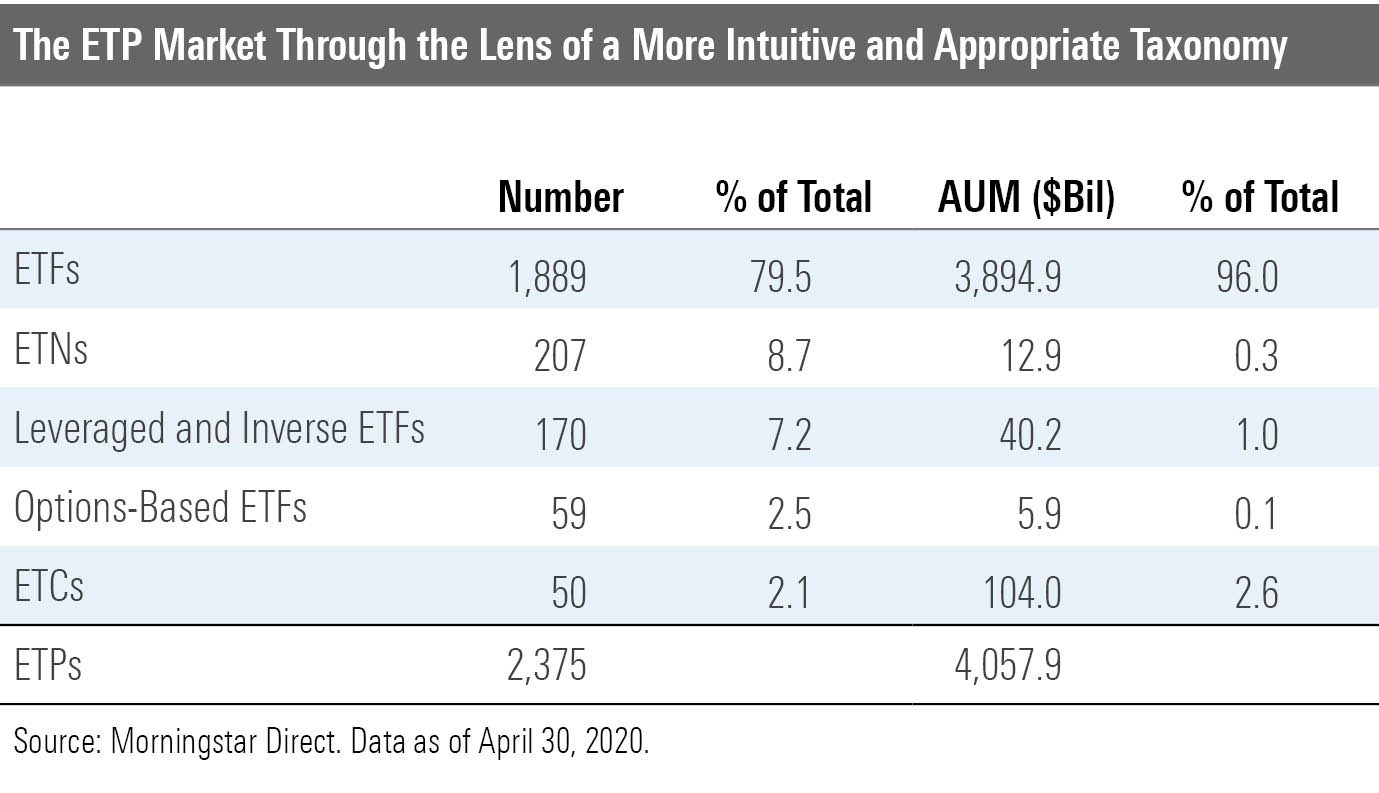

I believe that dividing this camp in two would better serve investors. One group would include all leveraged and inverse exchange-traded products and be labeled "Leveraged and Inverse Exchange-Traded Funds." This would neatly isolate and put an intuitive tag on products offering leveraged exposure that resets at regular intervals and make it clearer than ever to investors that these are not your ordinary ETPs.

The second camp would sweep in the remainder of the ETI group. Most of these remaining ETPs are funds that utilize options to provide additional income and/or cap funds' upside or downside. These strategies are clearly distinct from leveraged and inverse ETPs and don't deserve to be grouped together with them. I believe they would be appropriately and intuitively labeled as "Options-Based Exchange-Traded Funds."

Better Late Than Never More than 27 years after the introduction of the first U.S. ETF, a standard set of rules and naming conventions is long overdue--but better late than never. Educating investors on the unique features of these different product types will continue to be as important as ever, but education alone is not enough. While I agree with the spirit of the industry coalition's proposal, I take issue with the specifics. The labels can be made more intuitive and specific and the groupings more appropriate. I also disagree with the tack it has taken--effectively shopping venues to find the path of least resistance. I believe that the SEC needs to own this decision. Further fragmenting the already disjointed and overlapping mosaic of regulations that governs the ETP ecosystem wouldn't be good for anyone.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)