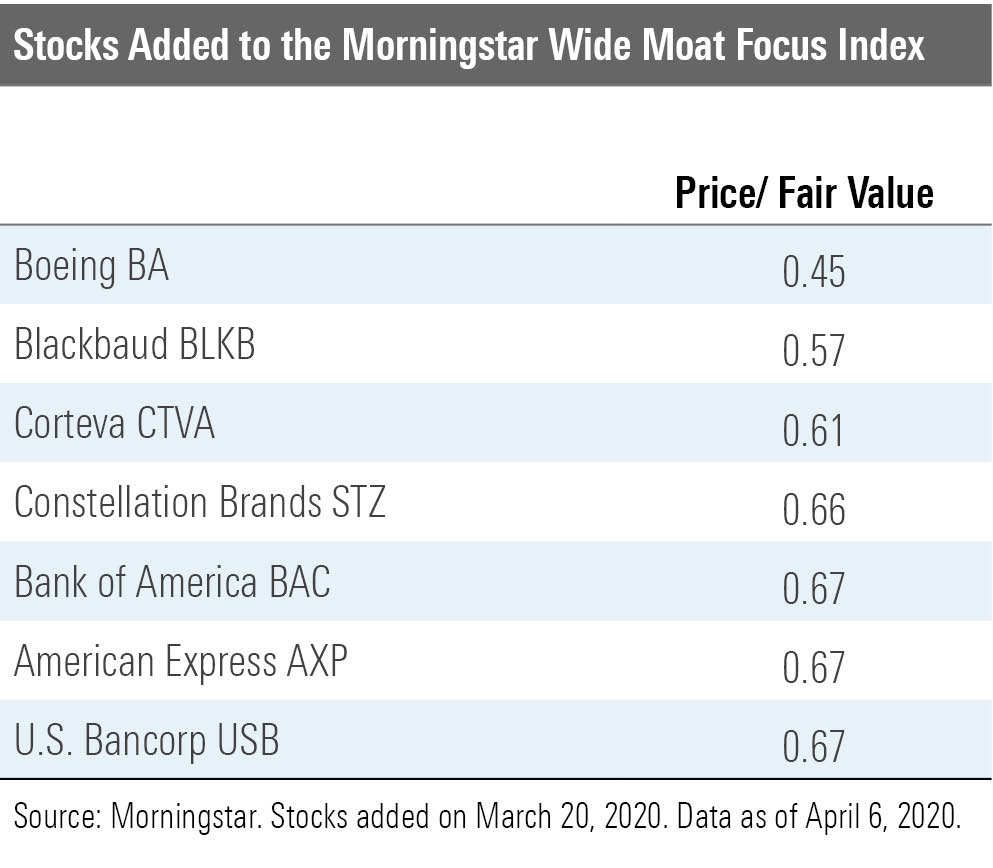

7 Additions to the Morningstar Wide Moat Focus Index

These high-quality names look relatively cheap today.

While market sell-offs can make investors nervous, they can also provide opportunities to buy stocks at low prices. When deciding on what ideas to investigate further, you might consider the March 2020 additions to the Morningstar Wide Moat Focus Index. Let's take a closer look.

What to Know About Companies in the Morningstar Wide Moat Focus Index To be considered for inclusion in the Morningstar Wide Moat Focus Index, a company must have a Morningstar Economic Moat Rating of wide, which means our equity research team believes the company has advantages that will help fend off competitors for at least 20 years. If a company is profitable, competitors will emerge that want a piece of this success; we believe wide-moat companies are high-quality businesses that can hold these competitors at bay and earn above-average returns over long periods of time.

A wide-moat company only joins the index if it's cheap. Our equity analyst team looks at a company's cash flows, business drivers, and fundamentals to determine a fair value estimate, which is our approximation of a company's dollar value per share based on its intrinsic worth. We use the price/fair value ratio, which helps us see how much lower a stock's price is to our fair value estimate, to help measure how inexpensive or pricey a company is.

The index has built a strong performance history by buying high-quality stocks when they're cheap. It has beaten the S&P 500 during the trailing three-, five-, and 10-year periods.

How Companies Get Added to the Index Morningstar regularly reconstitutes the index by adding relatively cheap wide-moat companies. To make room for these stocks, we remove companies that are trading close to their fair value or where the analyst downgraded its moat from wide.

The index contains two subportfolios that each have 40 (often overlapping) U.S. stock holdings that are reconstituted semiannually, and we stagger reconstitution so one subportfolio is adjusted each quarter; that means one subportfolio is reconstituted in December and June, and the other one is reconstituted in March and September. (During this process, we also rebalance the subportfolio's positions so they're equally weighted).

The Additions Of the seven new positions added to the subportfolio in March, three were financials companies and the remaining four each came from different sectors.

Bank of America BAC, one of the largest U.S. banks, has emerged from a decade of inefficient acquisitions with a leaner, more effective business model. The bank has effectively cut costs by selling off many risky business segments. The company has also increased its consumer loan standards, so most customers now have high average credit scores. Bank of America is also a top spender on technology compared with competitors, and we view this positively because we believe that banks will increasingly depend on technology innovations (like well-designed mobile apps and new functionality) to attract and maintain customers.

Analyst Eric Compton believes that large banks benefit from economies of scale, or cost advantages as a business segment grows larger. Bank of America is particularly well-positioned because it's a top provider across many banking products, including credit and debit cards, brokerages, and consumer bank accounts, which can help the bank grow its assets more quickly. For instance, the bank has a Preferred Rewards program that offers customers savings if their total balance across products reaches a certain threshold. With this program, the bank gives customers incentive to use more financial products, reducing the amount it needs to spend to acquire new customers.

As customers use more of the bank's offerings, swapping banks becomes more of a pain (in theory, anyway). As a result, the bank also benefits from switching costs, or the idea that customers will want to avoid the one-time inconveniences or expenses they face when they change products.

U.S. Bancorp USB also benefits from cost advantages and switching costs, says Compton. The bank gains cost advantages by minimizing costs. For instance, it runs physical branches relatively inexpensively, and its payments business, which helps businesses with tasks like accepting credit card payments, operates on a single platform with essentially zero costs per additional transaction. Finally, like Bank of America, Compton thinks that many U.S. Bancorp customers use many of its products, leading to a switching-costs advantage.

Analyst Colin Plunkett believes that American Express AXP will remain profitable over a long period given its historically successful commercial business segment, particularly business travelers who use company-issued cards. He argues that these are high-spending cardholders whom stores want as customers, and stores can only acquire them by accepting American Express, which earns the company money every time a transaction is processed. As more stores accept American Express cards, cardholders can use their cards more, which helps American Express' profits rise if transactions increase.

Since entering the index, the stock's price has further declined amid coronavirus concerns, but Plunkett believes this pressure is temporary and that financials will recover. While he believes the company's revenue in 2020 will decline compared with last year, he expects revenue in 2021 to rebound nicely.

The four remaining additions come from different sectors.

Analyst Seth Goldstein believes seed and crop chemical product producer Corteva's CTVA advantage stems from its research-and-development spending to create proprietary products. Through this investment, the company maintains a portfolio of seeds and crops with patents, which legally prevent other companies from selling an invention for a specific time period. As a result, Corteva can sell the products at a higher price and protect its revenue, which is an example of an intangible asset.

However, patents eventually lose their worth as they expire or a product loses effectiveness. But Goldstein believes Corteva is one of the best companies at developing new products given its vast experience in the field. As a result, he is confident that the company's reinvestment in research and development will be effective in helping the company develop new patented products.

{Deep Dive: Market Too Focused on Corteva's Near Term}

Analyst Nicholas Johnson recently upgraded alcoholic beverage producer Constellation Brands' STZ moat to wide given the strength of its Mexican beer business, which generates approximately 80% of its profits. We believe this business segment has a strong brand given U.S. consumers' increased affinity toward imported beer. Plus, the beer resonates with a growing U.S. Hispanic population.

We think that the market's overemphasizing the company's noncore business segments, such as wines and spirits. In recent years, management has been selling off many of the low-margin and less-profitable products. Plus, Johnson believes the market is overly concerned about Constellation Brands' acquisition of no-moat cannabis provider Canopy Growth given uncertainty in the cannabis industry; however, the acquired company represents a very small part of Constellation's overall revenue.

{Video: Mexican Beer Continues to Shine for Constellation}

Boeing BA, which primarily manufactures airplanes, faces some challenges given the grounding of its 737 MAX aircraft, but analyst Burkett Huey argues that structural barriers to entry and undercapacity in aircraft manufacturing will make it difficult for Boeing's customers to switch to a different supplier. First, regulators have strict requirements to certify new aircraft that would likely delay a new competitor entering for years, so Boeing has a competitive advantage given its regulatory knowledge and key industry relationships. Second, while airlines could switch to Airbus, which is Boeing's primary competitor, they would need to certify pilots and crews on these new airplanes. Additionally, both Boeing and Airbus maintain over five-year backlogs on popular 737 MAX replacements, so airlines could wait years for a new aircraft (or pay large fees to get one sooner). As a result, Boeing also benefits from switching costs.

In Boeing's defense unit, deep relationships and knowledge of military aircraft manufacturing creates another advantage. Plus, Boeing produces so much for the military that the government would essentially need to overhaul its aircraft lineup, creating switching costs.

{Deep Dive: Suspended MAX Production Dings Boeing Valuation}

Blackbaud BLKB is the leading software producer in the social-good community, which includes nonprofits, foundations, and educational institutions. These organizations use this software to help with various tasks, including searching for charitable donors or managing grants and charitable campaigns.

Analyst Dan Romanoff believes the company offers a robust suite of products that is more thorough than competitors' offerings. Romanoff thinks the company benefits from switching costs because once customers start using Blackbaud's software products, it's expensive to switch to a new software and it takes time to train employees on it. Romanoff also believes that Blackbaud's nonprofit customers are particularly sensitive to switching costs because they operate on tight budgets.

{Deep Dive: Blackbaud Sees Growth in Social Good}

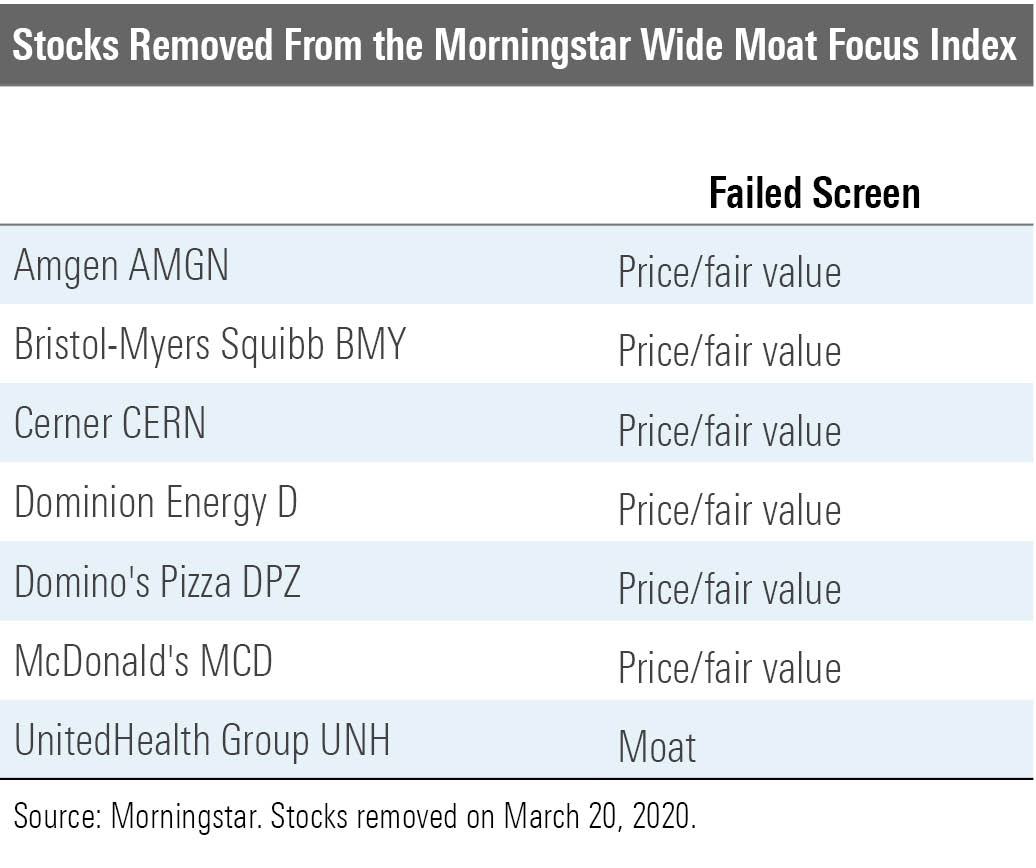

The Removals Seven holdings were removed from the subportfolio in March.

Health-insurance provider UnitedHealth UNH was removed because its economic moat rating was downgraded to narrow. Senior analyst Julie Utterback suggests that the company could face risks to profitability as regulators seek to improve the U.S. healthcare system.

"The U.S. health system continues to put significant financial pressure on many U.S. citizens, and we think medical insurers and pharmacy benefit managers will remain key targets of regulators looking to improve the U.S. healthcare system. These organizations may continue to face significant event risk that could cut into profitability eventually," says Utterback.

{Deep Dive: Checkup for Healthcare Moats}

The remaining six companies were removed from the index because they were trading at relatively higher price/fair value ratios at the time of reconstitution.

11 Cheapest Stocks in the Wide-Moat Index Below are the most undervalued stocks in the index as of April 6.

/s3.amazonaws.com/arc-authors/morningstar/b70d0063-c0bd-47f4-a1f5-74ff9b0435b1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b70d0063-c0bd-47f4-a1f5-74ff9b0435b1.jpg)